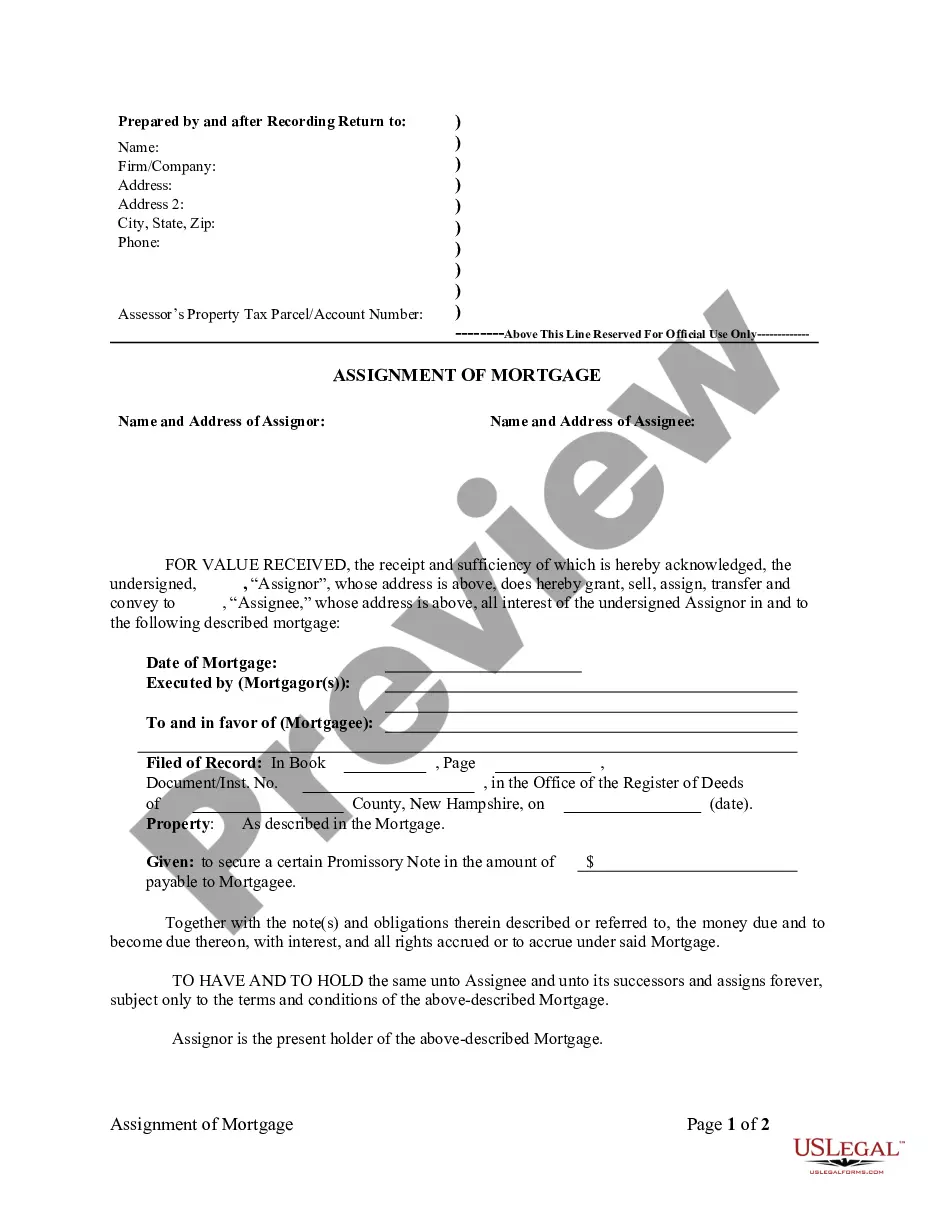

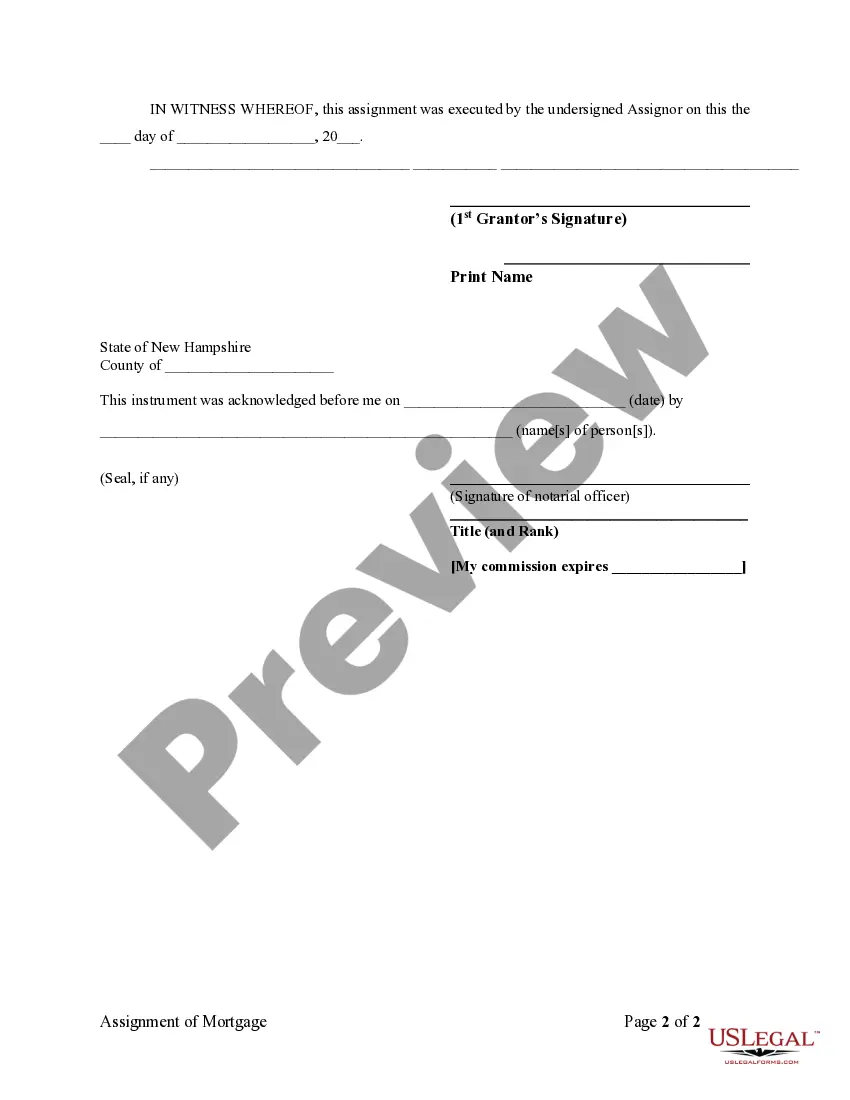

Title: Understanding the Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder Introduction: The Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder is an important legal process involving the transfer of mortgage rights from one individual mortgage holder to another. This assignment allows the new mortgage holder to assume the rights, benefits, and responsibilities associated with the mortgage. In this article, we will delve into the details of this assignment, its key components, and different types of assignments that occur in Manchester, New Hampshire. Key Keywords: Manchester, New Hampshire, Assignment of Mortgage, Individual Mortgage Holder 1. Definition and Purpose of Manchester Assignment of Mortgage: The Manchester Assignment of Mortgage by Individual Mortgage Holder refers to the transfer of a mortgage from one individual mortgage holder to another, ensuring the new holder assumes all associated rights and responsibilities. 2. Parties Involved in an Assignment of Mortgage: a) Assignor: The existing mortgage holder who transfers their mortgage rights to another individual. b) Assignee: The new individual who assumes the mortgage rights. 3. Understanding the Assignment Process: a) Execution: The assignment of mortgage must be executed in writing and signed by the assignor. b) Recording: The assignment document must be recorded in the appropriate county registry of deeds to provide public notice of the mortgage transfer. 4. Types of Assignments: a) Partial Assignment: In a partial assignment, the mortgage holder transfers a portion of their interest in the mortgage to another individual, usually in cases involving multiple borrowers or investors. b) Full Assignment: In a full assignment, the entire mortgage is transferred to a new individual mortgage holder, who assumes all rights and responsibilities associated with it. c) Assignment of Mortgage with Assumption: This occurs when the assignee not only assumes the mortgage but also assumes personal liability for the debt. 5. Legal Considerations: a) Due-on-Sale Clause: Mortgage agreements may contain a due-on-sale clause, which allows the lender to demand immediate payment in full upon the assignment of the mortgage. b) Recording Requirements: To ensure the assignment's validity, it must be recorded appropriately, following the guidelines set by the county registry of deeds. 6. Benefits of an Assignment of Mortgage: a) Transfer of Loan: An assignment allows the mortgage holder to transfer their loan to another individual. b) Secondary Market: Assignments enable loans to be traded in the secondary market, enhancing liquidity and investment opportunities for the mortgage industry. Conclusion: The Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder is a crucial legal mechanism that facilitates the transfer of mortgage rights. Whether it is a partial assignment, full assignment, or assignment with assumption, individuals must understand the process and adhere to legal requirements. By providing clarity on this topic, this article aims to assist individuals in navigating the complexities of mortgage assignments effectively.

Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder

State:

New Hampshire

City:

Manchester

Control #:

NH-120RE

Format:

Word;

Rich Text

Instant download

Description

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Title: Understanding the Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder Introduction: The Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder is an important legal process involving the transfer of mortgage rights from one individual mortgage holder to another. This assignment allows the new mortgage holder to assume the rights, benefits, and responsibilities associated with the mortgage. In this article, we will delve into the details of this assignment, its key components, and different types of assignments that occur in Manchester, New Hampshire. Key Keywords: Manchester, New Hampshire, Assignment of Mortgage, Individual Mortgage Holder 1. Definition and Purpose of Manchester Assignment of Mortgage: The Manchester Assignment of Mortgage by Individual Mortgage Holder refers to the transfer of a mortgage from one individual mortgage holder to another, ensuring the new holder assumes all associated rights and responsibilities. 2. Parties Involved in an Assignment of Mortgage: a) Assignor: The existing mortgage holder who transfers their mortgage rights to another individual. b) Assignee: The new individual who assumes the mortgage rights. 3. Understanding the Assignment Process: a) Execution: The assignment of mortgage must be executed in writing and signed by the assignor. b) Recording: The assignment document must be recorded in the appropriate county registry of deeds to provide public notice of the mortgage transfer. 4. Types of Assignments: a) Partial Assignment: In a partial assignment, the mortgage holder transfers a portion of their interest in the mortgage to another individual, usually in cases involving multiple borrowers or investors. b) Full Assignment: In a full assignment, the entire mortgage is transferred to a new individual mortgage holder, who assumes all rights and responsibilities associated with it. c) Assignment of Mortgage with Assumption: This occurs when the assignee not only assumes the mortgage but also assumes personal liability for the debt. 5. Legal Considerations: a) Due-on-Sale Clause: Mortgage agreements may contain a due-on-sale clause, which allows the lender to demand immediate payment in full upon the assignment of the mortgage. b) Recording Requirements: To ensure the assignment's validity, it must be recorded appropriately, following the guidelines set by the county registry of deeds. 6. Benefits of an Assignment of Mortgage: a) Transfer of Loan: An assignment allows the mortgage holder to transfer their loan to another individual. b) Secondary Market: Assignments enable loans to be traded in the secondary market, enhancing liquidity and investment opportunities for the mortgage industry. Conclusion: The Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder is a crucial legal mechanism that facilitates the transfer of mortgage rights. Whether it is a partial assignment, full assignment, or assignment with assumption, individuals must understand the process and adhere to legal requirements. By providing clarity on this topic, this article aims to assist individuals in navigating the complexities of mortgage assignments effectively.

Free preview

How to fill out Manchester New Hampshire Assignment Of Mortgage By Individual Mortgage Holder?

If you’ve already used our service before, log in to your account and download the Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Manchester New Hampshire Assignment of Mortgage by Individual Mortgage Holder. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!