Manchester New Hampshire Individual Credit Application refers to the process of applying for credit as an individual in the city of Manchester, New Hampshire. It is a detailed application form that individuals must fill out when seeking credit from financial institutions, such as banks, credit unions, or lenders, in Manchester. This credit application is crucial for individuals who wish to obtain credit for personal reasons, such as purchasing a vehicle, a home, or funding educational expenses. By filling out the Manchester New Hampshire Individual Credit Application, applicants provide necessary information that assesses their creditworthiness and helps lenders make informed decisions. The Manchester New Hampshire Individual Credit Application generally requires applicants to provide personal details, financial information, and employment history. The application might ask for full name, address, social security number, date of birth, contact details, and government-issued identification. Financial information sought in the application may include income details, existing debts, assets, and liabilities. Applicants may also need to disclose their employment status, employer details, and income stability. The Manchester New Hampshire Individual Credit Application includes provisions related to the type of credit requested, the desired loan amount, repayment terms, and the purpose of the credit. Applicants may need to specify whether they seek a personal loan, car loan, mortgage, or other forms of credit. Different types of Manchester New Hampshire Individual Credit Applications may relate to specific types of credit. For instance: 1. Manchester New Hampshire Auto Loan Application: Specifically designed for individuals seeking credit to purchase a vehicle. 2. Manchester New Hampshire Mortgage Loan Application: Tailored for those looking to obtain credit for buying a house or property. 3. Manchester New Hampshire Personal Loan Application: Intended for individuals who need credit for personal expenses, debt consolidation, or emergency situations. It is important to note that each financial institution may have its own version of the Manchester New Hampshire Individual Credit Application, with slight variations in terms of format and specific information required. It is advisable for applicants to familiarize themselves with the requirements of the particular lender they intend to approach and ensure they provide accurate and up-to-date information on the credit application. By diligently completing and submitting the Manchester New Hampshire Individual Credit Application, individuals can present their financial status and creditworthiness to potential lenders, increasing their chances of securing credit for their personal needs in Manchester, New Hampshire.

Manchester New Hampshire Individual Credit Application

State:

New Hampshire

City:

Manchester

Control #:

NH-21-CR

Format:

Word;

Rich Text

Instant download

Description

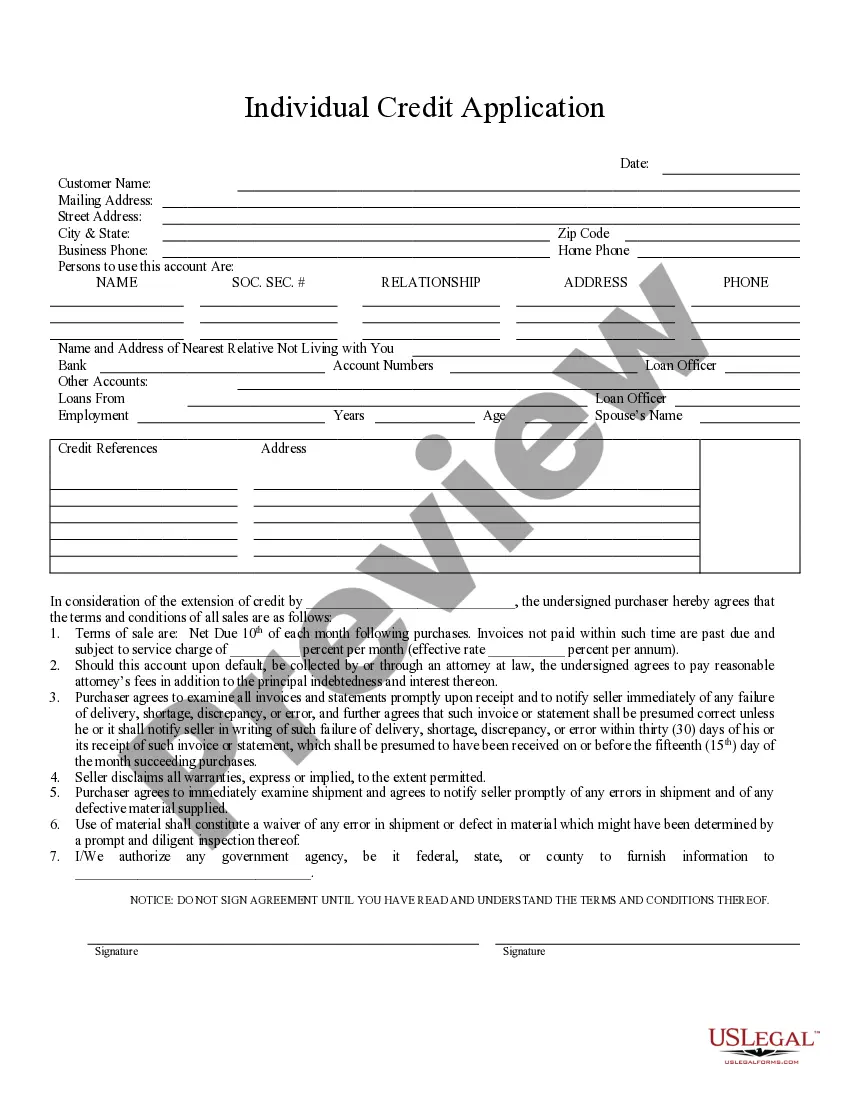

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Manchester New Hampshire Individual Credit Application refers to the process of applying for credit as an individual in the city of Manchester, New Hampshire. It is a detailed application form that individuals must fill out when seeking credit from financial institutions, such as banks, credit unions, or lenders, in Manchester. This credit application is crucial for individuals who wish to obtain credit for personal reasons, such as purchasing a vehicle, a home, or funding educational expenses. By filling out the Manchester New Hampshire Individual Credit Application, applicants provide necessary information that assesses their creditworthiness and helps lenders make informed decisions. The Manchester New Hampshire Individual Credit Application generally requires applicants to provide personal details, financial information, and employment history. The application might ask for full name, address, social security number, date of birth, contact details, and government-issued identification. Financial information sought in the application may include income details, existing debts, assets, and liabilities. Applicants may also need to disclose their employment status, employer details, and income stability. The Manchester New Hampshire Individual Credit Application includes provisions related to the type of credit requested, the desired loan amount, repayment terms, and the purpose of the credit. Applicants may need to specify whether they seek a personal loan, car loan, mortgage, or other forms of credit. Different types of Manchester New Hampshire Individual Credit Applications may relate to specific types of credit. For instance: 1. Manchester New Hampshire Auto Loan Application: Specifically designed for individuals seeking credit to purchase a vehicle. 2. Manchester New Hampshire Mortgage Loan Application: Tailored for those looking to obtain credit for buying a house or property. 3. Manchester New Hampshire Personal Loan Application: Intended for individuals who need credit for personal expenses, debt consolidation, or emergency situations. It is important to note that each financial institution may have its own version of the Manchester New Hampshire Individual Credit Application, with slight variations in terms of format and specific information required. It is advisable for applicants to familiarize themselves with the requirements of the particular lender they intend to approach and ensure they provide accurate and up-to-date information on the credit application. By diligently completing and submitting the Manchester New Hampshire Individual Credit Application, individuals can present their financial status and creditworthiness to potential lenders, increasing their chances of securing credit for their personal needs in Manchester, New Hampshire.

How to fill out Manchester New Hampshire Individual Credit Application?

If you’ve already utilized our service before, log in to your account and save the Manchester New Hampshire Individual Credit Application on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Manchester New Hampshire Individual Credit Application. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!