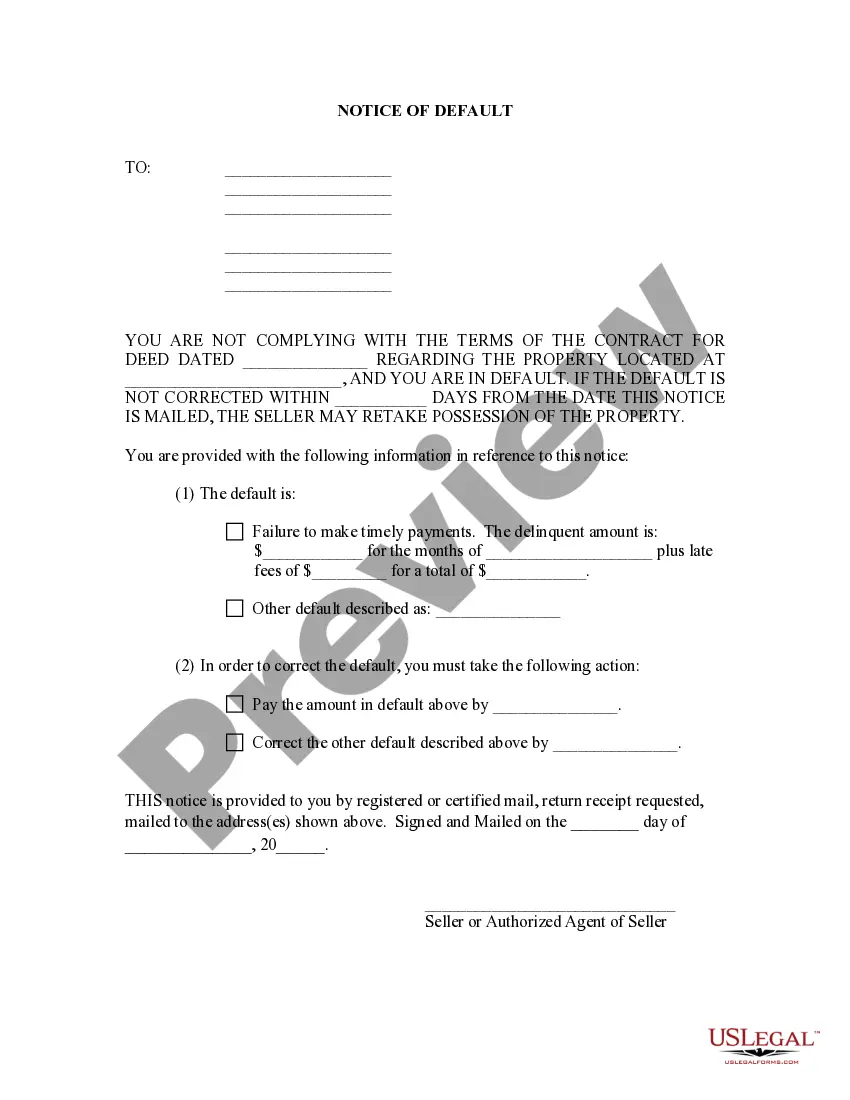

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

A Manchester New Hampshire General Notice of Default for Contract for Deed is a legal document that signifies the occurrence of a default on a contract for deed in the city of Manchester, New Hampshire. This notice is typically issued by the seller or the party holding the contract (referred to as the "seller" from hereon) to inform the buyer (also known as the "purchaser") about their failure to meet the obligations outlined in the contract for deed. Keywords: Manchester, New Hampshire, general notice, default, contract for deed. There can be different types of Manchester New Hampshire General Notice of Default for Contract for Deed, including: 1. Monetary Default Notice: This type of notice is issued when the buyer fails to make timely payments as per the terms specified in the contract for deed. It outlines the outstanding amount, due dates, and the actions required to rectify the default. The notice may include information regarding late fees and any consequences for prolonged non-payment. 2. Breach of Agreement Notice: This notice is relevant when the buyer breaches other terms of the contract for deed apart from monetary obligations. It details the specific provisions that have been violated, such as failure to maintain the property, unauthorized alterations, or failure to provide proof of insurance. 3. Cure or Quit Notice: A cure or quit notice is issued when the buyer has defaulted on the contract, and the seller gives them a specified period to "cure" the default by rectifying the non-compliance. If the buyer fails to do so within the given timeframe, the seller may initiate legal proceedings to terminate the contract and take possession of the property. 4. Acceleration Notice: This notice is sent when the seller wishes to accelerate the payment schedule and demand immediate payment of the entire remaining balance of the contract. It is usually issued when the buyer defaults on multiple payments or commits serious breaches of the agreement. 5. Notice of Intent to Foreclose: If the buyer continuously defaults on payments or breaches the contract, the seller may serve this notice to inform the buyer of their intention to initiate foreclosure proceedings. It outlines the steps the buyer can take to prevent foreclosure and provide an opportunity to rectify the default. It is important to note that the specifics of a Manchester New Hampshire General Notice of Default for Contract for Deed may vary based on the particular terms and conditions laid out in the original agreement. As legal processes can be complex, it is advisable for both parties involved to seek professional legal advice to ensure compliance with applicable laws and procedures.

A Manchester New Hampshire General Notice of Default for Contract for Deed is a legal document that signifies the occurrence of a default on a contract for deed in the city of Manchester, New Hampshire. This notice is typically issued by the seller or the party holding the contract (referred to as the "seller" from hereon) to inform the buyer (also known as the "purchaser") about their failure to meet the obligations outlined in the contract for deed. Keywords: Manchester, New Hampshire, general notice, default, contract for deed. There can be different types of Manchester New Hampshire General Notice of Default for Contract for Deed, including: 1. Monetary Default Notice: This type of notice is issued when the buyer fails to make timely payments as per the terms specified in the contract for deed. It outlines the outstanding amount, due dates, and the actions required to rectify the default. The notice may include information regarding late fees and any consequences for prolonged non-payment. 2. Breach of Agreement Notice: This notice is relevant when the buyer breaches other terms of the contract for deed apart from monetary obligations. It details the specific provisions that have been violated, such as failure to maintain the property, unauthorized alterations, or failure to provide proof of insurance. 3. Cure or Quit Notice: A cure or quit notice is issued when the buyer has defaulted on the contract, and the seller gives them a specified period to "cure" the default by rectifying the non-compliance. If the buyer fails to do so within the given timeframe, the seller may initiate legal proceedings to terminate the contract and take possession of the property. 4. Acceleration Notice: This notice is sent when the seller wishes to accelerate the payment schedule and demand immediate payment of the entire remaining balance of the contract. It is usually issued when the buyer defaults on multiple payments or commits serious breaches of the agreement. 5. Notice of Intent to Foreclose: If the buyer continuously defaults on payments or breaches the contract, the seller may serve this notice to inform the buyer of their intention to initiate foreclosure proceedings. It outlines the steps the buyer can take to prevent foreclosure and provide an opportunity to rectify the default. It is important to note that the specifics of a Manchester New Hampshire General Notice of Default for Contract for Deed may vary based on the particular terms and conditions laid out in the original agreement. As legal processes can be complex, it is advisable for both parties involved to seek professional legal advice to ensure compliance with applicable laws and procedures.