This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Last Will And Testament Nebraska

Description

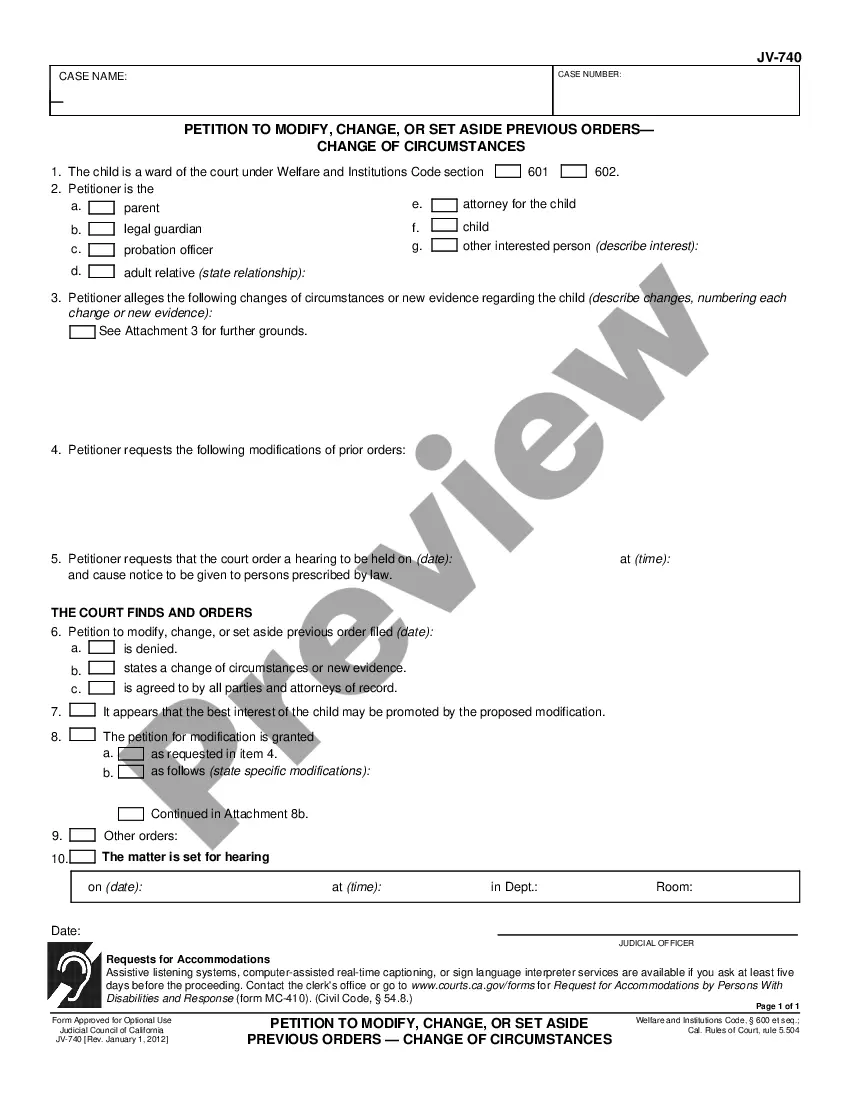

How to fill out Omaha Nebraska Last Will And Testament With All Property To Trust Called A Pour Over Will?

Locating verified templates that conform to your local laws can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life situations.

All files are systematically categorized by usage area and jurisdiction, making it as simple as 1-2-3 to find the Omaha Nebraska Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will.

Submit your credit card information or utilize your PayPal account to complete the payment for the subscription. Download the Omaha Nebraska Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will, and store the template on your device to complete it and access it in the My documents section of your profile whenever you need it again. Maintaining documents organized and compliant with legal standards is of utmost importance. Leverage the US Legal Forms library to always have crucial document templates readily available!

- Check the Preview mode and document description.

- Ensure you've chosen the right one that suits your requirements and aligns with your local jurisdiction standards.

- Search for an alternative template if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it fits, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

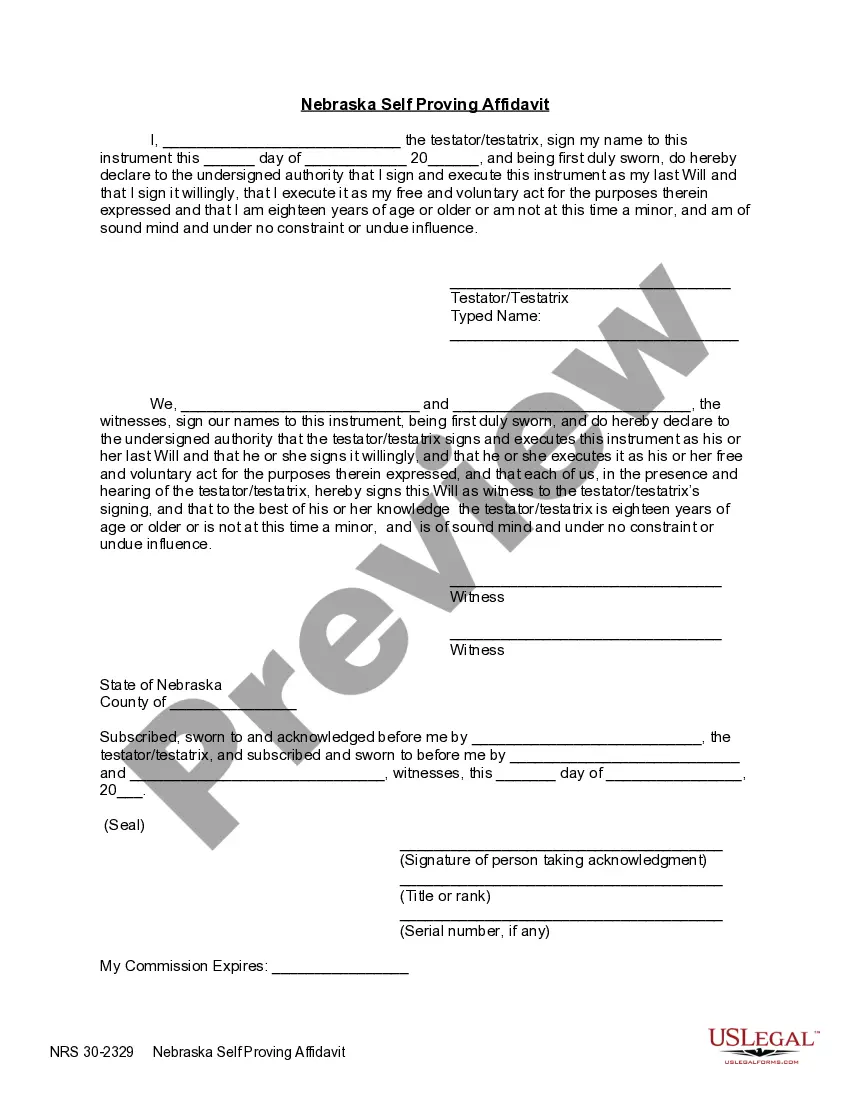

The basic requirements for a Nebraska last will and testament include the following: Age: The testator must be at least 18 years old. Capacity: The testator must be of sound mind. Signature: The will must be signed by the testator or by someone else in the testator's name in his presence, by his direction.

Having a pour-over will makes sure that all of your assets will pass to intended beneficiaries. This avoids probate by easily passing assets on to heirs.

over will is a will used alongside a living trust. You can use it to transfer assets not already held in your trust before you die into your trust after your death.

over will is an invaluable document for anyone who has created a living trust as part of their estate plan. It's a specialized last will and testament, designed to catch assets that have not been retitled or transferred into your living trust, ?pouring? them into the trust upon your death.

Requirements for a Will to Be Valid It must be in writing. Generally, of course, wills are composed on a computer and printed out.The person who made it must have signed and dated it. A will must be signed and dated by the person who made it.Two adult witnesses must have signed it. Witnesses are crucial.

You can make your own will in Nebraska, using Nolo's Quicken WillMaker. However, you may want to consult a lawyer in some situations. For example, if you think that your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.

Under Nebraska law, a will must be filed with the court with reasonable promptness after the death of the testator. Nebraska Revised Statutes § 30-2356.

False. When drafting a living trust for a client, a pour-over will is merely optional. Only upon determination by a doctor that the principal is incapacitated.

Nebraska Will Laws at a Glance Also, at least two witnesses must sign the will after having either witnessed the signing or the testator's acknowledgment of signing the will. While oral wills are not recognized in Nebraska, holographic (hand-written) wills are valid in most cases.

over will can help the family and beneficiaries of the testator's will avoid probate on nontrust assets by transferring them into the trust's care after the testator dies. If the value of the pourover assets does not exceed California's statutory limits for trust funds, the assets will not move into probate.