The Manchester New Hampshire Business Credit Application is a comprehensive and detailed document that is required by financial institutions and lending entities when a business owner in Manchester, New Hampshire is applying for a credit line or loan. This application is designed to provide necessary information about the business and its financial history, which helps the lender evaluate the creditworthiness and repayment capacity of the applicant. Keywords: Manchester New Hampshire, Business Credit Application, financial institutions, lending entities, credit line, loan, creditworthiness, repayment capacity. There are typically two main types of Manchester New Hampshire Business Credit Applications: 1. Manchester New Hampshire Small Business Credit Application: This type of credit application is suitable for small businesses operating in Manchester, New Hampshire. It includes specific sections to capture relevant information about the business, such as the business name, address, contact details, years in operation, legal structure, industry, and a brief description of the products or services offered. Additionally, the application requires details regarding the business owner's personal information, financial statements, tax returns, and any existing loans or lines of credit. Keywords: small business, business name, address, contact details, years in operation, legal structure, industry, products, services, personal information, financial statements, tax returns, loans, lines of credit. 2. Manchester New Hampshire Corporate Credit Application: This type of credit application is intended for larger corporations or companies established in Manchester, New Hampshire. It encompasses a more detailed set of information compared to the small business credit application. In addition to the basic business details, it typically requires comprehensive financial statements, balance sheets, income statements, cash flow statements, and a list of current assets and liabilities. Furthermore, the application may request information about the management team, shareholder details, and any significant achievements or awards earned by the company. Keywords: corporate credit application, larger corporations, companies, financial statements, balance sheets, income statements, cash flow statements, assets, liabilities, management team, shareholders, achievements, awards. Both types of Manchester New Hampshire Business Credit Applications play a crucial role in assessing the creditworthiness of businesses seeking financial assistance. It is important to ensure that all the required fields and documents are accurately completed and submitted, as any missing or incomplete information may delay the credit evaluation process or negatively impact the application's chances of approval.

Manchester New Hampshire Business Credit Application

State:

New Hampshire

City:

Manchester

Control #:

NH-20-CR

Format:

Word;

Rich Text

Instant download

Description

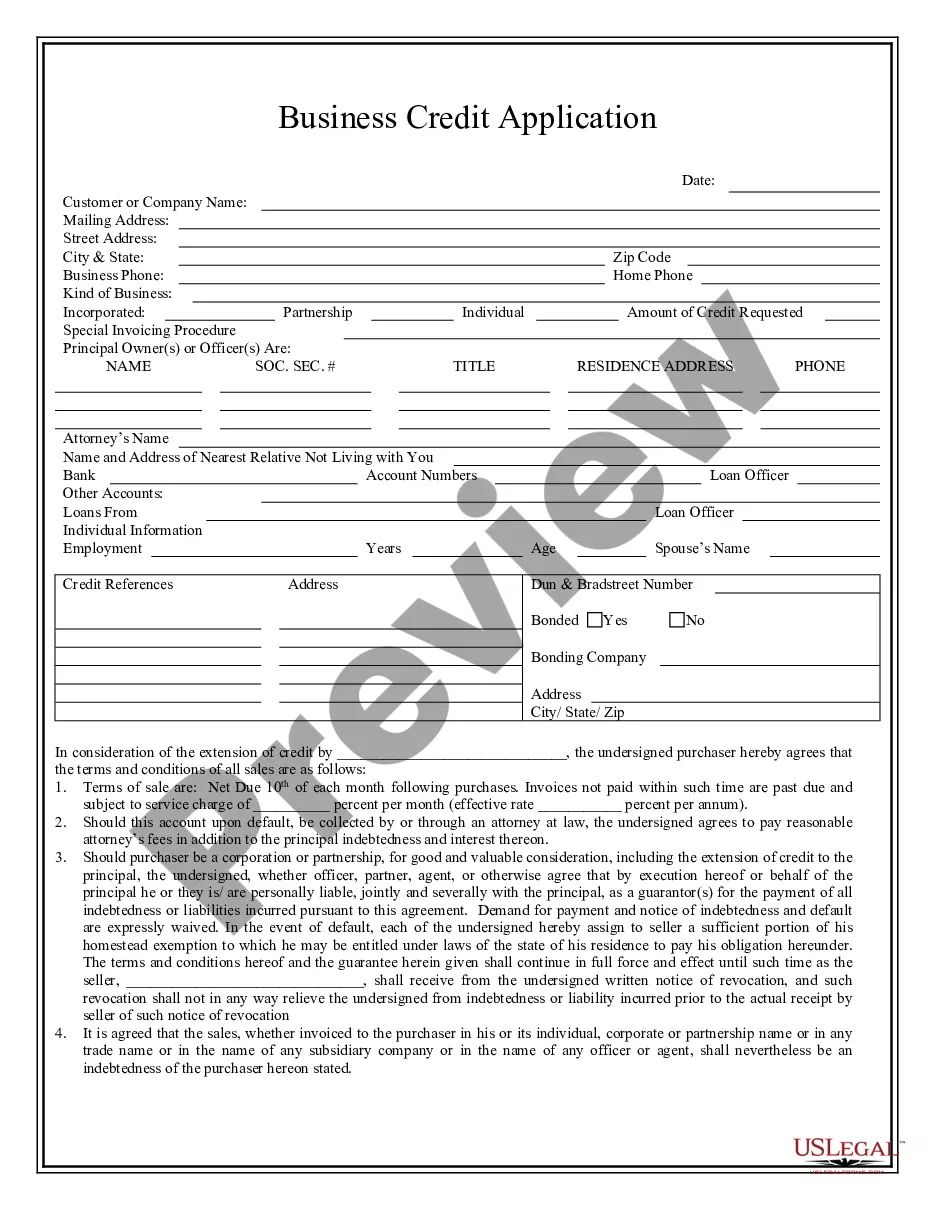

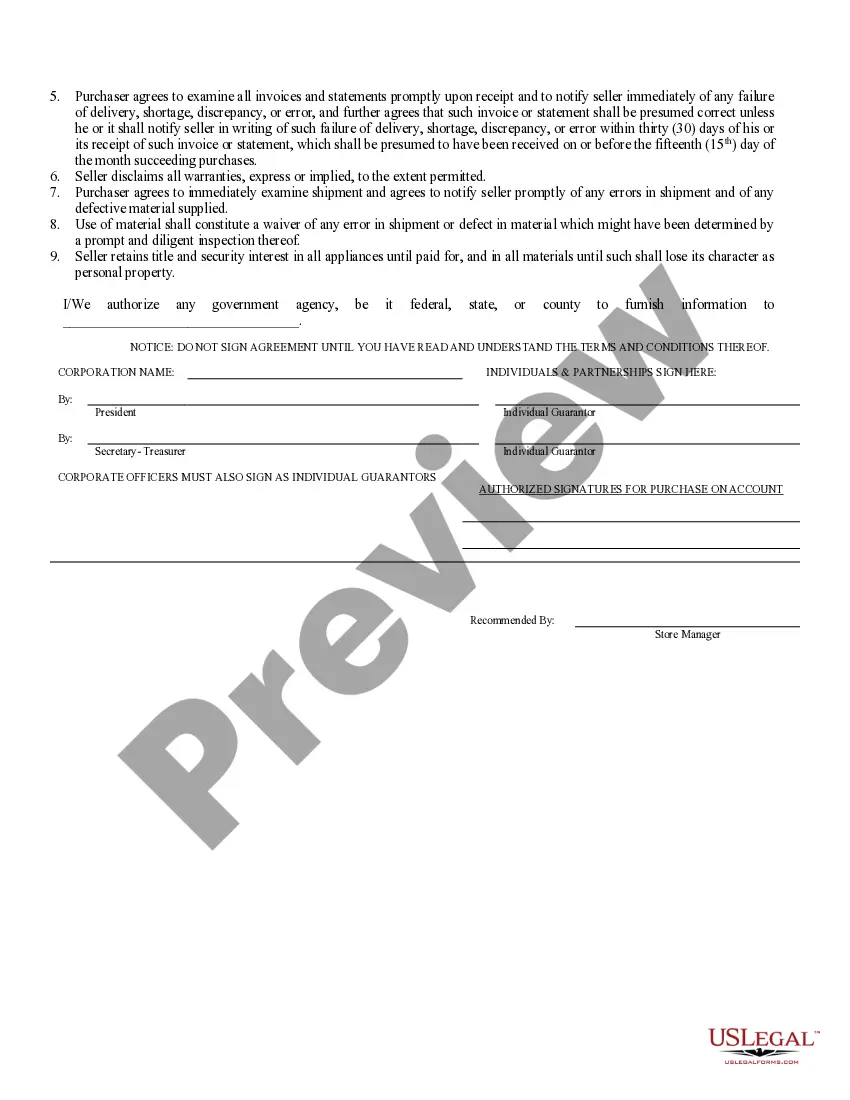

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

The Manchester New Hampshire Business Credit Application is a comprehensive and detailed document that is required by financial institutions and lending entities when a business owner in Manchester, New Hampshire is applying for a credit line or loan. This application is designed to provide necessary information about the business and its financial history, which helps the lender evaluate the creditworthiness and repayment capacity of the applicant. Keywords: Manchester New Hampshire, Business Credit Application, financial institutions, lending entities, credit line, loan, creditworthiness, repayment capacity. There are typically two main types of Manchester New Hampshire Business Credit Applications: 1. Manchester New Hampshire Small Business Credit Application: This type of credit application is suitable for small businesses operating in Manchester, New Hampshire. It includes specific sections to capture relevant information about the business, such as the business name, address, contact details, years in operation, legal structure, industry, and a brief description of the products or services offered. Additionally, the application requires details regarding the business owner's personal information, financial statements, tax returns, and any existing loans or lines of credit. Keywords: small business, business name, address, contact details, years in operation, legal structure, industry, products, services, personal information, financial statements, tax returns, loans, lines of credit. 2. Manchester New Hampshire Corporate Credit Application: This type of credit application is intended for larger corporations or companies established in Manchester, New Hampshire. It encompasses a more detailed set of information compared to the small business credit application. In addition to the basic business details, it typically requires comprehensive financial statements, balance sheets, income statements, cash flow statements, and a list of current assets and liabilities. Furthermore, the application may request information about the management team, shareholder details, and any significant achievements or awards earned by the company. Keywords: corporate credit application, larger corporations, companies, financial statements, balance sheets, income statements, cash flow statements, assets, liabilities, management team, shareholders, achievements, awards. Both types of Manchester New Hampshire Business Credit Applications play a crucial role in assessing the creditworthiness of businesses seeking financial assistance. It is important to ensure that all the required fields and documents are accurately completed and submitted, as any missing or incomplete information may delay the credit evaluation process or negatively impact the application's chances of approval.

Free preview

How to fill out Manchester New Hampshire Business Credit Application?

If you’ve already used our service before, log in to your account and save the Manchester New Hampshire Business Credit Application on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make certain you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Manchester New Hampshire Business Credit Application. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!