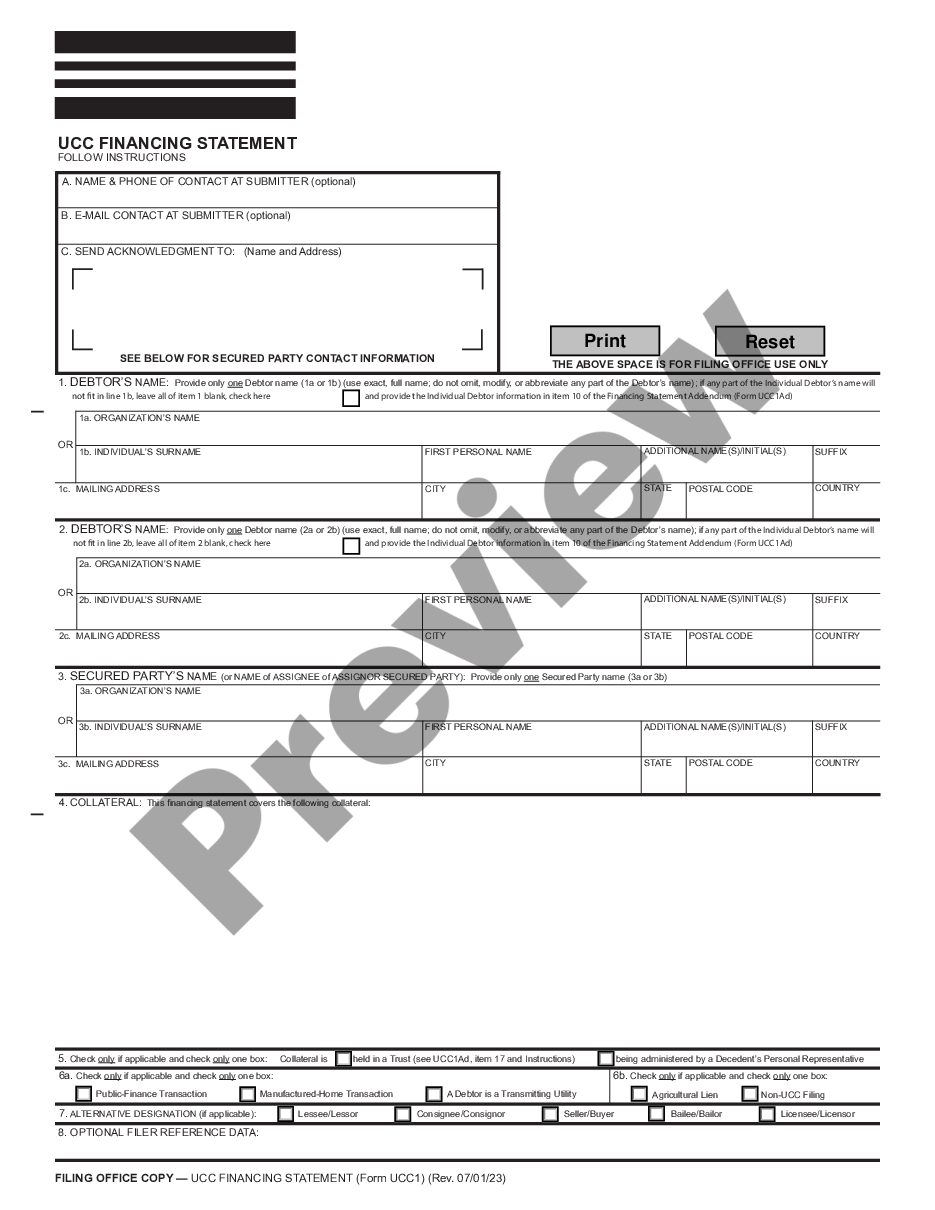

UCC1 - Financing Statement - Nebraska - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Omaha, Nebraska UCC1 Financing Statement is a legal document that serves as a notice of a secured party's interest in a debtor's personal property collateral. This statement is filed with the Secretary of State's office in Nebraska and helps establish priority rights in case of default or bankruptcy. UCC1 Financing Statements in Omaha, Nebraska are governed by the Uniform Commercial Code (UCC), a set of laws adopted by most states in the US to harmonize commercial transactions across the country. The primary purpose of the UCC1 Financing Statement is to inform potential future creditors about existing security interests and allow them to assess the risk of lending money to a debtor. It essentially creates a public record that establishes the order of priority for multiple creditors claiming rights to the same collateral. There are several types of UCC1 Financing Statements, each serving a specific purpose in Omaha, Nebraska: 1. General UCC1 Financing Statement: This is the most common type of UCC1 filing and is used to provide notice of a security interest in all of a debtor's assets, both present, and future. It covers a wide range of collateral, including inventory, equipment, accounts receivable, and intangible assets. 2. Amendment UCC1 Financing Statement: This type is used to make changes or amendments to an existing UCC1 filing. It is essential to correct errors, update information, or terminate a security interest previously recorded. 3. Assignment UCC1 Financing Statement: This filing records the assignment of a security interest from one secured party to another. It ensures that the new secured party has the rights to the collateral. 4. Amendment and Assignment UCC1 Financing Statement: This type combines the functionalities of an amendment and an assignment filing. It allows for both changes to the UCC1 and the assignment of the security interest. 5. Continuation UCC1 Financing Statement: A continuation filing extends the effectiveness of an existing UCC1 beyond its initial five-year period. According to Nebraska law, a secured party must file a continuation statement before the original filing expires to maintain priority rights. 6. Termination UCC1 Financing Statement: This filing is used to officially terminate a UCC1 financing statement. It removes the security interest from the public record and releases the debtor's collateral from the secured party's claim. Omaha, Nebraska UCC1 Financing Statements provide legal protection and clarity for both debtors and secured parties involved in commercial transactions. It is crucial to understand the specific requirements and guidelines set forth by the Secretary of State's office in Omaha to ensure compliance and the validity of the filing.