Manchester, New Hampshire Heirs-at-Law Estate Without Will: Explained in Detail When a person passes away without leaving a valid will behind, the distribution of their estate becomes a complex process. In Manchester, New Hampshire, heirs-at-law play a crucial role in the estate administration. An heir-at-law refers to an individual who is entitled to inherit assets from the deceased, as determined by state intestacy laws when no will exists. In New Hampshire, the laws regarding intestate succession determine who is eligible to inherit and the portion of estate assets they are entitled to receive. These laws take into consideration the deceased's familial relationships and hierarchy. Here are the various types of Manchester, New Hampshire Heirs-at-Law Estates Without a Will: 1. Spouse: If the deceased had a surviving spouse but no children, the spouse is usually the sole heir to inherit the entire estate. However, if there are surviving parents or siblings, the spouse may still inherit a portion of the estate alongside these other relatives. 2. Children: If the deceased had children but no surviving spouse, the children become the primary heirs. Generally, the estate is divided equally among the children, although there may be exceptions where certain circumstances arise, such as a child being legally adopted or born out of wedlock. 3. Parents: If the deceased has no surviving spouse or children, the parents become the heirs-at-law. In such cases, the estate is typically divided equally between both parents, or if one parent predeceased the deceased, the surviving parent would inherit the entire estate. 4. Siblings: If the deceased has no surviving spouse, children, or parents, the siblings become the potential heirs of the estate. The estate is generally split equally among the siblings. It is important to note that in situations where there are multiple heirs-at-law, such as children or siblings, effective estate administration can become complex. Joint decisions may be required for the sale or distribution of assets, adding an extra layer of coordination and cooperation. When there is no will, probate courts in Manchester, New Hampshire, appoint an administrator to handle the estate. The administrator's role is to identify and gather the deceased's assets, pay off any debts and taxes owed, and distribute the remaining assets to the rightful heirs-at-law according to the intestate succession laws. Handling an estate without a will can be time-consuming and emotionally challenging for the heirs-at-law. Seeking legal advice and guidance from experienced estate planning attorneys can help streamline the process, ensuring proper distribution and avoiding potential disputes among family members. In summary, Manchester, New Hampshire Heirs-at-Law Estate Without a Will refers to the distribution of an individual's assets when they pass away without leaving a valid will. It consists of determining eligible heirs, such as spouses, children, parents, and siblings, and dividing the estate according to state intestate succession laws. Seek legal assistance to ensure a smooth and fair administration of such estates.

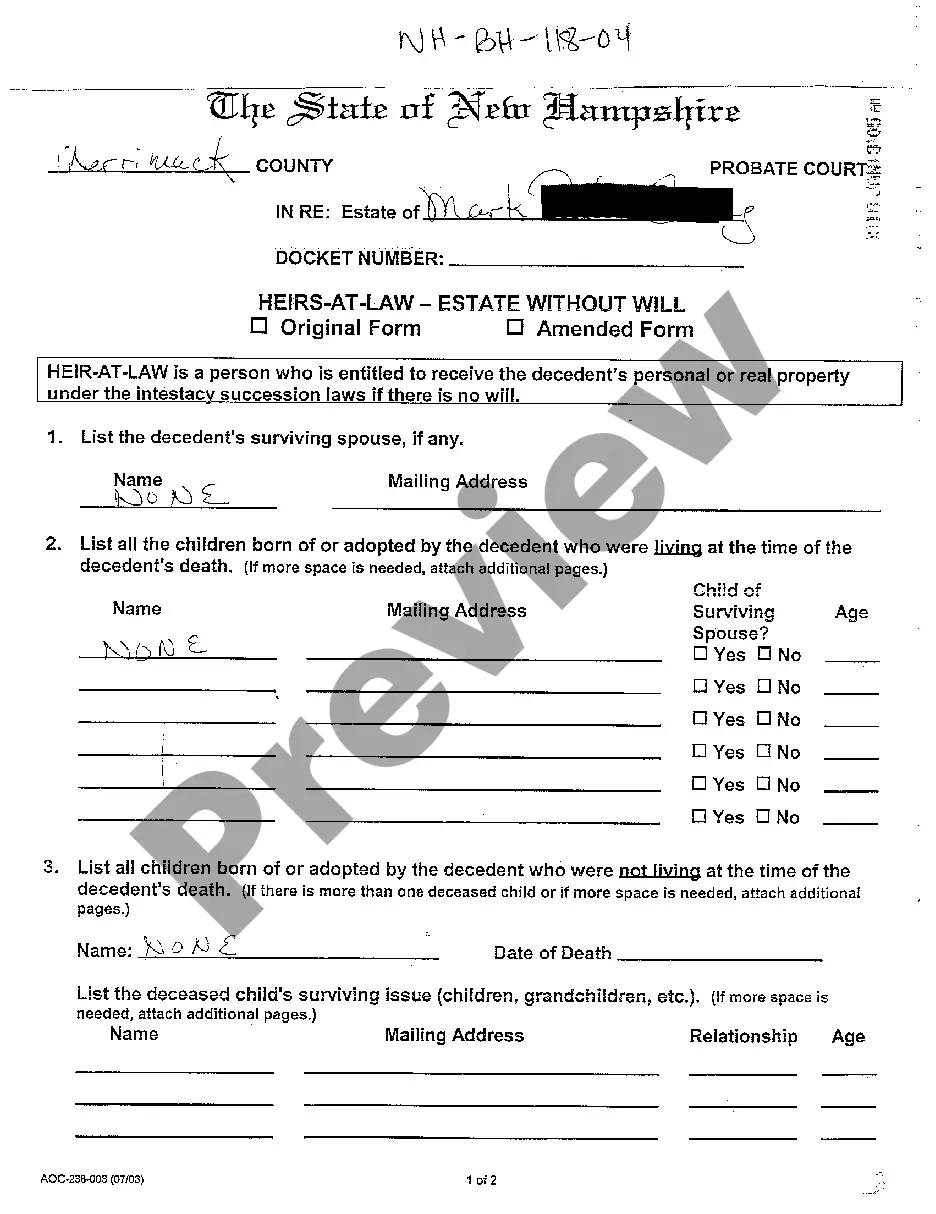

Manchester New Hampshire Heirs-at-Law Estate Without Will

Description

How to fill out Manchester New Hampshire Heirs-at-Law Estate Without Will?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are extremely costly. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of a lawyer. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Manchester New Hampshire Heirs-at-Law Estate Without Will or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Manchester New Hampshire Heirs-at-Law Estate Without Will complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Manchester New Hampshire Heirs-at-Law Estate Without Will is suitable for you, you can choose the subscription option and make a payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!