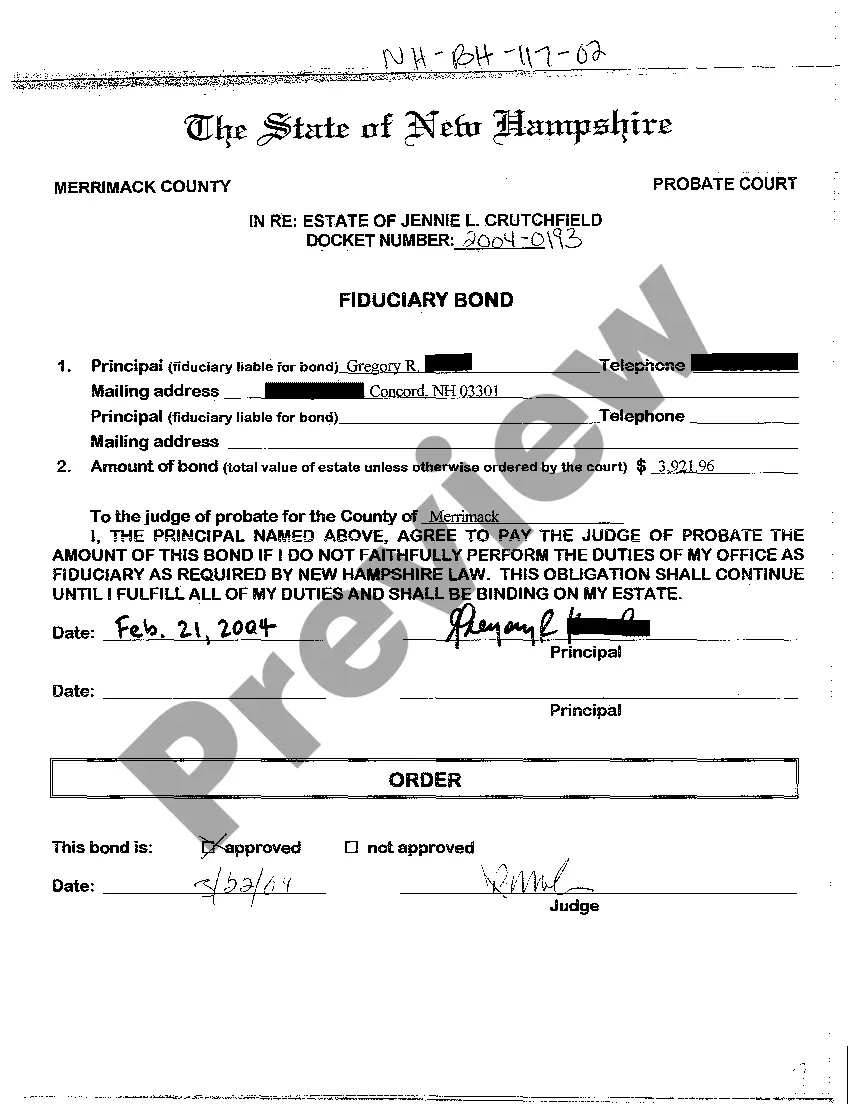

Manchester New Hampshire Fiduciary Bond is a type of surety bond required for individuals who serve as fiduciaries in the city of Manchester, New Hampshire. A fiduciary is someone who is appointed to manage the assets or interests of others, such as an executor, administrator, trustee, or guardian. The Manchester New Hampshire Fiduciary Bond serves as a financial guarantee to ensure that the fiduciary will act honestly, ethically, and in accordance with the law while carrying out their duties. It provides protection to the beneficiaries, creditors, and other interested parties involved. There are different types of Manchester New Hampshire Fiduciary Bonds, depending on the specific role or position being fulfilled by the fiduciary. These may include: 1. Executor Bond: Required for individuals appointed to manage the estate of a deceased person (executor) and distribute assets according to the terms of the will. 2. Administrator Bond: Required for individuals appointed to manage the estate of a deceased person when there is no will (administrator). They distribute assets in accordance with state laws. 3. Guardian Bond: Required for individuals appointed to care for and manage the assets of a minor or incapacitated person (guardian). It ensures that the ward's interests are protected. 4. Trustee Bond: Required for individuals appointed to manage and administer a trust, ensuring that they fulfill their fiduciary duties and act in the best interests of the beneficiaries. Irrespective of the type, Manchester New Hampshire Fiduciary Bonds are typically obtained by the fiduciary from a surety bond company. The bond amount is determined by the court, and the premium is a percentage of that amount. If the fiduciary fails to fulfill their duties, a claim can be made against the bond to compensate the affected parties. In conclusion, Manchester New Hampshire Fiduciary Bonds play a crucial role in overseeing the actions of fiduciaries in the city. They provide protection and assurance to beneficiaries, creditors, and other interested parties that their interests will be safeguarded. Executor Bonds, Administrator Bonds, Guardian Bonds, and Trustee Bonds are some specific types of fiduciary bonds required in Manchester, New Hampshire.

Manchester New Hampshire Fiduciary Bond

Description

How to fill out New Hampshire Fiduciary Bond?

Are you in search of a trustworthy and affordable provider of legal forms to obtain the Manchester New Hampshire Fiduciary Bond? US Legal Forms is your preferred option.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce in court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business use. All templates we provide access to are not generic and are tailored to meet the needs of specific states and regions.

To obtain the document, you must Log In to your account, locate the needed form, and click the Download button beside it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents tab.

Is this your first time visiting our site? No problem. You can register for an account in just a few minutes, but first, ensure you do the following: Check if the Manchester New Hampshire Fiduciary Bond adheres to your state's and local area's regulations. Review the form's description (if available) to understand who and what the document is intended for. If the form does not fit your legal circumstances, restart your search.

Try US Legal Forms today, and stop wasting hours searching for legal documents online once and for all.

- Now you can create your account.

- Then choose the subscription option and move to payment.

- Once the payment is processed, download the Manchester New Hampshire Fiduciary Bond in any available format.

- You can revisit the website whenever you need and redownload the document at no additional cost.

- Finding current legal forms has never been simpler.

Form popularity

FAQ

An ERISA fiduciary is indeed required to be bonded, which protects the participants of the retirement plan. A Manchester New Hampshire Fiduciary Bond serves as a critical safeguard against potential losses due to fiduciary breaches. This requirement emphasizes the importance of fiduciary responsibility in managing retirement assets. Adhering to these bonding requirements ensures compliance and fosters trust in managing employee benefits.

Yes, a fiduciary is legally bound to act in the best interests of their beneficiaries. This includes managing assets prudently and reporting accurately. Furthermore, a Manchester New Hampshire Fiduciary Bond reinforces this legal obligation, holding fiduciaries accountable for any mismanagement. Understanding these legal bindings is crucial for both fiduciaries and beneficiaries.

Yes, fiduciaries are often required to be bonded to protect the interests of beneficiaries. A Manchester New Hampshire Fiduciary Bond provides this essential protection, ensuring fiduciaries fulfill their responsibilities ethically. The bonding process typically involves underwriting and approval based on the fiduciary’s qualifications. This bond signifies commitment to uphold fiduciary duties diligently.

Legal requirements for a fiduciary can vary, but they generally involve acting in good faith and with care. A Manchester New Hampshire Fiduciary Bond is often a requirement to ensure accountability. Fiduciaries must also maintain clear records and openly communicate with beneficiaries. Understanding these requirements fosters trust and transparency in managing the estate.

In many cases, a fiduciary needs to be bonded to ensure they act in the best interest of the beneficiaries. A Manchester New Hampshire Fiduciary Bond provides this assurance, protecting the estate from potential mismanagement. Courts often require bonding as a safeguard against possible misconduct. As a fiduciary, being bonded reflects professionalism and reliability.

A Manchester New Hampshire Fiduciary Bond typically remains valid as long as the fiduciary is in service or until the bond is released by the court. Most bonds can be renewed annually if necessary. It's crucial to stay aware of the bond's expiration to ensure continuous protection for beneficiaries. Always check local regulations, as they can provide specific guidelines.

Waiving the fiduciary bond requirement can have significant implications for your responsibilities in Manchester, New Hampshire. It is important to carefully weigh the risks before making this decision. In many cases, having a fiduciary bond offers protection and peace of mind for all parties involved. Consulting with a legal expert or utilizing resources from US Legal Forms may help guide your choice effectively.

Filling out a bond form for a Manchester New Hampshire Fiduciary Bond involves several straightforward steps. First, gather the necessary information, such as your personal details and the specifics of the fiduciary responsibilities. Then, carefully complete the form, ensuring accuracy in every section. If you need assistance, consider using the US Legal Forms platform, which offers easy access to templates and guidance.

In New Hampshire, an executor generally has one year to settle an estate, though this timeframe can vary depending on the complexity of the estate. This period includes tasks such as paying debts, filing taxes, and distributing assets to beneficiaries. Additionally, the Manchester New Hampshire Fiduciary Bond can provide assurance to beneficiaries that the executor is committed to handling the estate responsibly and within legal guidelines. Always check with an attorney for specific details related to your situation.

A fiduciary bond is a type of surety bond that ensures a fiduciary, such as an executor or trustee, manages assets responsibly and in the best interest of beneficiaries. In the context of a Manchester New Hampshire Fiduciary Bond, this bond provides financial protection for those affected by the fiduciary's actions. It guarantees that the fiduciary will adhere to state laws and fulfill their obligations. This bond acts as a safeguard, offering peace of mind for all parties involved.