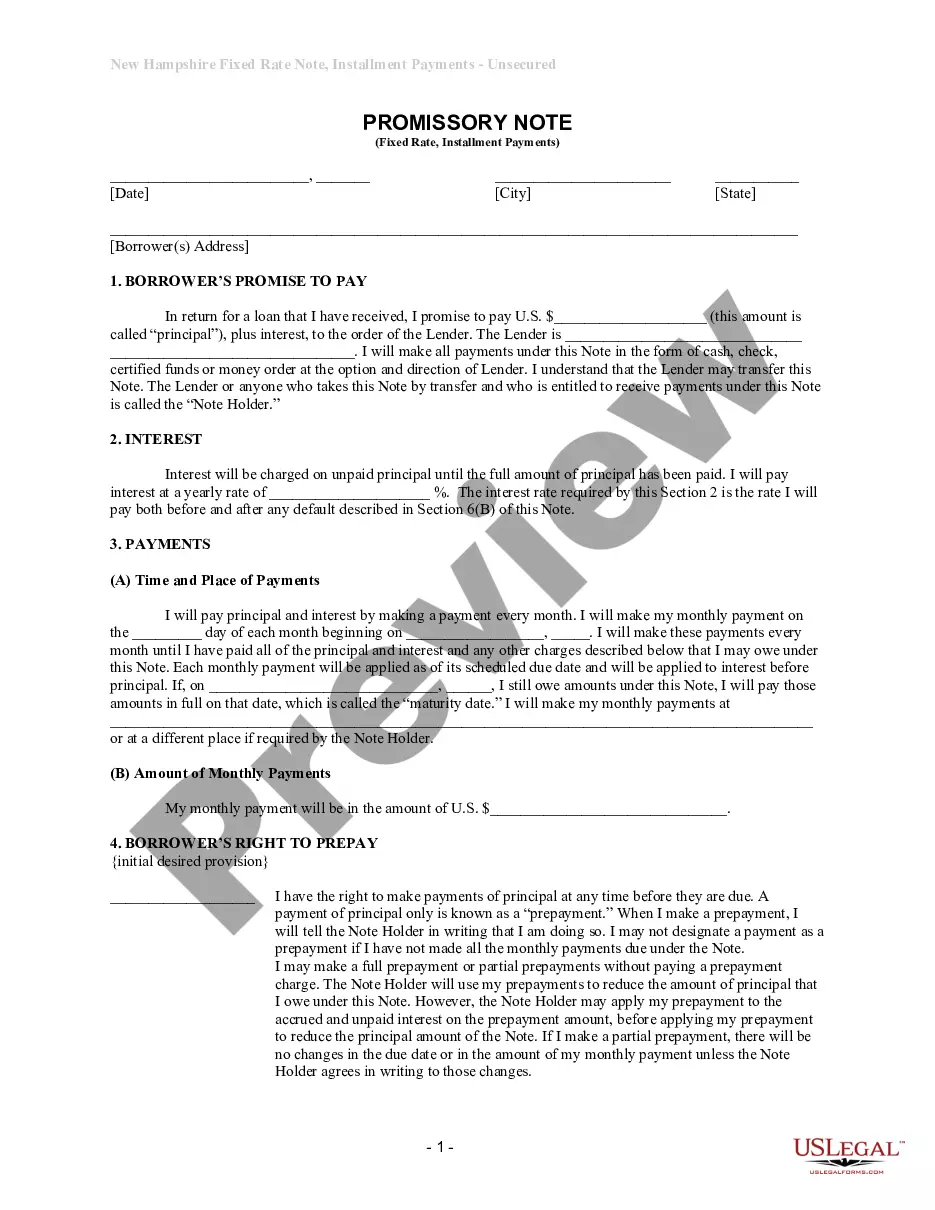

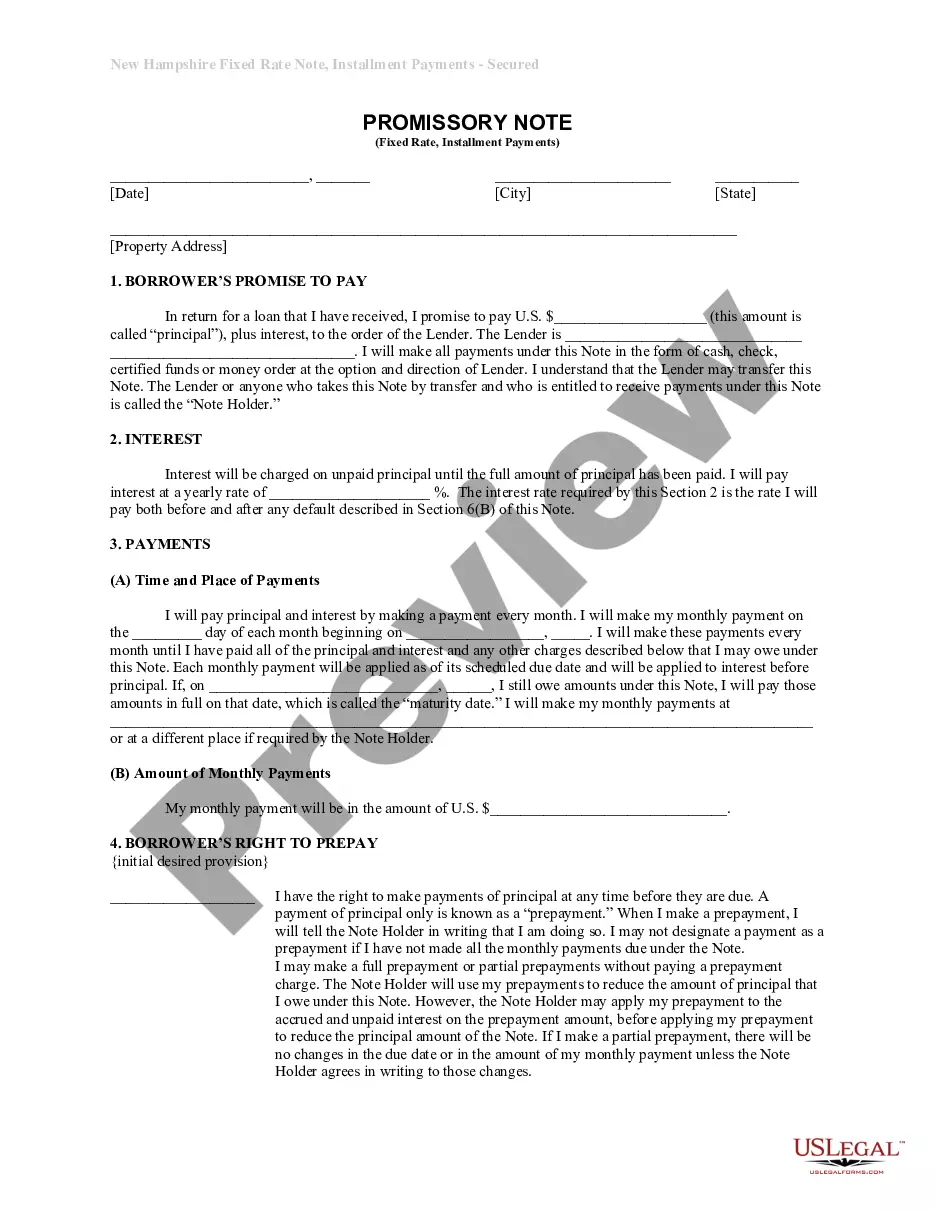

Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out New Hampshire Unsecured Installment Payment Promissory Note For Fixed Rate?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our helpful website featuring a vast array of document templates streamlines the process of locating and acquiring nearly any document sample you will need.

You can download, fill out, and sign the Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate in just a few minutes instead of spending hours searching the web for a suitable template.

Using our catalog is an excellent approach to enhance the security of your form submission.

If you haven’t created an account yet, follow the instructions below.

Feel free to fully utilize our platform and make your document experience as easy as possible!

- Our skilled attorneys regularly evaluate all documents to ensure that the templates are pertinent to a specific location and comply with the latest laws and regulations.

- How do you obtain the Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate.

- If you have an account, simply Log In to your profile.

- The Download option will be activated for all the samples you review.

- Moreover, you can access all previously saved documents in the My documents menu.

Form popularity

FAQ

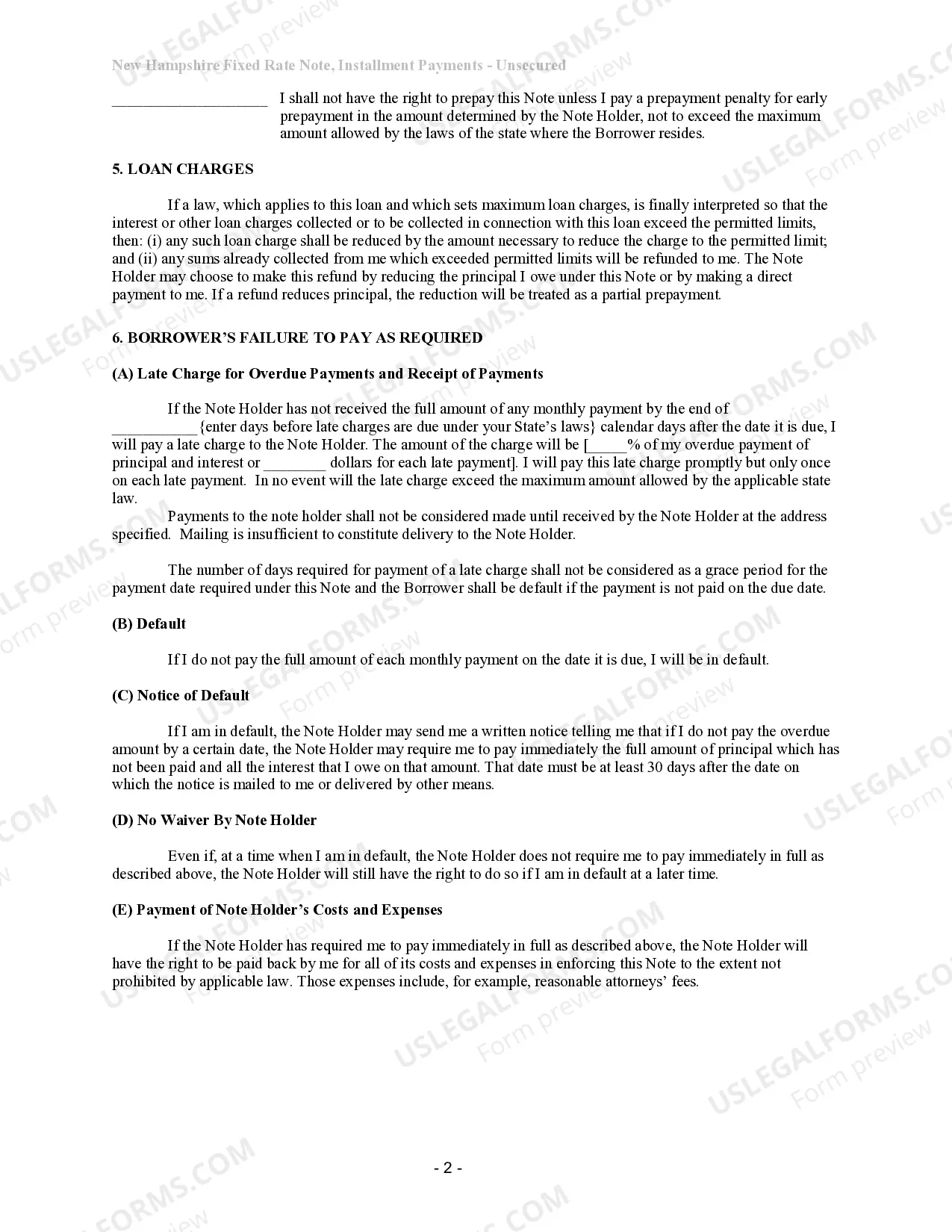

The interest rate on a promissory note can vary based on several factors, including the lender’s policies and current market conditions. Typically, for a Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate, the interest rate can be set at a competitive level to ensure fairness for both parties. It’s crucial to review your options and possibly consult a financial advisor to get the best rate suited to your needs.

In most cases, you do not need to record a promissory note, but if you want to establish a public record, you can file it at your local county clerk's office. This step can offer additional protection for the lender and clarify terms related to the Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate. Remember to inquire about any specific requirements your local office may have.

Enforcing an unsecured promissory note can be challenging, as it is not backed by collateral. To enforce it, you may need to send payment reminders or negotiate a payment plan with the borrower. If necessary, consulting with a lawyer may help you understand your options regarding the Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate and any legal proceedings that may follow.

When reporting a promissory note on your taxes, remember that interest earned on the note is typically taxable income. As a lender, you should report this income on your tax return. If you're unsure about the specific tax implications related to your Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate, consider consulting a tax professional or using resources like uslegalforms for guidance.

A promissory note itself does not automatically appear on your credit report or public record unless you fail to make payments. If the lender pursues legal action for nonpayment, it may result in a judgment that could affect your credit. This is why keeping up with payments on your Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate is crucial for maintaining a healthy financial record.

Creating a promissory note for payment involves outlining key details such as the amount borrowed, interest rate, payment schedule, and signatures of both parties. You can draft this document using templates available online or through platforms like uslegalforms, which provide customizable documents for the Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate. Make sure to include all essential terms to ensure clarity and enforceability.

To fill out a promissory note, first, gather necessary information such as the amount borrowed, names of borrower and lender, and the payment schedule. Follow the specific sections of the document carefully, ensuring accurate details to avoid confusion later. Resources like uslegalforms provide templates that can assist you in filling out a Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate effectively.

To write a promissory note for payment, outline the full details of the agreement, including the borrower's commitment to repay a specific amount, along with any agreed interest. Include the due date and repayment schedule to ensure clarity. Utilize resources from uslegalforms to access templates that make drafting your Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate straightforward.

The primary difference between an installment note and a promissory note lies in the repayment structure. An installment note requires regular payments over a specified period, while a promissory note may not require such periodic payments. When seeking a structured repayment plan, consider using a Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate to outline your terms clearly.

To obtain a promissory note, you can visit websites that specialize in legal forms, such as US Legal Forms. They provide a range of documents, including the Manchester New Hampshire Unsecured Installment Payment Promissory Note for Fixed Rate. After selecting the appropriate form, you will need to fill it out with your specific details to create a legally binding agreement.