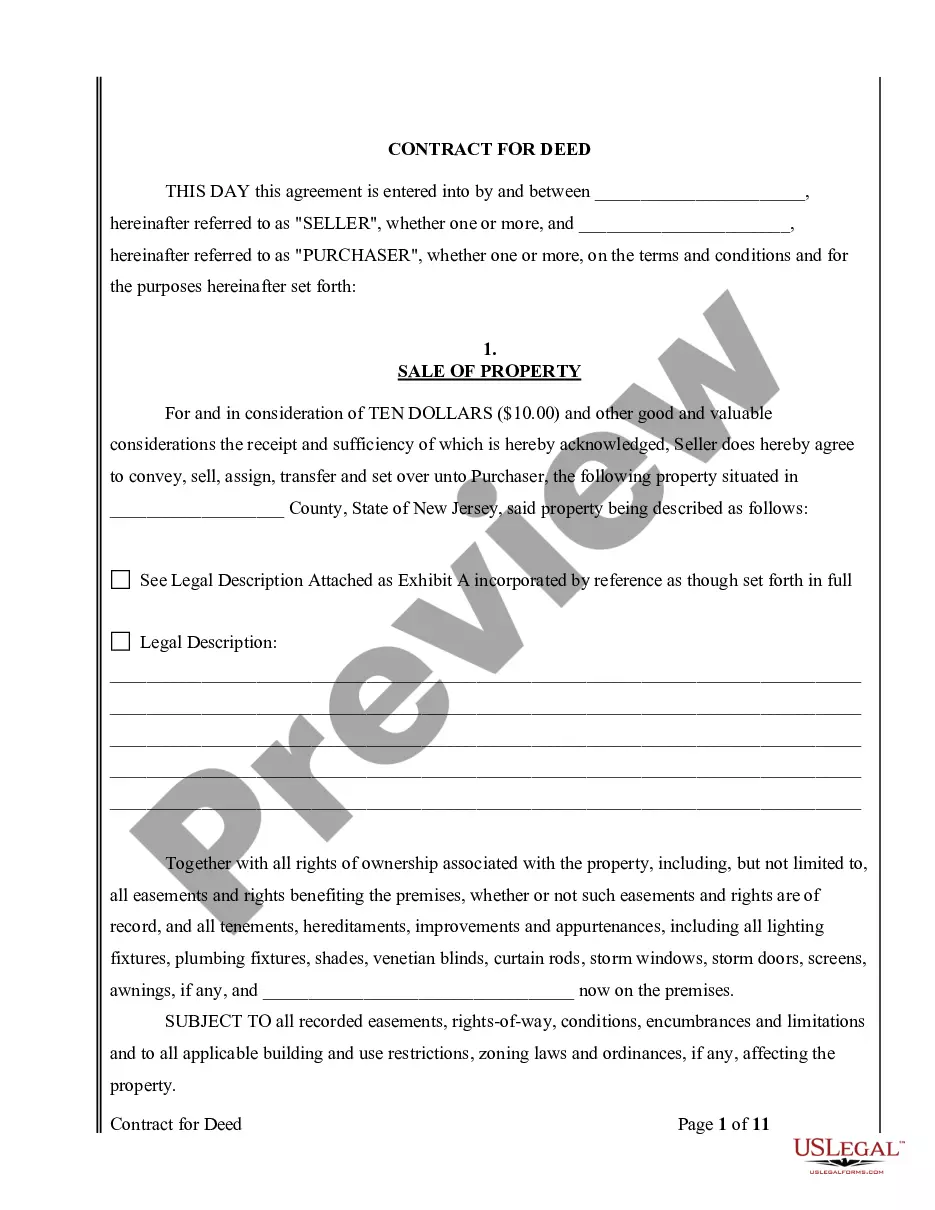

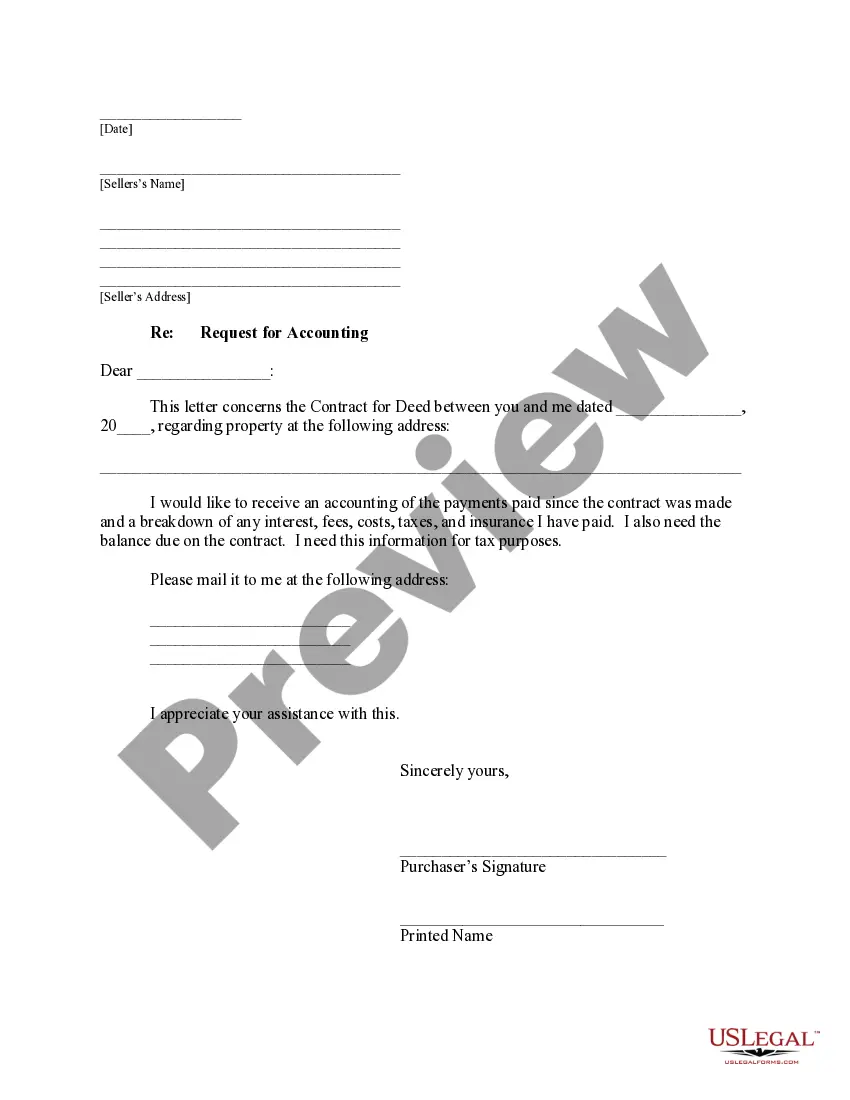

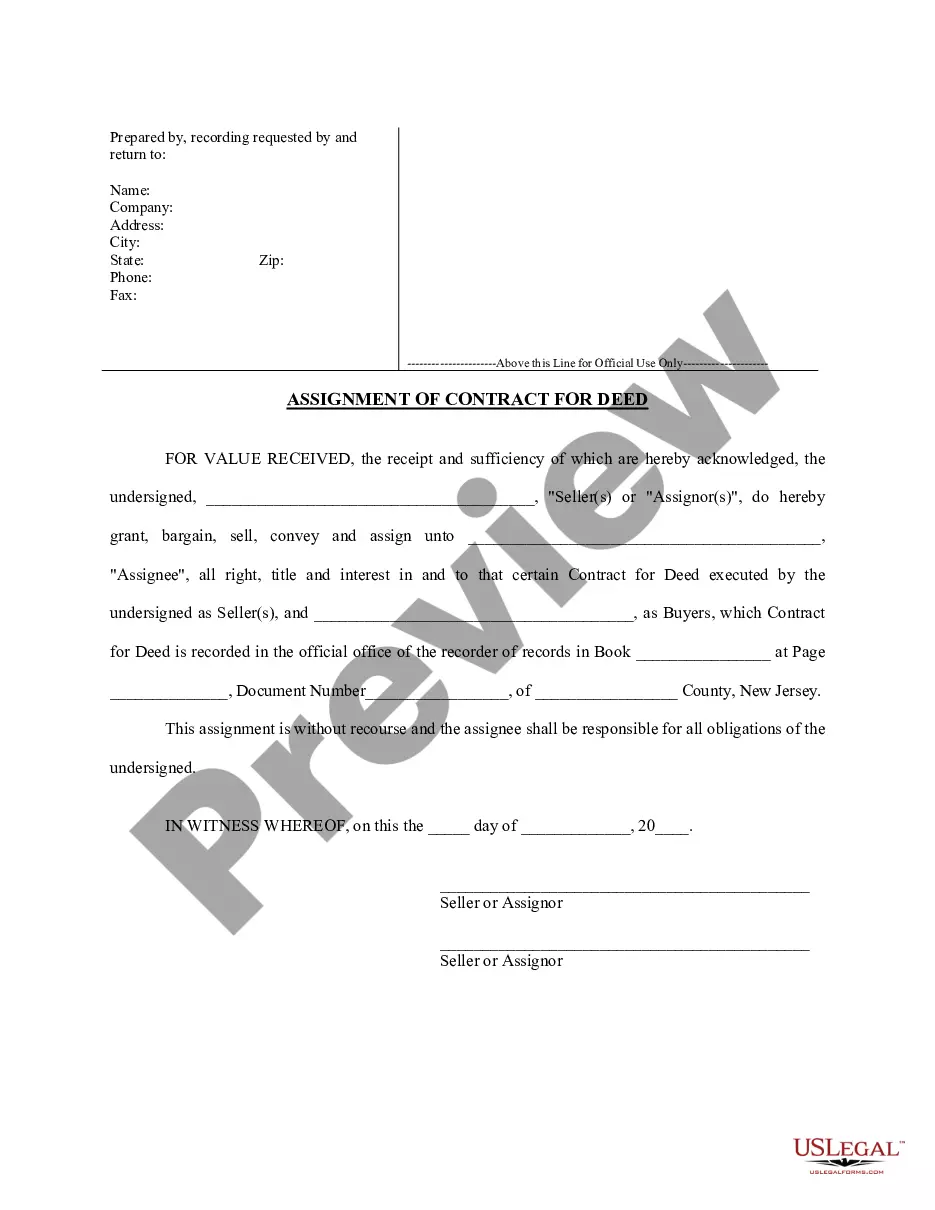

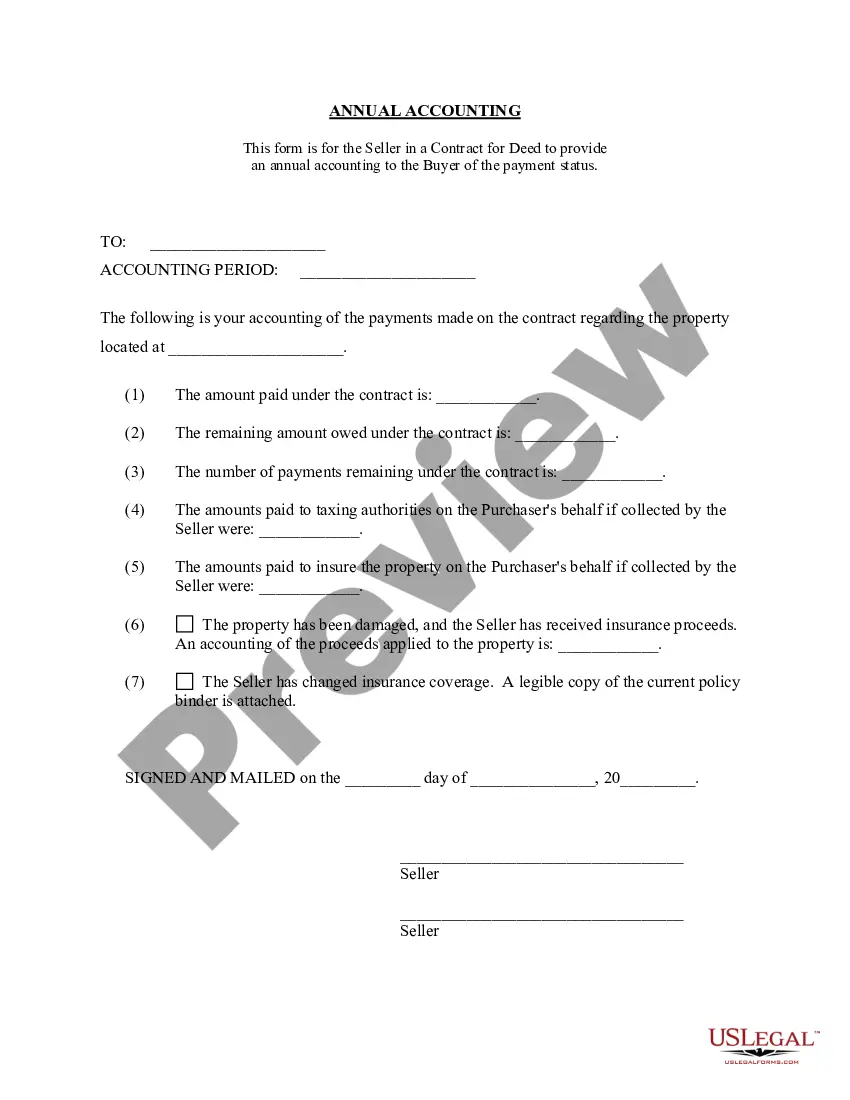

The Paterson New Jersey Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive overview of the financial transactions and obligations between a seller and buyer in a contract for deed agreement within Paterson, New Jersey. This statement allows sellers to demonstrate transparency and ensures buyers have a clear understanding of their financial standing and property ownership status. Keywords: Paterson, New Jersey, contract for deed, seller's annual accounting statement, financial transactions, obligations, transparency, property ownership. There are different types of Paterson New Jersey Contract for Deed Seller's Annual Accounting Statement that cater to various scenarios and requirements. These statements could include: 1. Generic Paterson NJ Contract for Deed Seller's Annual Accounting Statement: This statement contains essential financial details regarding the contract for deed transaction, such as the purchase price, payment schedule, and any interest charged. 2. Paterson NJ Contract for Deed Seller's Annual Accounting Statement with Property Improvements: In cases where the seller agrees to make improvements on the property during the contract period, this statement would include details of the improvements made and their corresponding costs. 3. Paterson NJ Contract for Deed Seller's Annual Accounting Statement with Escrow Account: If the buyer is required to contribute to an escrow account for taxes, insurance, or other expenses, this statement outlines the amount deposited, any interest earned, and details of disbursements made from the escrow account. 4. Paterson NJ Contract for Deed Seller's Annual Accounting Statement with Additional Fees: In situations where there are additional fees associated with the contract for deed, such as late payment penalties or administrative charges, this statement would provide a breakdown of these fees and their impact on the buyer's financial obligations. 5. Paterson NJ Contract for Deed Seller's Annual Accounting Statement with Balloon Payment: If the contract for deed agreement includes a balloon payment at the end of the contract term, this statement would specify the portion due, its calculation method, and the timeline for payment. 6. Paterson NJ Contract for Deed Seller's Annual Accounting Statement with Early Repayment: In cases where the buyer opts for early repayment of the contract, this statement would outline the applicable penalties, the remaining balance, and any adjustments needed to settle the account. By utilizing the relevant keywords and exploring the different types of Paterson New Jersey Contract for Deed Seller's Annual Accounting Statements, sellers and buyers can ensure their financial commitments are accurately documented and transparent throughout the duration of their contract for deed agreement.

Paterson New Jersey Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out New Jersey Contract For Deed Seller's Annual Accounting Statement?

Regardless of social or occupational standing, completing legal documents is a regrettable requirement in today’s society.

Too frequently, it’s nearly impossible for someone without any legal expertise to create such documents from scratch, primarily due to the complex vocabulary and legal nuances they involve.

This is where US Legal Forms can be a lifesaver.

Confirm the form you’ve selected is suitable for your area as the regulations of one state or county do not apply to another.

Review the document and check a brief summary (if available) of situations for which the paper can be utilized.

- Our service provides an extensive collection of over 85,000 ready-to-use state-specific forms applicable to nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to save time by utilizing our DIY forms.

- If you need the Paterson New Jersey Contract for Deed Seller's Annual Accounting Statement or any other document that is valid in your state or county, US Legal Forms has everything readily available.

- Here’s how to quickly obtain the Paterson New Jersey Contract for Deed Seller's Annual Accounting Statement using our dependable service.

- If you're already a customer, you can simply Log In to your account to access the appropriate form.

- However, if you are new to our platform, follow these steps before acquiring the Paterson New Jersey Contract for Deed Seller's Annual Accounting Statement.

Form popularity

FAQ

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

What is one advantage of a contract for deed? Gives the seller certain tax benefits.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.