Title: Manchester New Hampshire Satisfaction, Release, and Cancellation of Mortgage by Corporation: A Comprehensive Guide Introduction: In the state of New Hampshire, particularly in Manchester, corporations have the opportunity to satisfy, release, or cancel mortgages. This process is crucial as it clears any liens on the property and ensures that the corporation's mortgage no longer encumbers the property title. In this article, we will delve into the various aspects of Manchester New Hampshire Satisfaction, Release, and Cancellation of Mortgage by Corporation, explore its significance, and provide an overview of different types of satisfaction, release, or cancellation methods. Keywords: Manchester, New Hampshire, satisfaction, release, cancellation, mortgage, corporation, liens, property title 1. Understanding the Manchester, New Hampshire Satisfaction, Release, or Cancellation of Mortgage: The Satisfaction, Release, or Cancellation of Mortgage by Corporation is a legal procedure followed when a corporation wants to dissolve its mortgage lien on a property located in Manchester, New Hampshire. By completing this process, the corporation acknowledges the fulfillment of its mortgage and effectively nullifies any rights it had on the property. 2. Importance of Satisfaction, Release, or Cancellation: Clearing a property's title from a corporation's mortgage lien ensures that the property can be transferred or sold without any encumbrances. It provides peace of mind to the new owner or potential buyers, as the property is free from any legal restraints. 3. Types of Satisfaction, Release, or Cancellation Methods: a) Partial Satisfaction: This occurs when a corporation has multiple mortgages on a property. If the corporation decides to pay off a portion of the mortgage, a Partial Satisfaction is filed. This method allows for the release of a specified amount of land from the mortgage lien. b) Full Satisfaction: This method is used when the corporation has completely paid off the mortgage. The corporation files a Full Satisfaction document with the county registry, signifying that the mortgage is satisfied in its entirety, consequently releasing the lien. c) Release of Mortgage: If a corporation has sold the property or any part of it and the mortgage is to be released, a Release of Mortgage document is filed. This method absolves the corporation's mortgage on the specific portion sold, effectively releasing the lien. d) Cancellation of Mortgage: In cases where a corporation wants to completely cancel the mortgage, which may be due to errors, changes in circumstances, or other specific reasons, a Cancellation of Mortgage document is filed. This method permanently erases the mortgage from the property title. Conclusion: The Manchester, New Hampshire Satisfaction, Release, or Cancellation of Mortgage by Corporation holds paramount importance in protecting property rights and ensuring smooth property transfers. Corporations must understand the different methods available to fulfill their obligations and release their mortgage liens. By successfully completing these procedures, corporations contribute towards a transparent real estate market in Manchester, New Hampshire. Keywords: Manchester, New Hampshire, satisfaction, release, cancellation, mortgage, corporation, liens, property title

Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation

State:

New Hampshire

City:

Manchester

Control #:

NH-S123

Format:

Word;

Rich Text

Instant download

Description

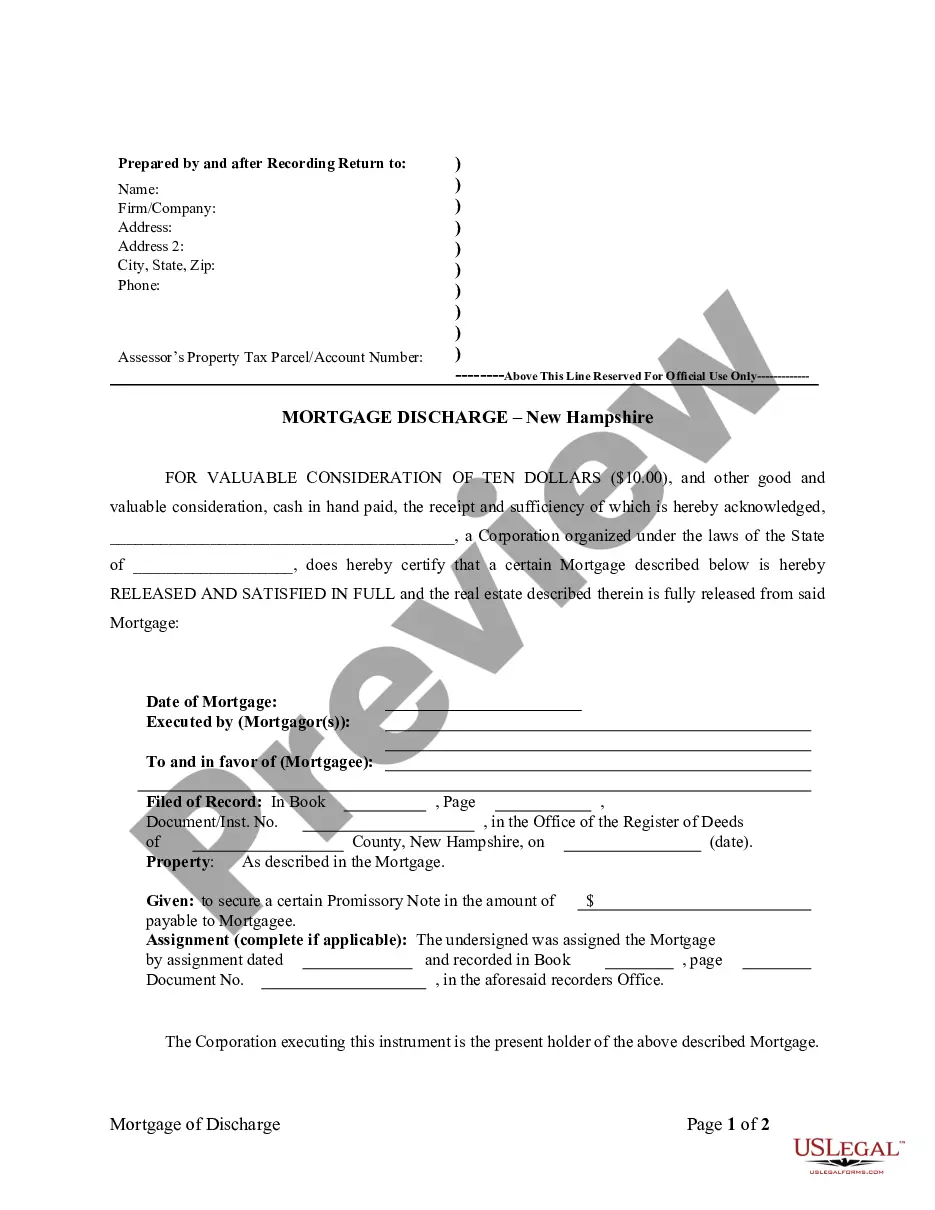

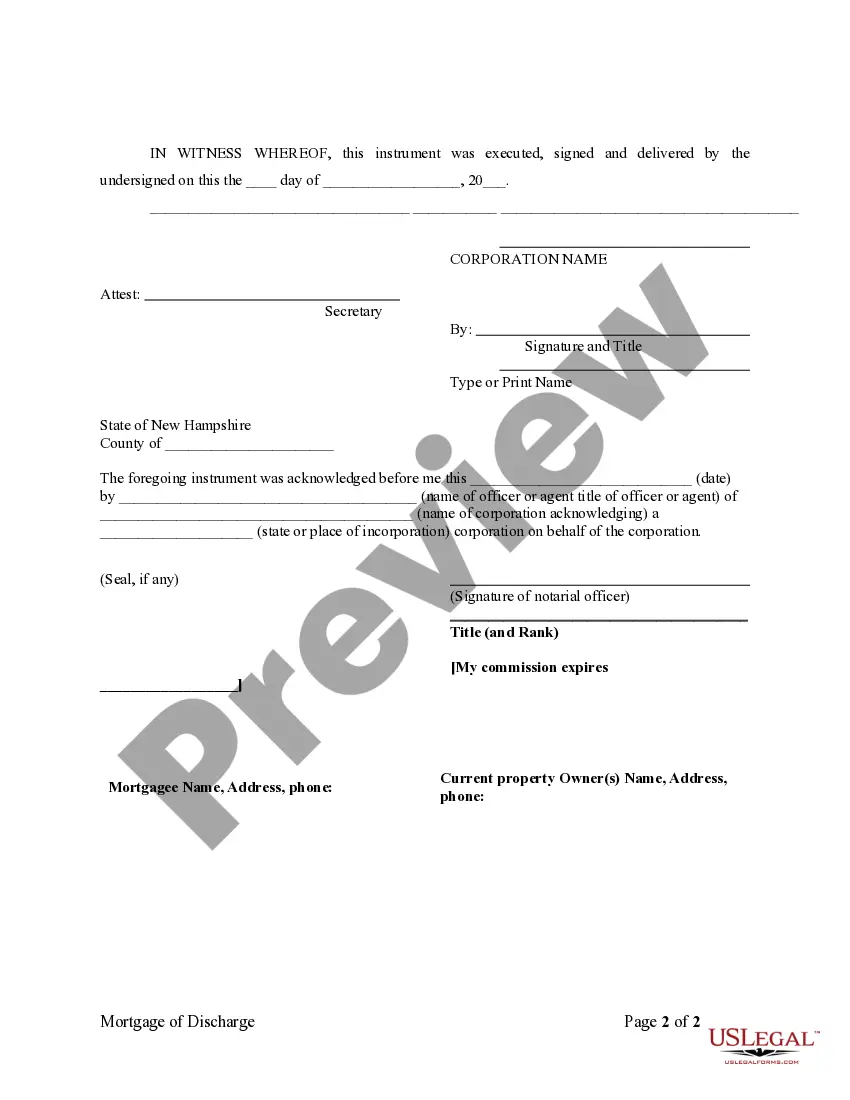

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of New Hampshire by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Manchester New Hampshire Satisfaction, Release, and Cancellation of Mortgage by Corporation: A Comprehensive Guide Introduction: In the state of New Hampshire, particularly in Manchester, corporations have the opportunity to satisfy, release, or cancel mortgages. This process is crucial as it clears any liens on the property and ensures that the corporation's mortgage no longer encumbers the property title. In this article, we will delve into the various aspects of Manchester New Hampshire Satisfaction, Release, and Cancellation of Mortgage by Corporation, explore its significance, and provide an overview of different types of satisfaction, release, or cancellation methods. Keywords: Manchester, New Hampshire, satisfaction, release, cancellation, mortgage, corporation, liens, property title 1. Understanding the Manchester, New Hampshire Satisfaction, Release, or Cancellation of Mortgage: The Satisfaction, Release, or Cancellation of Mortgage by Corporation is a legal procedure followed when a corporation wants to dissolve its mortgage lien on a property located in Manchester, New Hampshire. By completing this process, the corporation acknowledges the fulfillment of its mortgage and effectively nullifies any rights it had on the property. 2. Importance of Satisfaction, Release, or Cancellation: Clearing a property's title from a corporation's mortgage lien ensures that the property can be transferred or sold without any encumbrances. It provides peace of mind to the new owner or potential buyers, as the property is free from any legal restraints. 3. Types of Satisfaction, Release, or Cancellation Methods: a) Partial Satisfaction: This occurs when a corporation has multiple mortgages on a property. If the corporation decides to pay off a portion of the mortgage, a Partial Satisfaction is filed. This method allows for the release of a specified amount of land from the mortgage lien. b) Full Satisfaction: This method is used when the corporation has completely paid off the mortgage. The corporation files a Full Satisfaction document with the county registry, signifying that the mortgage is satisfied in its entirety, consequently releasing the lien. c) Release of Mortgage: If a corporation has sold the property or any part of it and the mortgage is to be released, a Release of Mortgage document is filed. This method absolves the corporation's mortgage on the specific portion sold, effectively releasing the lien. d) Cancellation of Mortgage: In cases where a corporation wants to completely cancel the mortgage, which may be due to errors, changes in circumstances, or other specific reasons, a Cancellation of Mortgage document is filed. This method permanently erases the mortgage from the property title. Conclusion: The Manchester, New Hampshire Satisfaction, Release, or Cancellation of Mortgage by Corporation holds paramount importance in protecting property rights and ensuring smooth property transfers. Corporations must understand the different methods available to fulfill their obligations and release their mortgage liens. By successfully completing these procedures, corporations contribute towards a transparent real estate market in Manchester, New Hampshire. Keywords: Manchester, New Hampshire, satisfaction, release, cancellation, mortgage, corporation, liens, property title

Free preview

How to fill out Manchester New Hampshire Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

If you’ve already used our service before, log in to your account and download the Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Manchester New Hampshire Satisfaction, Release or Cancellation of Mortgage by Corporation. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!