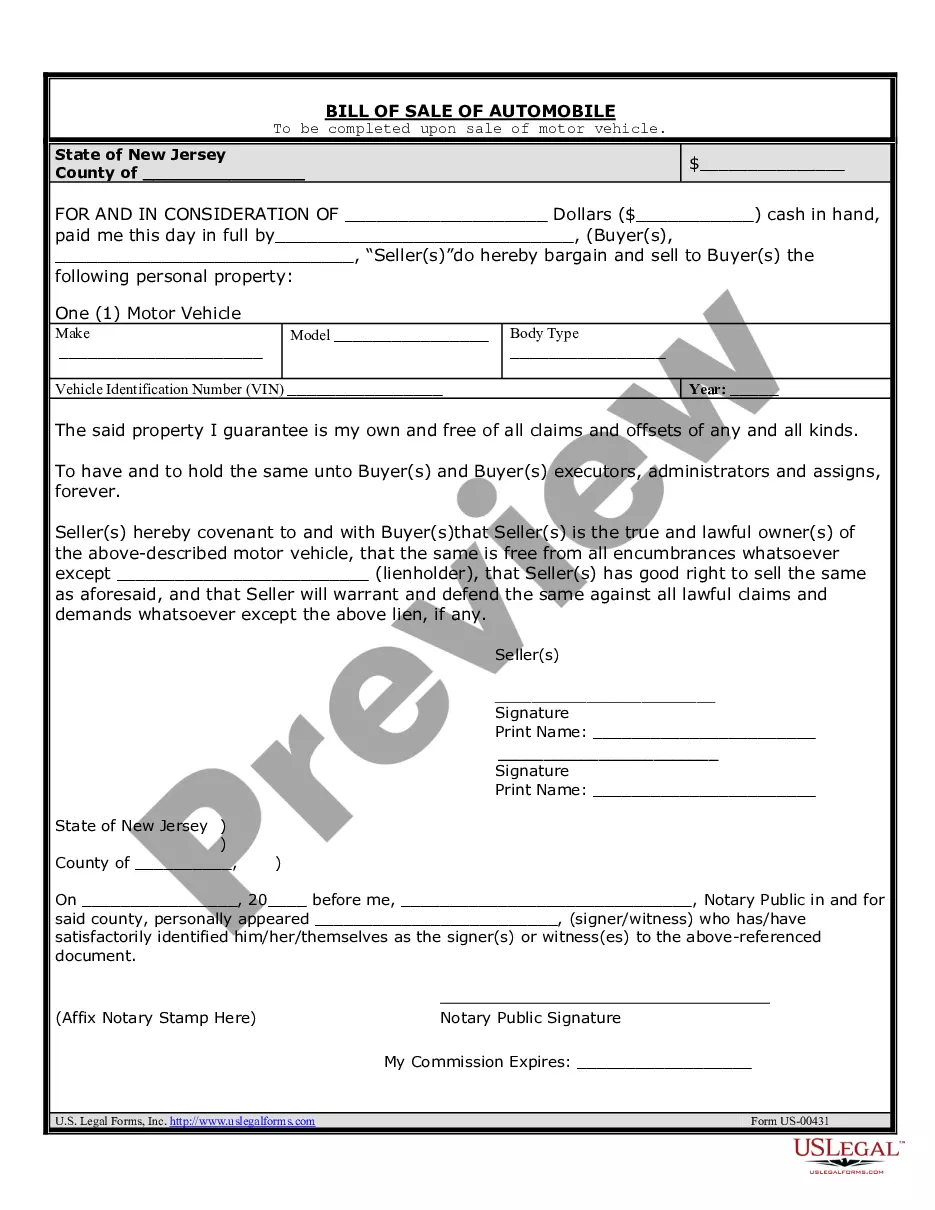

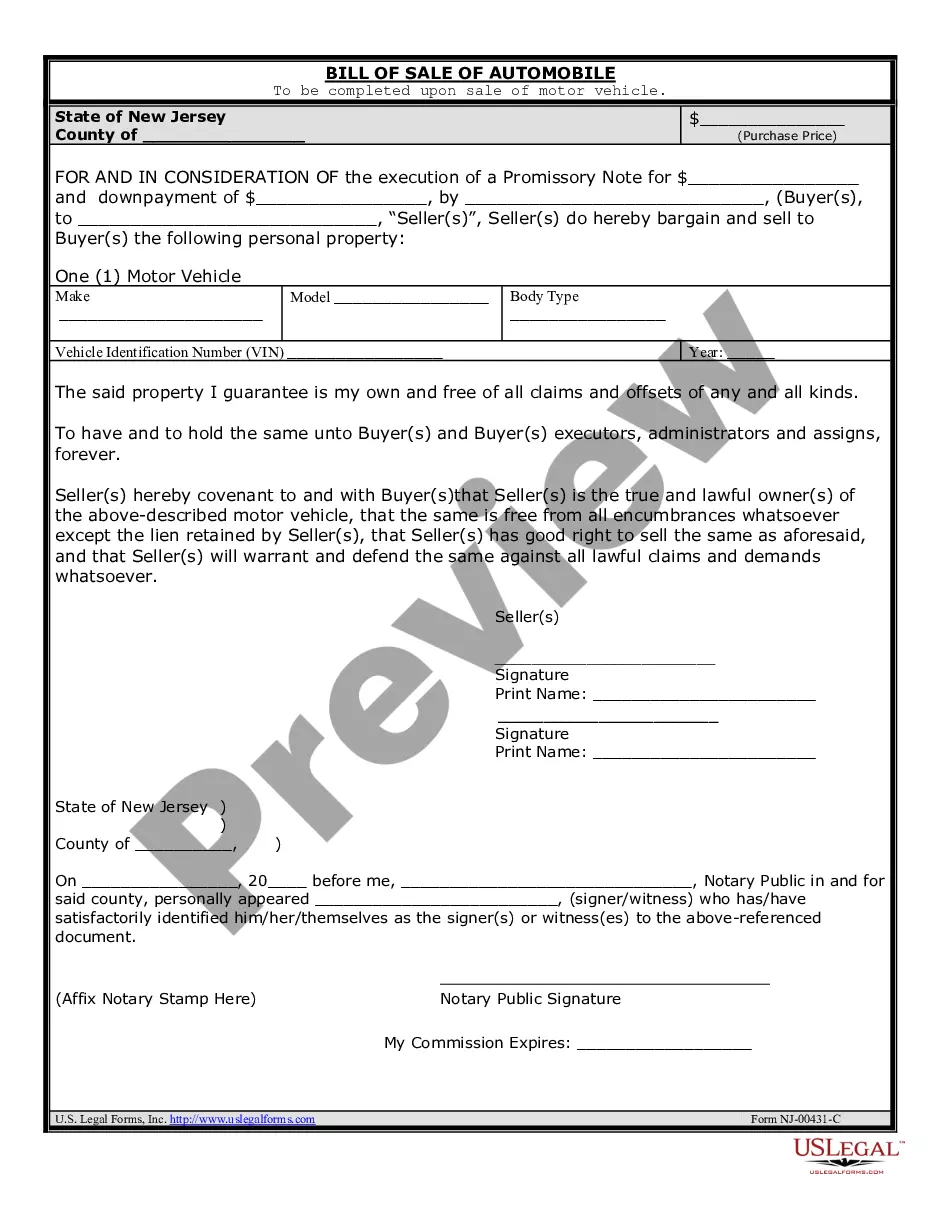

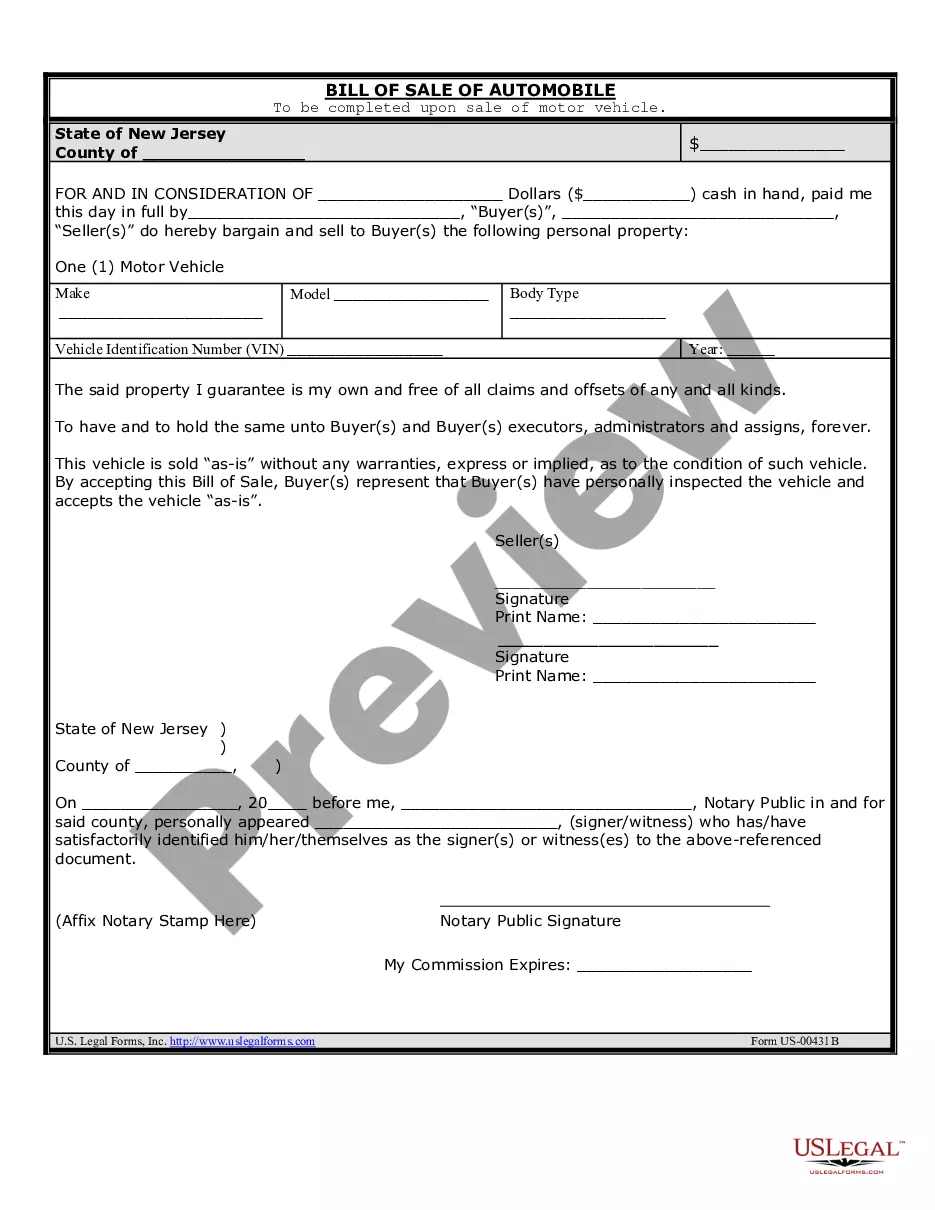

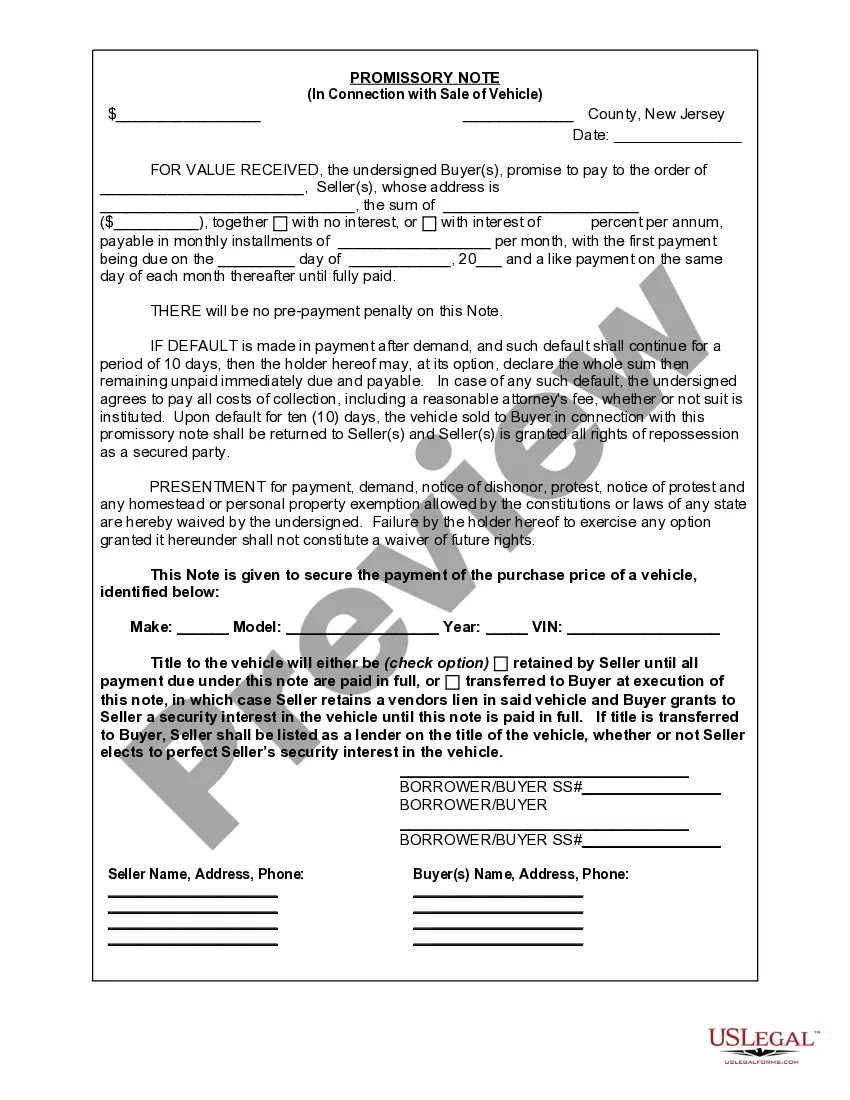

A promissory note is a legal document in Elizabeth, New Jersey, that outlines the terms and conditions of a loan agreement made between the seller and buyer during the sale of a vehicle or an automobile. This document provides both parties with a clear understanding of their obligations and rights. The Elizabeth New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile typically includes specific information such as: 1. Parties involved: The full legal names and contact information of both the seller and the buyer are listed in the promissory note. This ensures that both parties are clearly identified. 2. Vehicle details: The promissory note includes the detailed description of the vehicle being sold, including the make, model, year, and Vehicle Identification Number (VIN). This information prevents misunderstandings and ensures the correct vehicle is being sold. 3. Purchase price: The agreed-upon purchase price for the vehicle is clearly stated in the promissory note. It ensures that both parties are aware of the exact amount being loaned and repaid. 4. Payment terms: The note outlines the terms of repayment agreed upon by both parties. This includes the number of payments, the frequency (monthly, weekly, etc.), and the due dates. The note may also mention the interest rate, late payment penalties, and any other fees associated with the loan. 5. Signatures and date: Both the seller and the buyer must sign and date the promissory note, indicating their acknowledgment and acceptance of the terms mentioned within it. This ensures validity and enforceability of the document. Different types of promissory notes may exist within the framework of Elizabeth, New Jersey's legal system when it comes to the sale of vehicles or automobiles. Some variations might include: 1. Secured Promissory Note: If the buyer is unable to pay the loan in full, this type of note allows the seller to claim ownership of the vehicle as collateral until the debt is repaid. 2. Unsecured Promissory Note: Unlike the secured note, an unsecured promissory note does not involve any collateral. This means that the seller relies completely on the buyer's creditworthiness and trust to fulfill the loan obligations. 3. Installment Promissory Note: This type of note divides the purchase price into equal installments to be paid over a specific period, usually with interest applied. Regular payments are made according to the schedule until the loan is fully repaid. 4. Balloon Promissory Note: With a balloon note, the buyer agrees to make smaller regular payments over a set period, with a large "balloon" payment due at the end of the term. This option may be suitable for buyers who expect a lump sum payment in the future. It is important for both the buyer and seller in Elizabeth, New Jersey, to understand the specific terms and types of promissory notes available in connection with the sale of vehicles or automobiles. Seeking legal guidance or consulting with a professional before entering into a promissory note agreement is highly recommended ensuring compliance with the local laws and to protect the interests of both parties involved.

Elizabeth New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Elizabeth New Jersey Promissory Note In Connection With Sale Of Vehicle Or Automobile?

If you are searching for a valid form template, it’s extremely hard to choose a more convenient platform than the US Legal Forms website – one of the most extensive libraries on the web. With this library, you can find a large number of document samples for organization and personal purposes by categories and states, or keywords. Using our advanced search function, discovering the latest Elizabeth New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile is as easy as 1-2-3. Moreover, the relevance of each and every file is proved by a group of skilled lawyers that regularly review the templates on our website and revise them in accordance with the latest state and county regulations.

If you already know about our system and have a registered account, all you need to get the Elizabeth New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have found the sample you want. Check its description and make use of the Preview option to see its content. If it doesn’t suit your needs, use the Search field near the top of the screen to find the needed document.

- Affirm your selection. Click the Buy now button. Following that, select your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Receive the form. Pick the file format and save it to your system.

- Make changes. Fill out, revise, print, and sign the obtained Elizabeth New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile.

Every single form you save in your profile does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to get an extra copy for enhancing or printing, feel free to come back and save it once again at any time.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Elizabeth New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile you were seeking and a large number of other professional and state-specific templates on a single platform!