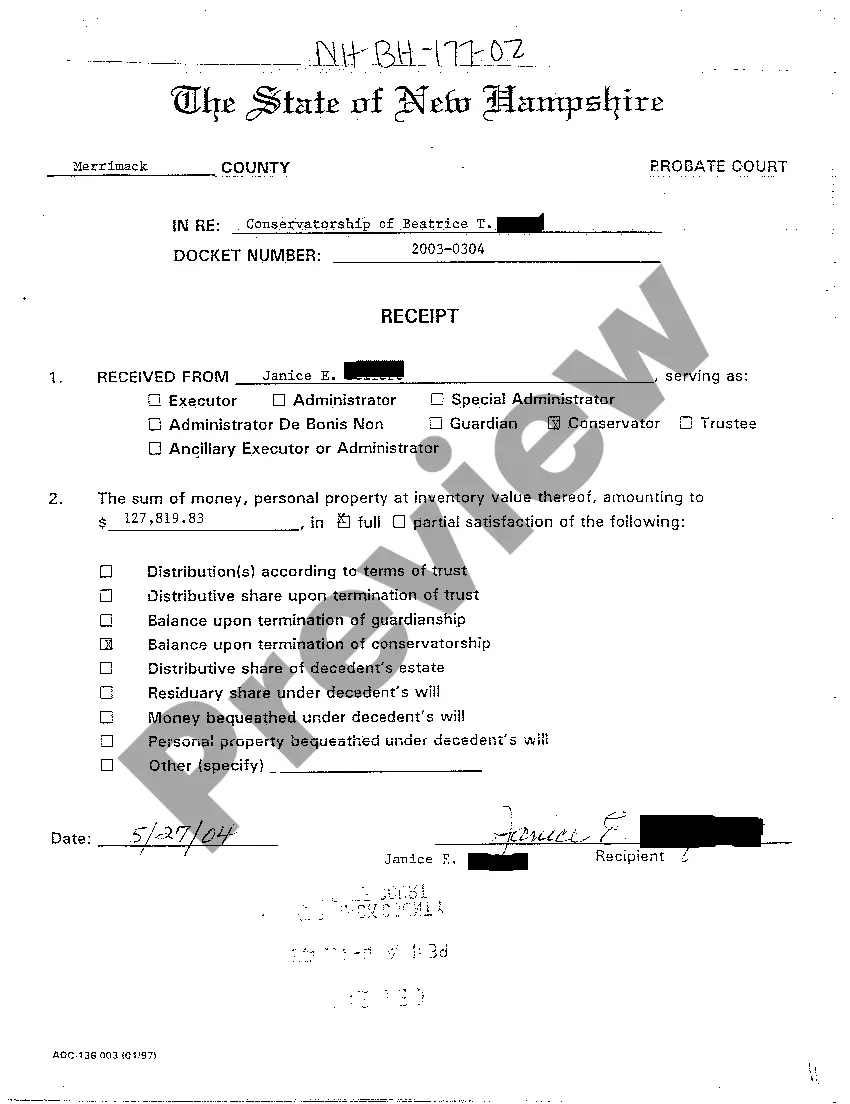

Manchester, New Hampshire Receipt of Balance Upon Termination of Trust is a legal document that serves as proof of the final distribution of assets and funds upon the termination of a trust in Manchester, New Hampshire. It outlines the detailed account of the remaining balance and assets held within the trust, and verifies their rightful distribution to the beneficiaries or designated individuals. In Manchester, New Hampshire, there are several types of receipts upon the termination of a trust that might be encountered, including: 1. Revocable Living Trust Receipt of Balance Upon Termination: This type of receipt is issued when a revocable living trust comes to an end, either due to the death of the granter or by the explicit revocation of the trust. It lists all the assets and funds remaining within the trust and highlights their allocation among the named beneficiaries. 2. Irrevocable Trust Receipt of Balance Upon Termination: When an irrevocable trust reaches its termination date or fulfills its intended purpose, this receipt is issued. It provides an itemized statement of the remaining balance and assets in the trust, detailing the allocation of these funds to the intended recipients or beneficiaries. 3. Charitable Trust Receipt of Balance Upon Termination: If the trust in question is a charitable trust, this receipt is used to document the final distribution of funds and assets to the designated charitable organization(s) upon the trust's termination. It ensures transparency in the transfer of funds and confirms compliance with the original charitable intentions. 4. Testamentary Trust Receipt of Balance Upon Termination: This type of receipt is relevant when a trust is established through a will and comes into effect after the granter's death. Upon the fulfillment of the trust's conditions or expiration of the trust term, the Testamentary Trust Receipt of Balance Upon Termination is issued, providing evidence of the final distribution of assets as outlined in the granter's will. In conclusion, the Manchester, New Hampshire Receipt of Balance Upon Termination of Trust is a significant legal document that establishes the accountability and legitimacy of asset distribution following the termination of various types of trusts, including revocable living trusts, irrevocable trusts, charitable trusts, and testamentary trusts. It plays a crucial role in ensuring that the beneficiaries or designated recipients receive their rightful share of the trust's remaining assets.

Manchester New Hampshire Receipt of Balance Upon Termination of Trust

Description

How to fill out Manchester New Hampshire Receipt Of Balance Upon Termination Of Trust?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Manchester New Hampshire Receipt of Balance Upon Termination of Trust? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Manchester New Hampshire Receipt of Balance Upon Termination of Trust conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Start the search over in case the form isn’t good for your specific situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Manchester New Hampshire Receipt of Balance Upon Termination of Trust in any provided format. You can get back to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal papers online for good.

Form popularity

FAQ

A receipt of inheritance is a document that confirms the distribution of assets to an heir, following the terms laid out in a will. This receipt provides legal proof of what each beneficiary has received, which is essential for future reference, especially regarding the Manchester New Hampshire Receipt of Balance Upon Termination of Trust. Proper documentation protects both the estate and the heirs, preventing any misunderstandings. Consider using uslegalforms to create or manage your inheritance receipts efficiently.

One of the most common mistakes in a will is failing to update it after major life changes, such as marriage, divorce, or the birth of a child. This oversight can lead to unwanted disputes among heirs and may complicate the receipt of assets. Ensuring your will reflects your current circumstances can simplify the Manchester New Hampshire Receipt of Balance Upon Termination of Trust process for your beneficiaries. Utilize uslegalforms to easily manage and update your will as needed.

In New Hampshire, a will generally should be filed within three years of a person's death. If you are managing the estate, it is essential to file the will promptly to ensure that assets are distributed according to the deceased's wishes. Delaying this process can complicate the inheritance and the Manchester New Hampshire Receipt of Balance Upon Termination of Trust may be affected. Use our platform at uslegalforms to assist with your filing process and streamline the necessary documentation.

In NH, there's no specific legal deadline for an executor to settle an estate; however, they must do so in a reasonable timeframe. Executors should assess debts, gather assets, and distribute inheritances efficiently to prevent frustration among beneficiaries. If too much time passes, interested parties can take action to encourage timely settlement. Utilizing the Manchester New Hampshire Receipt of Balance Upon Termination of Trust can help clarify the final stages of settling the estate.

While there is no fixed time frame to settle an estate in New Hampshire, executors are expected to finalize the estate in a reasonable period, typically within a year. Timeliness helps beneficiaries receive their entitlements without prolonged waiting. If delays occur, stakeholders should be informed and proactive. The Manchester New Hampshire Receipt of Balance Upon Termination of Trust should be a part of this process to document settlements.

A will receipt is a formal acknowledgment of receipt of a will by an executor or appointed administrator. This document serves as proof that the will has been received and is now under the executor's responsibility. Maintaining accurate records, including the Manchester New Hampshire Receipt of Balance Upon Termination of Trust, ensures transparency in how wills and estates are managed.

Yes, New Hampshire law does not set a strict time limit for executors to distribute estates, but they are expected to act reasonably. Beneficiaries have a vested interest in timely distributions, so executors should proceed without unnecessary delays. If an executor fails to act, beneficiaries may need to explore options for recourse. Engaging with a service like USLegalForms can streamline understanding of the Manchester New Hampshire Receipt of Balance Upon Termination of Trust.

In New Hampshire, trusts are not typically recorded with the state. Unlike wills, trusts maintain privacy and do not enter public records unless challenged in court. However, key documentation may be retained by the trustee. Understanding how the Manchester New Hampshire Receipt of Balance Upon Termination of Trust operates can help clarify trust management.

If you feel the executor is delaying the estate settlement, you can address the issue by communicating directly with them. As a beneficiary, you have the right to inquire about the progress and timelines. If the delays persist, you may seek legal advice or a court intervention to ensure the timely distribution of assets. Understanding the Manchester New Hampshire Receipt of Balance Upon Termination of Trust can empower you to navigate these situations effectively.

In New Hampshire, an estate generally must exceed $25,000 to qualify for formal probate. However, certain exceptions can apply depending on the situation. If you're handling an estate or thinking about the Manchester New Hampshire Receipt of Balance Upon Termination of Trust, understanding these values is critical for effective estate planning.