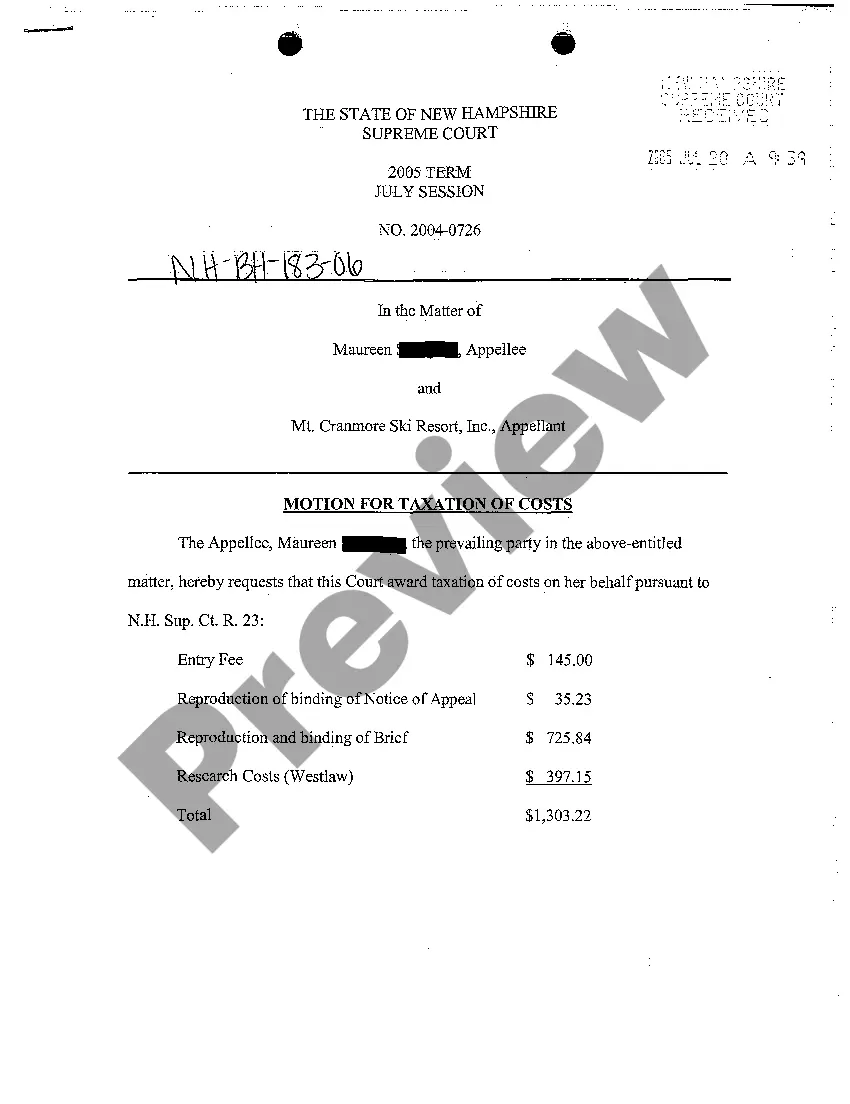

A Motion for Taxation of Costs in Manchester, New Hampshire is a legal document filed by a party seeking reimbursement of their litigation costs after winning a lawsuit. It is an essential step in the post-trial process, aiming to recoup various expenses incurred during the course of the legal action. This motion seeks to outline the specific costs the prevailing party, also known as the "plaintiff," requests to be reimbursed by the losing party, referred to as the "defendant." The Manchester New Hampshire Motion for Taxation of Costs serves as a formal request to the court to review the costs incurred by the prevailing party. The court will then assess and determine the appropriateness of each requested cost, ultimately deciding whether they should be awarded or not. This motion is an important tool for the prevailing party to seek fair compensation for expenses directly related to the litigation process. There are several categories of costs that may be included in a Manchester New Hampshire Motion for Taxation of Costs. These costs may vary depending on the nature and complexity of the case. Common types of costs that could be listed in this motion may include: 1. Filing Fees: This covers the expenses associated with initiating the lawsuit and filing necessary documents with the court. 2. Service of Process Fees: These costs may include fees paid to process servers for delivering legal documents to the opposing party. 3. Witness Fees: If witnesses were called to testify during the trial, their expenses for travel, accommodation, and daily allowances may be included. 4. Deposition Costs: This includes expenses related to taking depositions, such as court reporter fees, transcript copies, and videographer costs. 5. Expert Witness Fees: If expert witnesses were retained for the trial, their fees for providing professional opinions or testimony may be eligible for reimbursement. 6. Court Reporting Costs: This covers the expenses incurred for court reporters to document the proceedings, including transcription and copies of transcripts. 7. Copying and Printing Costs: Costs associated with photocopying, printing, and reproducing legal documents necessary for the case. 8. Evidentiary Presentations: Expenses related to the preparation and presentation of evidence, such as graphics, exhibits, or audio-visual aids. 9. Travel Expenses: If travel was necessary for the case, reasonable expenses for transportation, lodging, and meals may be included. 10. Research and Investigation Costs: Costs incurred for researching case law, legal documents, or any investigations directly related to the litigation. It is important to note that the court has the discretion to approve or deny each requested cost. Therefore, it is crucial for the prevailing party to provide detailed documentation for each expense, including receipts or invoices. Failure to adequately substantiate the costs may result in the court denying reimbursement. In summary, a Manchester New Hampshire Motion for Taxation of Costs is a legal document aimed at recuperating litigation expenses for the prevailing party. It allows them to seek reimbursement for various costs associated with the lawsuit. By providing an itemized list of costs, the prevailing party can effectively present their case to the court in order to recover the financial burden imposed by the litigation process.

Manchester New Hampshire Motion for Taxation of Costs

Description

How to fill out Manchester New Hampshire Motion For Taxation Of Costs?

Make use of the US Legal Forms and have immediate access to any form you want. Our helpful website with a large number of document templates makes it easy to find and obtain almost any document sample you require. You can export, complete, and sign the Manchester New Hampshire Motion for Taxation of Costs in a couple of minutes instead of surfing the Net for several hours searching for an appropriate template.

Using our library is a wonderful way to raise the safety of your document submissions. Our experienced lawyers regularly review all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and polices.

How do you get the Manchester New Hampshire Motion for Taxation of Costs? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. In addition, you can get all the previously saved records in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Find the form you require. Make certain that it is the form you were looking for: check its title and description, and make use of the Preview option if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading procedure. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Save the document. Choose the format to obtain the Manchester New Hampshire Motion for Taxation of Costs and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy form libraries on the internet. Our company is always happy to assist you in any legal procedure, even if it is just downloading the Manchester New Hampshire Motion for Taxation of Costs.

Feel free to take full advantage of our service and make your document experience as convenient as possible!