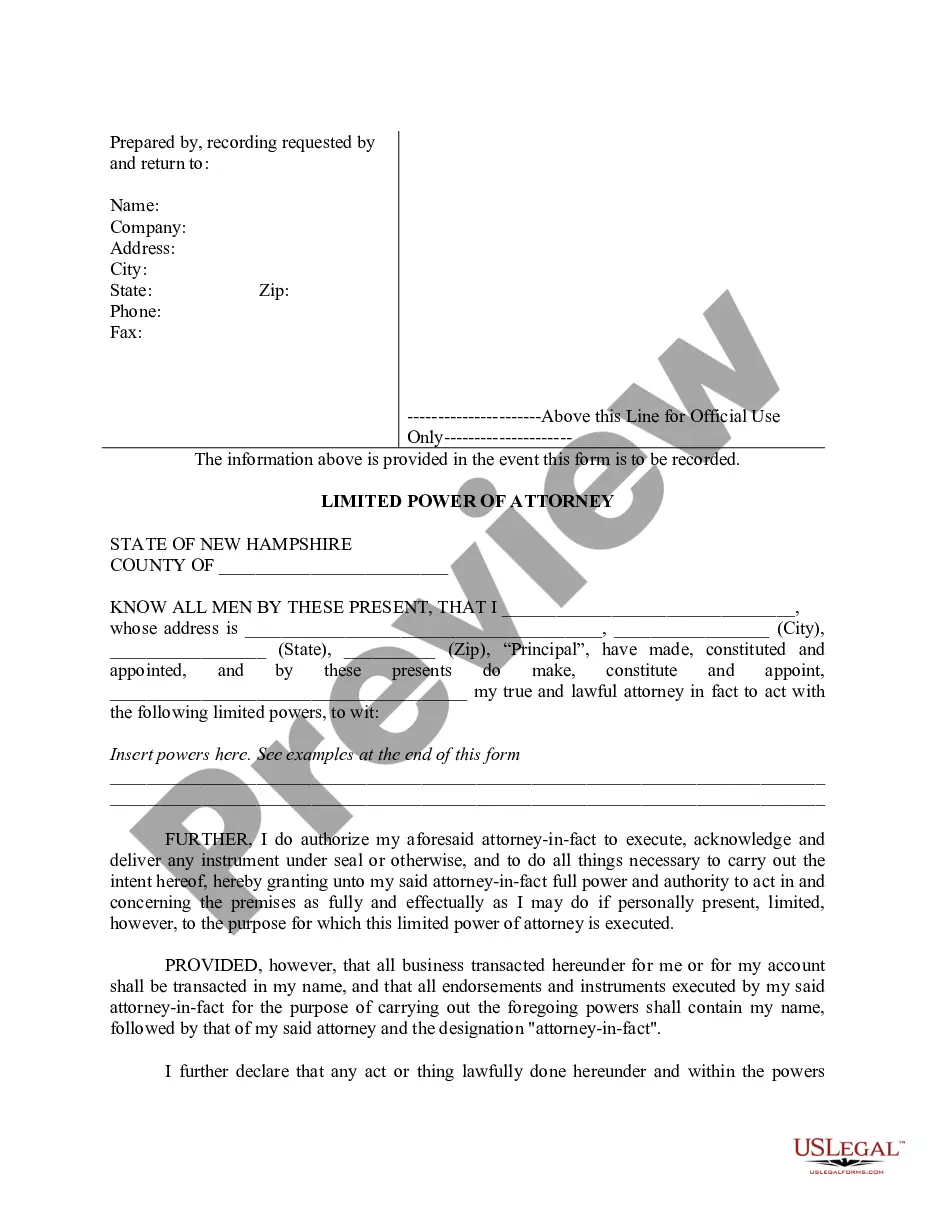

Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out New Hampshire Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

If you have previously utilized our service, Log In to your account and store the Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included on your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your first encounter with our service, follow these straightforward steps to acquire your document.

You have continual access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Confirm you’ve found a suitable document. Browse through the description and use the Preview feature, if available, to verify if it fulfills your needs. If it’s unsuitable, use the Search tab above to discover the right one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included. Choose the file format for your document and save it on your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

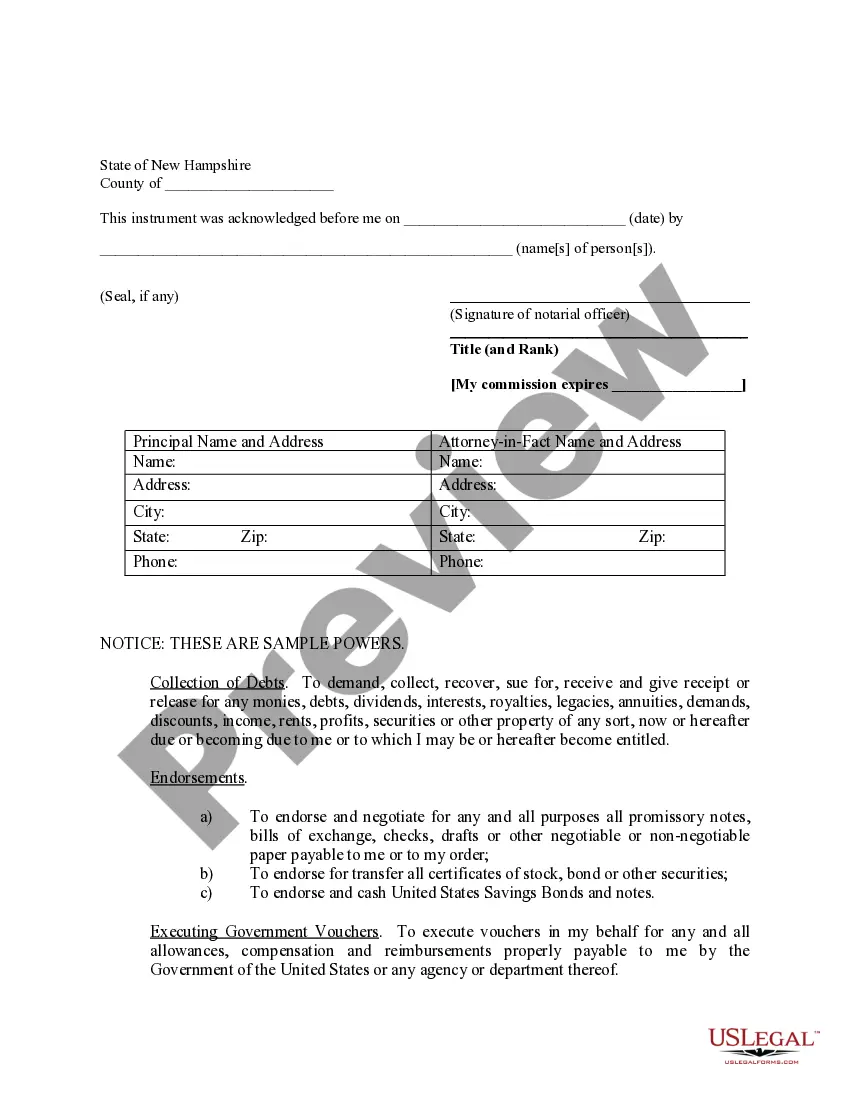

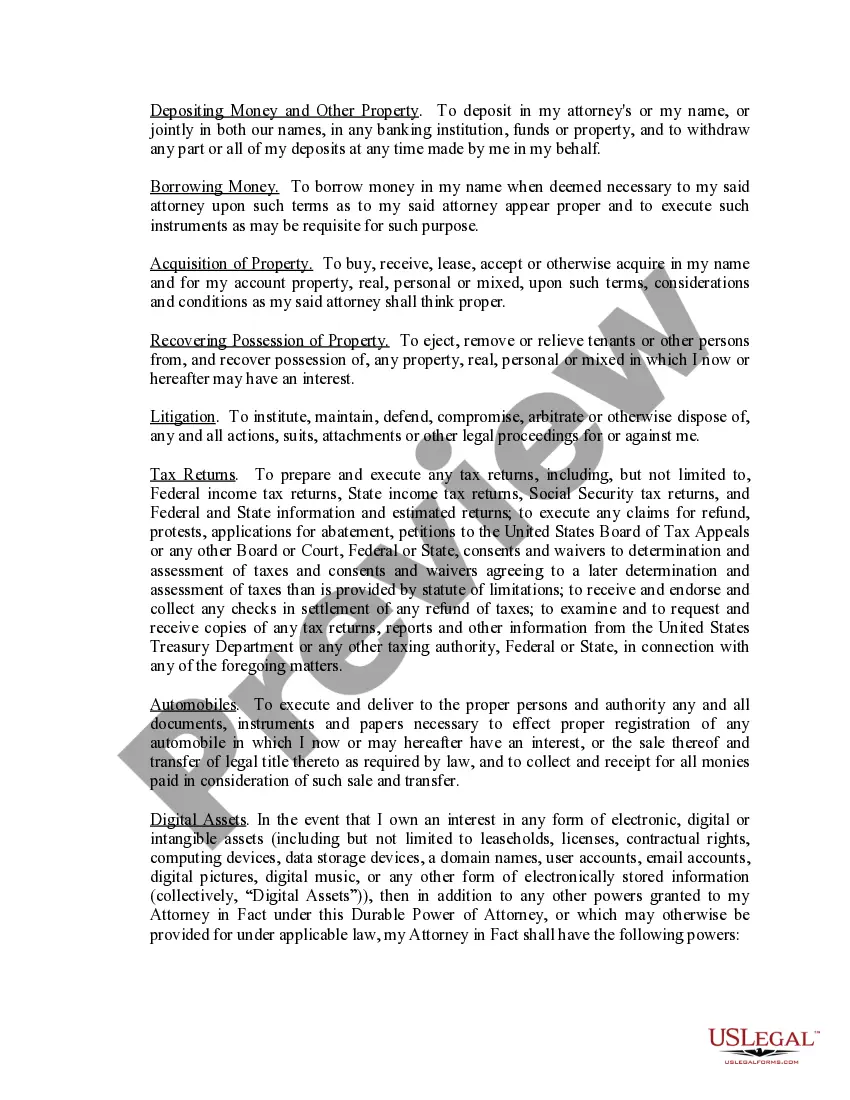

In the context of a Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included, there are certain decisions that a power of attorney cannot make. First, a power of attorney cannot make healthcare decisions if the principal is already incapacitated, as this requires a separate directive. Second, it cannot make decisions regarding the principal's will or estate planning after their death. Lastly, a power of attorney cannot change the beneficiary of a life insurance policy or retirement account unless specifically granted that authority in the document. Understanding these limitations is vital when creating your limited power of attorney, and utilizing resources like USLegalForms can provide clarity and direction for your needs.

To fill out a limited power of attorney form, begin by selecting a template that suits your needs. For the Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included, clearly outline the specific actions you want the agent to take on your behalf. Include necessary details such as names, dates, and conditions under which the authority is granted. Utilizing platforms like uLegalForms can simplify this process significantly.

In New Jersey, a power of attorney must meet certain criteria, including the principal being of sound mind and the document being in writing. For anyone considering a Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included, it’s important to follow these guidelines closely. Ensure that you comply with state-specific requirements, as they can vary significantly. Consulting resources like uLegalForms can help clarify these requirements.

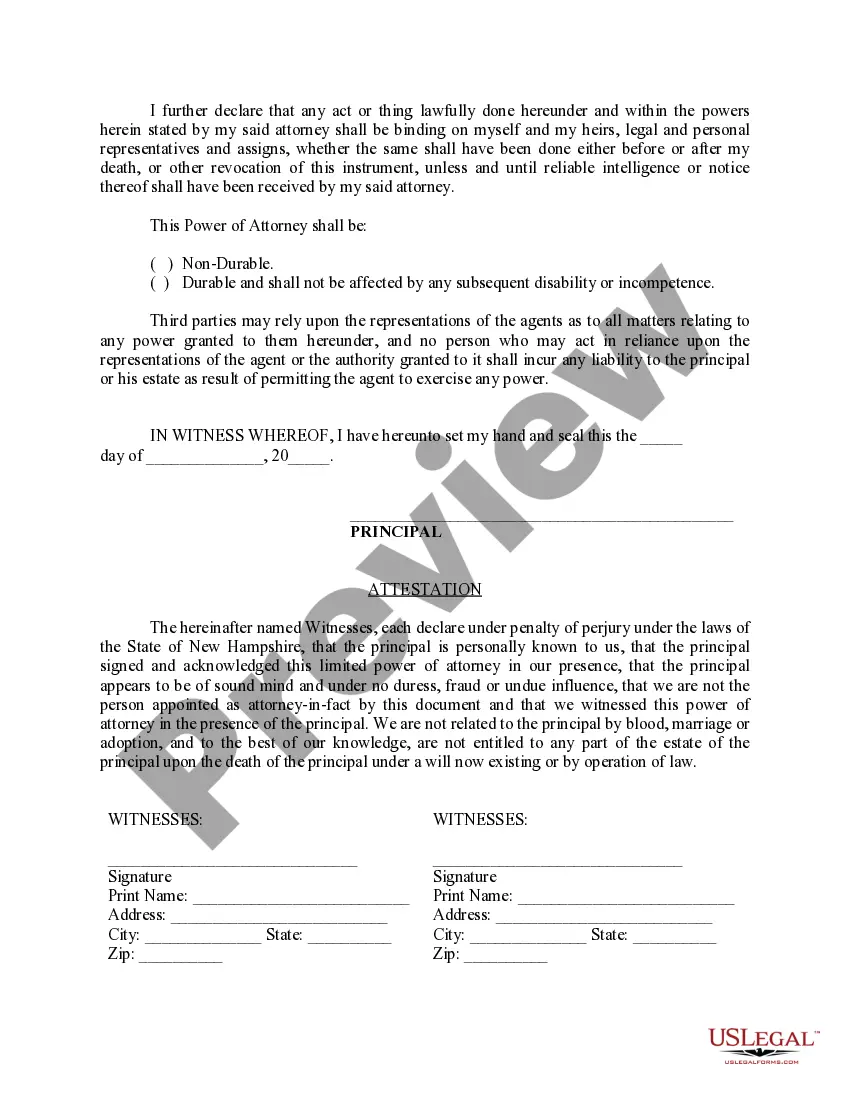

In New Hampshire, a power of attorney generally requires notarization to be legally effective. This is vital for ensuring the authenticity of the document. If you are preparing a Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included, having it notarized not only adds legitimacy but also protects against potential disputes. Be sure to check the latest regulations to stay informed.

Filling out a power of attorney form requires attention to detail. Start with the principal's information, followed by the agent's details. For the Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included, list out the specific powers being granted, ensuring they are clearly stated. Take your time to review and ensure all fields are filled correctly before signing.

When listing power of attorney in your documents, it's important to clearly identify both the principal and the agent. Specifically, for the Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included, detail the exact powers being granted. This may include financial, legal, or healthcare decisions. A well-structured listing ensures clarity and legal compliance.

To fill out a power of attorney paper PDF, you should start by downloading the correct form that aligns with your needs. For Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included, ensure you include essential details like the principal's name and the agent's name. Carefully read the instructions, and fill in any specific powers you wish to grant. If you need assistance, consider using uLegalForms, which provides user-friendly templates.

The abbreviation for power of attorney is 'POA'. When you are dealing with a Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included, it's helpful to know this acronym. It simplifies discussions about legal documents and requirements. Remember, understanding these basics will help you navigate your options better.

A Power of Attorney cannot act outside the authority granted by the principal in the document. For example, with a Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included, you cannot make health care decisions if you have not been granted that specific power. Additionally, you must not use your authority for personal gain at the expense of the principal. Understanding these limitations is crucial to maintaining trust and legality in your role.

While being a Power of Attorney can be an honor, it also comes with significant responsibilities. You must act in the best interests of the principal, and any mistakes could lead to disputes or legal issues. Furthermore, the authority granted in a Manchester New Hampshire Limited Power of Attorney where you Specify Powers with Sample Powers Included can become quite complex, demanding diligent management and oversight. This role can be demanding and emotionally taxing, so consider this carefully.