Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out New Hampshire Quitclaim Deed From Husband And Wife To LLC?

If you are searching for a pertinent form, it’s unfeasible to select a more suitable service than the US Legal Forms website – one of the largest online repositories.

Here you can discover a vast array of form samples for organizational and personal needs categorized by types and states, or keywords.

Leveraging our top-notch search feature, obtaining the latest Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Receive the form. Select the format and store it to your computer.

- If you are already acquainted with our platform and possess a registered account, all you need to obtain the Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions outlined below.

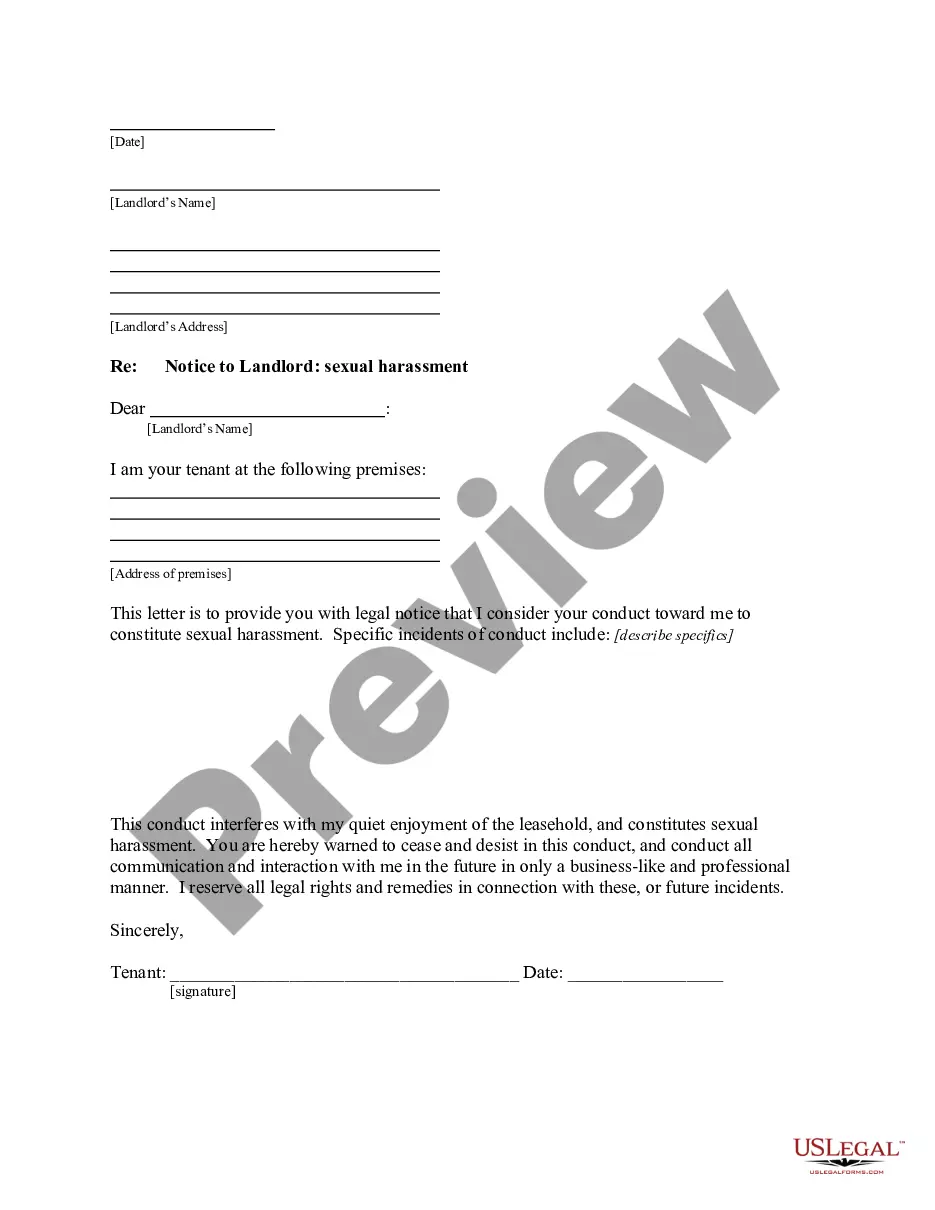

- Ensure you have located the sample you desire. Review its description and employ the Preview feature to examine its content.

- If it does not satisfy your requirements, use the Search bar positioned at the top of the screen to locate the necessary document.

- Confirm your choice. Click the Buy now button. Next, select the desired pricing plan and provide the information to create an account.

Form popularity

FAQ

A quitclaim deed does not override a will; instead, it operates independently. If a property is transferred via a Quitclaim Deed, that transfer may take precedence over any instructions in a will regarding that property. Therefore, when executing a Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC, one should ensure that all estate planning documents are updated accordingly to avoid conflicts.

The main disadvantage of a quitclaim deed is that it offers no protection for the grantee regarding the property's title. The grantee accepts the property with all existing risks, including outstanding liens or claims. If you are considering a Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC, it is advisable to conduct thorough due diligence to avoid potential regret down the line.

Quitclaim deeds are primarily used to transfer property ownership without warranty of title. They are often utilized in situations such as transferring property between family members, creating joint ownership, or converting personal property into an LLC. If you need to facilitate a transfer through a Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC, it is especially useful for protecting your business interests.

To file a quitclaim deed in New Hampshire, you should prepare a Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC. After completing the document with accurate information, take it to your local county registry of deeds. Ensure you include any required signatures and witness or notarization as needed. Using services from platforms like US Legal Forms can simplify access to forms and guide you through the filing process.

Yes, you can prepare a quitclaim deed yourself, but it is crucial to follow local laws carefully. Using a Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC ensures that you include all necessary details for a valid transfer. Consider utilizing resources like US Legal Forms that provide templates and instructions to make the process easier. However, consulting a legal professional is wise, especially for significant assets.

One disadvantage of putting your house in an LLC is that it may limit certain tax benefits, such as capital gains tax exemptions. Additionally, transferring your property may lead to added costs, including filing fees and potential tax implications. If you opt for a Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC, remember that creditor protections could be more complex. Evaluating your situation fully can help you make the best choice.

Yes, you can run an LLC from your house, making it a convenient option for many entrepreneurs. However, it's important to check local zoning laws to ensure compliance. By utilizing a Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC, you can formalize your home-based business setup. This approach allows you to operate your LLC while maintaining personal privacy.

People often place property into an LLC to protect their personal assets from business liabilities. Using a Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC can shield owners from legal risks and simplify property management. Additionally, it may provide tax benefits and enhance privacy regarding property ownership. Overall, an LLC can serve as a valuable tool for real estate investment.

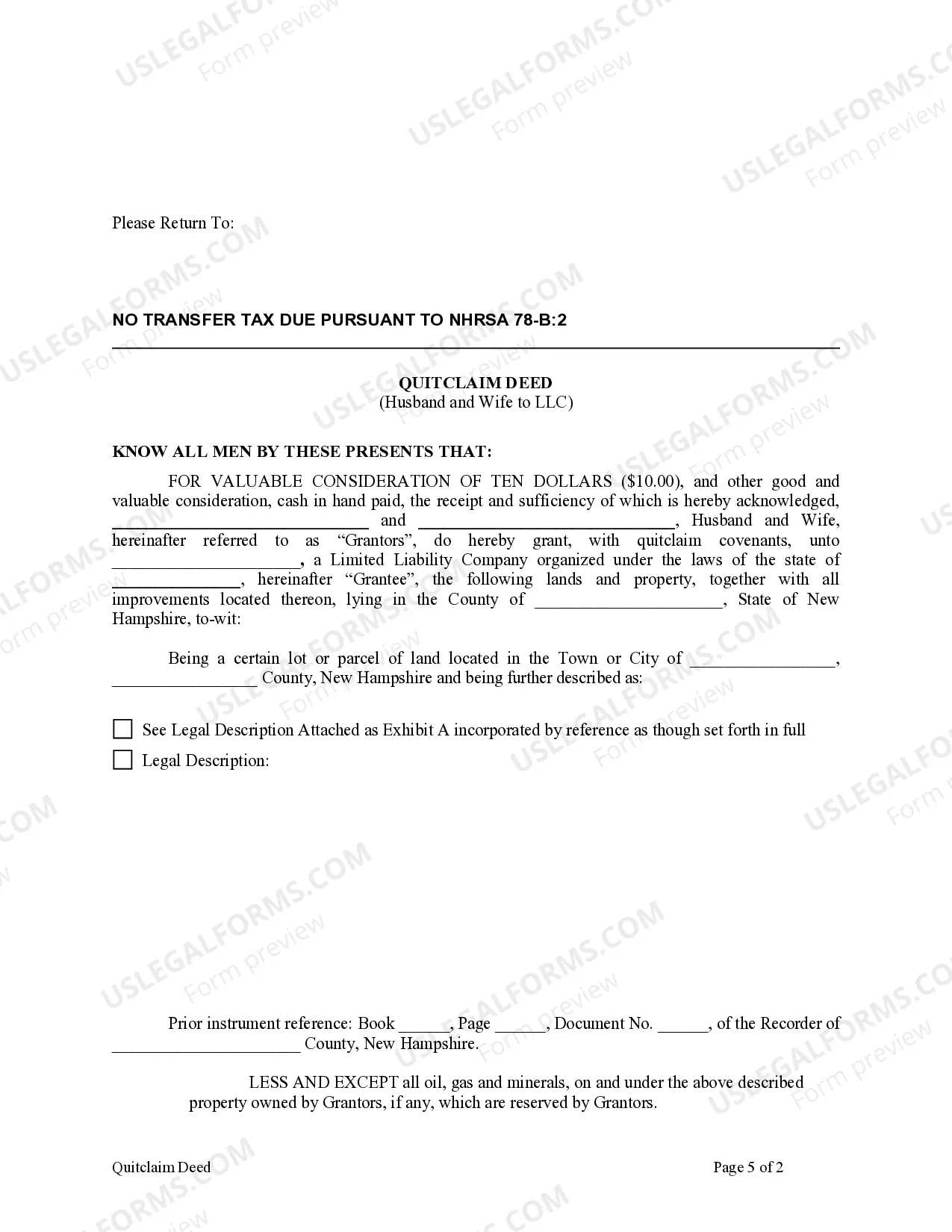

To transfer a deed to an LLC, you must prepare a Manchester New Hampshire Quitclaim Deed from Husband and Wife to LLC. This document should detail the property address and the LLC’s name. After signing the quitclaim deed, you must file it with the local county recorder’s office to complete the transfer. Using a platform like US Legal Forms can help you access the correct forms and ensure the process is smooth.

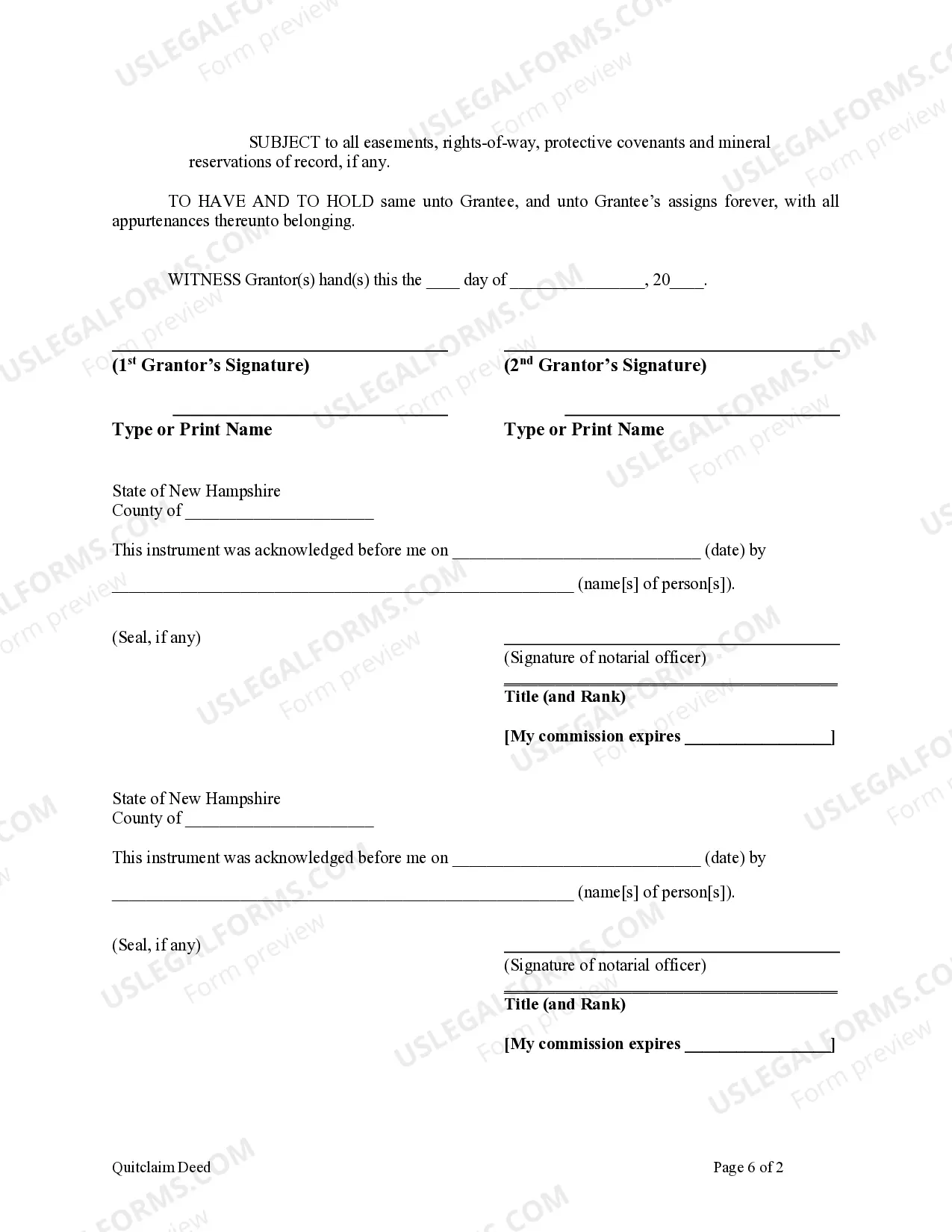

In New Hampshire, a quitclaim deed must include specific elements: the names and addresses of the grantor and grantee, a clear description of the property, and the signature of the grantor, among other details. It must also be notarized and recorded at the local county registry of deeds. Ensuring compliance with these requirements is essential for a valid Manchester New Hampshire quitclaim deed from husband and wife to LLC.