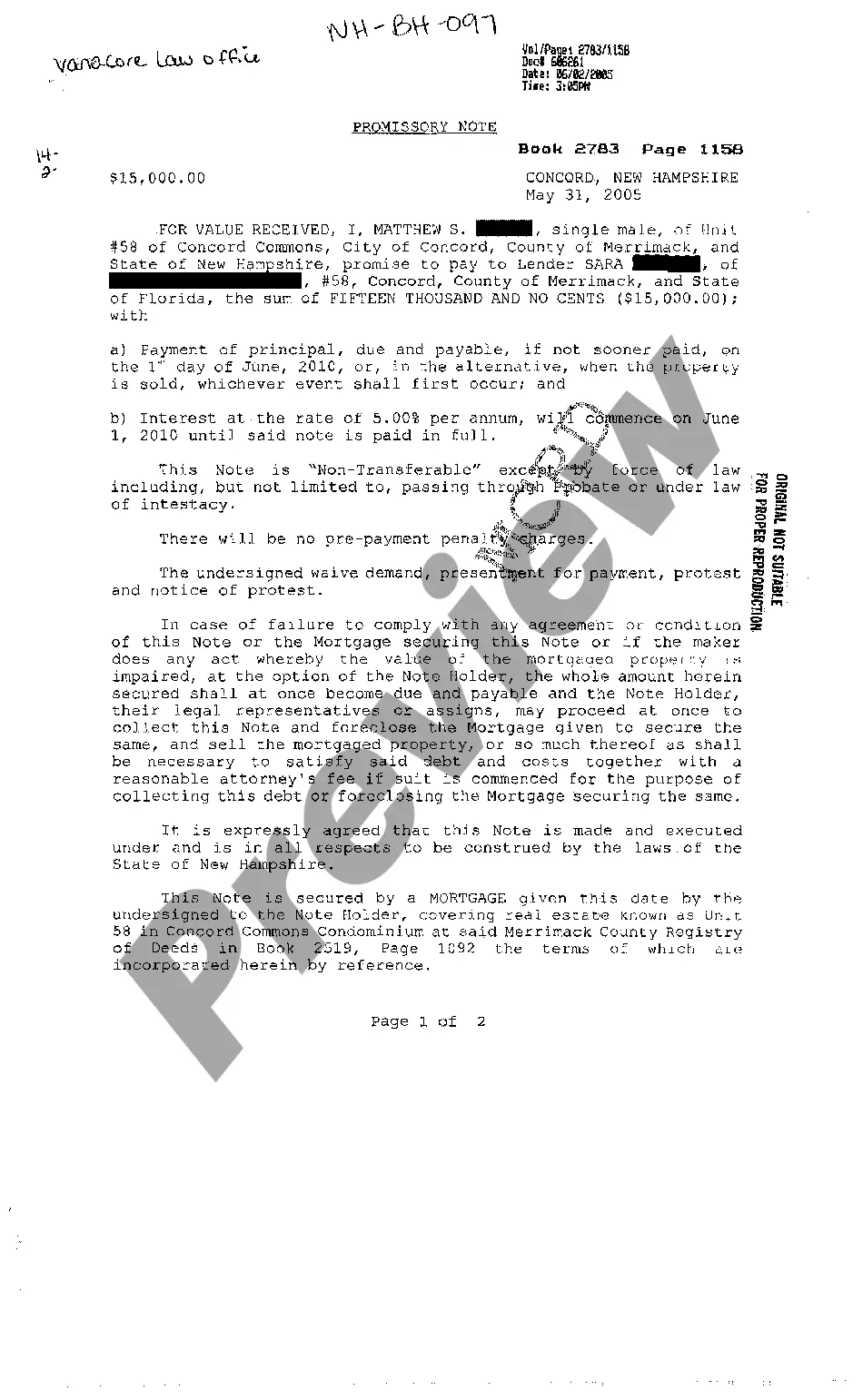

A Manchester New Hampshire Promissory Note Secured by Mortgage refers to a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the context of real estate transactions. This type of promissory note serves as evidence of a borrower's promise to repay a specific amount of money borrowed, along with any applicable interest, within a specified time frame. The note also acts as a guarantee, as it is secured by a mortgage on a property located in Manchester, New Hampshire. The Manchester New Hampshire Promissory Note Secured by Mortgage is commonly used when individuals or businesses in the Manchester area require financing for property acquisitions, refinancing existing mortgages, home renovations, or any other purpose related to real estate. This legal document plays a crucial role in protecting the rights and interests of both parties involved. Several variations of Manchester New Hampshire Promissory Notes Secured by Mortgage exist, depending on the specific circumstances and requirements of the parties involved. These variations may include: 1. Fixed-Rate Promissory Note Secured by Mortgage: This type of promissory note features a fixed interest rate that remains unchanged throughout the loan term. Borrowers can accurately forecast their repayment obligations, providing stability and predictability. 2. Adjustable-Rate Promissory Note Secured by Mortgage: With an adjustable-rate promissory note, the interest rate can vary periodically, typically tied to an index such as the Treasury Bill rate or the London Interbank Offered Rate (LIBOR). This type of note offers potential savings if the interest rate decreases but may introduce uncertainty if the rate rises. 3. Balloon Promissory Note Secured by Mortgage: This variation involves regular payments based on a predetermined schedule, but with a large final payment (balloon payment) due at the end of the loan term. This structure allows borrowers to make lower monthly payments during the loan duration and may suit individuals or businesses with predictable future income. 4. Interest-Only Promissory Note Secured by Mortgage: Under this arrangement, borrowers are initially required to pay only the interest due on the loan for a specified period before starting to repay the principal. This type of note may be suitable for borrowers planning to sell the property before the principal repayment phase begins. Regardless of the specific type, a Manchester New Hampshire Promissory Note Secured by Mortgage is a legally binding agreement that protects the rights of both borrowers and lenders by clearly outlining the terms and conditions of the loan. It is vital for the parties involved to consult legal professionals to ensure compliance with applicable laws and regulations, providing a secure transaction for all parties involved.

Manchester New Hampshire Promissory Note Secured by Mortgage

Description

How to fill out Manchester New Hampshire Promissory Note Secured By Mortgage?

Make use of the US Legal Forms and have instant access to any form sample you need. Our helpful platform with a huge number of documents simplifies the way to find and obtain virtually any document sample you require. You can download, fill, and certify the Manchester New Hampshire Promissory Note Secured by Mortgage in just a few minutes instead of browsing the web for many hours trying to find a proper template.

Using our collection is a wonderful way to raise the safety of your form filing. Our experienced attorneys regularly check all the records to make certain that the forms are appropriate for a particular state and compliant with new laws and polices.

How do you obtain the Manchester New Hampshire Promissory Note Secured by Mortgage? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you view. Additionally, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions below:

- Open the page with the template you require. Ensure that it is the template you were seeking: examine its title and description, and use the Preview function when it is available. Otherwise, use the Search field to look for the needed one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you like. Then, sign up for an account and process your order with a credit card or PayPal.

- Save the document. Choose the format to obtain the Manchester New Hampshire Promissory Note Secured by Mortgage and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and reliable form libraries on the web. Our company is always happy to help you in any legal case, even if it is just downloading the Manchester New Hampshire Promissory Note Secured by Mortgage.

Feel free to benefit from our service and make your document experience as efficient as possible!