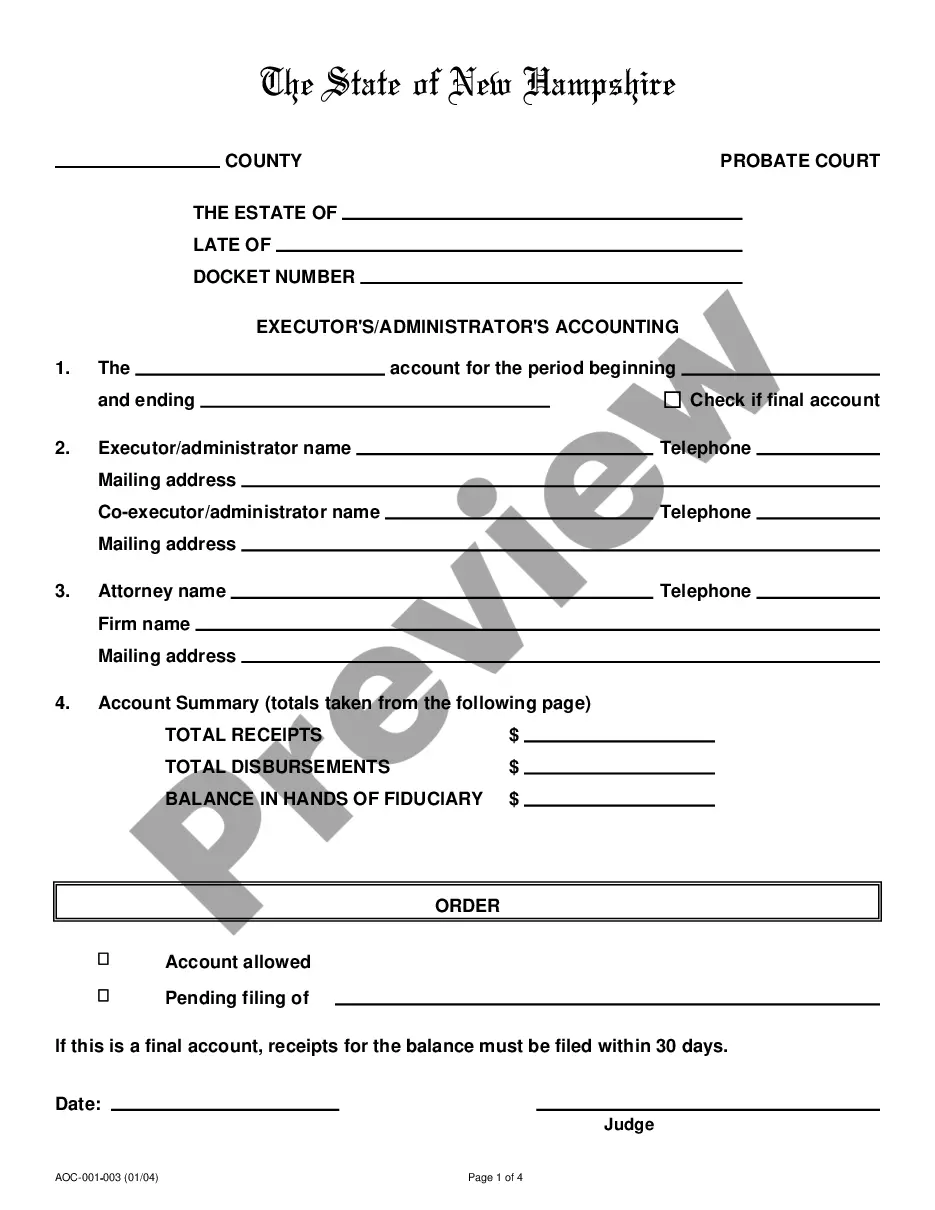

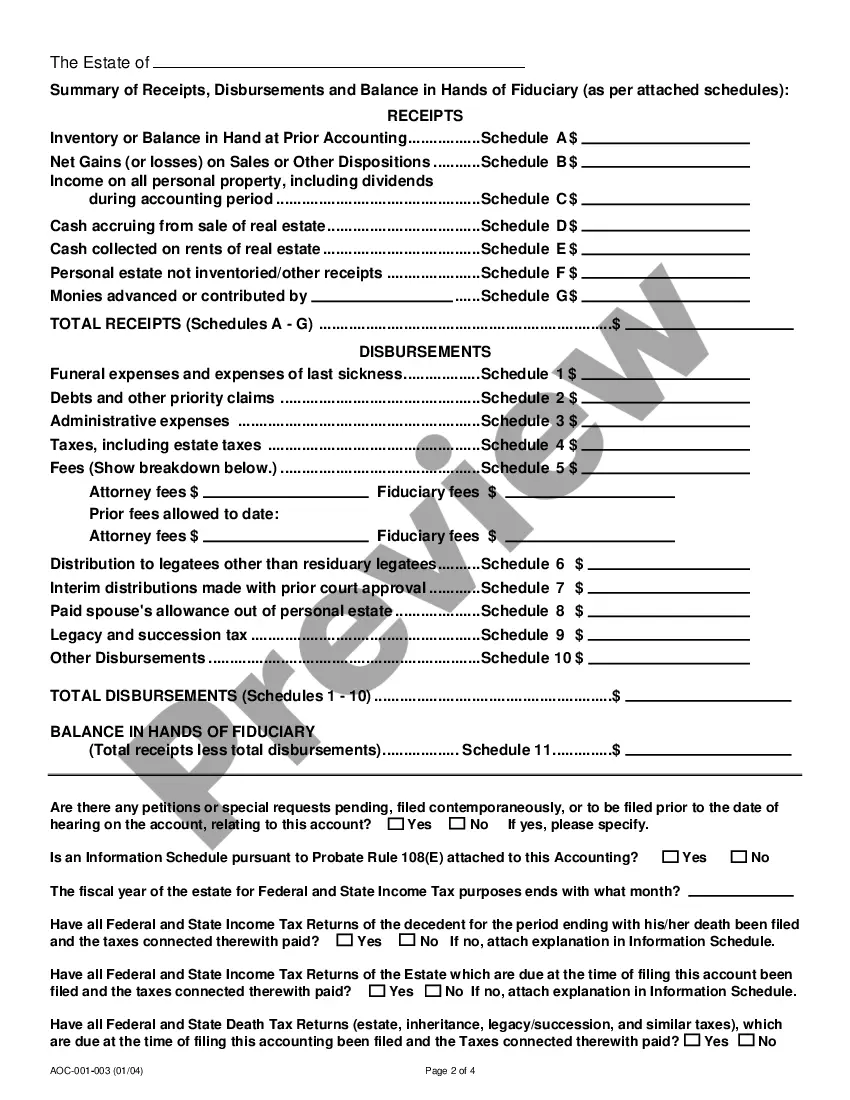

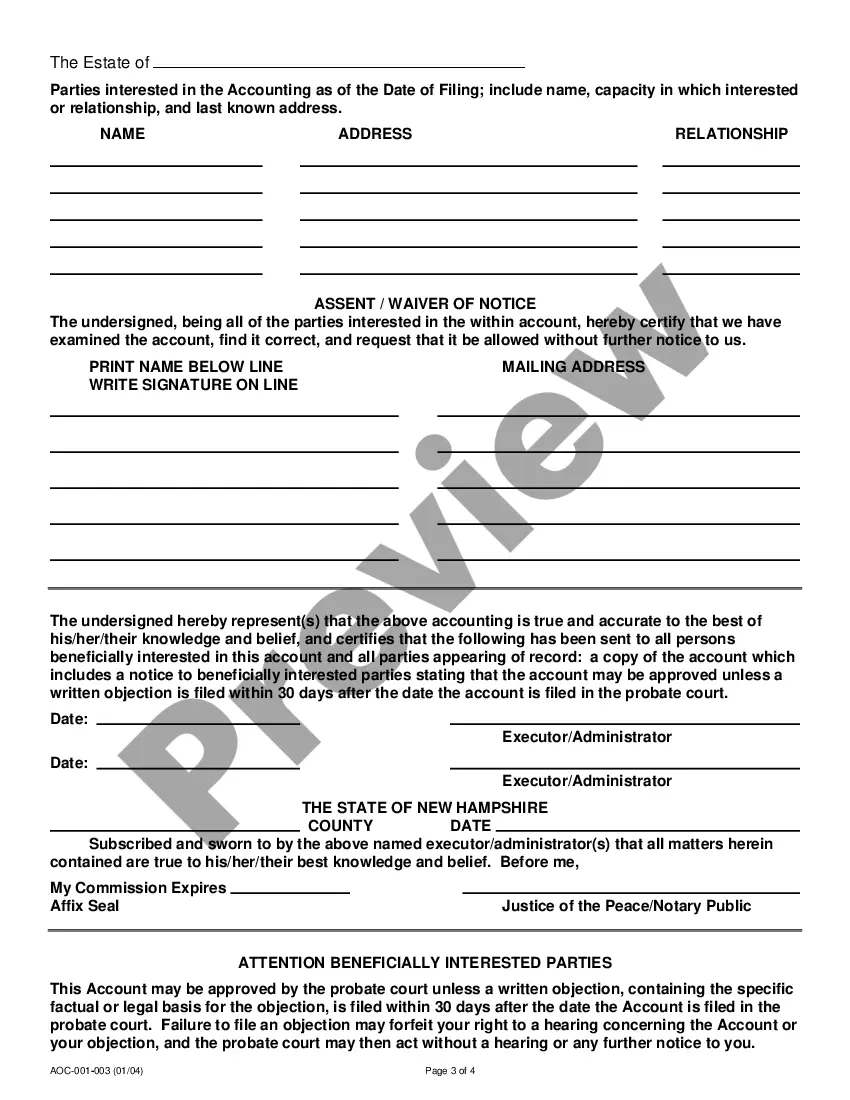

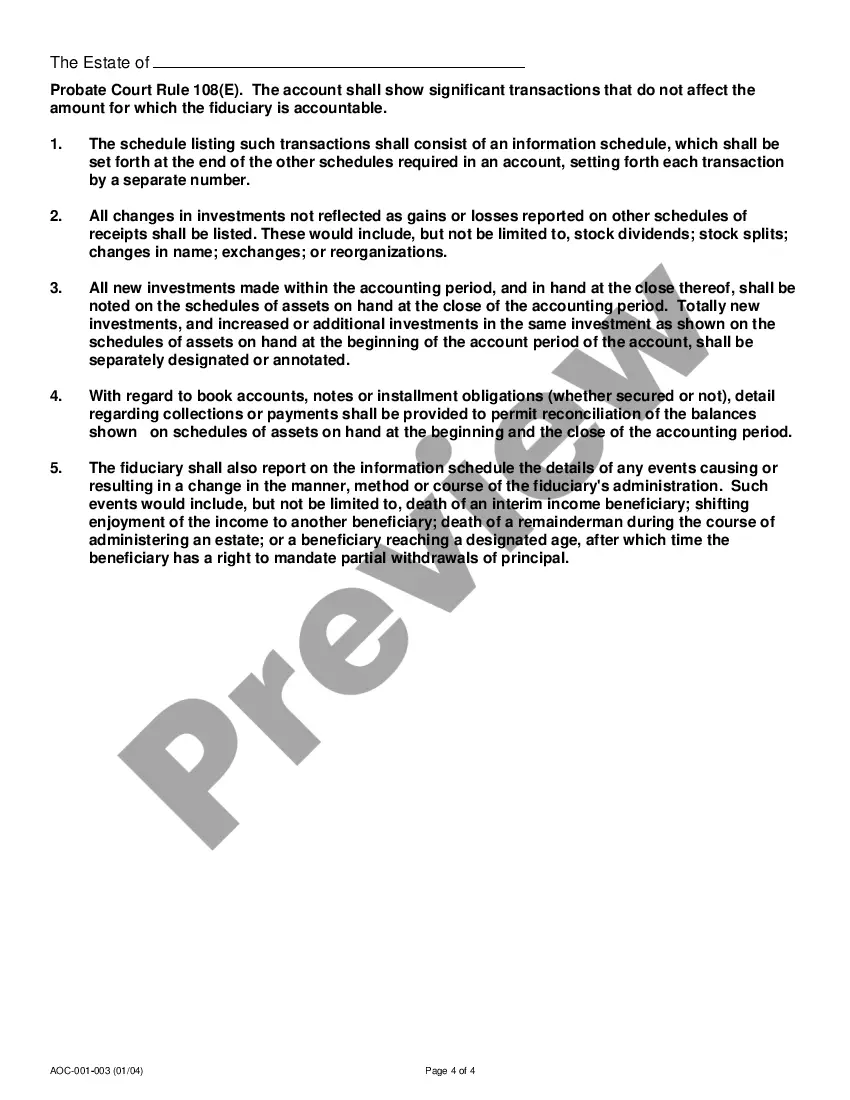

Manchester New Hampshire Executor's Accounting is an essential service provided to individuals who have been appointed as executors of a deceased person's estate in the city of Manchester, New Hampshire. Executors are responsible for managing and distributing the assets and liabilities of the deceased according to the terms and conditions outlined in their will or as mandated by the probate court. The primary goal of Manchester New Hampshire Executor's Accounting is to ensure a thorough and accurate financial record of the estate's transactions is maintained throughout the process. This includes keeping track of all income, expenses, debts, and assets related to the estate. Executors are entrusted with the duty to prudently handle the deceased's finances, settle outstanding debts, pay necessary taxes, and distribute the remaining assets to beneficiaries as specified. The scope of Manchester New Hampshire Executor's Accounting can vary depending on the complexity of the estate. There are different types of accounting services tailored to meet specific needs: 1. Standard Executor's Accounting: This refers to the basic accounting services provided by professionals in Manchester, New Hampshire who have experience in managing estates. It includes the preparation of comprehensive financial statements, such as income statements and balance sheets, summarizing the estate's financial activities. 2. Tax Planning and Preparation: Executors may seek specialized accounting services for the purpose of minimizing the estate's tax liability in compliance with state and federal tax regulations. Certified Public Accountants (CPA's) proficient in estate tax planning can assist in maximizing deductions, exploring tax-saving strategies, and preparing accurate tax returns. 3. Auditing and Compliance: For larger estates or those with complex financial structures, executor's accounting may involve auditing and compliance services. These services ensure that all financial transactions are accurately recorded, provide oversight to prevent fraud or mismanagement, and ensure adherence to legal requirements. 4. Investment Advisory: Executors who are responsible for managing investment portfolios within the estate may engage professionals for investment advisory services. These advisors can provide guidance on investment strategies, risk management, and ensure the executor's fiduciary duty is fulfilled. Manchester New Hampshire Executor's Accounting professionals play a vital role in easing the burden on executors, offering expertise in financial management, tax compliance, and minimizing potential disputes among beneficiaries. With their assistance, executors can navigate the intricate accounting and reporting requirements involved in settling an estate while safeguarding the deceased's assets and fulfilling their final wishes.

Manchester New Hampshire Executor's Accounting

Description

How to fill out Manchester New Hampshire Executor's Accounting?

Take advantage of the US Legal Forms and obtain immediate access to any form sample you need. Our useful website with thousands of document templates simplifies the way to find and get virtually any document sample you want. It is possible to download, complete, and sign the Manchester New Hampshire Executor's Accounting in a couple of minutes instead of surfing the Net for hours looking for the right template.

Using our catalog is a great way to increase the safety of your record filing. Our professional legal professionals regularly review all the records to make sure that the templates are relevant for a particular state and compliant with new laws and polices.

How do you get the Manchester New Hampshire Executor's Accounting? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. Moreover, you can get all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instruction below:

- Open the page with the form you need. Ensure that it is the form you were looking for: examine its headline and description, and use the Preview option when it is available. Otherwise, make use of the Search field to find the needed one.

- Start the saving process. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Download the document. Pick the format to get the Manchester New Hampshire Executor's Accounting and revise and complete, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy document libraries on the internet. Our company is always ready to assist you in virtually any legal case, even if it is just downloading the Manchester New Hampshire Executor's Accounting.

Feel free to make the most of our platform and make your document experience as efficient as possible!