The Manchester New Hampshire Loan Modification Agreement to Increase Loan Amount and Confirm Maturity Date is an important legal document that outlines the terms and conditions for modifying an existing loan in Manchester, New Hampshire. This agreement is primarily used when borrowers require additional funds and wish to extend the maturity date of their loan. Keywords: Manchester New Hampshire Loan Modification Agreement, Increase Loan Amount, Confirm Maturity Date, modification terms, legal document, borrowers, existing loan, additional funds, extend maturity date. There may be different types of Manchester New Hampshire Loan Modification Agreement to Increase Loan Amount and Confirm Maturity Date, including: 1. Fixed-Rate Loan Modification: This type of agreement ensures that the new loan amount will have a fixed interest rate. Borrowers can increase their loan amount while maintaining a predictable interest rate throughout the modified loan term. 2. Adjustable-Rate Loan Modification: With this agreement, borrowers can increase their loan amount and adjust the interest rate based on prevailing market conditions. The interest rate may vary over the term of the modified loan based on changes in the market index. 3. Term Extension Agreement: This type of modification agreement allows borrowers to extend the maturity date of their loan while increasing the loan amount. It provides flexibility by spreading the repayments over a longer period, which may result in lower monthly payments. 4. Balloon Loan Modification: In certain cases, borrowers may opt for a balloon loan modification agreement, where a significant portion of the loan balance becomes due at the end of the modified loan term. Increasing the loan amount and confirming the maturity date in this case allows borrowers to structure repayments while balancing the immediate need for additional funds. 5. Principal Deferment Modification: This unique modification agreement allows borrowers to temporarily defer a portion of the principal amount, effectively increasing the loan amount while confirming a new maturity date. This can be useful for borrowers facing temporary financial hardship, providing them with flexibility in managing their loan obligations. It is essential to consult legal professionals or loan specialists to understand the specific terms, conditions, and options available for Manchester New Hampshire Loan Modification Agreements to Increase Loan Amounts and Confirm Maturity Dates. The exact terms and variations of these agreements may differ depending on lenders, borrower qualifications, and the specific needs of each individual situation.

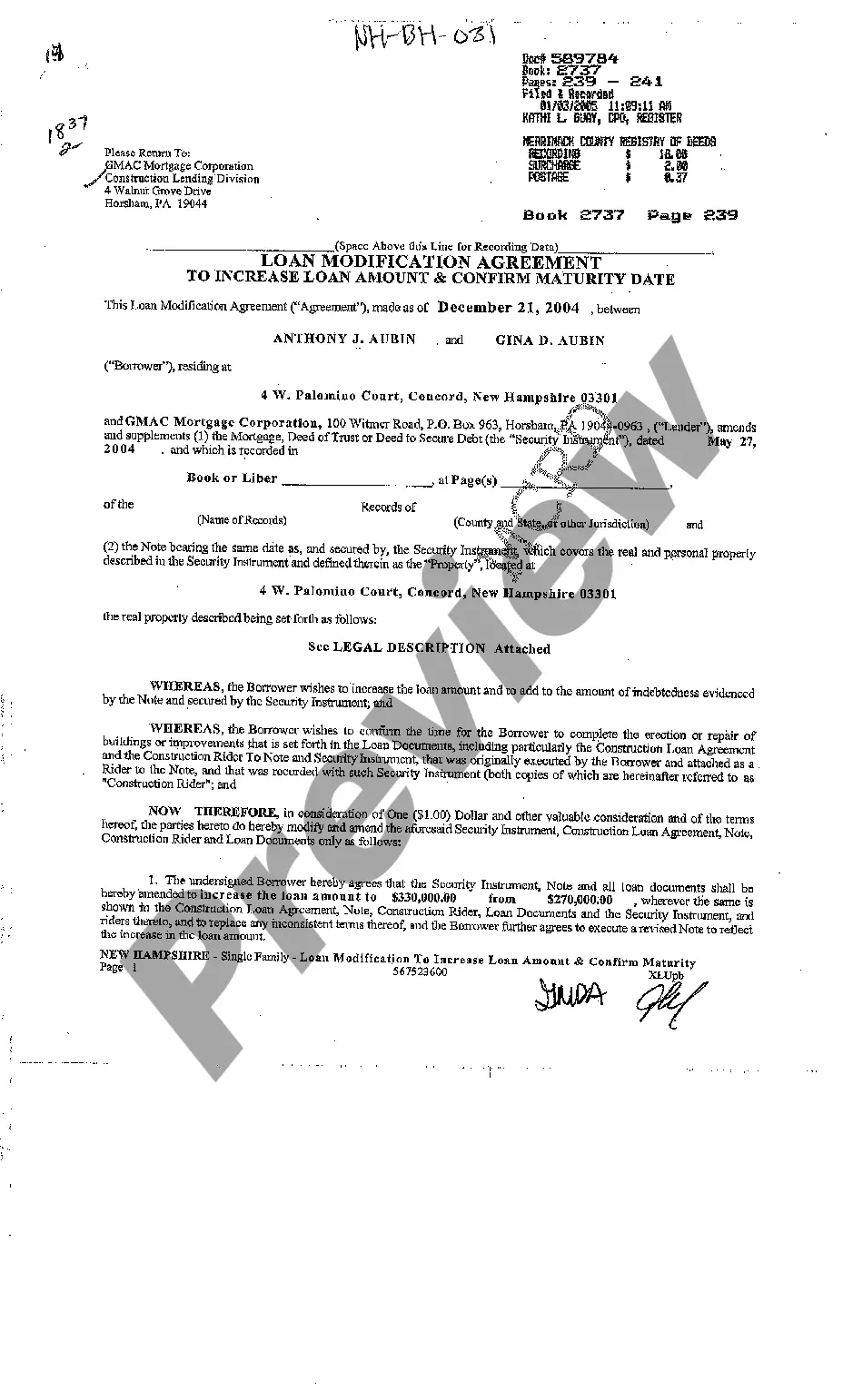

Manchester New Hampshire Loan Modification Agreement to Increase Loan Amount and Confirm Maturity Date

State:

New Hampshire

City:

Manchester

Control #:

NH-BH-031

Format:

PDF

Instant download

This form is available by subscription

Description

Loan Modification Agreement to Increase Loan Amount and Confirm Maturity Date

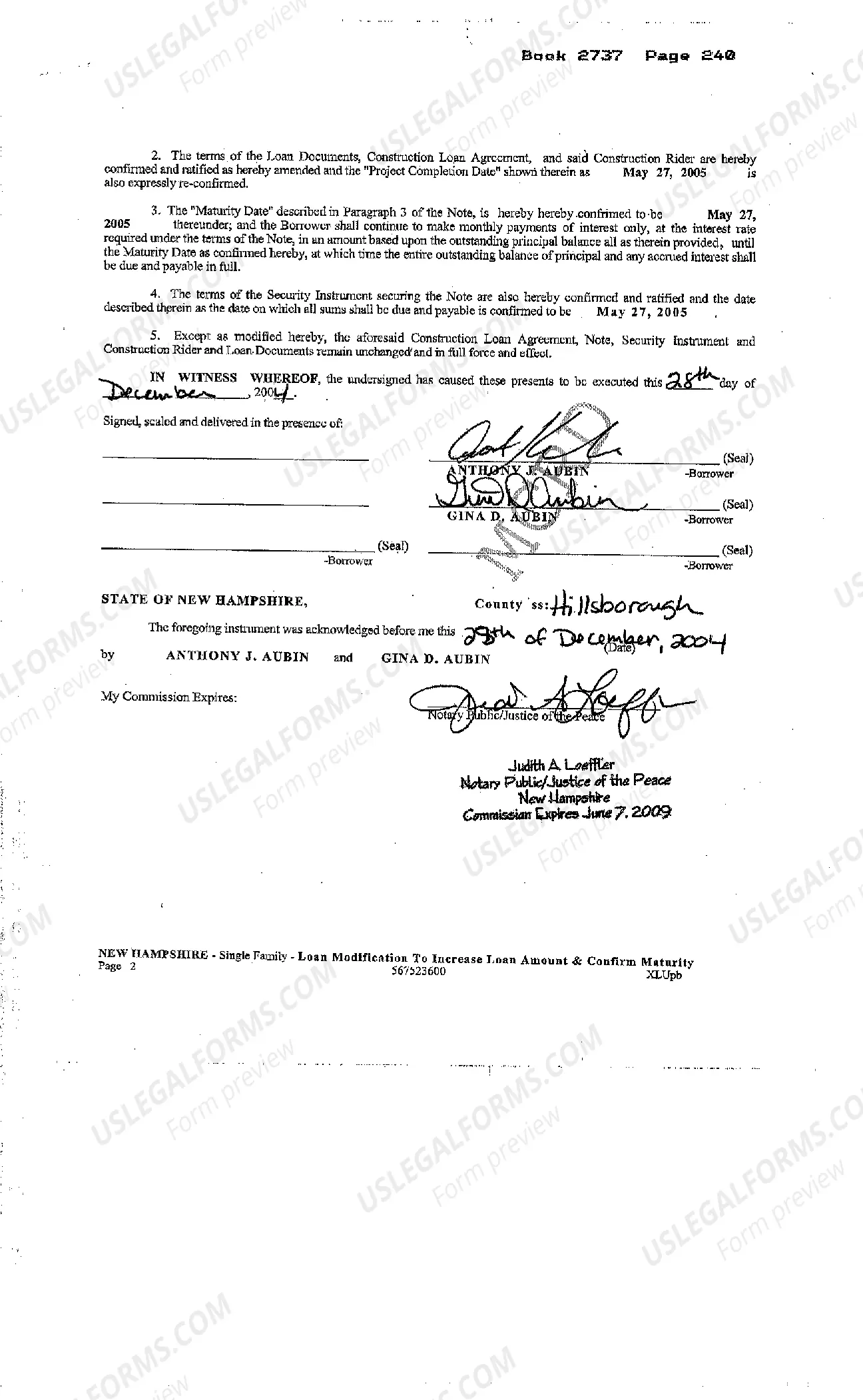

The Manchester New Hampshire Loan Modification Agreement to Increase Loan Amount and Confirm Maturity Date is an important legal document that outlines the terms and conditions for modifying an existing loan in Manchester, New Hampshire. This agreement is primarily used when borrowers require additional funds and wish to extend the maturity date of their loan. Keywords: Manchester New Hampshire Loan Modification Agreement, Increase Loan Amount, Confirm Maturity Date, modification terms, legal document, borrowers, existing loan, additional funds, extend maturity date. There may be different types of Manchester New Hampshire Loan Modification Agreement to Increase Loan Amount and Confirm Maturity Date, including: 1. Fixed-Rate Loan Modification: This type of agreement ensures that the new loan amount will have a fixed interest rate. Borrowers can increase their loan amount while maintaining a predictable interest rate throughout the modified loan term. 2. Adjustable-Rate Loan Modification: With this agreement, borrowers can increase their loan amount and adjust the interest rate based on prevailing market conditions. The interest rate may vary over the term of the modified loan based on changes in the market index. 3. Term Extension Agreement: This type of modification agreement allows borrowers to extend the maturity date of their loan while increasing the loan amount. It provides flexibility by spreading the repayments over a longer period, which may result in lower monthly payments. 4. Balloon Loan Modification: In certain cases, borrowers may opt for a balloon loan modification agreement, where a significant portion of the loan balance becomes due at the end of the modified loan term. Increasing the loan amount and confirming the maturity date in this case allows borrowers to structure repayments while balancing the immediate need for additional funds. 5. Principal Deferment Modification: This unique modification agreement allows borrowers to temporarily defer a portion of the principal amount, effectively increasing the loan amount while confirming a new maturity date. This can be useful for borrowers facing temporary financial hardship, providing them with flexibility in managing their loan obligations. It is essential to consult legal professionals or loan specialists to understand the specific terms, conditions, and options available for Manchester New Hampshire Loan Modification Agreements to Increase Loan Amounts and Confirm Maturity Dates. The exact terms and variations of these agreements may differ depending on lenders, borrower qualifications, and the specific needs of each individual situation.

Free preview

How to fill out Manchester New Hampshire Loan Modification Agreement To Increase Loan Amount And Confirm Maturity Date?

If you’ve already used our service before, log in to your account and download the Manchester New Hampshire Loan Modification Agreement to Increase Loan Amount and Confirm Maturity Date on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Manchester New Hampshire Loan Modification Agreement to Increase Loan Amount and Confirm Maturity Date. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!