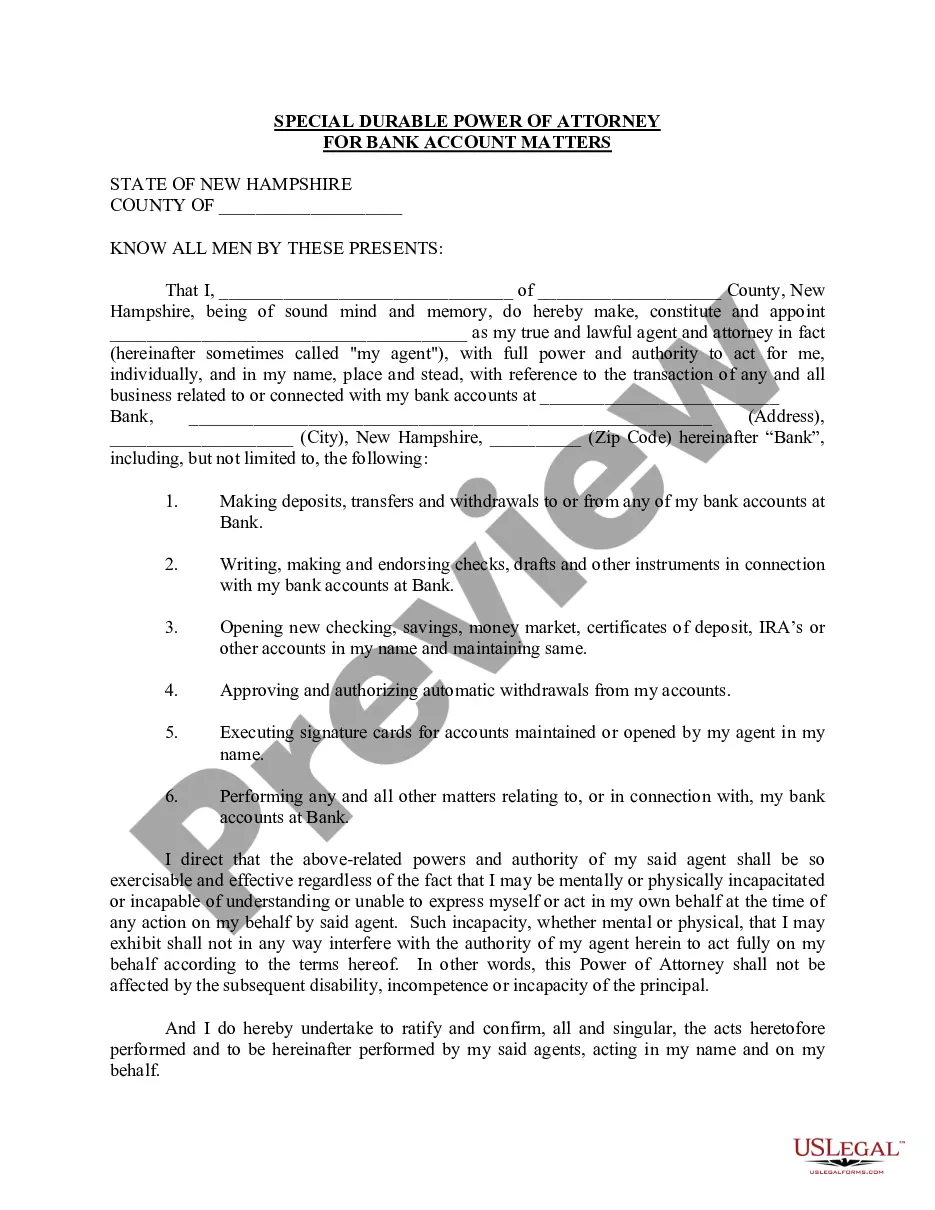

Manchester, New Hampshire Special Durable Power of Attorney for Bank Account Matters A Manchester, New Hampshire special durable power of attorney for bank account matters is a legal document that grants an appointed individual the authority to make decisions and manage specific bank account-related affairs on behalf of another person, known as the principal. This legal arrangement is particularly beneficial in situations where the principal is unable to handle their bank account matters due to physical or mental incapacity, prolonged absence, or any other reason. The Manchester, New Hampshire special durable power of attorney for bank account matters allows the appointed agent, also known as the attorney-in-fact, to act within the specified limits outlined in the document. The range of power bestowed upon the attorney-in-fact can vary depending on the preferences and needs of the principal. Commonly, this type of power of attorney for bank account matters grants the agent authority to manage various activities, which may include but are not limited to: 1. Depositing and withdrawing funds: The attorney-in-fact can make deposits into the principal's designated bank accounts, as well as withdraw funds for necessary expenses or to fulfill the principal's obligations. 2. Paying bills: The agent can handle bill payments from the principal's bank account, ensuring timely payment of utilities, mortgages, loans, and other financial obligations. 3. Managing investments: If authorized in the power of attorney, the attorney-in-fact can handle investment-related matters, including buying or selling stocks, bonds, or other securities. 4. Accessing account information: The appointed agent can access the principal's bank account statements, transaction history, and other financial records. 5. Opening and closing accounts: With the principal's consent, the attorney-in-fact may open new bank accounts or close existing ones as deemed necessary. In Manchester, New Hampshire, there are no specific subtypes of special durable power of attorney for bank account matters. However, it is important to note that different individuals may grant varying levels of authority depending on their unique circumstances and personal preferences. Some may choose to provide general authority over all financial matters, including managing bank accounts, while others may restrict the agent to only specific accounts or transactions. It is crucial to consult with a knowledgeable attorney when creating a Manchester, New Hampshire special durable power of attorney for bank account matters to ensure that the document adheres to the state's legal requirements and accurately reflects the principal's intentions. Additionally, it is recommended that the principal shares a copy of the executed power of attorney with their designated financial institutions to facilitate the attorney-in-fact's smooth management of the bank account matters.

Manchester New Hampshire Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Manchester New Hampshire Special Durable Power Of Attorney For Bank Account Matters?

If you are searching for a valid form, it’s extremely hard to choose a more convenient platform than the US Legal Forms website – probably the most extensive libraries on the internet. With this library, you can find a huge number of templates for company and individual purposes by categories and states, or keywords. With our advanced search function, discovering the newest Manchester New Hampshire Special Durable Power of Attorney for Bank Account Matters is as easy as 1-2-3. Additionally, the relevance of every record is verified by a group of professional lawyers that regularly check the templates on our platform and update them based on the most recent state and county requirements.

If you already know about our platform and have a registered account, all you need to get the Manchester New Hampshire Special Durable Power of Attorney for Bank Account Matters is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the sample you want. Read its information and utilize the Preview function (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to get the appropriate file.

- Affirm your choice. Choose the Buy now button. Following that, choose your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the template. Pick the format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Manchester New Hampshire Special Durable Power of Attorney for Bank Account Matters.

Every template you add to your user profile does not have an expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to get an additional duplicate for editing or printing, you may come back and save it once again whenever you want.

Take advantage of the US Legal Forms extensive collection to get access to the Manchester New Hampshire Special Durable Power of Attorney for Bank Account Matters you were seeking and a huge number of other professional and state-specific templates on a single platform!