Manchester New Hampshire Assignment of Mortgage by Corporate Mortgage Holder In Manchester, New Hampshire, an Assignment of Mortgage by a Corporate Mortgage Holder is a legal document that transfers the rights and interests of a mortgage from one corporate entity to another. This process typically occurs when the original corporate mortgage holder sells, transfers, or assigns the mortgage loan to another corporate entity or financial institution. The Assignment of Mortgage is an important legal instrument that ensures the proper transfer and documentation of ownership of the mortgage loan. It provides a clear and transparent record of the change in ownership, which is crucial for any future transactions or legal proceedings related to the mortgage. The document contains several key elements, including the identification of the original mortgage lender or corporation and the transferee corporation. It also specifies the terms and conditions of the assignment, including the principal amount of the mortgage, the interest rate, the maturity date, and any other relevant terms of the loan. In Manchester, New Hampshire, there are different types of Assignment of Mortgage by Corporate Mortgage Holder, depending on the nature of the transfer or assignment. Some of these types include: 1. Full Assignment: This type of assignment involves the complete transfer of the mortgage, including all rights, interests, and obligations, from one corporate mortgage holder to another. 2. Partial Assignment: In certain cases, a corporate mortgage holder may choose to transfer only a portion of their interest in the mortgage loan to another corporate entity. This partial assignment outlines the specific portion of the mortgage being transferred and any associated terms or conditions. 3. Assignment with Assumption: In some instances, the Assignment of Mortgage may involve the assumption of the mortgage loan by the transferee corporation. This means that the transferee corporation becomes responsible for all future mortgage payments and obligations. 4. Assignment for Security: This type of assignment occurs when a corporate mortgage holder transfers the mortgage as security for a debt or other obligation owed to the transferee corporation. In this case, the assignment serves as collateral for the repayment of the debt or obligation. It's essential to note that the Manchester, New Hampshire Assignment of Mortgage by Corporate Mortgage Holder must comply with all applicable state and federal laws and regulations. The document should be executed and recorded in the appropriate county registry of deeds to ensure its legality and validity. In conclusion, the Assignment of Mortgage by Corporate Mortgage Holder in Manchester, New Hampshire, plays a crucial role in the transfer of mortgage ownership from one corporate entity to another. It serves as a legal document that ensures transparency and clarity in the mortgage transfer process, while also protecting the rights and interests of both the original and transferee corporations.

Manchester New Hampshire Assignment of Mortgage by Corporate Mortgage Holder

State:

New Hampshire

City:

Manchester

Control #:

NH-121RE

Format:

Word;

Rich Text

Instant download

Description

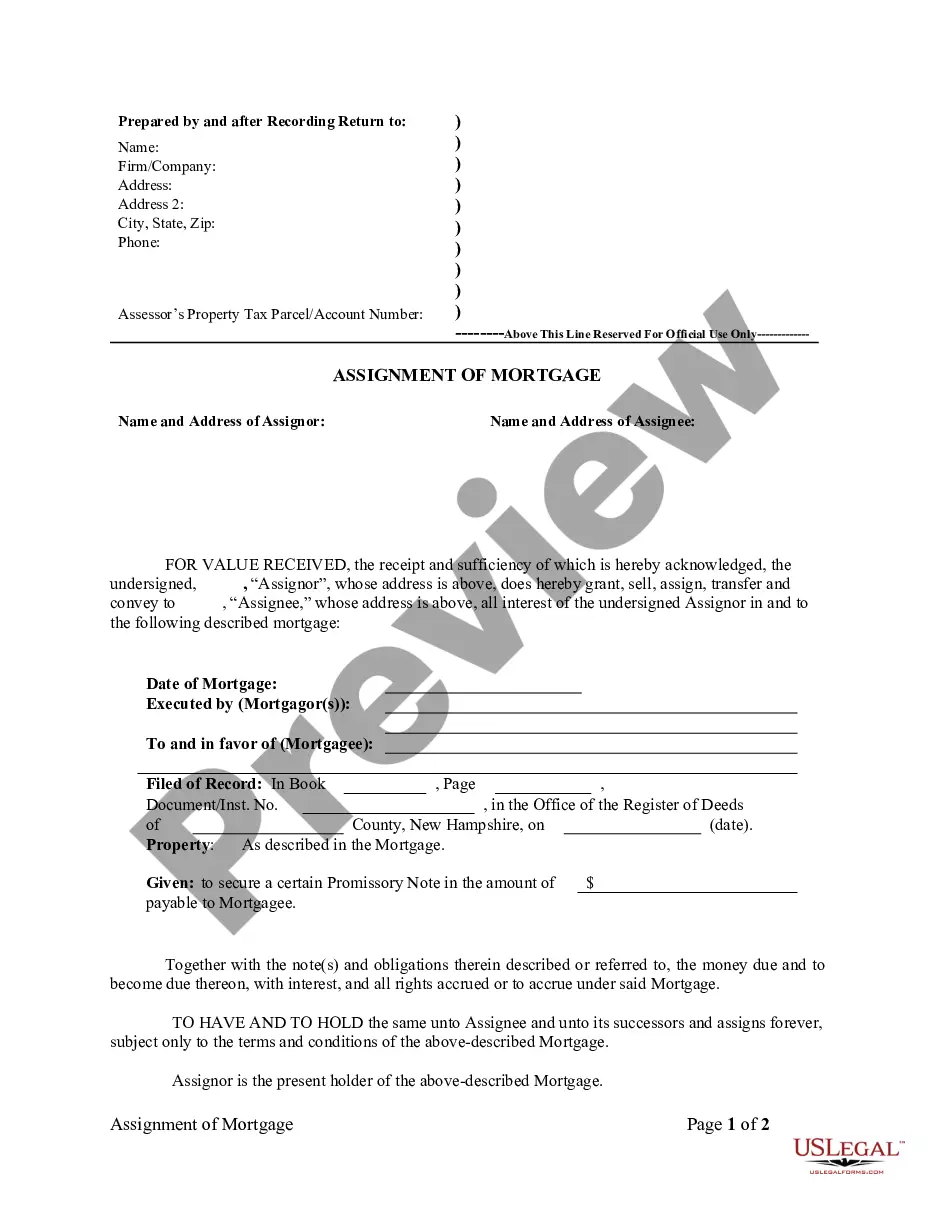

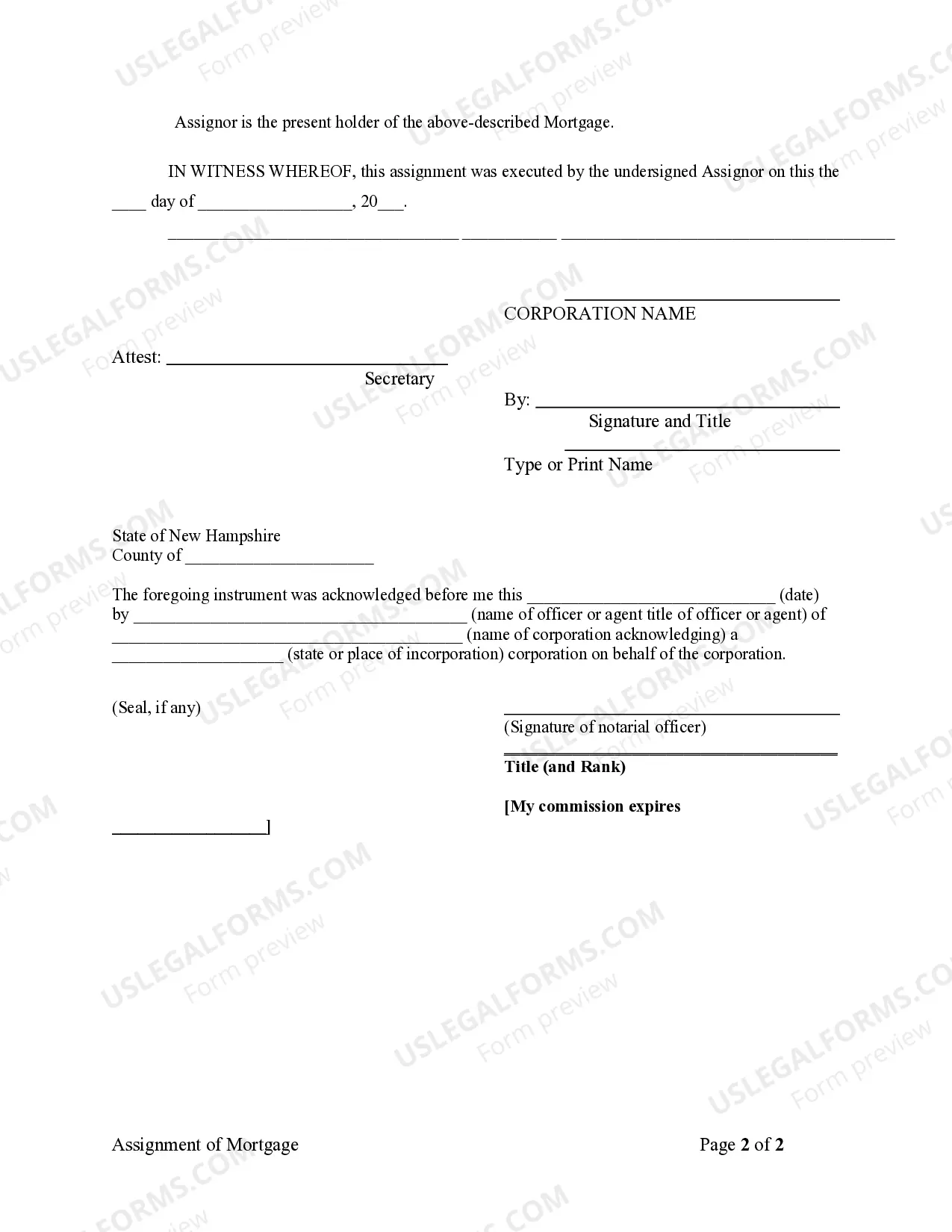

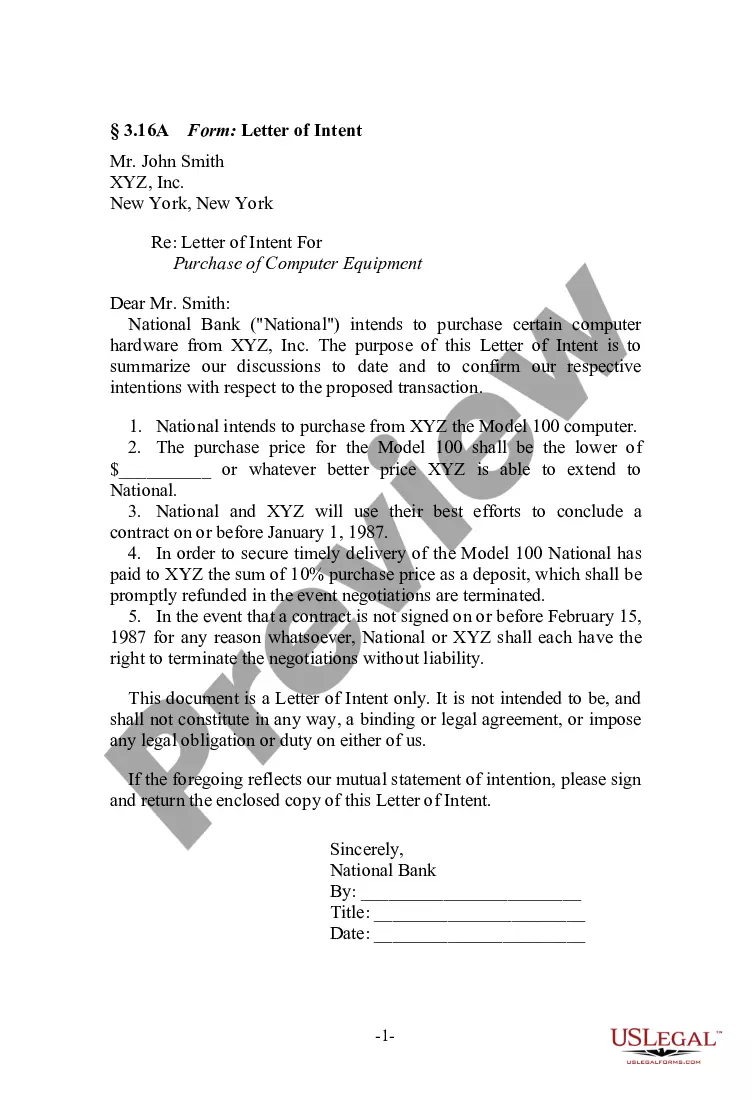

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Manchester New Hampshire Assignment of Mortgage by Corporate Mortgage Holder In Manchester, New Hampshire, an Assignment of Mortgage by a Corporate Mortgage Holder is a legal document that transfers the rights and interests of a mortgage from one corporate entity to another. This process typically occurs when the original corporate mortgage holder sells, transfers, or assigns the mortgage loan to another corporate entity or financial institution. The Assignment of Mortgage is an important legal instrument that ensures the proper transfer and documentation of ownership of the mortgage loan. It provides a clear and transparent record of the change in ownership, which is crucial for any future transactions or legal proceedings related to the mortgage. The document contains several key elements, including the identification of the original mortgage lender or corporation and the transferee corporation. It also specifies the terms and conditions of the assignment, including the principal amount of the mortgage, the interest rate, the maturity date, and any other relevant terms of the loan. In Manchester, New Hampshire, there are different types of Assignment of Mortgage by Corporate Mortgage Holder, depending on the nature of the transfer or assignment. Some of these types include: 1. Full Assignment: This type of assignment involves the complete transfer of the mortgage, including all rights, interests, and obligations, from one corporate mortgage holder to another. 2. Partial Assignment: In certain cases, a corporate mortgage holder may choose to transfer only a portion of their interest in the mortgage loan to another corporate entity. This partial assignment outlines the specific portion of the mortgage being transferred and any associated terms or conditions. 3. Assignment with Assumption: In some instances, the Assignment of Mortgage may involve the assumption of the mortgage loan by the transferee corporation. This means that the transferee corporation becomes responsible for all future mortgage payments and obligations. 4. Assignment for Security: This type of assignment occurs when a corporate mortgage holder transfers the mortgage as security for a debt or other obligation owed to the transferee corporation. In this case, the assignment serves as collateral for the repayment of the debt or obligation. It's essential to note that the Manchester, New Hampshire Assignment of Mortgage by Corporate Mortgage Holder must comply with all applicable state and federal laws and regulations. The document should be executed and recorded in the appropriate county registry of deeds to ensure its legality and validity. In conclusion, the Assignment of Mortgage by Corporate Mortgage Holder in Manchester, New Hampshire, plays a crucial role in the transfer of mortgage ownership from one corporate entity to another. It serves as a legal document that ensures transparency and clarity in the mortgage transfer process, while also protecting the rights and interests of both the original and transferee corporations.

Free preview

How to fill out Manchester New Hampshire Assignment Of Mortgage By Corporate Mortgage Holder?

If you’ve already utilized our service before, log in to your account and save the Manchester New Hampshire Assignment of Mortgage by Corporate Mortgage Holder on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Manchester New Hampshire Assignment of Mortgage by Corporate Mortgage Holder. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!