Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

No matter one’s social or professional standing, filling out law-related documents is a regrettable requirement in the modern world.

Frequently, it’s nearly impossible for individuals lacking any legal training to draft these types of papers from scratch, primarily because of the intricate terminology and legal nuances they involve.

This is where US Legal Forms comes to assist.

Make sure the form you have selected is tailored to your area, as the regulations of one state or county do not apply to another.

Review the document and read a brief summary (if available) of the situations for which the document can be utilized.

- Our platform features an extensive collection of over 85,000 state-specific forms that cater to virtually any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors who wish to save time by using our DIY forms.

- Whether you require the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors or any other documentation that is valid in your state or county, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors in just a few minutes using our trustworthy platform.

- If you already have an account, you may Log In to access the necessary form.

- However, if you are new to our library, make sure to follow these steps before acquiring the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors.

Form popularity

FAQ

Qualifying to assume a mortgage typically requires you to meet the lender's financial criteria, which usually include demonstrating a sufficient credit score, employment history, and debt-to-income ratio. In the context of the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors, your lender will evaluate your financial stability as part of their approval process. You can enhance your chances of qualifying by gathering relevant financial documentation and presenting it clearly. Reaching out to uslegalforms can also provide additional insights and resources to streamline this process.

You can find mortgage agreements at various online platforms, including uslegalforms, which offers comprehensive resources for legal documents related to mortgages. Their website is specifically designed to help you navigate the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors. Additionally, you may consult with local lenders or real estate attorneys for more specific and tailored agreements. Always ensure that any agreement closely reflects your needs and complies with local laws.

The duration to transfer an assumable mortgage can vary, but typically it takes a few weeks to a couple of months. This timeline allows the lender time to review the buyer’s qualifications and the current Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors. Also, factors such as local regulations and the responsiveness of involved parties can impact the overall timeframe. It's advisable to stay in close contact with your lender during this process.

To obtain a mortgage assumption, you must first review your existing mortgage terms to confirm if it allows for assumptions. Next, contact your lender to obtain the necessary forms and guidelines specific to your Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors. You’ll need to gather documentation to demonstrate your financial stability. Finally, complete the required paperwork and submit it to your lender for approval.

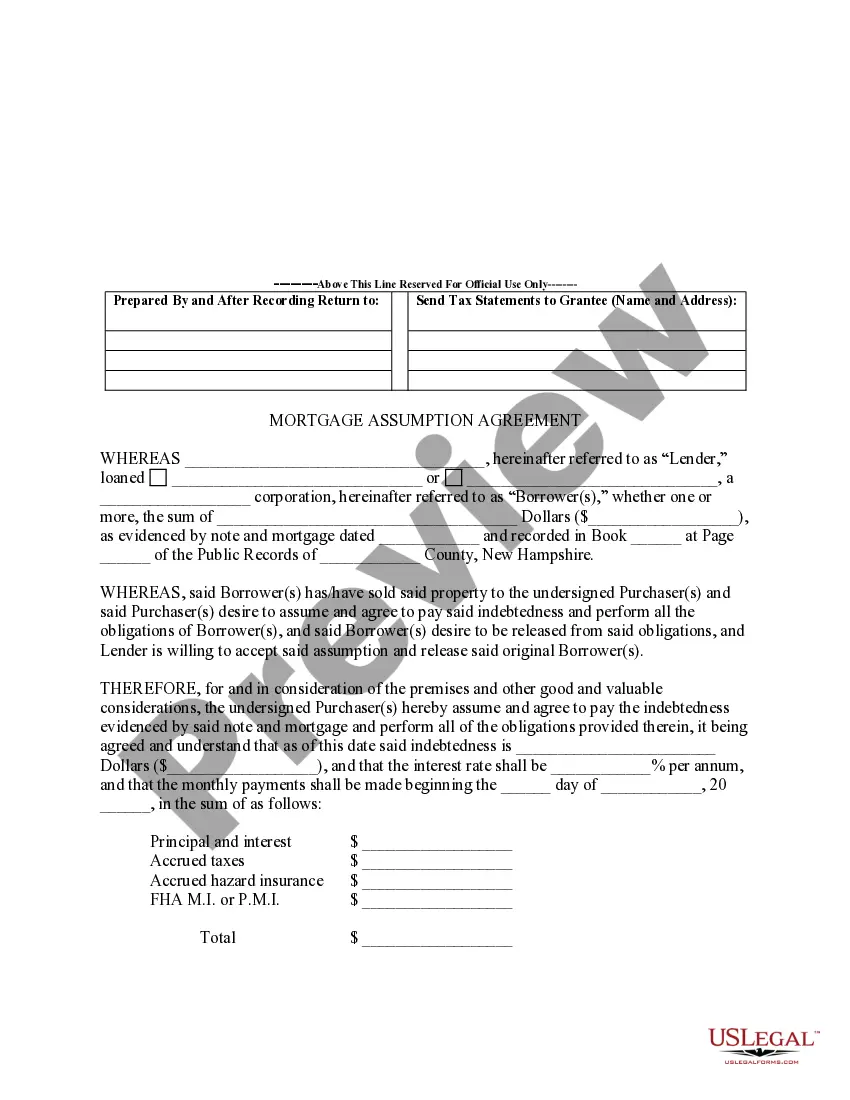

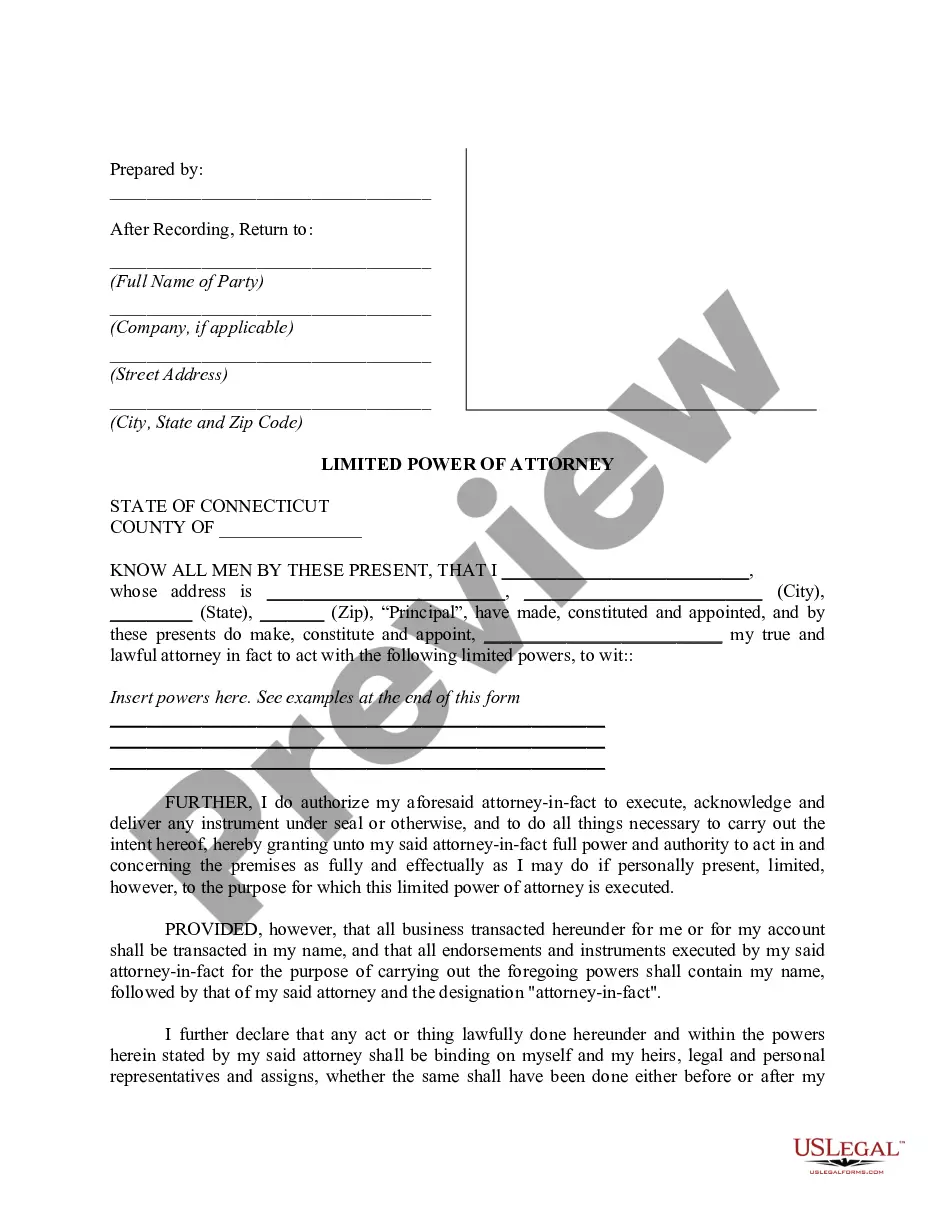

When assuming a mortgage, you will generally need several key documents, such as the original mortgage agreement, financial statements of the new borrower, and personal identification. Additionally, your lender may require specific forms for the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors to ensure regulatory compliance. Using uslegalforms can streamline this process by providing you with the necessary templates and guidance.

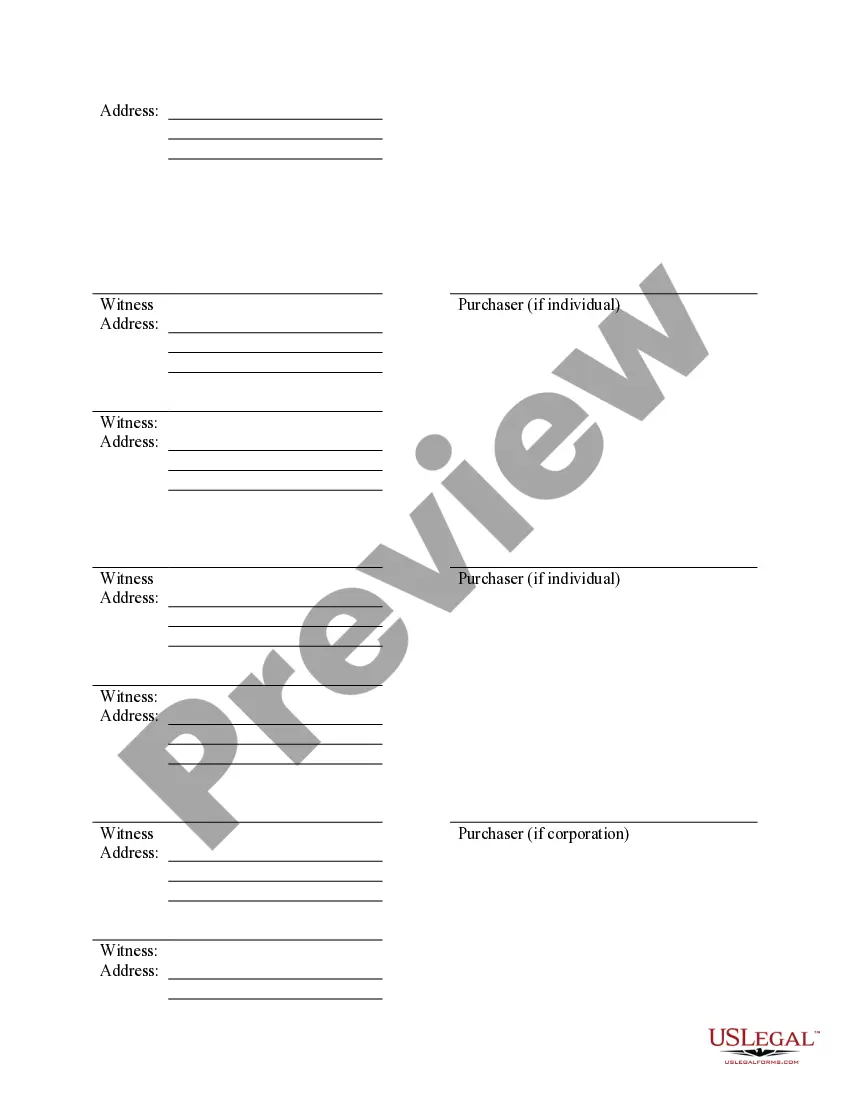

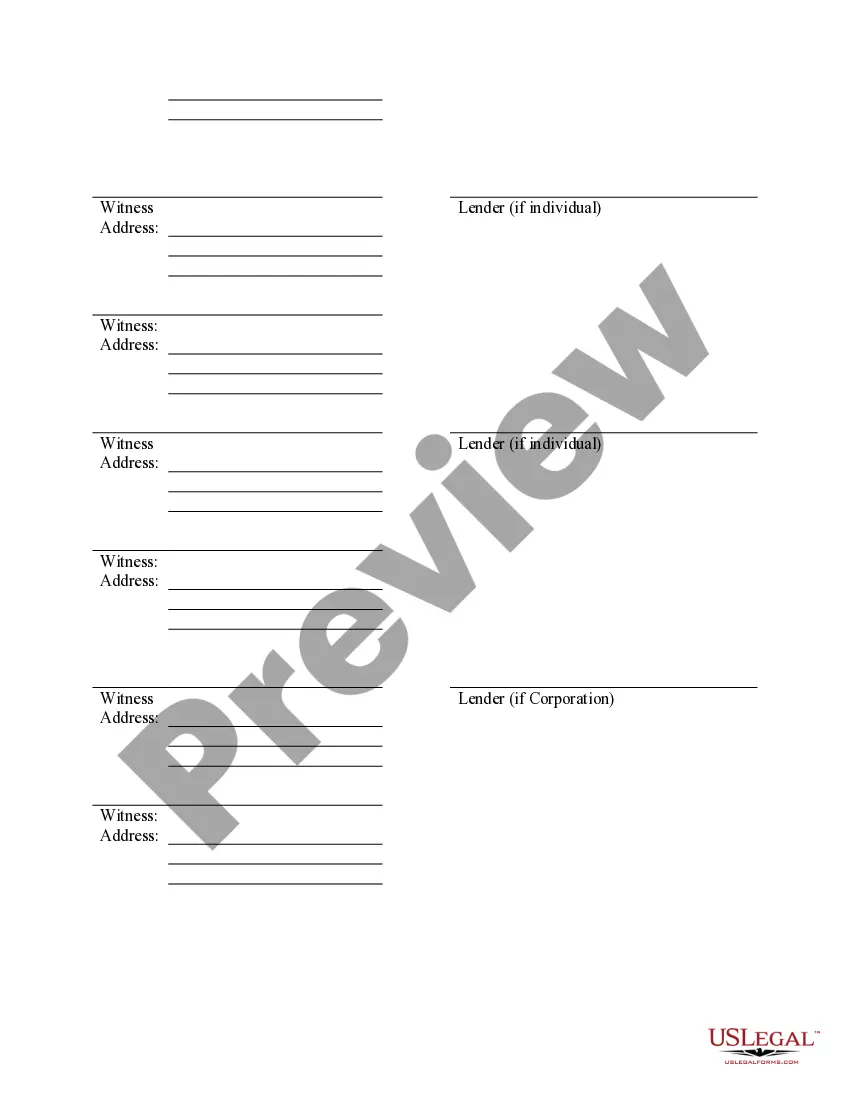

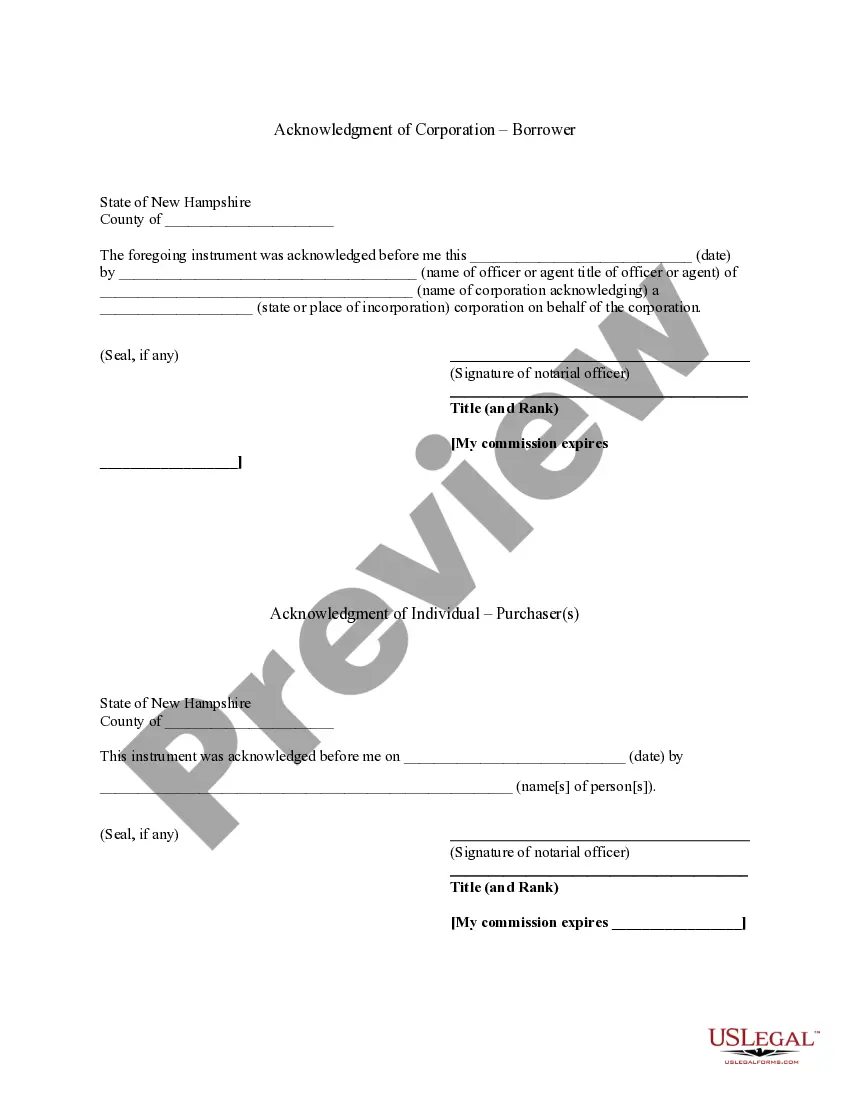

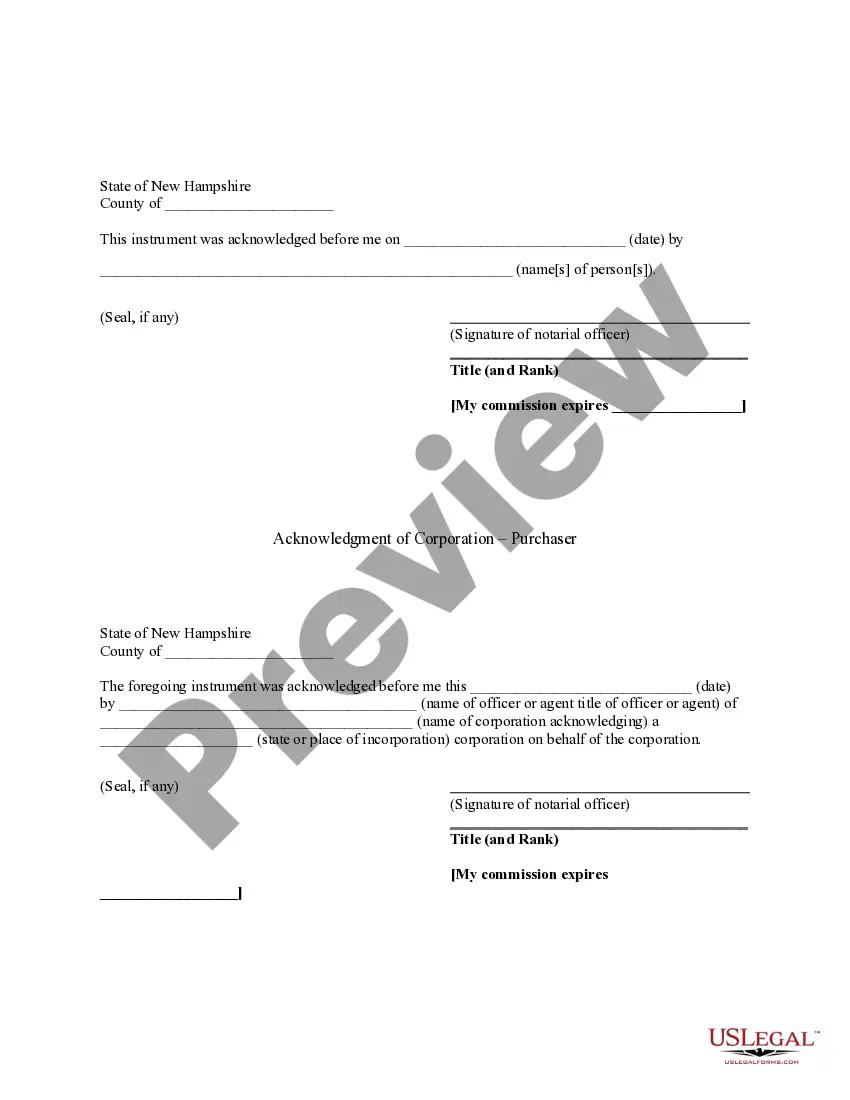

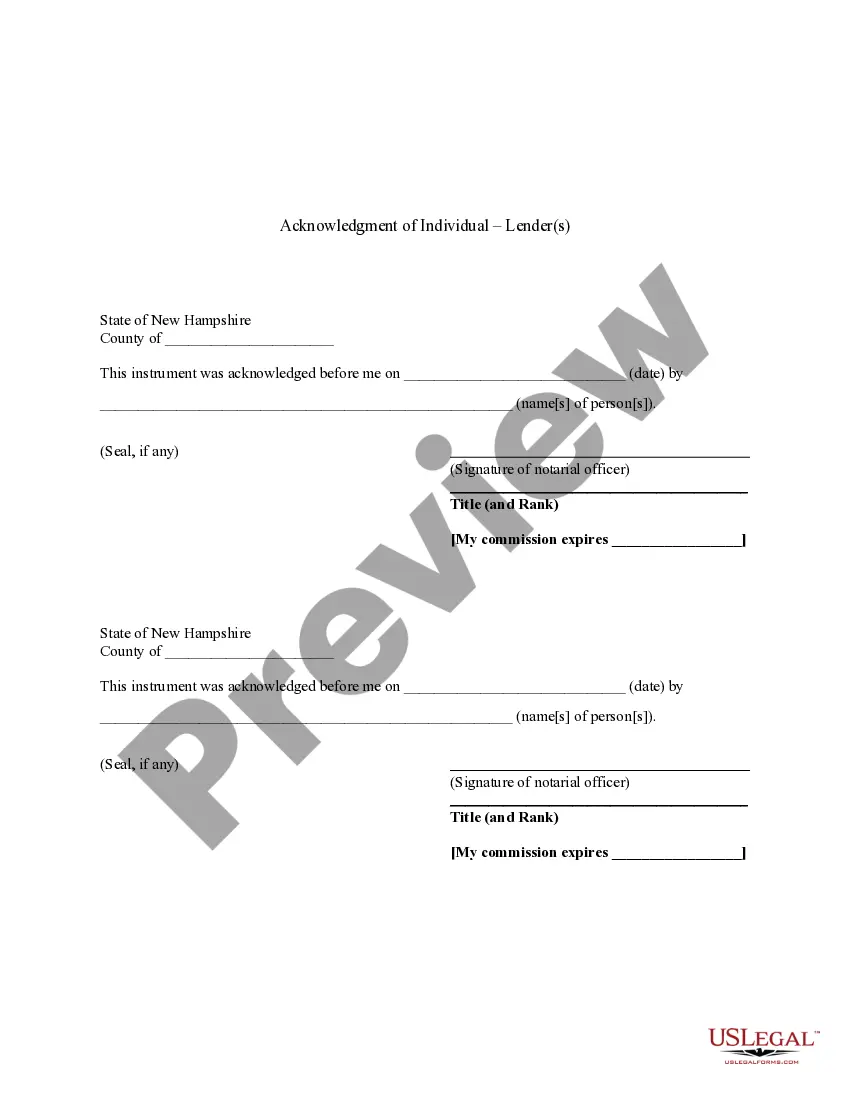

In a Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors, both the buyer and the lender must sign the agreement. This process confirms that the buyer will assume the remaining mortgage obligations of the original borrower. Additionally, the original mortgagors may also need to sign to release them from future liabilities related to the mortgage. If you need help with this process, uslegalforms offers easy-to-use templates to facilitate the signing and ensure your agreement meets all legal requirements.

To buy a house by assuming the mortgage, first, find a property where the seller's mortgage has an assumable clause. Engage in discussions with the seller to understand the terms and conditions outlined in the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors. Afterward, present your financial qualifications to the lender to facilitate the assumption process. This strategy can result in favorable financial terms compared to traditional mortgage options.

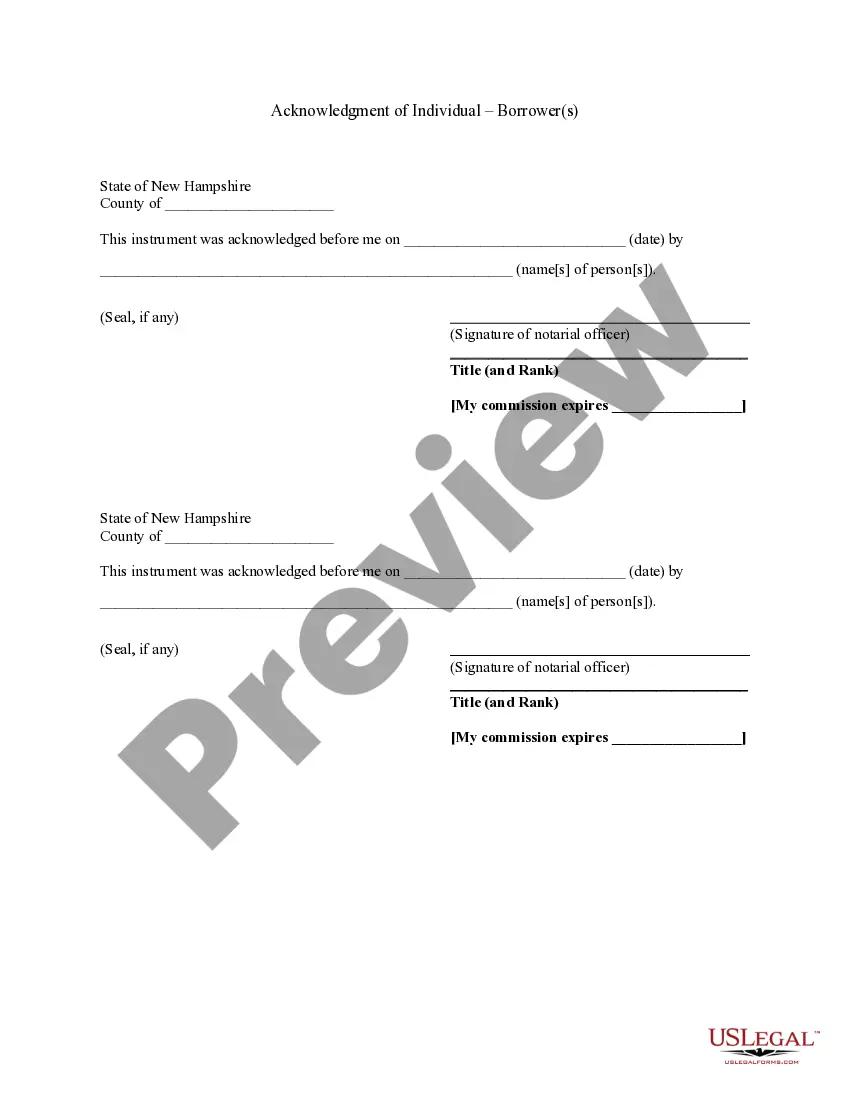

Yes, assumption agreements typically get recorded with the appropriate local government office, which ensures public notice of the financial commitment. In the framework of the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors, recording the agreement is essential for protecting both the new borrower and the lender's interests. It is wise to confirm that all requisite documentation is filed correctly.

An assumption agreement is a legal document that allows one borrower to take over another borrower's mortgage, ensuring the terms and responsibilities transfer to the new borrower. In the context of the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors, it offers a way to facilitate property transfers without needing to refinance. This agreement benefits both parties by providing a streamlined process for handling existing debts.

Typically, when you assume a mortgage under the Manchester New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors, a down payment might not be necessary. However, this can vary based on the terms set forth by the lender. It is important to clarify this detail when exploring your options for assumption agreements. Always consult with your lender or a mortgage advisor for specific requirements.