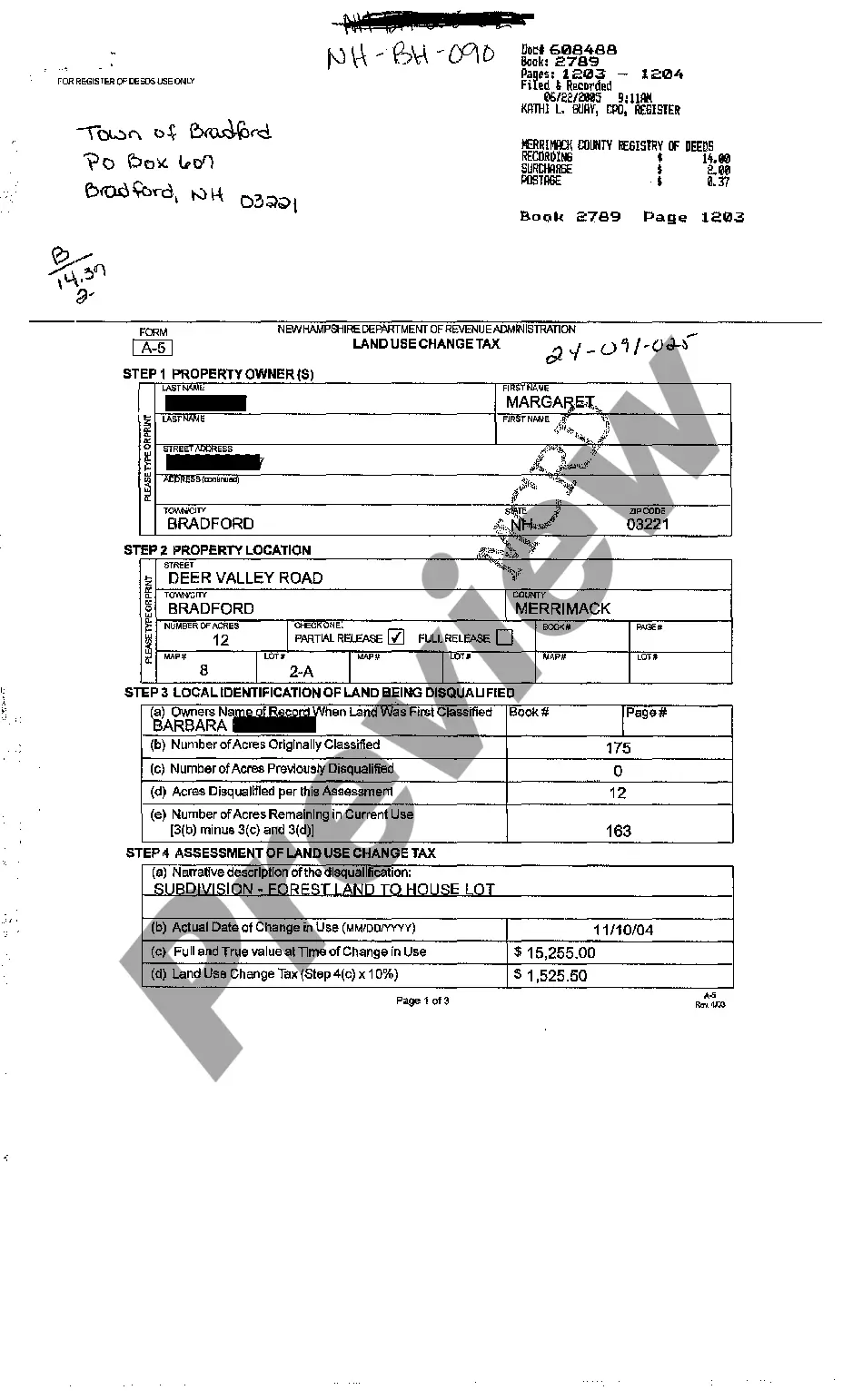

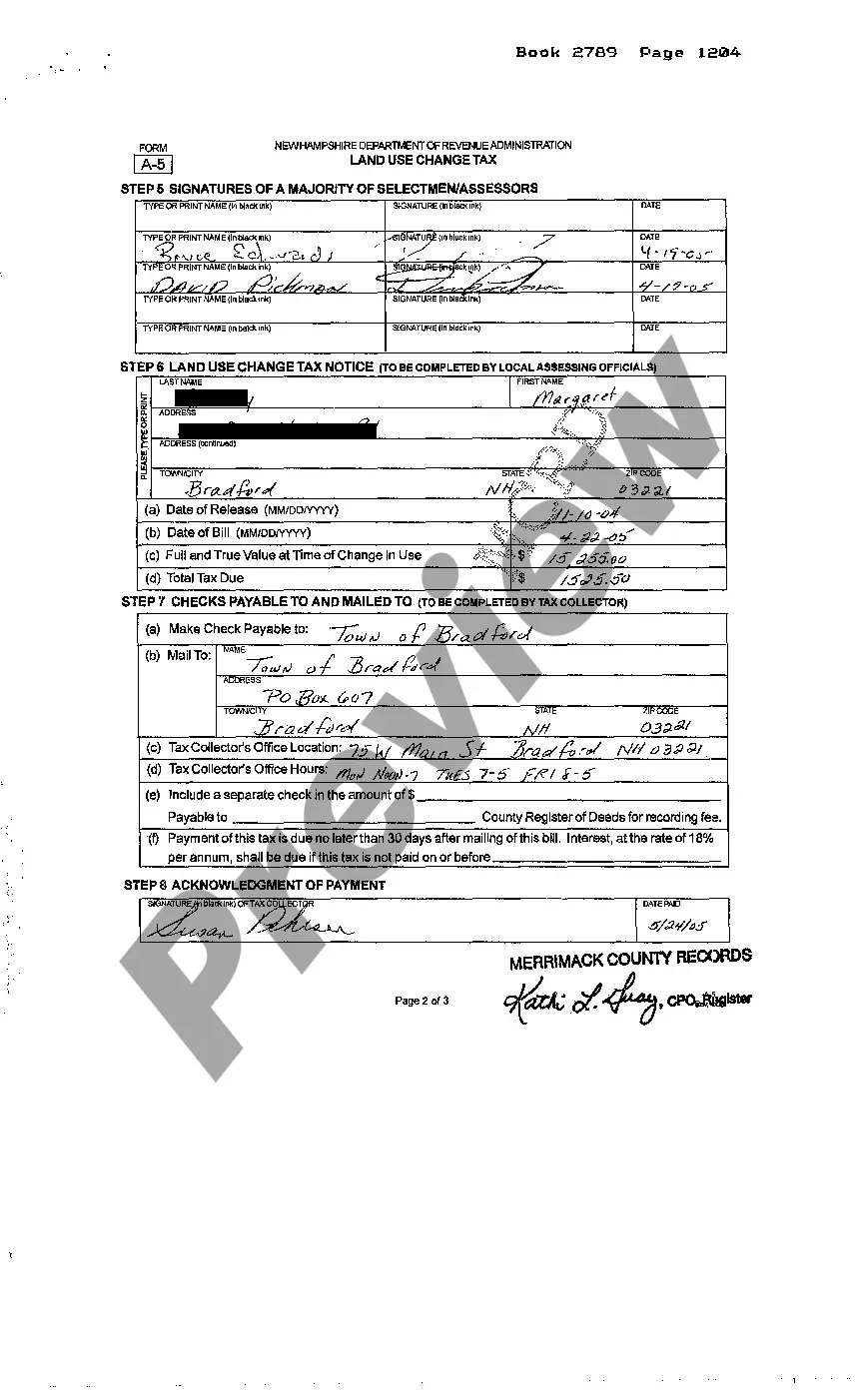

The Manchester New Hampshire Land Use Change Tax is a tax imposed on properties within the city of Manchester when a change in land use occurs. This tax is designed to capture the potential increase in property value that occurs when a property changes from a lower valued use to a higher valued use. The land use change tax is an important revenue source for the city, helping to fund various municipal services and infrastructure projects. One type of Manchester New Hampshire Land Use Change Tax is applicable when a property is changed from agricultural or undeveloped land to residential, commercial, or industrial use. This type of land use change can significantly impact the value of the property, and the tax is imposed to capture a portion of this increased value. Another type of land use change tax in Manchester is applicable when a property is converted from one type of commercial or industrial use to another. This tax is imposed to account for the potential increase in value that may occur with the change, as different commercial uses may have varying levels of demand and profitability. The land use change tax rates in Manchester, New Hampshire vary depending on the type of use change and the assessed value of the property. The tax is calculated based on a percentage of the increased assessed value resulting from the change in land use. The collected revenue from the land use change tax is an important source of income for the city of Manchester. It helps fund public schools, road maintenance, parks, and other essential services that contribute to the overall quality of life for residents. Proper documentation and compliance with land use change tax regulations are essential for property owners and developers in Manchester. Failure to pay the required tax or comply with reporting requirements can result in penalties and legal consequences. Overall, the Manchester New Hampshire Land Use Change Tax plays a crucial role in managing and funding the development and growth of the city. By capturing a portion of the value created through land use changes, it ensures that the city can continue to provide essential services and maintain its infrastructure for the benefit of its residents.

Manchester New Hampshire Land Use Change Tax

Description

How to fill out Manchester New Hampshire Land Use Change Tax?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no law education to draft this sort of papers cfrom the ground up, mostly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes in handy. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the Manchester New Hampshire Land Use Change Tax or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Manchester New Hampshire Land Use Change Tax in minutes using our trustworthy platform. In case you are already an existing customer, you can proceed to log in to your account to download the appropriate form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps prior to obtaining the Manchester New Hampshire Land Use Change Tax:

- Be sure the template you have chosen is specific to your area considering that the regulations of one state or county do not work for another state or county.

- Preview the document and read a quick description (if available) of cases the document can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start over and look for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or create one from scratch.

- Choose the payment method and proceed to download the Manchester New Hampshire Land Use Change Tax as soon as the payment is done.

You’re all set! Now you can proceed to print the document or complete it online. If you have any issues locating your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

Yes, you can file certain New Hampshire taxes online, particularly if you use state-approved e-filing services. This simplifies the process and helps you keep accurate records. However, for specific forms like the NH DP 10 related to the Manchester New Hampshire Land Use Change Tax, in-person submission remains necessary.

You need to file the NH DP 10 form if you have altered your land from its current use classification, including any changes that could affect your tax status. Filing this form timely helps prevent penalties and ensures that your obligations regarding the Manchester New Hampshire Land Use Change Tax are handled appropriately.

New Hampshire has made discussions around phasing out the interest and dividends tax a priority, though no final decision has been made. Currently, it still exists and may impact your total tax burden. Staying informed about these legislative changes is essential for accurately planning for taxes, including the Manchester New Hampshire Land Use Change Tax.

Anyone who has made changes to their property that could affect its land use status must file the NH DP 10 form. This includes property owners converting land from current use or making significant improvements. Filing this form is crucial for managing the Manchester New Hampshire Land Use Change Tax implications.

Currently, you cannot file the NH DP 10 form online. You must print the form, complete it, and submit it to the appropriate local officials. This form is essential for reporting changes that may affect your Manchester New Hampshire Land Use Change Tax status.

Whether you need to file a New Hampshire state tax return depends on your income and residency status. Generally, if you earn income that exceeds certain thresholds, you must file a return. This ensures compliance with state tax obligations, including those related to the Manchester New Hampshire Land Use Change Tax.

To put land in current use in New Hampshire, you must submit an application to the local assessing office. This application allows your property to be assessed based on its use rather than its potential market value. This process can help you save on property taxes in the long run, especially in regard to the Manchester New Hampshire Land Use Change Tax.

To put land in current use in New Hampshire, you must file a Current Use Application with your local assessing office. This process involves providing information about the land's size, use, and any applicable maps. Remember, enrolling in the current use program can help you avoid the Manchester New Hampshire Land Use Change Tax, which is assessed when land is developed or no longer used for its original purpose. It’s essential to understand the guidelines to maximize your benefits while ensuring compliance with local regulations.

In New Hampshire, the property transfer tax is calculated at a rate of $0.75 for every $100 of value transferred during a sale. Additionally, the seller and buyer may each be responsible for half of this tax. It's essential to note that if land changes use, it may also result in a Manchester New Hampshire Land Use Change Tax, which could add to your overall costs. Understanding these taxes can help you make informed decisions when buying or selling property in the state.

The current use tax in New Hampshire is a tax applied to land that is assessed based on its use rather than its highest potential value. This means that if you keep your land in its natural state or for agricultural purposes, you may be eligible for reduced property tax rates. However, if you change the use of your land, such as developing it, you may trigger the Manchester New Hampshire Land Use Change Tax. This tax helps maintain the balance between development and preservation of the state's natural resources.