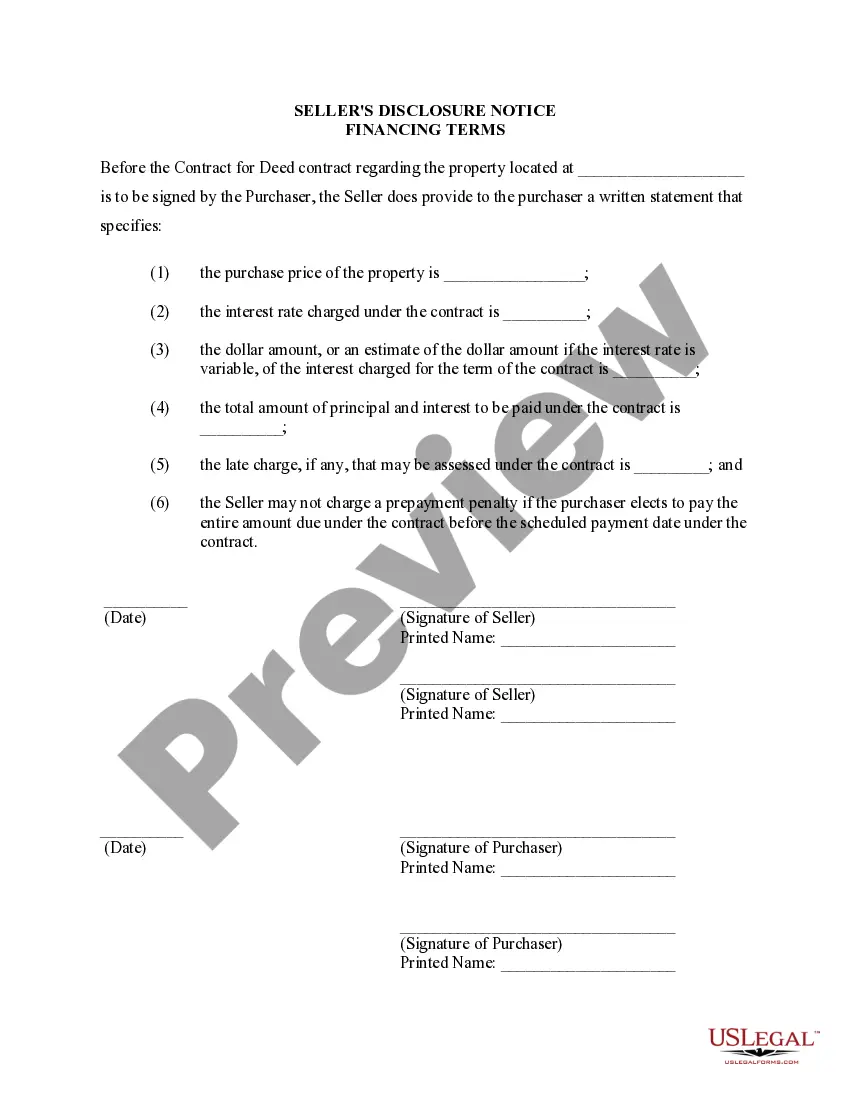

Paterson New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is an important legal document that outlines the financing terms and conditions when buying or selling a property. This disclosure provides critical information to both parties involved in the transaction and ensures transparency and protection for all parties. Key Points: 1. Purpose and Importance: The Paterson New Jersey Seller's Disclosure of Financing Terms for Residential Property is designed to inform the buyer about the financing terms and conditions associated with the purchase of a property through a Contract or Agreement for Deed. This document discloses the seller's terms, payment structure, interest rates, deadlines, and any additional fees or charges that the buyer needs to be aware of before entering into the agreement. It plays a crucial role in ensuring that both parties understand and agree upon the financial aspects of the transaction. 2. Sections of the Disclosure: The disclosure document typically includes several sections covering different aspects of the financing terms. These sections may include: a. Purchase Price and Payments: This section outlines the total purchase price of the property, any down payment required, and the structure of subsequent payments, including the frequency and due dates of installments. b. Interest Rate and Finance Charges: Here, the seller discloses the interest rate applicable to the financing arrangement, along with any other finance charges or fees involved. This helps the buyer understand the overall cost of the property and calculates their monthly obligations accurately. c. Payment Schedule and Delinquencies: This section specifies the payment schedule, including the number of payments required and any grace period provided for late payments. It may also define the penalties or consequences for defaulting on payments. d. Title and Ownership: This part clarifies the status of the property's title during the agreement. It may outline if the buyer will receive equitable title during the contract period or if the seller retains full ownership until the final payment. e. Property Conditions: Some disclosures may include information about the property's current condition, including any known defects or issues, which may affect the buyer's decision or their willingness to enter into the agreement. f. Default and Termination: This section explains the circumstances under which the agreement may be terminated or canceled, both by the buyer and the seller, due to default, breach of the contract, or other specified reasons. 3. Other Types of Seller's Disclosures: While the main focus is on the Paterson New Jersey Seller's Disclosure of Financing Terms for Residential Property, it's important to note that other related disclosures may exist, depending on the specifics of the transaction. Some common additional disclosures include: a. Paterson New Jersey Seller's Disclosure of Property Conditions: This document outlines the seller's knowledge about the property's physical condition, including any known defects or issues that might affect the buyer's decision. b. Paterson New Jersey Seller's Disclosure of Environmental Hazards: If the property is located in an area with potential environmental hazards, sellers may be required to disclose any known risks or hazards associated with the property, such as flooding, soil contamination, or proximity to hazardous sites. c. Paterson New Jersey Seller's Disclosure of Lead-Based Paint: If the property was built before 1978, sellers are required to disclose any knowledge or information regarding the presence of lead-based paint in the property. In conclusion, the Paterson New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is a comprehensive document that outlines the financing terms and conditions when buying or selling a property. It ensures transparency, protects all parties involved, and helps establish a clear understanding of the financial aspects of the transaction.

Paterson New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Paterson New Jersey Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Make use of the US Legal Forms and have immediate access to any form template you need. Our helpful platform with a large number of templates makes it simple to find and obtain almost any document sample you will need. You are able to save, fill, and sign the Paterson New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract in just a few minutes instead of surfing the Net for many hours trying to find a proper template.

Using our catalog is a great strategy to raise the safety of your form filing. Our professional lawyers on a regular basis review all the documents to make certain that the templates are relevant for a particular state and compliant with new laws and regulations.

How do you obtain the Paterson New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. Moreover, you can find all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the instruction below:

- Open the page with the form you require. Make sure that it is the template you were looking for: check its title and description, and utilize the Preview option when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving process. Select Buy Now and select the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Save the document. Select the format to obtain the Paterson New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract and modify and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable form libraries on the internet. We are always happy to help you in any legal case, even if it is just downloading the Paterson New Jersey Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract.

Feel free to make the most of our platform and make your document experience as efficient as possible!