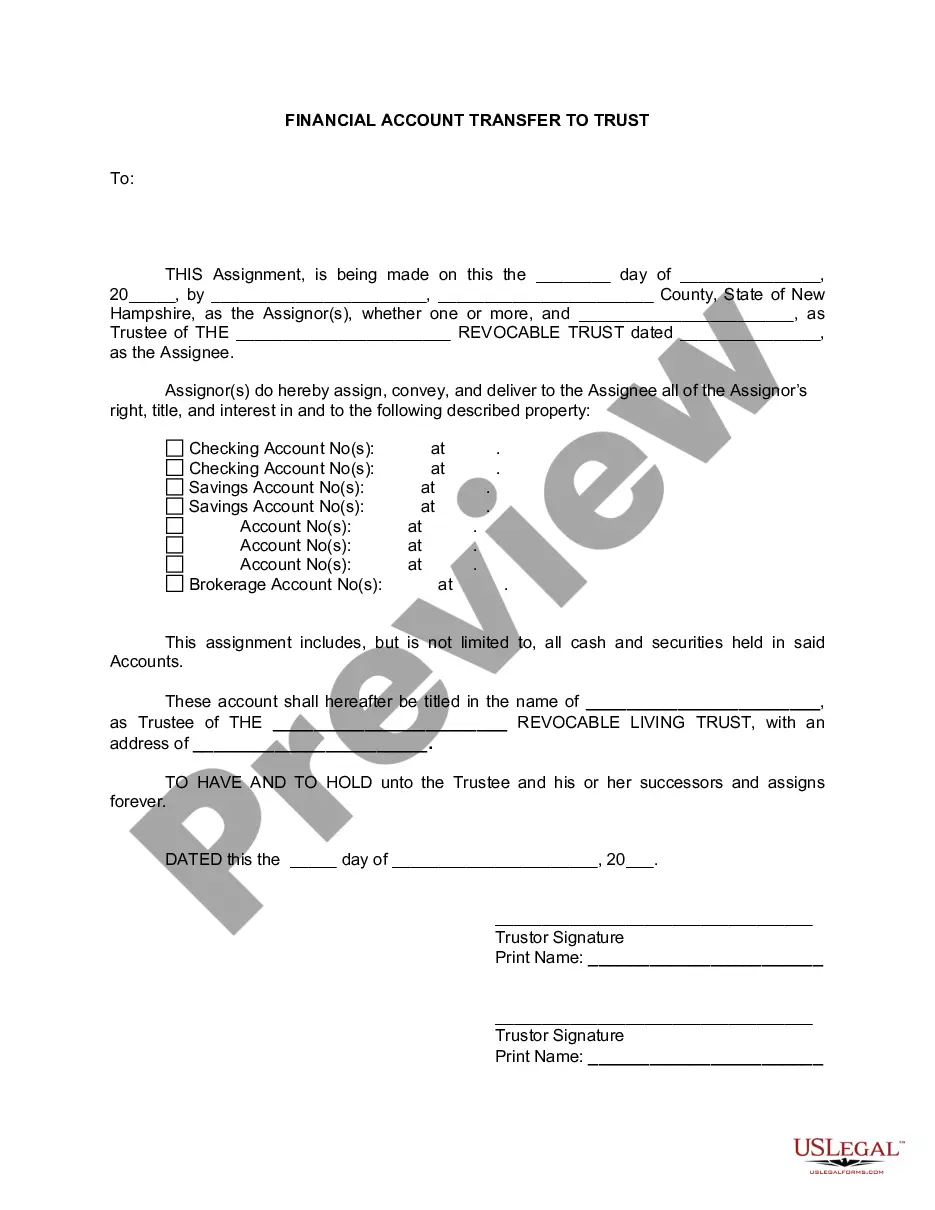

Manchester New Hampshire Financial Account Transfer to Living Trust: A Comprehensive Guide When it comes to securing your financial future and ensuring the smooth transfer of assets, a Manchester New Hampshire Financial Account Transfer to Living Trust is an essential tool. By transferring your financial accounts to a living trust, you can protect your assets, avoid probate, and provide for your loved ones in a seamless manner. Types of Manchester New Hampshire Financial Account Transfer to Living Trust: 1. Bank Accounts: One of the most common types of financial accounts transferred to a living trust in Manchester, New Hampshire, is bank accounts. This includes checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). By transferring these accounts to a living trust, you ensure that the assets held within them are seamlessly passed on to your designated beneficiaries upon your passing. 2. Investment Accounts: Another vital aspect of financial account transfers to a living trust includes investment accounts. These accounts may consist of stocks, bonds, mutual funds, and other securities. Transferring investment accounts to your living trust allows you to maintain control over these assets during your lifetime while simplifying the transfer process after your demise. 3. Retirement Accounts: Manchester residents can also transfer their retirement accounts, such as IRAs (Individual Retirement Accounts), 401(k)s, and pension plans, to a living trust. By doing so, you can dictate how these funds are distributed after your passing, reducing potential tax burdens for your beneficiaries. 4. Life Insurance Policies: While life insurance policies are not financial accounts per se, they require careful consideration when creating a living trust. By transferring ownership of these policies to your trust, you maintain control over their proceeds and ensure they are distributed according to your wishes, avoiding the need for probate. Benefits of Manchester New Hampshire Financial Account Transfer to Living Trust: 1. Avoidance of Probate: Transferring financial accounts to a living trust helps your loved ones navigate through the complex probate process, saving time, and expenses. Assets held in a living trust bypass probate and are distributed efficiently, following your pre-defined guidelines. 2. Privacy: Unlike probate, which is a public process, a living trust allows your estate affairs to remain private. This confidentiality can be of great value to ensure that your financial matters stay within the purview of your family and beneficiaries. 3. Incapacity Planning: A living trust also acts as an effective tool for incapacity planning. In the event of your inability to manage your finances due to a medical condition or incapacity, the appointed successor trustee can seamlessly take over and manage your financial accounts, ensuring your best interests are protected. 4. Flexibility and Control: By establishing a living trust, you have the flexibility to revise or revoke it at any time, as long as you have the capacity to make decisions. This feature allows you to adapt your estate planning strategy as your circumstances change, ensuring your financial accounts are included and protected in your overall plan. In conclusion, a Manchester New Hampshire Financial Account Transfer to Living Trust is a crucial step in securing your financial legacy and providing for your loved ones. By transferring different types of financial accounts, such as bank accounts, investment accounts, retirement accounts, and life insurance policies to a living trust, you can avoid probate, maintain privacy, and exercise control over your assets. Seek the guidance of a qualified estate planning attorney to ensure your financial accounts are seamlessly transferred to a living trust, aligning with your unique goals and objectives.

Manchester New Hampshire Financial Account Transfer to Living Trust

Description

How to fill out Manchester New Hampshire Financial Account Transfer To Living Trust?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Manchester New Hampshire Financial Account Transfer to Living Trust? US Legal Forms is your go-to solution.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Manchester New Hampshire Financial Account Transfer to Living Trust conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Start the search over in case the template isn’t suitable for your legal scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is completed, download the Manchester New Hampshire Financial Account Transfer to Living Trust in any provided file format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal papers online for good.