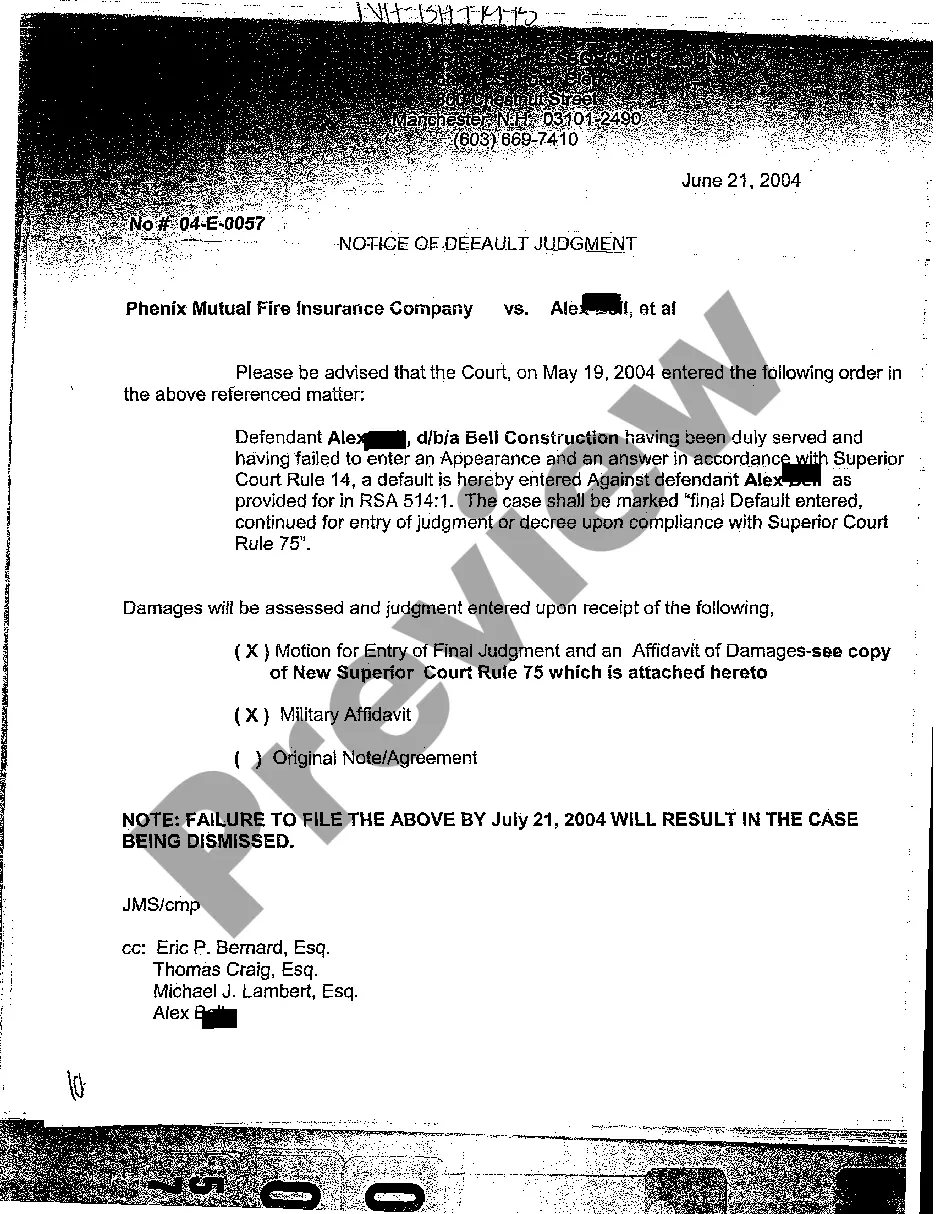

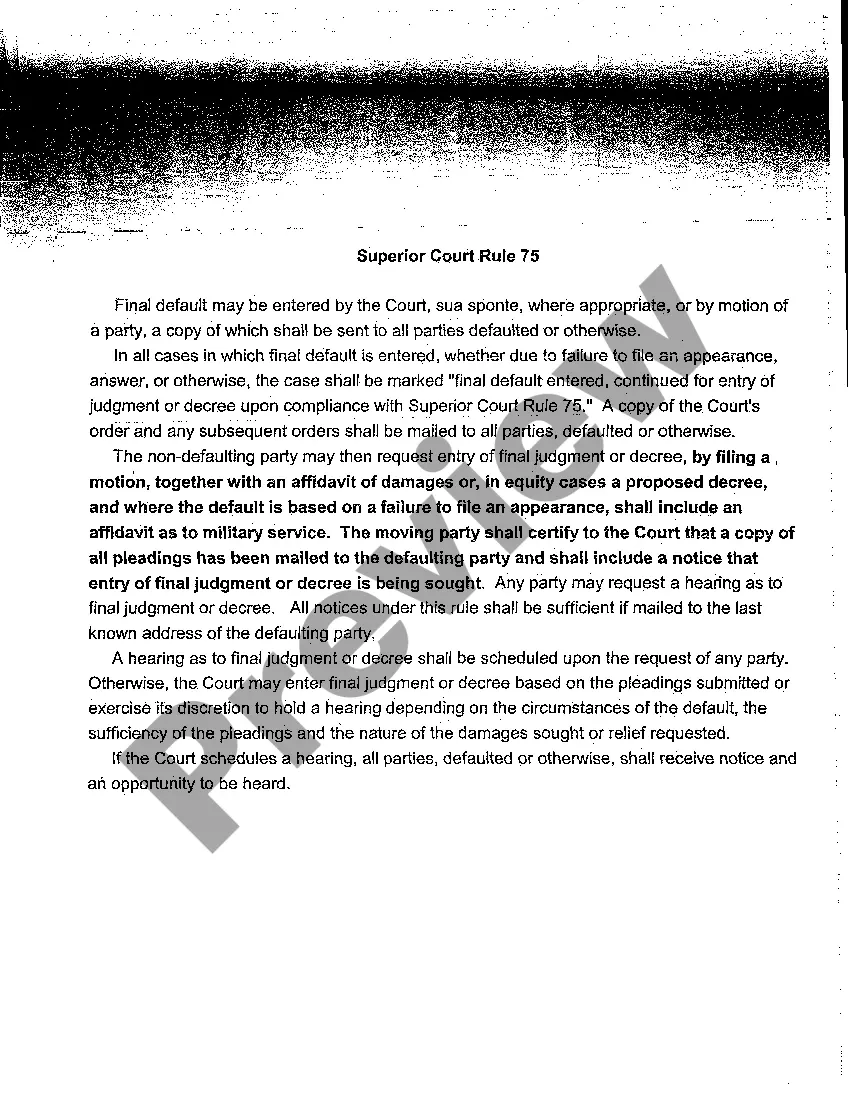

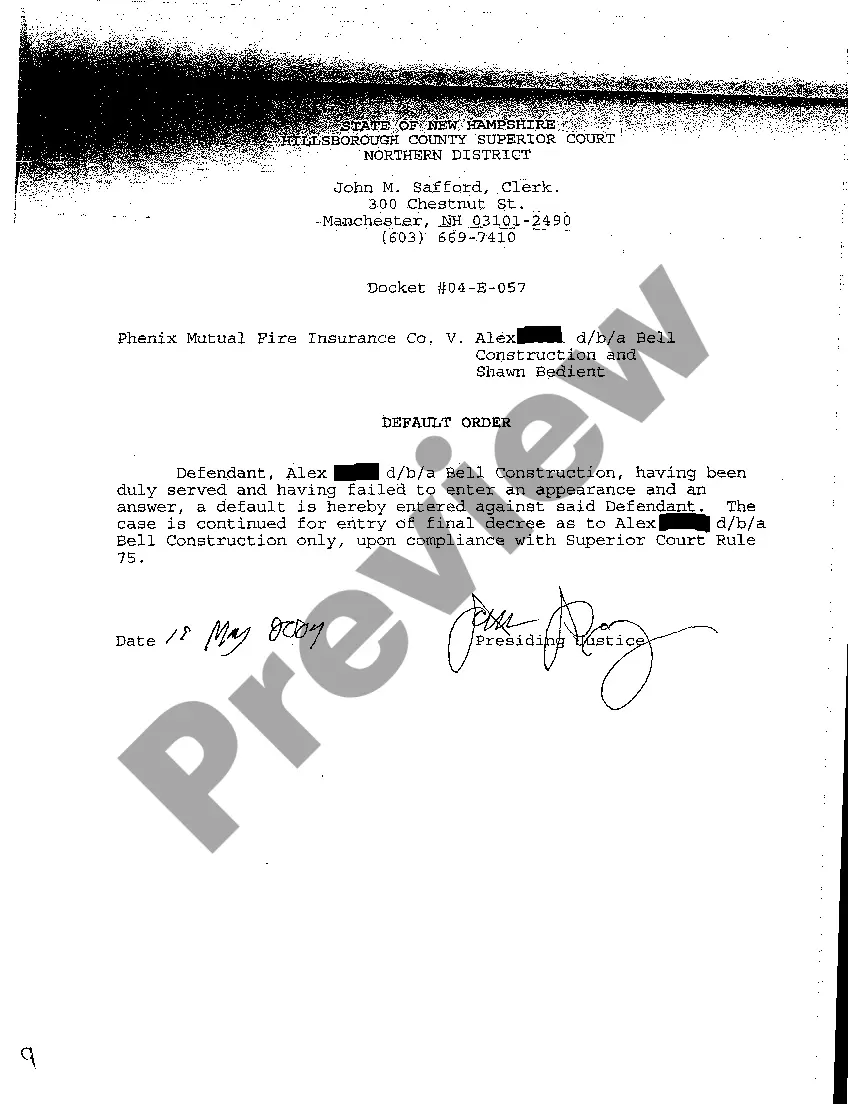

The Manchester New Hampshire Notice of Default Judgment is a legal document that is issued by a court when a borrower fails to fulfill their financial obligations as outlined in a loan or contract. It serves as an official notice to the borrower that a default judgment has been rendered against them. A default judgment typically occurs when a borrower neglects to respond to a lawsuit filed against them within the specified timeframe. As a result, the court may automatically rule in favor of the plaintiff, granting them a judgment by default. The Manchester Notice of Default Judgment is crucial as it notifies the borrower of the court's decision and the subsequent legal consequences. It outlines the details of the judgment, including the amount owed, any accrued interest or penalties, and the deadline for payment or compliance with the court's ruling. This document is typically served to the borrower by mail or through personal service by a court officer. It is important for borrowers to take immediate action upon receiving the Notice of Default Judgment to either satisfy the judgment or explore legal options such as filing an appeal or requesting a reconsideration. Different types of Manchester New Hampshire Notice of Default Judgment may include: 1. Mortgage Default Judgment: This occurs when a homeowner defaults on their mortgage payments, resulting in a foreclosure or repossession of the property by the lender. 2. Debt Default Judgment: This type of judgment is issued when a borrower fails to repay outstanding debts, such as credit card bills, personal loans, or medical bills. The creditor may seek legal action to obtain a default judgment to recover the owed amount. 3. Contract Default Judgment: In cases where a borrower breaches a contract agreement, such as failing to deliver goods or services as agreed upon, the affected party can pursue legal action and obtain a default judgment if the defendant fails to respond or appear in court. In summary, the Manchester New Hampshire Notice of Default Judgment is a significant legal document that informs borrowers of a court's decision to issue a default judgment against them. It is crucial for borrowers to understand the implications of a default judgment and take prompt action to resolve the matter or explore legal options to protect their rights.

Manchester New Hampshire Notice of Default Judgment

Description

How to fill out Manchester New Hampshire Notice Of Default Judgment?

Take advantage of the US Legal Forms and have immediate access to any form you want. Our helpful platform with a large number of document templates makes it simple to find and obtain almost any document sample you need. It is possible to export, fill, and sign the Manchester New Hampshire Notice of Default Judgment in a matter of minutes instead of browsing the web for several hours trying to find an appropriate template.

Utilizing our library is a wonderful strategy to increase the safety of your document submissions. Our professional legal professionals on a regular basis check all the documents to make certain that the templates are relevant for a particular region and compliant with new acts and regulations.

How do you obtain the Manchester New Hampshire Notice of Default Judgment? If you already have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. Furthermore, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, follow the tips listed below:

- Find the template you need. Make certain that it is the template you were seeking: verify its name and description, and utilize the Preview function when it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Download the document. Choose the format to get the Manchester New Hampshire Notice of Default Judgment and change and fill, or sign it according to your requirements.

US Legal Forms is probably the most extensive and reliable document libraries on the web. We are always ready to assist you in any legal case, even if it is just downloading the Manchester New Hampshire Notice of Default Judgment.

Feel free to benefit from our platform and make your document experience as efficient as possible!