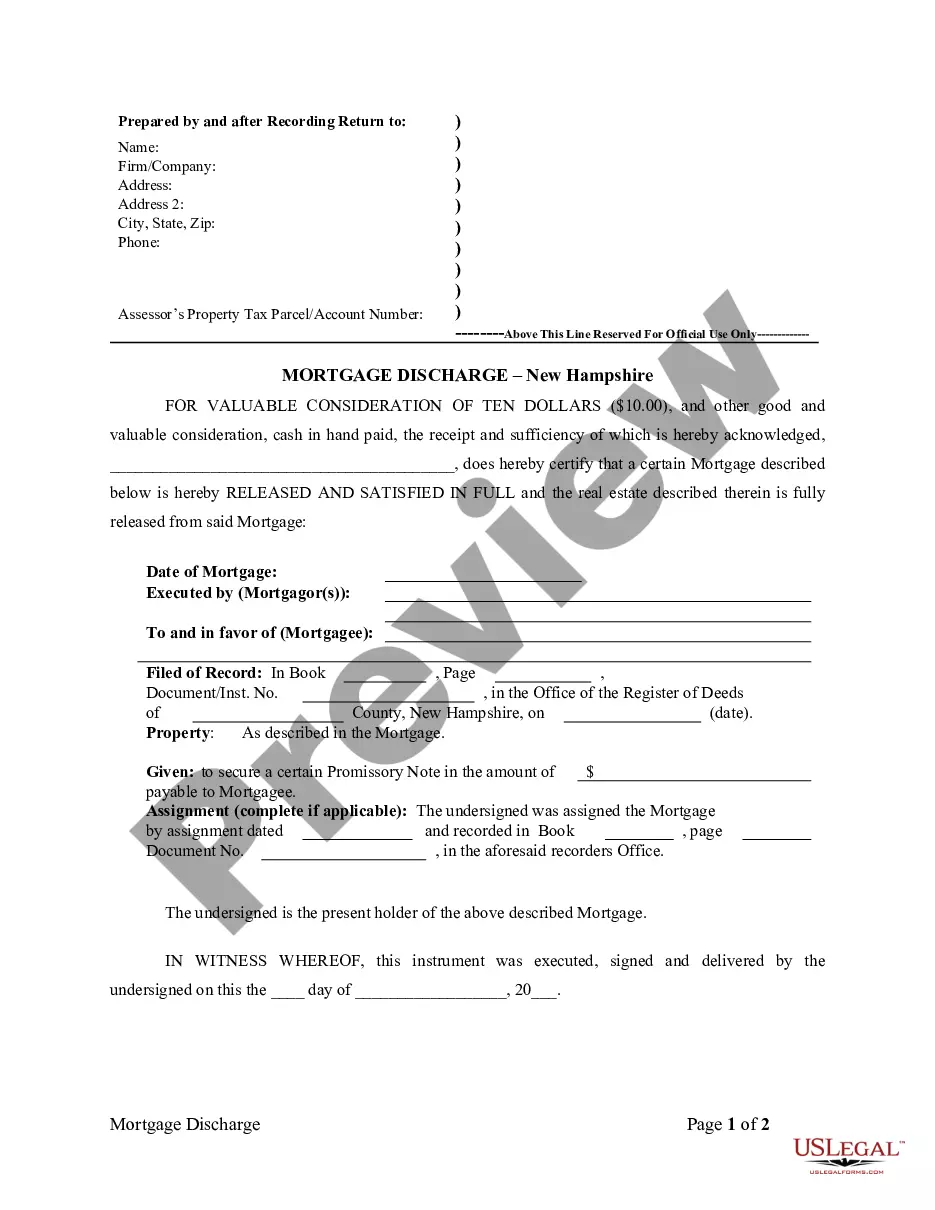

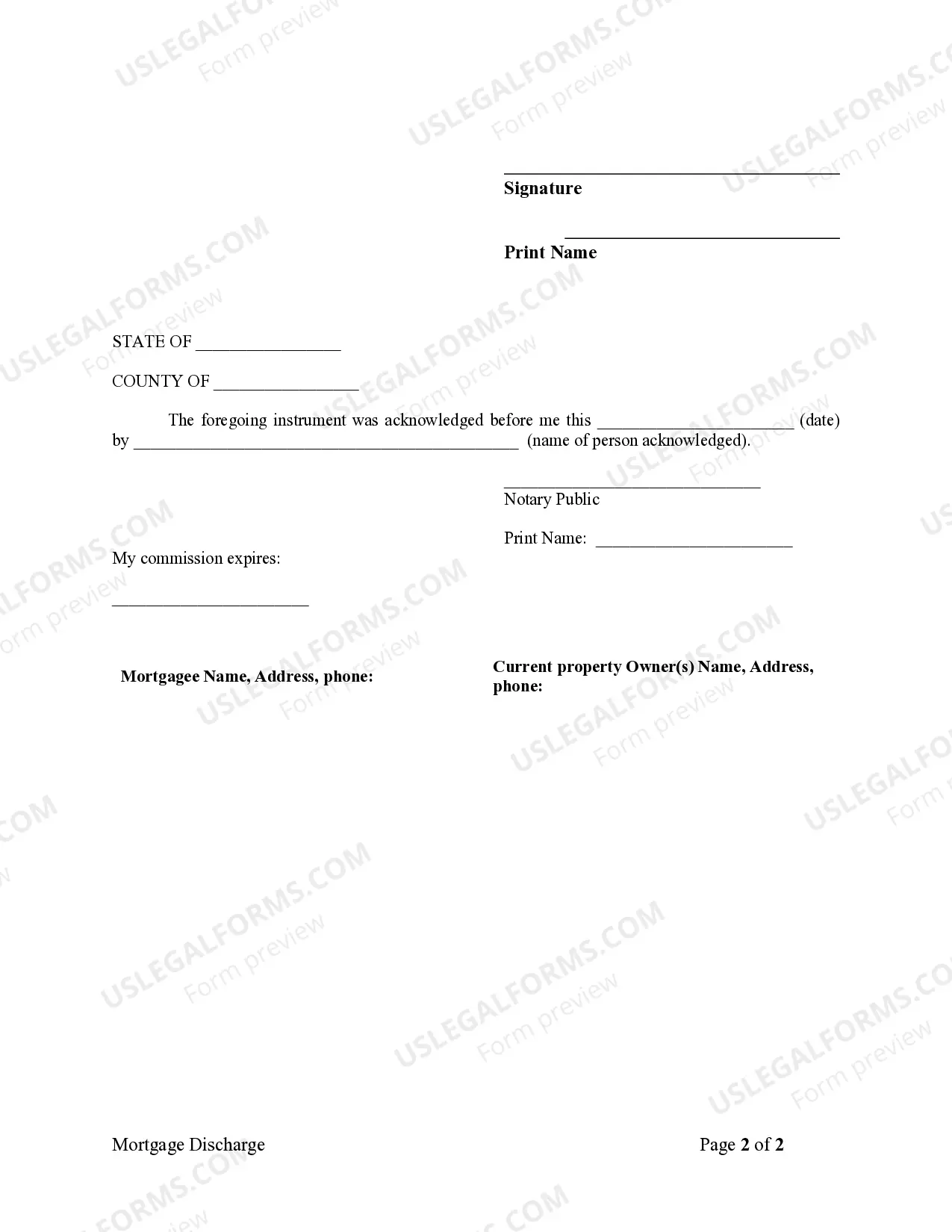

Title: Manchester, New Hampshire Satisfaction, Release, or Cancellation of Mortgage by Individual: Explained Introduction: In the realm of real estate transactions, it is crucial to understand the process of Satisfaction, Release, or Cancellation of a Mortgage by Individual. Manchester, New Hampshire, being a vibrant city with a thriving real estate market, follows specific protocols for individuals looking to clear their mortgage obligations. This detailed description will shed light on the various aspects of this process while incorporating relevant keywords. Types of Satisfaction, Release, or Cancellation of Mortgage by Individual in Manchester, New Hampshire: 1. Full Satisfaction: This type occurs when a homeowner pays off their mortgage entirely, resulting in the need for releasing or canceling the mortgage lien. 2. Partial Satisfaction: In certain scenarios, property owners may make a significant payment towards their mortgage, resulting in a partial release or cancellation of the mortgage lien on specific portions of the property. 3. Loan Modification: While not a direct release or cancellation, a loan modification enables individuals to adjust the terms of their existing mortgage, providing relief in certain financial situations and preventing foreclosure. 4. Mortgage Assumption: In cases where a property is sold or transferred, a new individual may assume the mortgage, leading to the original borrower's satisfaction and release from the mortgage liability. Procedure for Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Final Mortgage Payment: Once a borrower makes the last payment towards their mortgage, they must request a Satisfaction, Release, or Cancellation of Mortgage from their lender. 2. Drafting a Satisfaction Document: The lender, upon receiving the payment, prepares a satisfaction document or release of mortgage letter, attesting to the debt's complete repayment. 3. Notarization: The satisfaction document must be notarized to ensure its legal authenticity. 4. Filing with the Registry of Deeds: The borrower, or their representative, must file the satisfaction document with the local Registry of Deeds office within a specific timeframe, often 30 days. This filing ensures the mortgage lien is officially removed from the property's records. 5. Confirmation of Cancellation: Once approved, the Registry of Deeds will provide an acknowledgment or recorded satisfaction/cancellation document as evidence of the mortgage's release. Keywords: Manchester, New Hampshire, satisfaction of mortgage, release of mortgage, cancellation of mortgage by individual, mortgage lien, property, real estate transactions, full satisfaction, partial satisfaction, loan modification, mortgage assumption, final mortgage payment, drafting satisfaction document, notarization, filing with Registry of Deeds, confirmation of cancellation. Conclusion: Understanding the process of Satisfaction, Release, or Cancellation of Mortgage by Individual in Manchester, New Hampshire, is crucial for homeowners and property buyers alike. Whether it involves a full or partial satisfaction, loan modification, or mortgage assumption, following proper procedures and timely filings are vital for securing one's property rights. By familiarizing oneself with the aforementioned keywords and the specific terminology associated with this process, individuals can navigate mortgage-related transactions with confidence in Manchester, New Hampshire.

Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Manchester New Hampshire Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Do you need a trustworthy and inexpensive legal forms provider to get the Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Individual? US Legal Forms is your go-to choice.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and county.

To download the document, you need to log in account, locate the needed form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Individual conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is intended for.

- Start the search over in case the form isn’t suitable for your legal situation.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Individual in any provided format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.