Manchester, New Hampshire Assignment to Living Trust: A Comprehensive Guide to Protecting Your Assets In Manchester, New Hampshire, individuals seeking to safeguard their assets and ensure efficient estate planning often turn to Assignment to Living Trust. This legal process offers numerous benefits, including avoiding probate, maintaining privacy, and providing seamless asset management during incapacitation. This article will delve into the details of Manchester New Hampshire Assignment to Living Trust, exploring its types and advantages while incorporating relevant keywords for a comprehensive understanding. 1. What is an Assignment to Living Trust? An Assignment to Living Trust is a legal mechanism through which individuals in Manchester, New Hampshire transfer ownership of their assets to a trust during their lifetime. This trust becomes the beneficiary and manager of those assets, allowing the granter to have full control and utilization of them during their lifetime. After the granter's passing, the assets are smoothly distributed to the chosen beneficiaries, bypassing the probate process. 2. Revocable Living Trust: Revocable Living Trust is a commonly utilized form of Assignment to Living Trust in Manchester, New Hampshire. This type of trust enables individuals to retain control over their assets, modify or revoke the trust, and enjoy the income generated. Naming oneself as the trustee allows full control and flexibility in managing assets during incapacity or in case of other life changes. 3. Irrevocable Living Trust: Contrary to the revocable trust, an Irrevocable Living Trust in Manchester, New Hampshire cannot be altered or terminated by the granter once it is established. Through this trust, the granter transfers ownership and control of assets to the trust, removing them from their estate. This provides significant tax advantages and protection against creditors. However, it is important to note that once the assets are transferred, the granter loses control over them. 4. Benefits of Manchester New Hampshire Assignment to Living Trust: i. Avoiding Probate: By transferring assets to a living trust, individuals ensure their assets will not go through the time-consuming and potentially expensive probate process in Manchester, New Hampshire. ii. Maintaining Privacy: Probate proceedings are public, allowing anyone to access information about the estate. Assignment to Living Trust keeps asset distribution and beneficiary details private. iii. Incapacity Planning: Living trusts include provisions to manage assets if the granter becomes incapacitated or deemed unfit to handle financial matters in Manchester, New Hampshire. iv. Minimizing Estate Taxes: With careful planning, an Assignment to Living Trust can help decrease estate taxes by utilizing tax strategies available in New Hampshire. In conclusion, Manchester, New Hampshire Assignment to Living Trust provides an effective way to protect assets, eliminate the probate process, and maintain personal privacy during estate distribution. Whether individuals opt for a Revocable or Irrevocable Living Trust, both types offer substantial advantages depending on their specific needs and goals. By engaging in comprehensive estate planning, residents in Manchester, New Hampshire can ensure their assets are fully protected and efficiently managed both during their lifetime and after their passing.

Manchester New Hampshire Assignment to Living Trust

Description

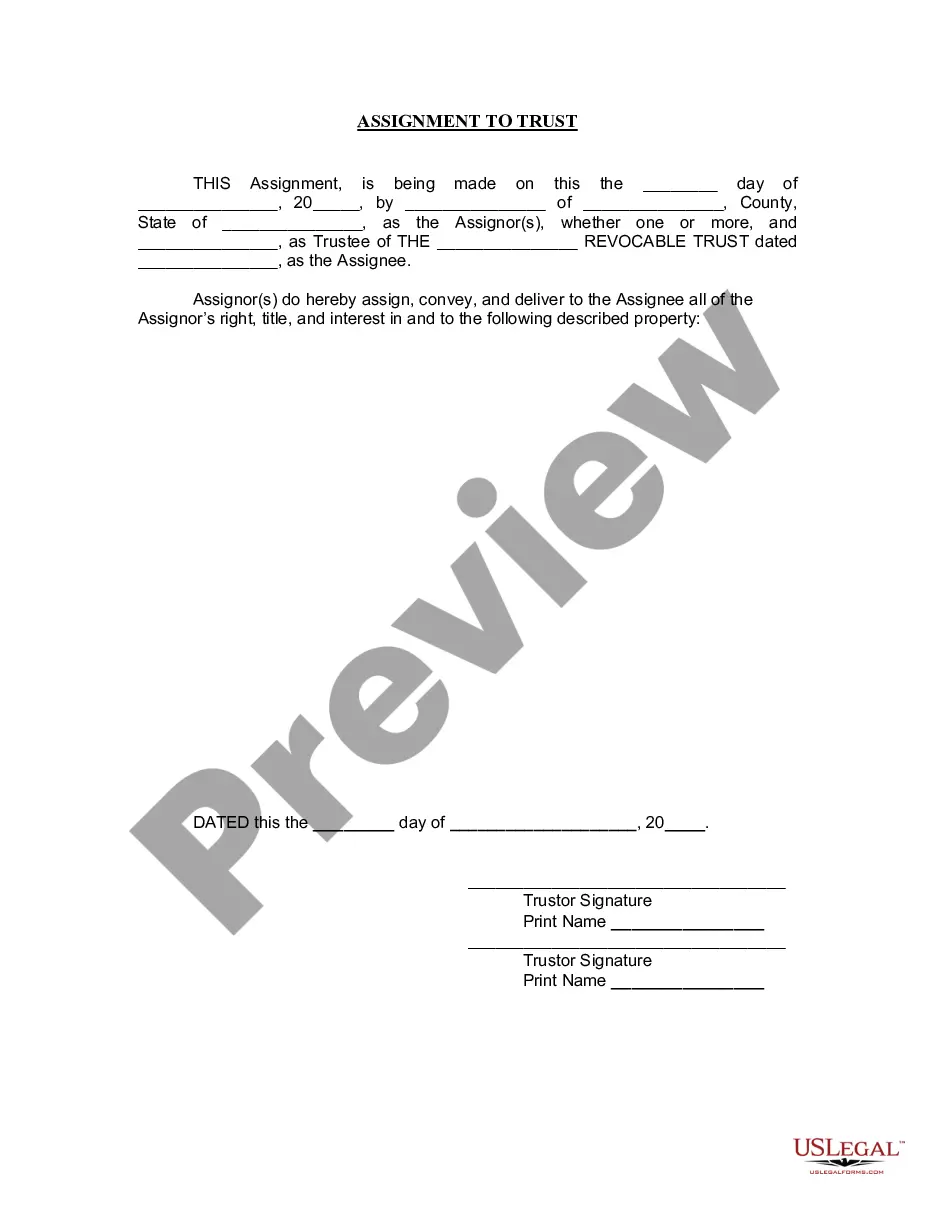

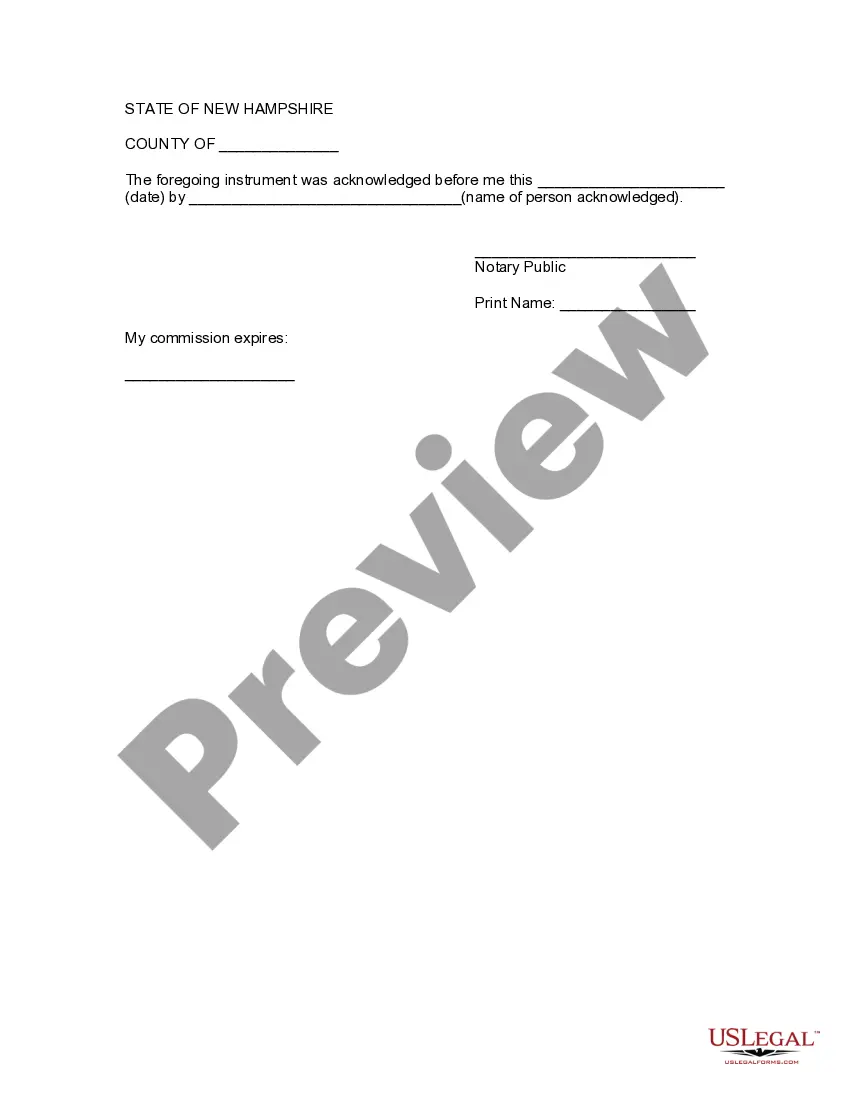

How to fill out Manchester New Hampshire Assignment To Living Trust?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney services that, usually, are very costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Manchester New Hampshire Assignment to Living Trust or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Manchester New Hampshire Assignment to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Manchester New Hampshire Assignment to Living Trust is proper for you, you can select the subscription plan and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!