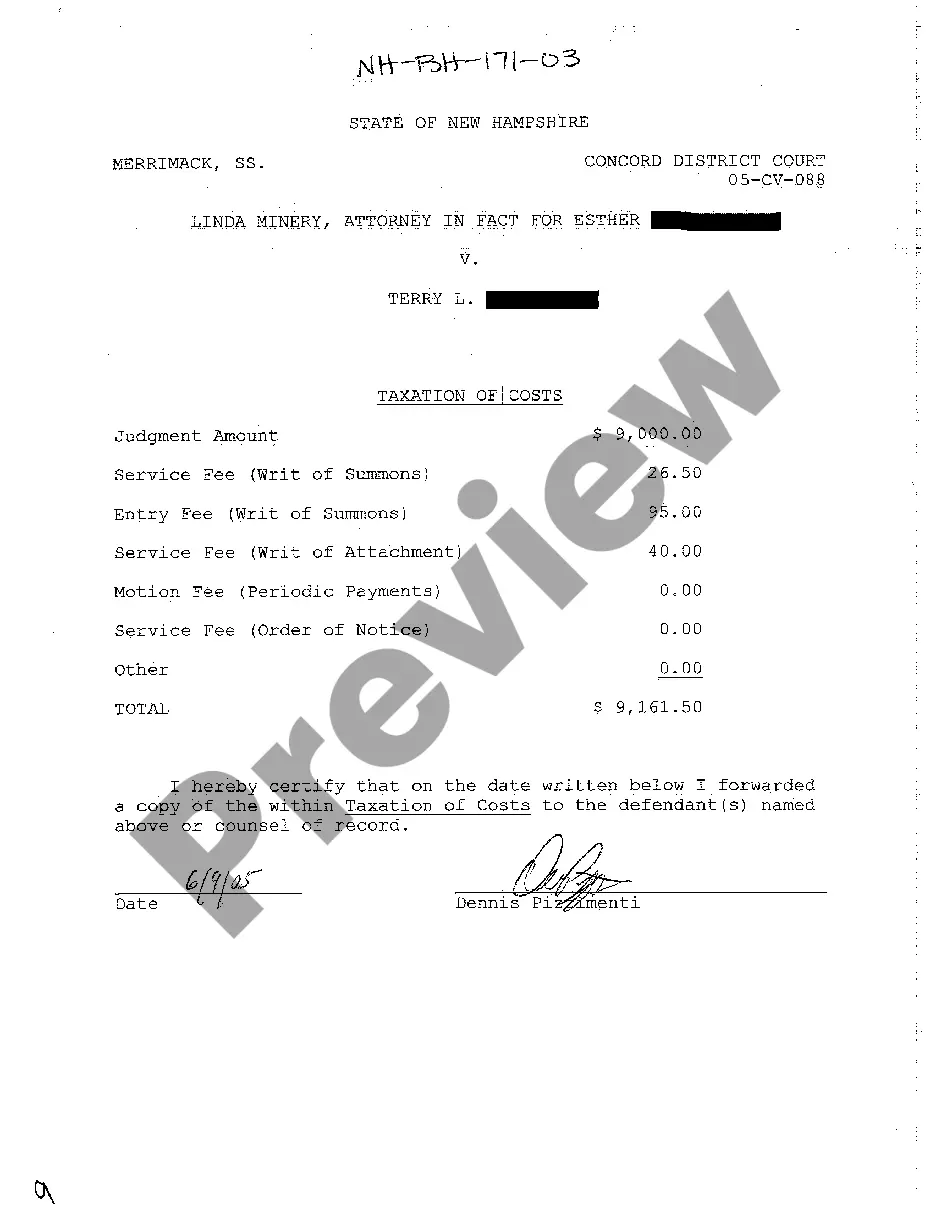

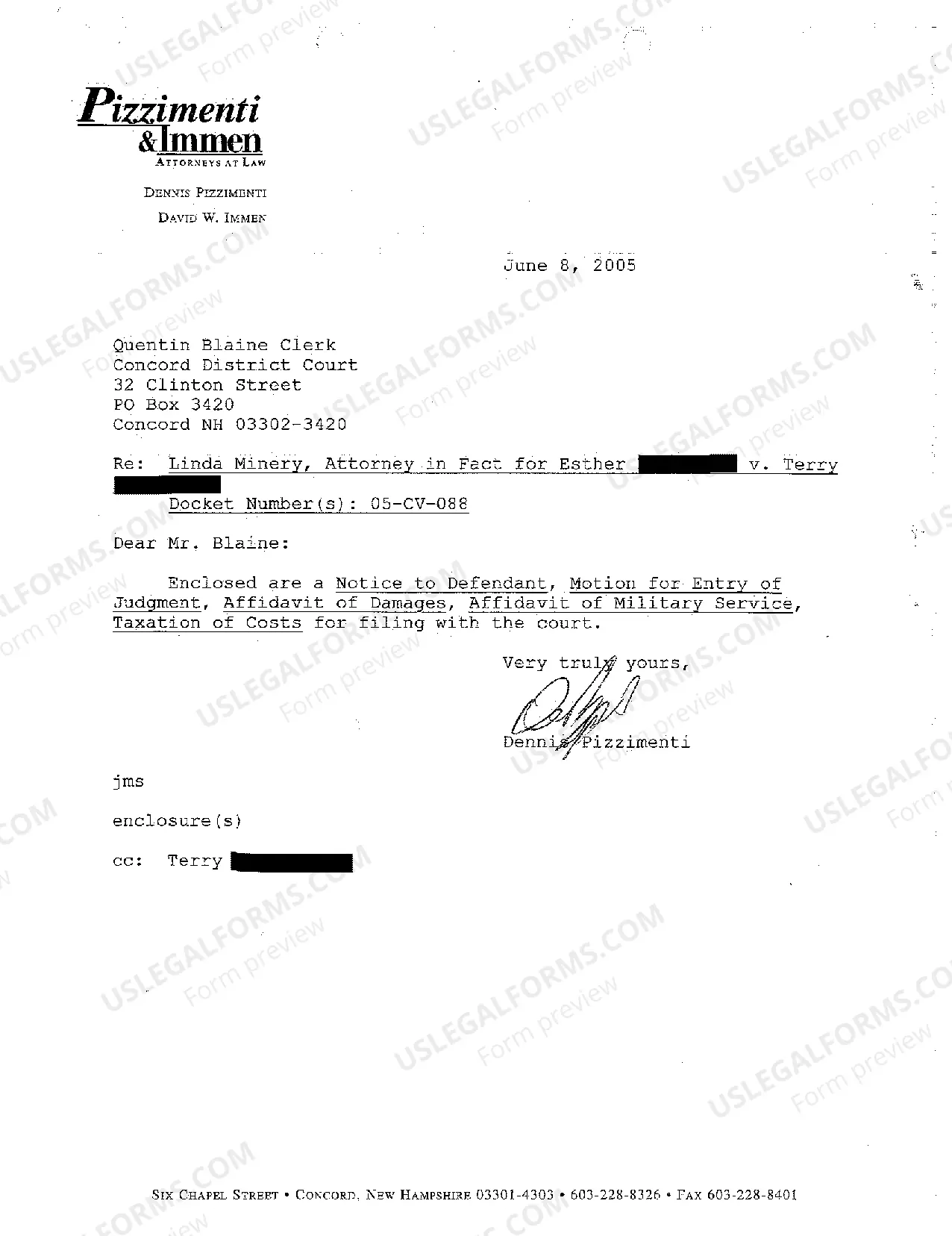

Manchester, New Hampshire Taxation of Costs refers to the legal process involving the assessment and collection of costs incurred during a legal case within the city of Manchester, New Hampshire. In legal matters, various expenses are accumulated, including court fees, filings, document production, expert witnesses, and other relevant costs necessary for litigation. Manchester, New Hampshire Taxation of Costs can be categorized into several types, including: 1. Court Costs: Manchester citizens involved in legal proceedings are subject to court fees, which vary depending on the type and complexity of the case. These costs cover the administrative expenses associated with the court system, such as the maintenance of courtrooms, clerks, judges, and other personnel. 2. Filing Fees: When initiating a lawsuit or submitting legal documents to the court in Manchester, individuals are required to pay filing fees. These fees cover the processing, handling, and storage of legal paperwork and are typically determined based on the nature and complexity of the case. 3. Document Production: In Manchester, New Hampshire, costs related to document production during a legal case may be taxed. These expenses include the copying, printing, and delivery of important legal documents, such as affidavits, pleadings, and exhibits. 4. Expert Witness Fees: If expert witnesses are required to testify or provide professional opinions in Manchester court cases, their fees may also be considered taxable costs. Expert witness expenses cover the compensation for their time, expertise, travel, accommodation, and any related expenses incurred in connection with the case. 5. Other Costs: Manchester, New Hampshire Taxation of Costs may further include various additional expenses such as deposition fees, transcription services, court reporter costs, process serving fees, and expenses related to investigations or inspections. The Taxation of Costs process in Manchester involves the determination of the actual costs incurred by each party and may require the submission of detailed documentation and receipts. These costs are then evaluated by the court, and a judgment is made regarding their reasonableness and necessity. Ultimately, the court has the authority to award taxes on costs, determining whether one party or both parties will be responsible for paying the assessed expenses. Understanding the Manchester, New Hampshire Taxation of Costs is crucial when engaging in legal proceedings within the city. It is important to consult with an experienced attorney to navigate this process effectively and ensure compliance with the applicable regulations and guidelines.

Manchester New Hampshire Taxation of Costs

State:

New Hampshire

City:

Manchester

Control #:

NH-BH-171-03

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Taxation of Costs

Manchester, New Hampshire Taxation of Costs refers to the legal process involving the assessment and collection of costs incurred during a legal case within the city of Manchester, New Hampshire. In legal matters, various expenses are accumulated, including court fees, filings, document production, expert witnesses, and other relevant costs necessary for litigation. Manchester, New Hampshire Taxation of Costs can be categorized into several types, including: 1. Court Costs: Manchester citizens involved in legal proceedings are subject to court fees, which vary depending on the type and complexity of the case. These costs cover the administrative expenses associated with the court system, such as the maintenance of courtrooms, clerks, judges, and other personnel. 2. Filing Fees: When initiating a lawsuit or submitting legal documents to the court in Manchester, individuals are required to pay filing fees. These fees cover the processing, handling, and storage of legal paperwork and are typically determined based on the nature and complexity of the case. 3. Document Production: In Manchester, New Hampshire, costs related to document production during a legal case may be taxed. These expenses include the copying, printing, and delivery of important legal documents, such as affidavits, pleadings, and exhibits. 4. Expert Witness Fees: If expert witnesses are required to testify or provide professional opinions in Manchester court cases, their fees may also be considered taxable costs. Expert witness expenses cover the compensation for their time, expertise, travel, accommodation, and any related expenses incurred in connection with the case. 5. Other Costs: Manchester, New Hampshire Taxation of Costs may further include various additional expenses such as deposition fees, transcription services, court reporter costs, process serving fees, and expenses related to investigations or inspections. The Taxation of Costs process in Manchester involves the determination of the actual costs incurred by each party and may require the submission of detailed documentation and receipts. These costs are then evaluated by the court, and a judgment is made regarding their reasonableness and necessity. Ultimately, the court has the authority to award taxes on costs, determining whether one party or both parties will be responsible for paying the assessed expenses. Understanding the Manchester, New Hampshire Taxation of Costs is crucial when engaging in legal proceedings within the city. It is important to consult with an experienced attorney to navigate this process effectively and ensure compliance with the applicable regulations and guidelines.

Free preview

How to fill out Manchester New Hampshire Taxation Of Costs?

If you’ve already utilized our service before, log in to your account and download the Manchester New Hampshire Taxation of Costs on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Manchester New Hampshire Taxation of Costs. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!