Manchester, New Hampshire Taxation of Costs is a legal process that involves assessing and allocating various costs associated with legal proceedings in the city of Manchester, New Hampshire. These costs can include court fees, attorney fees, deposition expenses, witness fees, and other related expenses incurred during a legal case. In Manchester, New Hampshire, there are different types of taxation of costs, including: 1. Court Costs: These are fees required to be paid for initiating a legal action or filing court documents. Examples of court costs include filing fees, docketing fees, and fees for requesting copies of court records. 2. Attorney Fees: These are the charges an attorney or law firm incurs during their representation of a client in a legal matter. Attorney fees may be taxed as costs if they are deemed reasonable and necessary for the case. 3. Witness Fees: Witness fees are compensation provided to individuals who testify in court or provide depositions. Manchester, New Hampshire Taxation of Costs may include the reimbursement of witness fees as part of the overall costs of the legal proceedings. 4. Deposition Expenses: These are costs incurred during the process of taking witness depositions, which involve sworn statements given by witnesses outside the courtroom. Deposition expenses may include court reporter fees, transcript fees, and travel expenses for attorneys or witnesses. 5. Expert Witness Fees: If expert witnesses are employed in a case to provide specialized knowledge or opinions, their fees can be considered part of the taxation of costs. These fees may include the expert's hourly rate, fees for preparing reports, and fees for deposition and trial appearances. 6. Miscellaneous Expenses: Manchester, New Hampshire Taxation of Costs may also cover various miscellaneous expenses directly related to the legal proceedings. Examples may include costs for document copying, postage, long-distance telephone calls, and court-ordered mediation or arbitration fees. It is important to note that the taxation of costs is a discretionary decision made by the court. The court will assess the reasonableness and necessity of each cost before including it in the final taxation. Additionally, certain costs may be recoverable from the opposing party if they are deemed the prevailing party in the litigation. Understanding Manchester, New Hampshire Taxation of Costs is crucial for litigants, attorneys, and anyone involved in the legal system in Manchester. Properly navigating these costs can help ensure transparency and fairness in legal proceedings while providing an accurate assessment of the financial impact of litigation.

Manchester New Hampshire Taxation of Costs

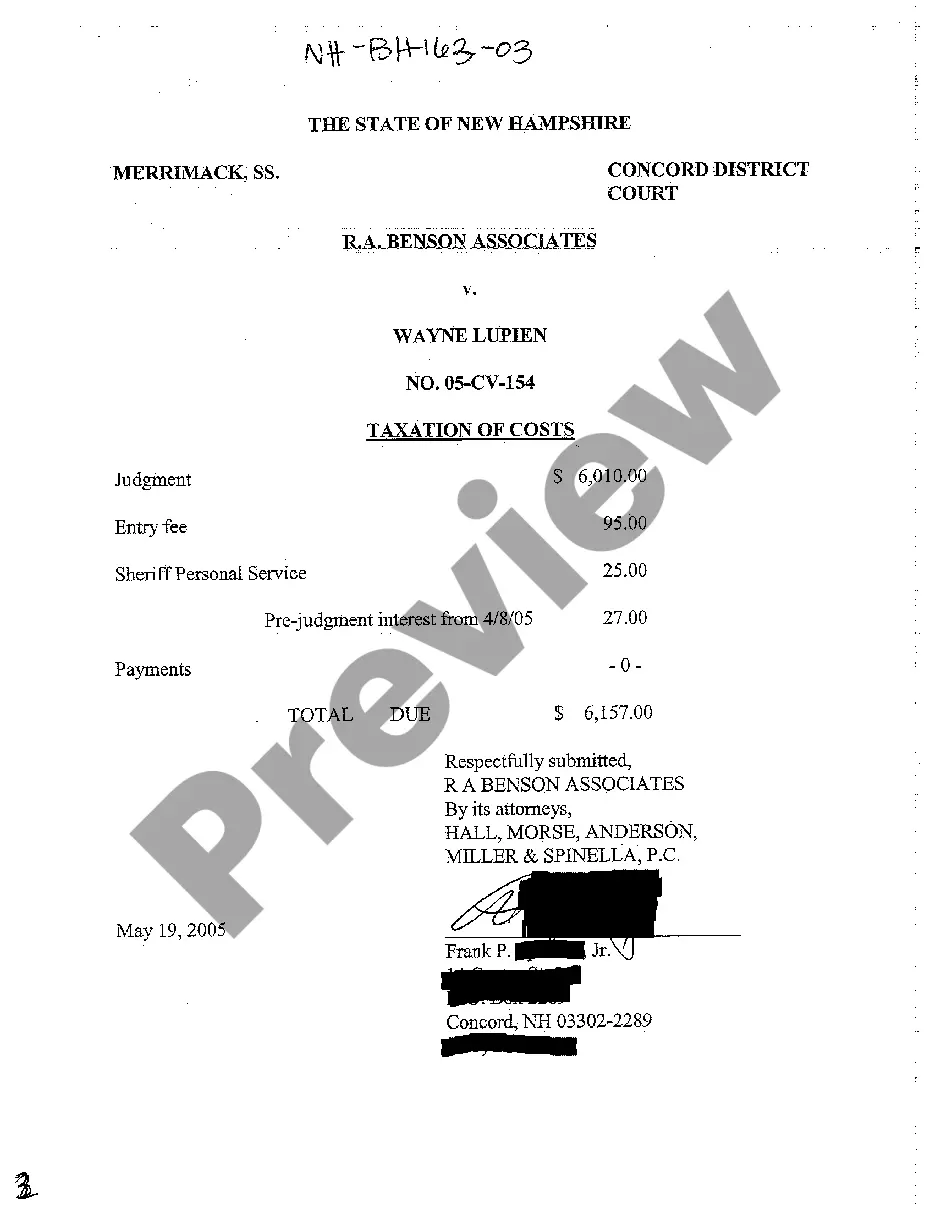

Description

How to fill out Manchester New Hampshire Taxation Of Costs?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Manchester New Hampshire Taxation of Costs becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Manchester New Hampshire Taxation of Costs takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Manchester New Hampshire Taxation of Costs. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!