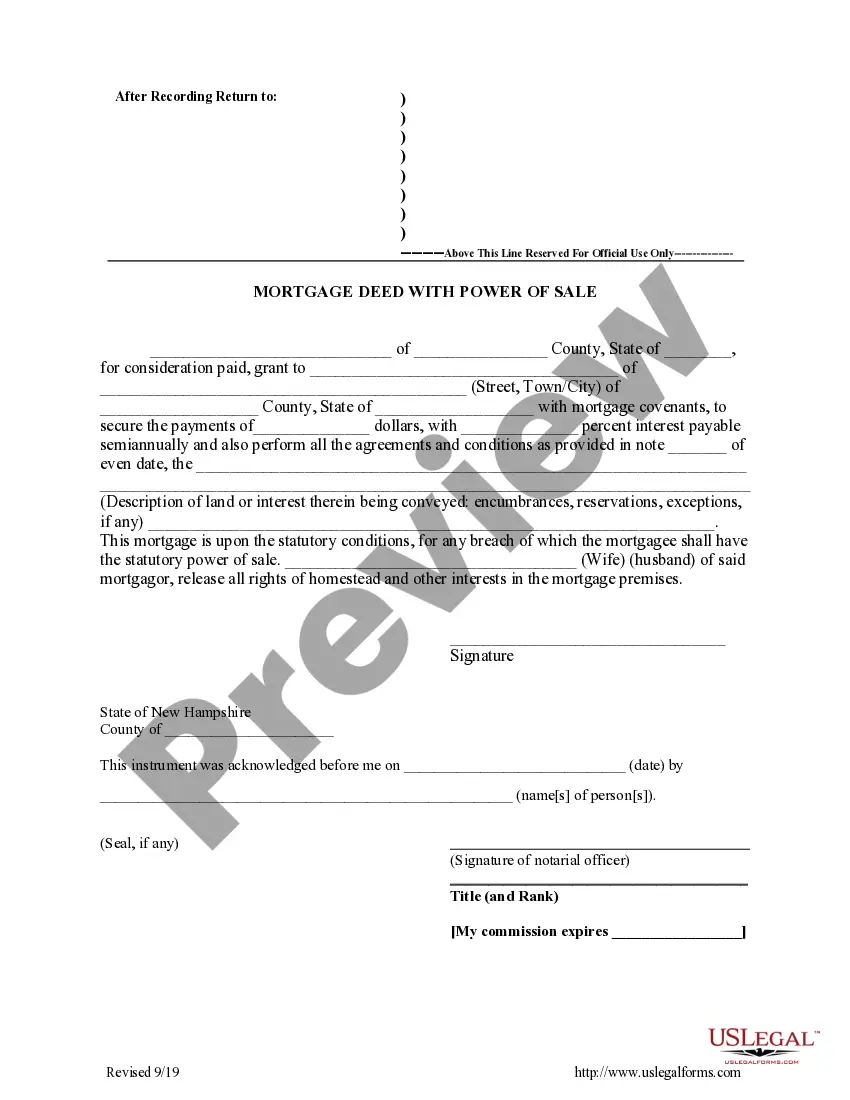

Manchester New Hampshire Form for Mortgage Deed, with Power of Sale

Description

How to fill out New Hampshire Form For Mortgage Deed, With Power Of Sale?

No matter one's societal or occupational standing, finishing legal documents is an unfortunate requirement in today’s workplace.

Frequently, it’s nearly impossible for an individual lacking legal experience to draft such documents from the ground up, primarily due to the complex terminology and legal subtleties involved.

This is where US Legal Forms proves to be beneficial.

Check that the template you discovered is appropriate for your area since the laws of one state or county may not be applicable in another.

You’re prepared! Now you can either print the form or complete it online. If you encounter any difficulties finding your purchased documents, you can easily find them in the My documents section.

- Our platform provides an extensive collection of over 85,000 state-specific documents that cater to virtually any legal matter.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to save time using our DIY forms.

- Whether you need the Manchester New Hampshire Form for Mortgage Deed, including Power of Sale, or any other paperwork valid in your state or county, US Legal Forms has everything accessible.

- Here’s a quick guide to obtain the Manchester New Hampshire Form for Mortgage Deed, including Power of Sale using our reliable platform.

- If you are a current customer, you can go ahead and Log In to your account to access the necessary form.

- However, if you are new to our library, make sure to follow these steps before downloading the Manchester New Hampshire Form for Mortgage Deed, including Power of Sale.

Form popularity

FAQ

To add someone to a house deed in New Hampshire, you will need to prepare a new deed that formally includes the new owner's name. This action typically involves the current owner signing the deed and then recording it with the local registry of deeds. The Manchester New Hampshire Form for Mortgage Deed, with Power of Sale can assist in making this process straightforward and legally sound.

A statutory power of attorney in New Hampshire grants someone the legal authority to act on your behalf, particularly in financial matters and real estate transactions. This document is crucial for ensuring that decisions can be made if you are unable to do so. It is advisable to create a clear and comprehensive document, and the Manchester New Hampshire Form for Mortgage Deed, with Power of Sale may help in drafting related documents.

Filing a quitclaim deed in New Hampshire involves preparing the deed that includes relevant information about the property and the parties involved. After signing the deed, you must file it at your local registry of deeds. Additionally, if you are looking for guidance, the Manchester New Hampshire Form for Mortgage Deed, with Power of Sale can be a valuable resource to ensure you're following the correct procedures.

To update a deed in New Hampshire, you generally need to prepare a new deed that reflects the changes, such as the name of an owner or the transfer of property. After drafting the new deed, ensure it's signed by the necessary parties and recorded with the local registry of deeds. The Manchester New Hampshire Form for Mortgage Deed, with Power of Sale provides a user-friendly option for making these updates legally efficient.

In New Hampshire, a deed typically includes the names of the grantor and grantee, a description of the property, and the signatures of all parties involved. It is essential for documenting the transfer of ownership. You can find examples of standard deeds through resources like the Manchester New Hampshire Form for Mortgage Deed, with Power of Sale. This form can aid in ensuring your deed meets state requirements.

Yes, you can create a quit claim deed yourself, provided you follow the correct procedures. Start by obtaining the Manchester New Hampshire Form for Mortgage Deed, with Power of Sale. Carefully fill it out with all required information, ensuring each detail is accurate. After signing the document in front of a notary, file it with your local registry of deeds to complete the process. Alternatively, US Legal Forms offers easy-to-use templates and guidance if you prefer assistance.

Transferring a house deed in New Hampshire involves preparing the appropriate documentation, specifically the Manchester New Hampshire Form for Mortgage Deed, with Power of Sale. Begin by ensuring all parties related to the property are informed and lawfully eligible to execute the transfer. Next, fill out all necessary sections of the form accurately. Once complete, you must notarize and file the deed with the local registry to make the transfer official.

To file a quit claim deed in New Hampshire, you will need to complete the Manchester New Hampshire Form for Mortgage Deed, with Power of Sale. First, gather relevant property information, and accurately fill out the form with your and the buyer's details. Afterward, you must sign the form in front of a notary public. Finally, submit your completed deed to your local registry of deeds for proper recording.

A deed of trust with power of sale is a type of security instrument that allows the lender to sell the property in the event of a default without needing court involvement. This arrangement simplifies the foreclosure process and can provide a quicker resolution for lenders. By using the Manchester New Hampshire Form for Mortgage Deed, with Power of Sale, all parties can benefit from clear terms and streamlined processes. This can lead to more efficient transactions in real estate.

A contract for deed with power of sale allows the seller to retain legal title to the property while the buyer makes payments towards ownership. In the event of non-payment, the seller can reclaim the property through a power of sale provision without lengthy legal procedures. Employing the Manchester New Hampshire Form for Mortgage Deed, with Power of Sale, can ensure that this agreement includes all necessary provisions. This form simplifies the process for both parties.