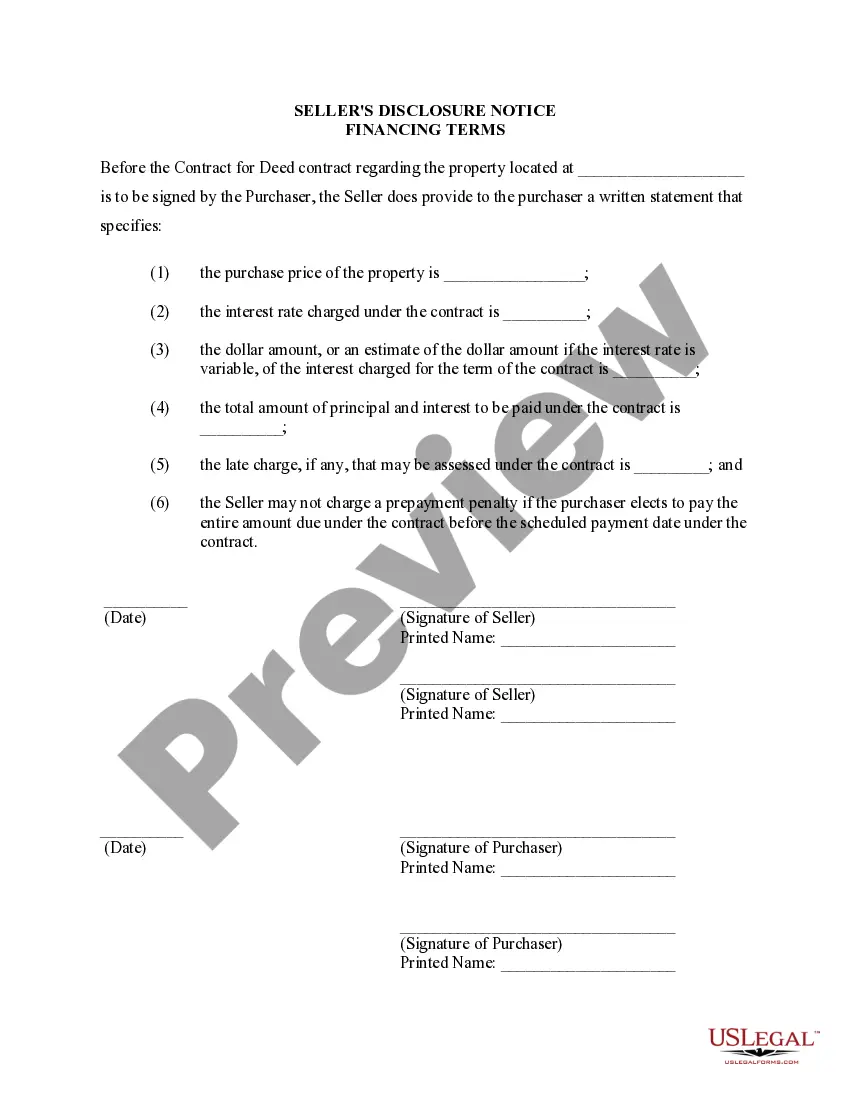

The Elizabeth New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a crucial document that outlines the specific financing terms for residential property transactions within the city of Elizabeth. This disclosure is vital for both sellers and buyers as it ensures transparency and clarity regarding the financing arrangements related to the contract or agreement for deed. One type of Elizabeth New Jersey Seller's Disclosure of Financing Terms for Residential Property is the Fixed-Rate Mortgage Disclosure. This type of disclosure outlines the terms and conditions of a fixed-rate mortgage that the seller intends to provide to the buyer. It includes details such as the interest rate, loan duration, prepayment penalties (if any), and any other relevant information regarding the mortgage. Another type is the Adjustable-Rate Mortgage (ARM) Disclosure. In this disclosure, the seller provides information about an adjustable-rate mortgage option for the buyer. It includes details about the initial fixed-rate period, subsequent adjustments, interest rate caps, and any potential adjustments to monthly payments. Furthermore, there may be a Seller Financing Disclosure included if the seller offers financing options directly to the buyer. This disclosure explains the terms of the financing provided by the seller, including the interest rate, down payment requirements, installment amounts, and any potential penalties or terms that may apply. The Elizabeth New Jersey Seller's Disclosure of Financing Terms for Residential Property also includes information on taxation and insurance. It outlines any taxes or insurance costs that the buyer may be responsible for, such as property taxes or homeowners insurance. This ensures that the buyer is aware of these additional expenses associated with the property. Additionally, the disclosure may include details about any required property inspections or appraisals. It informs the buyer if there are any obligations or conditions related to the financing terms regarding inspections or appraisals, ensuring transparency and clarity in the transaction. In conclusion, the Elizabeth New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract provides a comprehensive overview of the financing arrangements associated with the property transaction. It covers different types of financing options such as fixed-rate mortgages, adjustable-rate mortgages, and seller financing. The disclosure also includes information about taxes, insurance, inspections, and appraisals, ensuring that both parties are fully informed before entering into the contract or agreement for deed.

Elizabeth New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Elizabeth New Jersey Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

This is an online compilation of over 85,000 legal documents for both individual and professional requirements and various real-world situations.

All the paperwork is accurately classified by area of application and jurisdiction, making the search for the Elizabeth New Jersey Seller's Disclosure of Financing Terms for Residential Property regarding Contract or Agreement for Deed also known as Land Contract as straightforward as ABC.

Maintain your documents organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to have essential document templates readily available for all your needs!

- Ensure to review the Preview mode and document description.

- Confirm that you have selected the right one that fulfills your needs and completely aligns with your local jurisdiction requirements.

- If necessary, look for another template.

- Utilize the Search tab above to locate the correct one if any discrepancies arise. If it fits your needs, proceed to the next step.

- Click on the Buy Now button to purchase the document and choose your preferred subscription plan.

Form popularity

FAQ

Required Elements of a Real Estate Contract To establish legality, a real estate contract must include a legal purpose, legally competent parties, agreement by offer and acceptance, consideration, and consent.

If you find yourself competing to buy the home of your dreams, a well-crafted letter to the seller may give you an edge. The letter should build a connection with the seller, be short, and stay positive. It's a good idea to leave out any remodeling plans you have in mind.

If a subject to clause is in the contract, the seller commits to that buyer for a period of time and cannot accept any other offers during that time period. If another offer is received by the seller within the subject to time period, the seller can request the buyer remove the clause.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

It specifies what happens to the earnest money should you or the sellers default, as well as what legal recourse each party has in the event of a default.

How do I write a Sales Agreement? Specify your location.Provide the buyer's and seller's information.Describe the goods and services.State the price and deposit details (if applicable)Outline payment details.Provide delivery terms.Include liability details.State if there's a warranty on the goods.

A sale agreement should include all important details regarding the exchange. This includes aspects such as payment method and date, expected or actual delivery date, price and order quotes, and the date the order was submitted. The sale agreement letter should take both parties' interests into consideration.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

How do I write a Sales Agreement? Specify your location.Provide the buyer's and seller's information.Describe the goods and services.State the price and deposit details (if applicable)Outline payment details.Provide delivery terms.Include liability details.State if there's a warranty on the goods.

Here are the steps to write a letter of agreement: Title the document. Add the title at the top of the document.List your personal information.Include the date.Add the recipient's personal information.Address the recipient.Write an introduction paragraph.Write your body.Conclude the letter.