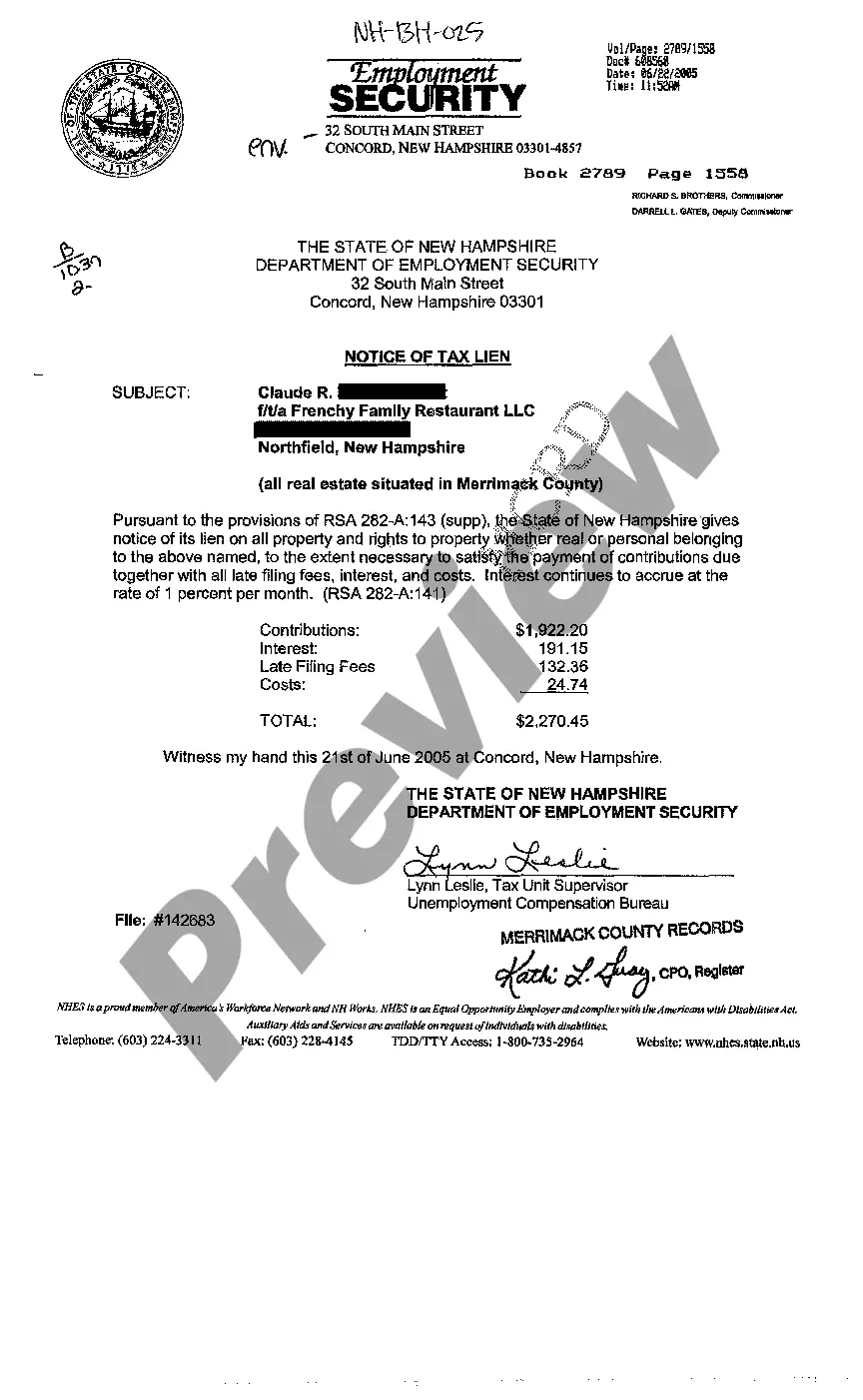

Description: A Manchester New Hampshire Notice of Tax Lien is an official document issued by the local government to inform property owners of their unpaid taxes and the subsequent legal actions that may be taken if the debts are not settled. It serves as a notice of the government's claim to the property due to unpaid taxes. When a property owner fails to pay their property taxes on time, the local tax office has the authority to place a lien on the property. This lien acts as a legal claim against the property and guarantees the government's right to collect the outstanding taxes plus any applicable penalties and interest. The Manchester New Hampshire Notice of Tax Lien is the formal communication sent to the property owner, alerting them of the lien's creation. The Notice of Tax Lien provides detailed information such as the property owner's name, address, and the amount of outstanding taxes owed. It includes the tax year(s) in which the debts have accumulated, and the total amount due, including any interest and penalties that may have accrued. There are different types of Manchester New Hampshire Notice of Tax Liens that may be issued depending on the situation: 1. General Tax Lien: This is the most common type of tax lien that is placed on properties when property owners fail to pay their annual property taxes. It ensures the government's right to collect the unpaid taxes and secure the debt against the property. 2. Special Assessment Tax Lien: In some cases, the local government may levy a special assessment on a property for specific improvements or services such as sewer installation or pavement repairs. If the property owner fails to pay the special assessment, a Notice of Tax Lien will be issued to secure the amount owed. 3. Personal Income Tax Lien: This type of tax lien applies when an individual or business has not paid their state income tax obligations. The Department of Revenue Administration may file a Notice of Tax Lien against the individual or business, attaching it to their personal or business assets, including real estate. 4. Business Tax Lien: If a business entity fails to pay its business taxes, including sales tax, meals and rooms tax, or business enterprise tax, the Department of Revenue Administration may issue a Notice of Tax Lien against the business and its assets. It is important for property owners to address a Manchester New Hampshire Notice of Tax Lien promptly. Ignoring or neglecting the notice can have serious consequences, including foreclosure or forced sale of the property. Property owners should contact the local tax office or seek professional advice to understand their options for resolving the outstanding tax debt and removing the lien from their property.

Manchester New Hampshire Notice of Tax Lien

Description

How to fill out Manchester New Hampshire Notice Of Tax Lien?

If you’ve already utilized our service before, log in to your account and save the Manchester New Hampshire Notice of Tax Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Manchester New Hampshire Notice of Tax Lien. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!

Form popularity

FAQ

Filing a Manchester New Hampshire Notice of Tax Lien typically involves several steps, and the timeframe can vary. Generally, it takes anywhere from a few days to a couple of weeks to complete the filing process, depending on the accuracy of your documentation and the responsiveness of the authorities involved. To expedite the process, gather all necessary information beforehand and ensure that your paperwork complies with state regulations. Consider using online services like uslegalforms to simplify your filing and reduce potential delays.

Yes, tax liens can appear on your credit report, affecting your creditworthiness. They remain on your credit file for several years, making it vital to address any outstanding obligations promptly. If a Manchester New Hampshire Notice of Tax Lien appears on your report, taking action can help clear your credit history and improve your financial standing.

In New Hampshire, property owners typically have about two years before the state initiates property tax foreclosure. However, penalties and interest accrue during this period, making it crucial to address unpaid taxes promptly. If you receive a Manchester New Hampshire Notice of Tax Lien, consider seeking help to avoid further financial repercussions.

To withdraw a tax lien, you typically need to resolve the debt by paying the owed amount or negotiating a payment plan with the IRS. Once the debt is settled, you can request a withdrawal of the lien, which can help improve your credit status. The process can be intricate, so using resources like UsLegalForms may streamline your experience regarding a Manchester New Hampshire Notice of Tax Lien.

You can check if the IRS has placed a lien on you by reviewing your credit report or contacting the IRS directly for information. Additionally, local courthouses may have public records that indicate if a Manchester New Hampshire Notice of Tax Lien has been filed against you. Promptly checking these sources can help you address any potential issues.

In New Hampshire, a tax lien claims the government has on a property due to unpaid property taxes. This lien allows the state to collect debts owed to them, including property taxes. When you receive a Manchester New Hampshire Notice of Tax Lien, it is important to address the situation quickly to avoid further complications, such as foreclosure on your property.

Before the IRS places a lien, they usually send several notices regarding unpaid tax obligations. Generally, you will receive at least two notices before they escalate to a tax lien scenario. It is crucial to respond promptly to these notices, as ignoring them can lead to a Manchester New Hampshire Notice of Tax Lien being issued against you.

The IRS informs you of a tax lien through a written notice sent to your last known address. This notice explains the amount owed, the nature of the tax lien, and provides guidance on how to resolve the issue. You can take action to address this lien, particularly a Manchester New Hampshire Notice of Tax Lien, to protect your assets and credit.

To obtain a tax lien, you must first ensure that property taxes remain unpaid for a specified duration. The local tax authority will issue the lien to recover the owed amount. Utilizing platforms like uslegalforms can assist you in understanding the process for securing a Manchester New Hampshire Notice of Tax Lien on your property.

New Hampshire has a unique tax structure that does not impose a sales tax or an income tax. Instead, property taxes are the primary source of government revenue. Knowing this can help you anticipate possible tax liens, such as the Manchester New Hampshire Notice of Tax Lien, if property taxes are not met.