Title: Understanding Paterson, New Jersey General Notice of Default for Contract for Deed Introduction: The Paterson, New Jersey General Notice of Default for Contract for Deed serves as a legal instrument that highlights the initiation of a default in a contract for deed agreement. This notice alerts the involved parties of the potential consequences and steps to be taken to rectify the default situation. Paterson, New Jersey recognizes different types of general notices of default for contract for deed, including: 1. Non-Payment of Installments: The first type of notice concerns non-payment of installments, wherein the buyer fails to make regular payments as outlined in the contract for deed agreement. This notice is issued after a grace period has lapsed and serves to inform the buyer about their default status. 2. Breach of Conditions: A breach of conditions notice is issued when the buyer fails to comply with specific terms and conditions outlined in the contract for deed agreement. These conditions may pertain to property maintenance, insurance coverage, or other factors essential for the contract's successful execution. 3. Failure to Maintain Property: This notice is applicable when the buyer neglects the property's maintenance and upkeep as per the contract for deed agreement's stipulations. It informs the buyer of their default status and the necessary actions to address the maintenance concerns. 4. Violation of Zoning or Ordinance Laws: If the buyer violates local zoning regulations or ordinance laws, this notice is issued. It outlines the specific violations and provides an opportunity for the buyer to rectify the situation within a stipulated timeframe. 5. Failure to Pay Taxes and Insurance: When the buyer neglects to pay applicable property taxes or fails to maintain adequate insurance coverage as agreed upon in the contract for deed, this notice is issued. It highlights the default and provides instructions for resolving the financial obligations. 6. Default Cure Period: The default cure period refers to the timeframe granted to the buyer to rectify the default situation discussed in the notice. This period varies depending on the individual contract for deed agreement and is highlighted in the Paterson, New Jersey General Notice of Default. Conclusion: In Paterson, New Jersey, the General Notice of Default for Contract for Deed plays a critical role in maintaining contractual obligations and ensuring appropriate actions are taken to resolve any defaults. These notices cover a wide range of defaults, including non-payment, breaches of conditions, failure to maintain the property, violation of zoning laws, and failure to pay taxes or insurance premiums. Understanding these notices and adhering to their requirements is essential for both buyers and sellers involved in the contract for deed process.

Paterson New Jersey General Notice of Default for Contract for Deed

State:

New Jersey

City:

Paterson

Control #:

NJ-00470-16

Format:

Word;

Rich Text

Instant download

Description

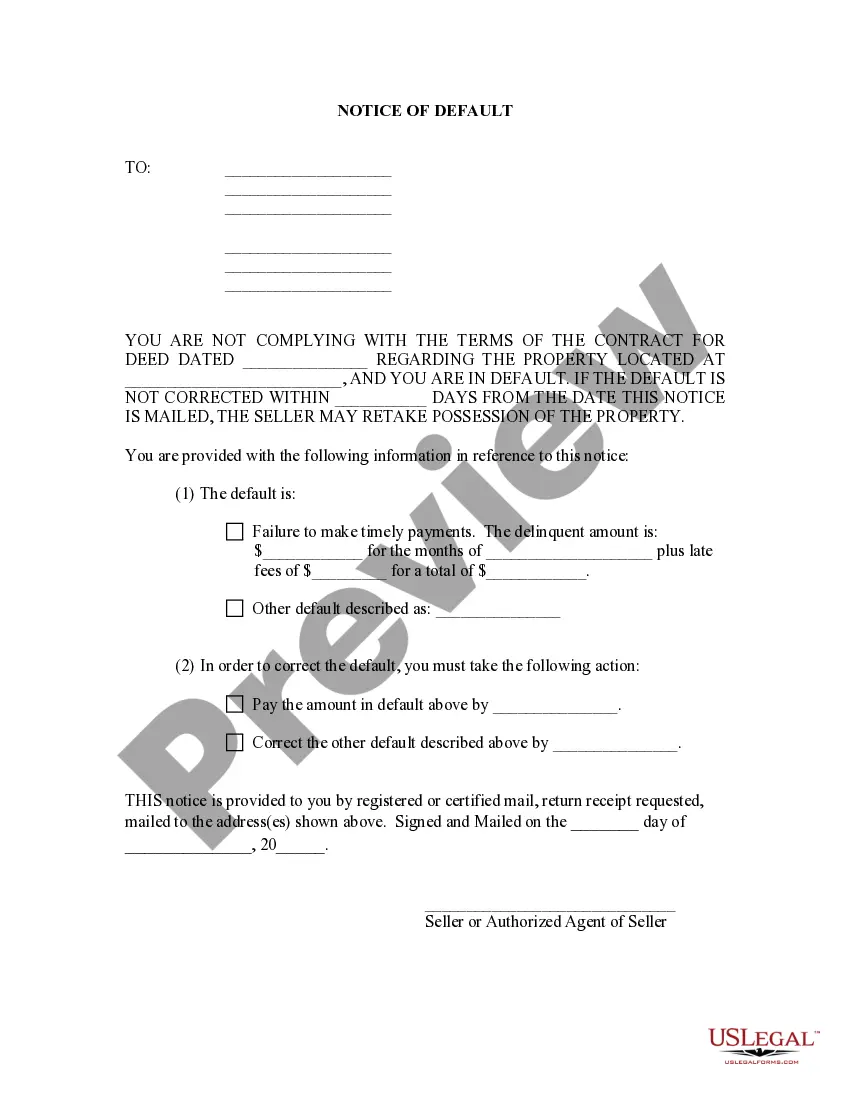

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

Title: Understanding Paterson, New Jersey General Notice of Default for Contract for Deed Introduction: The Paterson, New Jersey General Notice of Default for Contract for Deed serves as a legal instrument that highlights the initiation of a default in a contract for deed agreement. This notice alerts the involved parties of the potential consequences and steps to be taken to rectify the default situation. Paterson, New Jersey recognizes different types of general notices of default for contract for deed, including: 1. Non-Payment of Installments: The first type of notice concerns non-payment of installments, wherein the buyer fails to make regular payments as outlined in the contract for deed agreement. This notice is issued after a grace period has lapsed and serves to inform the buyer about their default status. 2. Breach of Conditions: A breach of conditions notice is issued when the buyer fails to comply with specific terms and conditions outlined in the contract for deed agreement. These conditions may pertain to property maintenance, insurance coverage, or other factors essential for the contract's successful execution. 3. Failure to Maintain Property: This notice is applicable when the buyer neglects the property's maintenance and upkeep as per the contract for deed agreement's stipulations. It informs the buyer of their default status and the necessary actions to address the maintenance concerns. 4. Violation of Zoning or Ordinance Laws: If the buyer violates local zoning regulations or ordinance laws, this notice is issued. It outlines the specific violations and provides an opportunity for the buyer to rectify the situation within a stipulated timeframe. 5. Failure to Pay Taxes and Insurance: When the buyer neglects to pay applicable property taxes or fails to maintain adequate insurance coverage as agreed upon in the contract for deed, this notice is issued. It highlights the default and provides instructions for resolving the financial obligations. 6. Default Cure Period: The default cure period refers to the timeframe granted to the buyer to rectify the default situation discussed in the notice. This period varies depending on the individual contract for deed agreement and is highlighted in the Paterson, New Jersey General Notice of Default. Conclusion: In Paterson, New Jersey, the General Notice of Default for Contract for Deed plays a critical role in maintaining contractual obligations and ensuring appropriate actions are taken to resolve any defaults. These notices cover a wide range of defaults, including non-payment, breaches of conditions, failure to maintain the property, violation of zoning laws, and failure to pay taxes or insurance premiums. Understanding these notices and adhering to their requirements is essential for both buyers and sellers involved in the contract for deed process.

How to fill out Paterson New Jersey General Notice Of Default For Contract For Deed?

If you’ve already used our service before, log in to your account and save the Paterson New Jersey General Notice of Default for Contract for Deed on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make certain you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Paterson New Jersey General Notice of Default for Contract for Deed. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!