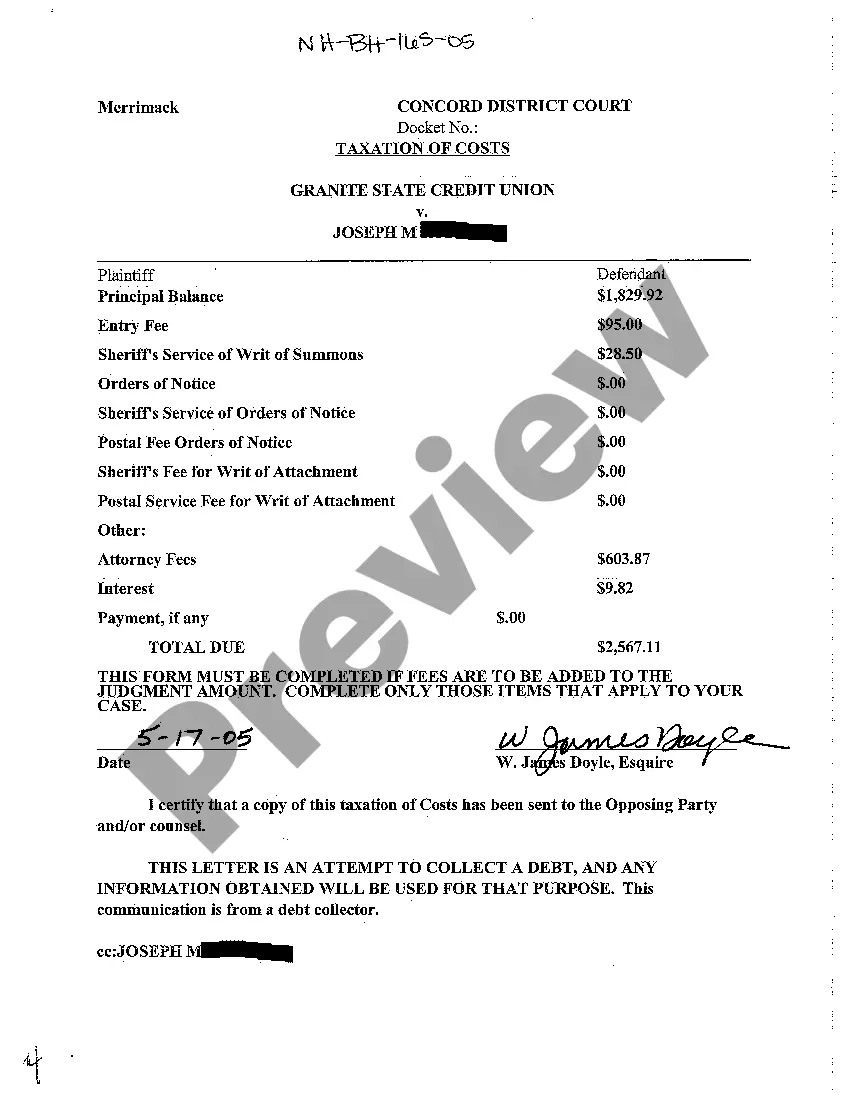

Manchester New Hampshire Taxation of Costs is a legal process that involves determining and awarding the costs associated with a legal case in the city of Manchester, New Hampshire. When a lawsuit is filed, certain expenses are incurred by both the plaintiff and the defendant. These costs can include attorney fees, court filing fees, expert witness fees, deposition costs, and other related expenses. In Manchester, the taxation of costs is governed by specific rules and regulations to ensure fairness and consistency in awarding costs. The court has the authority to assess and allocate costs to either party based on several factors, including the nature of the case, the successful party, and the reasonableness of the expenses incurred. There are different types of Manchester New Hampshire Taxation of Costs that can be encountered in legal cases. Some of them include: 1. Pre-trial Costs: These are costs incurred before the trial begins, such as filing fees, document preparation, and service of process expenses. 2. Witness Costs: If witnesses are called to testify during the trial, their expenses, including travel, accommodation, and daily living allowances, may be included in the taxation of costs. 3. Expert Witness Costs: In cases where expert witnesses are retained to provide specialized opinions or testimony, their fees and related expenses may be taxed as costs. 4. Transcript Costs: If transcripts of court proceedings or depositions are required, the expenses associated with their preparation and production may be included in the taxation of costs. 5. Post-judgment Costs: These are costs incurred after a judgment is rendered, such as collection expenses, enforcement costs, and appeals-related fees. It is important to note that not all expenses will be allowed as costs, and the court has the discretion to determine what is reasonable and necessary. Additionally, the prevailing party is not automatically entitled to recover all costs incurred. It is essential to consult with an experienced attorney familiar with Manchester New Hampshire Taxation of Costs to understand the specific rules and procedures that apply to your case. In conclusion, Manchester New Hampshire Taxation of Costs involves the assessment and allocation of the expenses incurred during a legal case. It aims to ensure fairness and reimbursement for the prevailing party's reasonable and necessary costs. Different types of costs can be taxed, including pre-trial costs, witness costs, expert witness costs, transcript costs, and post-judgment costs. Seeking legal guidance is crucial to navigate the taxation of costs process effectively.

Manchester New Hampshire Taxation of Costs

Description

How to fill out Manchester New Hampshire Taxation Of Costs?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Manchester New Hampshire Taxation of Costs gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Manchester New Hampshire Taxation of Costs takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

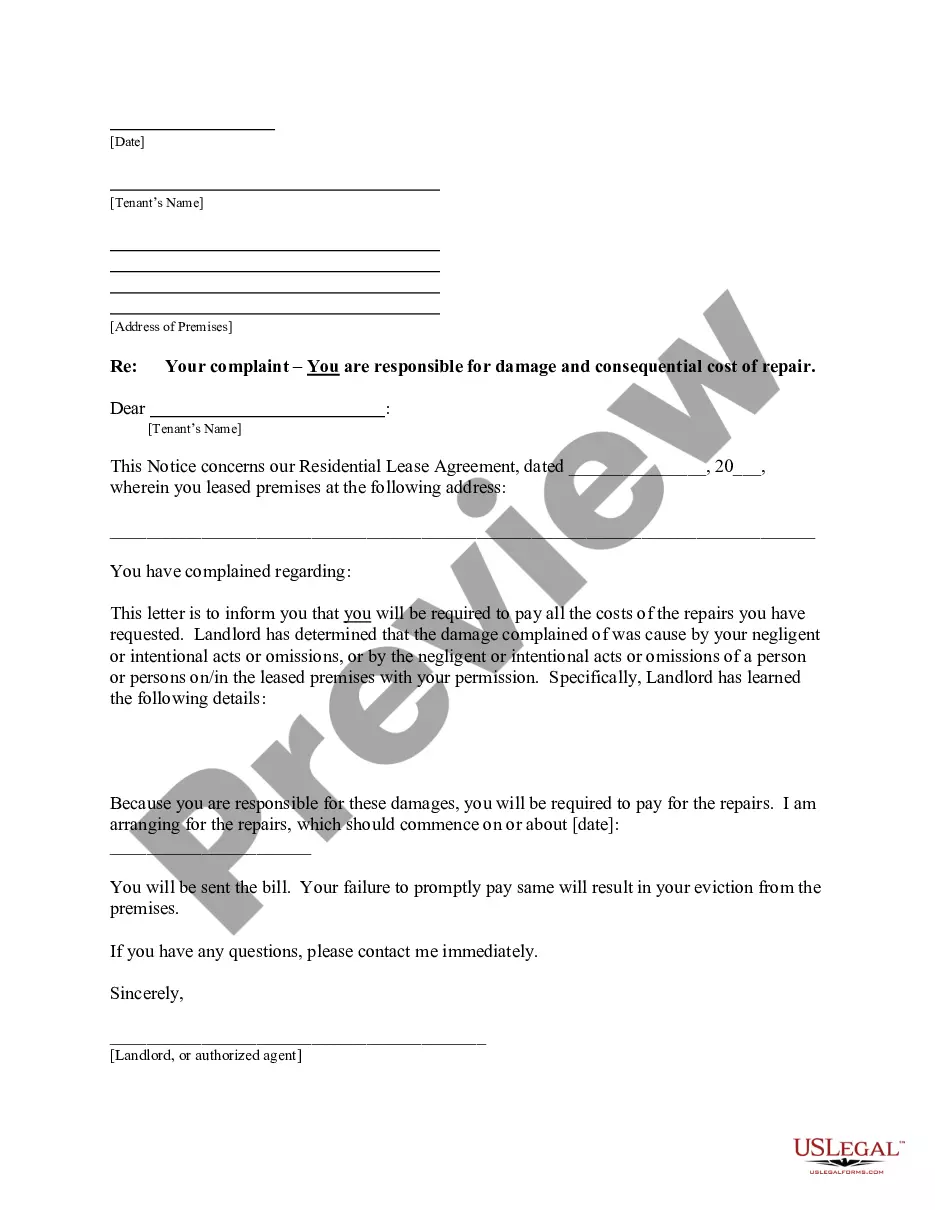

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Manchester New Hampshire Taxation of Costs. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!