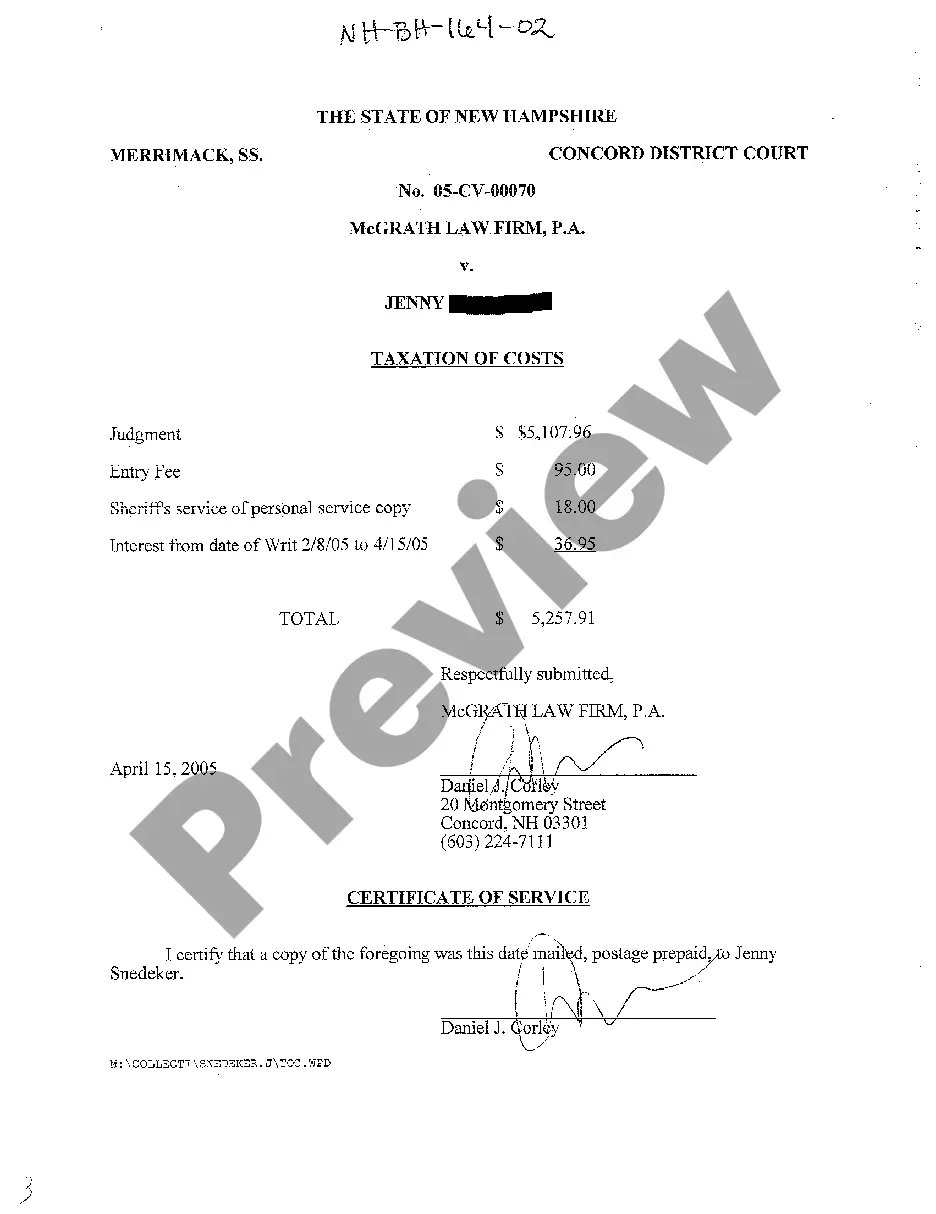

The Manchester New Hampshire Taxation of Costs refers to the legal process of allocating costs and expenses associated with a court case or legal proceedings in the city of Manchester, New Hampshire. This includes various fees, charges, taxes, and disbursements that the prevailing party can claim from the losing party or for reimbursement from the court. In Manchester, the Taxation of Costs may vary depending on the type of case and the court involved. Here are some key types of Manchester New Hampshire Taxation of Costs: 1. Civil Case Taxation of Costs: In civil cases, the prevailing party can typically recover costs such as filing fees, deposition costs, court reporter fees, subpoena expenses, copy costs, and service of process fees. The court assesses these costs based on legal statutes and guidelines. 2. Criminal Case Taxation of Costs: In criminal cases, costs may be taxed for the prosecution or defense side. These costs can include fees related to the preparation of discovery materials, expert witness fees, investigation expenses, and other necessary costs incurred during the trial or plea negotiation. 3. Appellate Case Taxation of Costs: When a case is appealed to a higher court, the prevailing party may be entitled to costs associated with the appeal process. These costs can include fees for transcripts, copies of court documents, brief preparation and printing, and other expenses related to the appeal. 4. Administrative Case Taxation of Costs: In administrative proceedings, parties may be responsible for costs such as filing fees, administrative hearing fees, expert witness fees, and other expenses incurred during the administrative process. It is important to note that the specific rules and procedures regarding Manchester New Hampshire Taxation of Costs can be complex and subject to change. It is advisable to consult with a qualified attorney or refer to the relevant court rules and statutes to ensure accurate understanding and compliance with these regulations.

Manchester New Hampshire Taxation of Costs

Description

How to fill out Manchester New Hampshire Taxation Of Costs?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone without any legal background to create this sort of paperwork from scratch, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the Manchester New Hampshire Taxation of Costs or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Manchester New Hampshire Taxation of Costs in minutes using our trusted service. In case you are already an existing customer, you can go on and log in to your account to get the appropriate form.

Nevertheless, in case you are new to our library, ensure that you follow these steps prior to downloading the Manchester New Hampshire Taxation of Costs:

- Be sure the form you have found is good for your area since the regulations of one state or county do not work for another state or county.

- Preview the document and read a short description (if provided) of scenarios the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start again and look for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Select the payment gateway and proceed to download the Manchester New Hampshire Taxation of Costs as soon as the payment is done.

You’re good to go! Now you can go on and print the document or fill it out online. In case you have any issues locating your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.