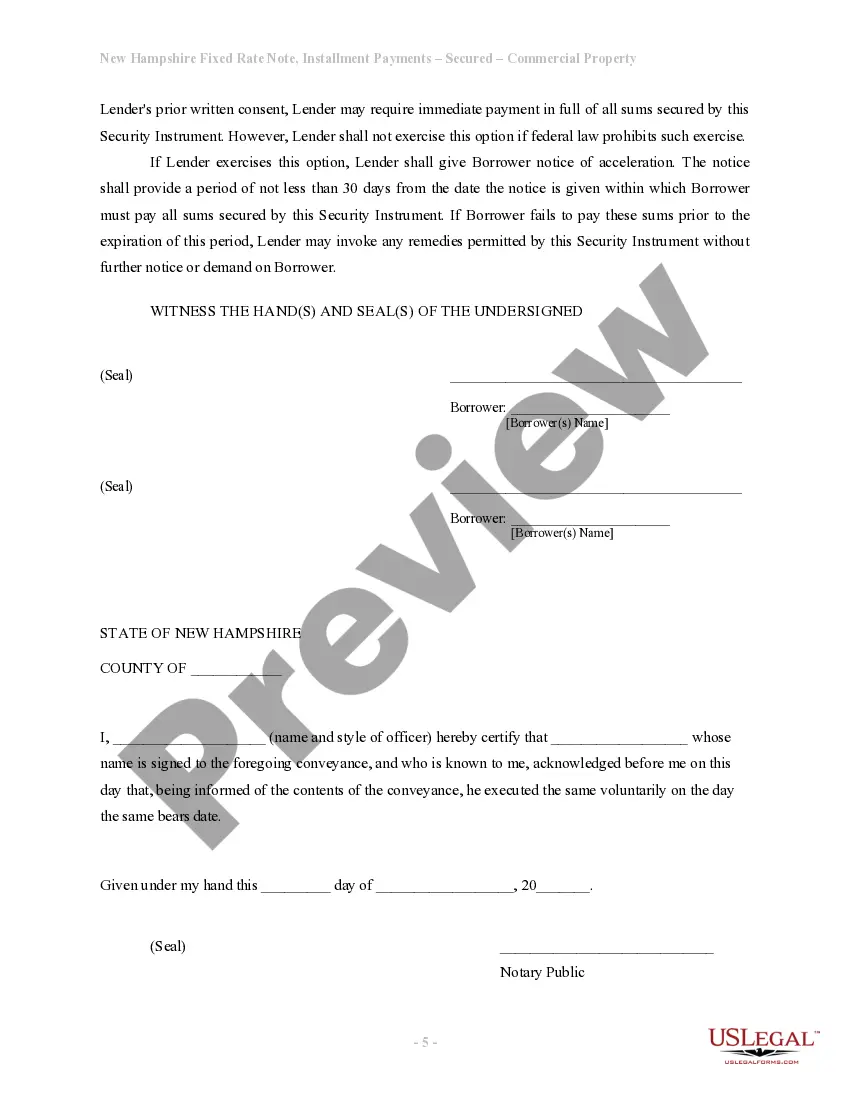

A Manchester New Hampshire Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document that outlines the terms and conditions for a loan agreement between a lender and a borrower. This type of promissory note is specifically secured by commercial real estate in Manchester, New Hampshire. The note provides lenders with the assurance that they have a valid claim to the commercial property if the borrower defaults on the loan. Key Terms and Conditions: — Installments: The loan amount is typically repaid in regular installments over a specific period of time. These installments ensure that the borrower gradually pays off the principal and interest, providing a structured repayment schedule. — Fixed Rate: The interest rate on the promissory note is fixed throughout the loan term. It offers stability and predictability, as the borrower's monthly payments remain constant. — Promissory Note: This legal document establishes the borrower's promise to repay the loan, outlining the repayment terms, interest rate, and consequences of default. — Secured by Commercial Real Estate: The promissory note is backed by commercial real estate in Manchester, New Hampshire. The borrower pledges this property as collateral, giving the lender the right to claim it if the borrower defaults. Variations of Manchester New Hampshire Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate: 1. Residential Installments Fixed Rate Promissory Note Secured by Commercial Real Estate: This specific promissory note is secured by residential units within a commercial property, such as an apartment complex or mixed-use building. 2. Construction Loan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate: This type of promissory note is used for financing construction projects involving commercial real estate in Manchester. It provides funds in installments at a fixed interest rate to cover the project's costs until completion. 3. Bridge Loan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate: Designed for shorter-term financing, this promissory note is utilized when a borrower needs immediate funding to bridge a financial gap before securing a long-term loan. It is secured by commercial real estate in Manchester. 4. Short-Term Installments Fixed Rate Promissory Note Secured by Commercial Real Estate: This promissory note is beneficial for borrowers who require a short-term loan, typically less than a year, secured by commercial property. The fixed rate makes it easier to budget for payments within the shorter timeframe. Remember, these are general variations of Manchester New Hampshire Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate, and specific terms and conditions may vary depending on the lender and borrower's agreement.

Manchester New Hampshire Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Manchester New Hampshire Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Make use of the US Legal Forms and have immediate access to any form sample you want. Our helpful website with thousands of document templates allows you to find and obtain virtually any document sample you require. It is possible to save, fill, and sign the Manchester New Hampshire Installments Fixed Rate Promissory Note Secured by Commercial Real Estate in a matter of minutes instead of browsing the web for many hours searching for an appropriate template.

Utilizing our catalog is an excellent way to increase the safety of your record submissions. Our professional lawyers on a regular basis check all the records to make certain that the forms are relevant for a particular region and compliant with new laws and regulations.

How do you obtain the Manchester New Hampshire Installments Fixed Rate Promissory Note Secured by Commercial Real Estate? If you already have a profile, just log in to the account. The Download button will be enabled on all the samples you view. In addition, you can find all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction below:

- Open the page with the form you require. Ensure that it is the form you were looking for: check its title and description, and use the Preview function if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Launch the saving process. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Save the file. Indicate the format to obtain the Manchester New Hampshire Installments Fixed Rate Promissory Note Secured by Commercial Real Estate and revise and fill, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy form libraries on the internet. Our company is always ready to assist you in any legal procedure, even if it is just downloading the Manchester New Hampshire Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!