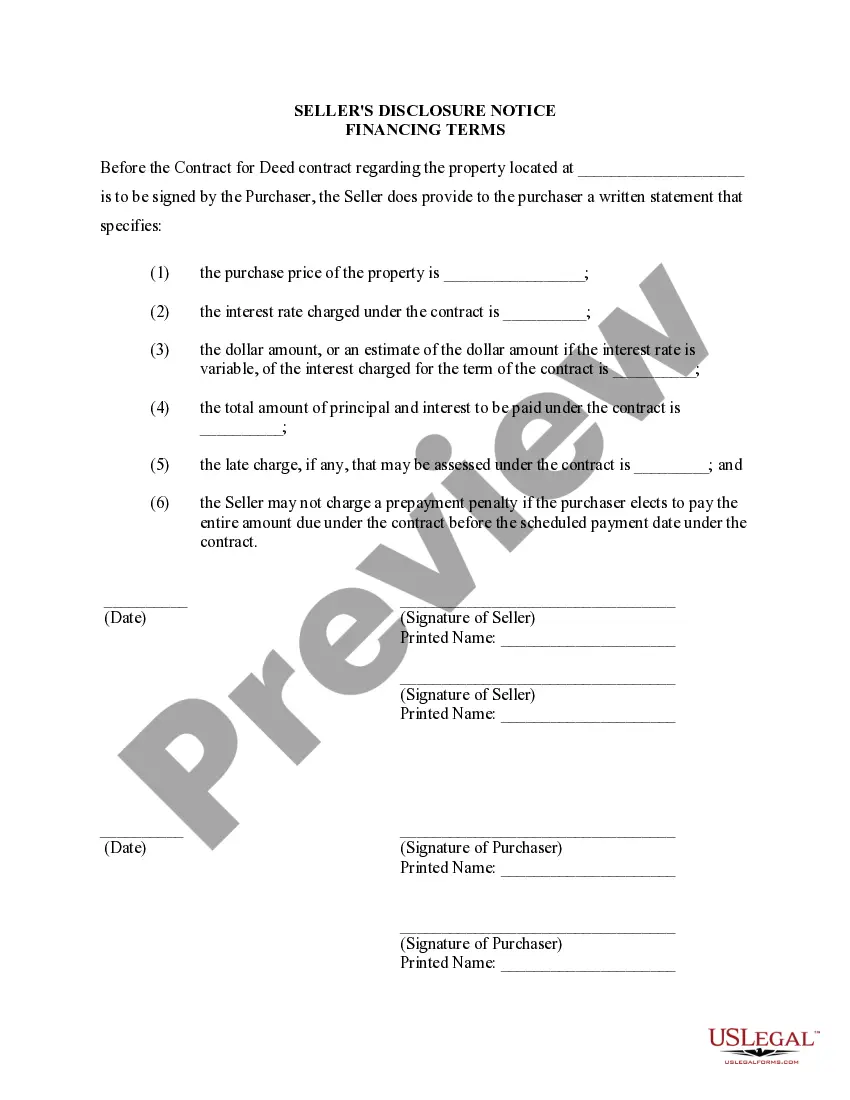

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Manchester New Hampshire Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legally binding document that outlines the specific financing terms and conditions between the seller and buyer when purchasing or selling a residential property. This disclosure is crucial in ensuring transparency and trust between both parties involved in the transaction. There are various types of Manchester New Hampshire Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, depending on the specific terms and conditions agreed upon by the buyer and seller. Some of the key components that may be included in this disclosure are: 1. Purchase Price: This section specifies the agreed-upon purchase price of the residential property. It clarifies the amount that the buyer will pay to the seller for the property. 2. Down Payment: This section outlines the amount of money the buyer must provide as a down payment towards the purchase price. It may detail whether the down payment is required upfront or can be paid in installments. 3. Interest Rate: The disclosure includes the interest rate that will be applicable to the financing. This rate may be fixed or adjustable, depending on the agreement between the parties. 4. Payment Schedule: This section details the payment schedule agreed upon by the buyer and seller. It specifies the frequency and amount of payments to be made towards the property, including any principal and interest payments. 5. Duration of Contract: The disclosure states the duration of the land contract or agreement for deed. It specifies the length of time the buyer will have to complete the repayment of the agreed-upon amount. 6. Default and Remedies: This section outlines the consequences of defaulting on the terms of the financing agreement. It highlights the remedies available to the seller in case of non-payment or violation of other specified terms. 7. Taxes and Insurance: The disclosure may include provisions regarding who is responsible for taxes and insurance on the property during the term of the contract. 8. Transfer of Title: This section clarifies the conditions under which the title of the property will be transferred from the seller to the buyer. It may include provisions for title insurance and any necessary inspections or appraisals. It is important to note that while the Manchester New Hampshire Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed serves as a guide, it is always advisable to consult with a legal professional to ensure that the document complies with all applicable laws and regulations.