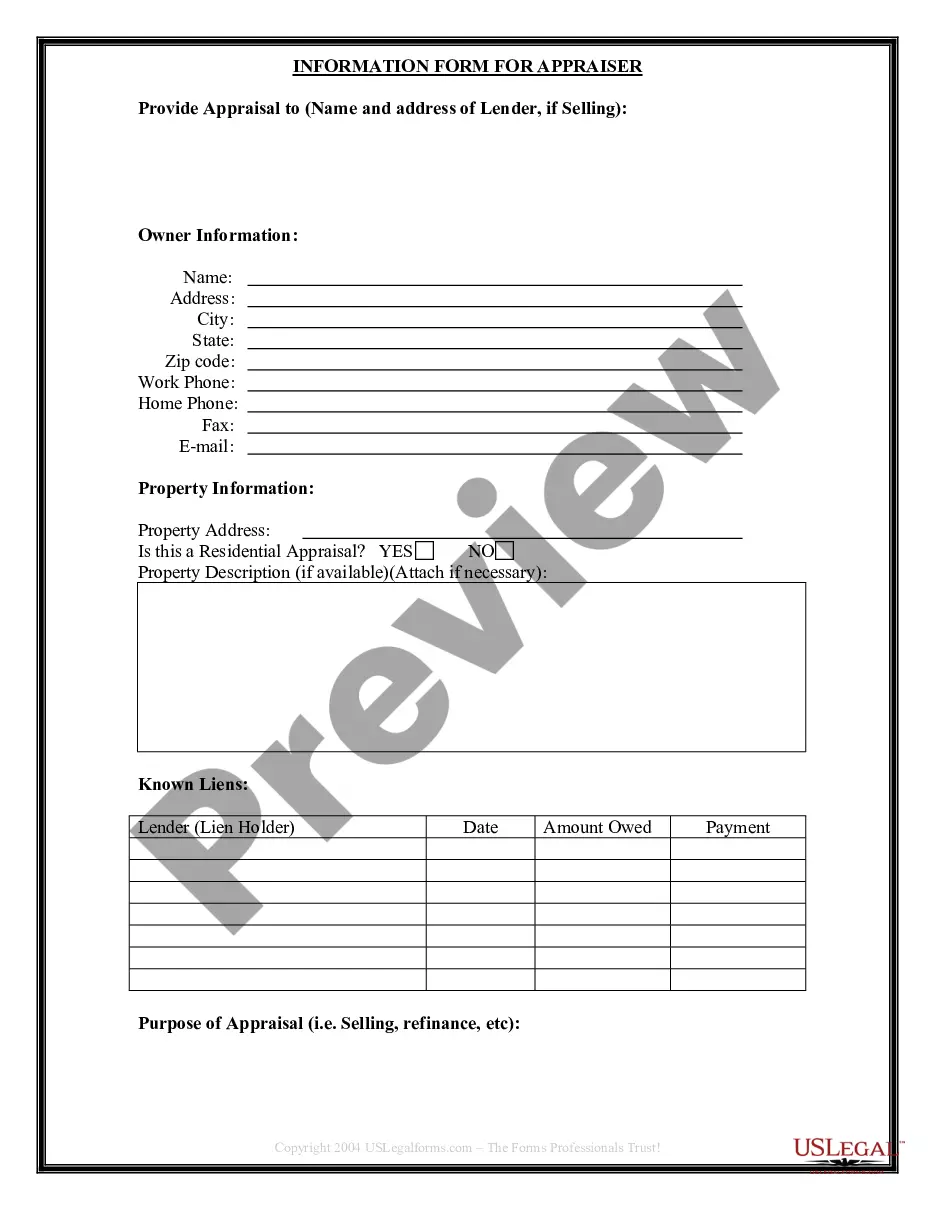

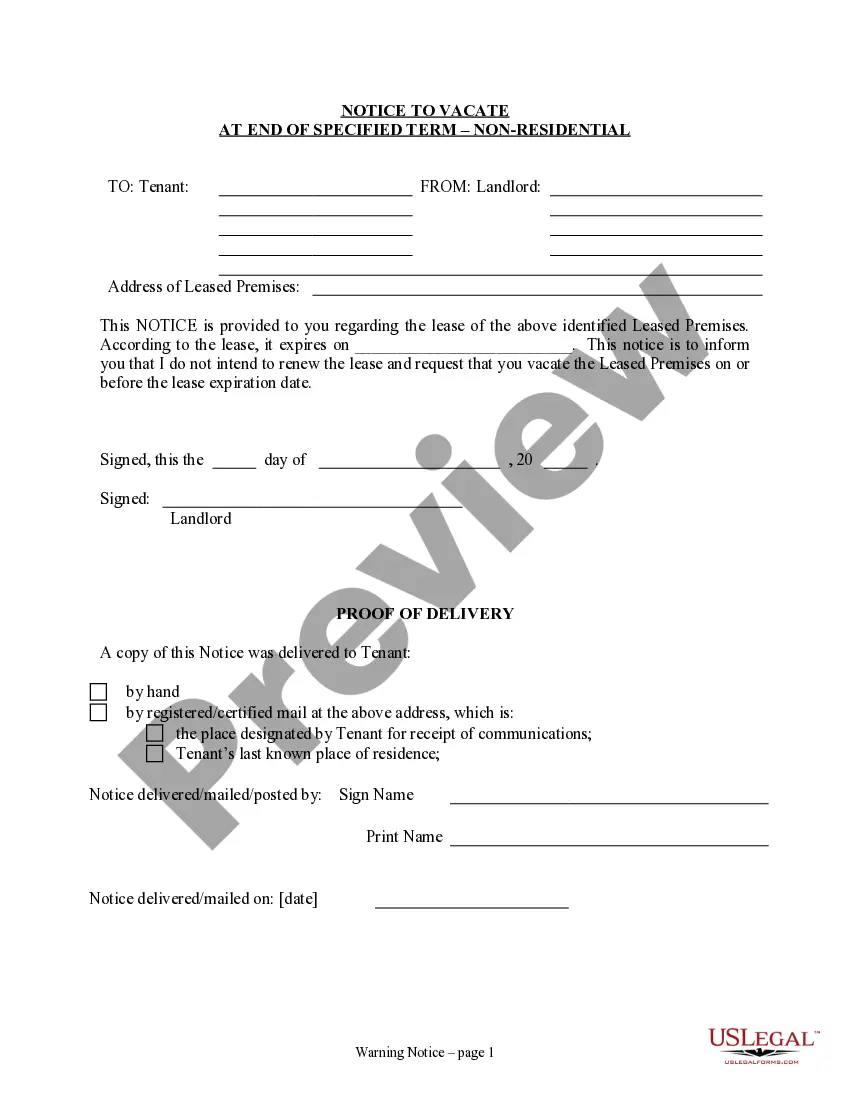

Title: Newark, New Jersey Seller's Information for Appraiser: A Comprehensive Guide for Buyers Introduction: When considering a property in Newark, New Jersey, understanding the Seller's Information for Appraiser becomes crucial for buyers. This detailed description will shed light on the various types of information provided by sellers to appraisers, helping buyers make informed decisions. Explore the specific documents and data essential for appraisers during property valuation in Newark. 1. Property Description: As part of the Seller's Information for Appraiser, buyers can expect a comprehensive property description covering essential details such as property size, address, lot dimensions, zoning information, and any recent construction or renovations. This preliminary information facilitates accurate evaluation and helps buyers gain insight into the property's potential. 2. Listing History and Comparative Market Analysis (CMA): Buyers benefit from knowing the property's listing history, including past sales, listing prices, and how long the property has been on the market. The Comparative Market Analysis presented by the seller's agent gives appraisers a broader understanding of the property's value relative to similar properties, aiding accurate valuation. 3. Property Disclosures: Newark, New Jersey, follows strict disclosure laws, and sellers are required to provide key disclosures to the appraiser for buyer's information. These may include previous damages, repairs, insurance claims, lead-based paint disclosure, flood zone classification, and any environmental concerns. Appraisers rely on this information to assess a property's condition thoroughly. 4. Maintenance, Upgrade, and Repair Records: Details regarding past maintenance, upgrades, and repairs carried out on the property play a crucial role in assessing its overall condition and value. The seller's information may include receipts, invoices, or records documenting these activities. Appraisers use this data to evaluate the property's quality, durability, and potential lifespan of various components. 5. Tax Assessment and Recent Property Taxes: Appraisers often require accurate information on property tax assessments and recent tax payment history to provide a comprehensive valuation. Sellers should provide tax records indicating the assessed value of the property and any outstanding tax liabilities. This data plays a vital role in determining the property's worth. 6. Mortgage Information: For a holistic appraisal, buyers can furnish the appraiser with mortgage information offered by the seller. This may include the remaining balance, interest rates, and repayment terms. These details help appraisers understand the existing financial arrangements and market conditions, ensuring an accurate assessment of the property's value. Conclusion: Newark, New Jersey Seller's Information for Appraiser encompasses various key documents and data buys should be aware of when evaluating a property. This detailed guide has provided an overview of the various types of information typically provided by sellers. By familiarizing themselves with this information, buyers can make informed decisions and navigate the Newark real estate market more confidently.

Newark New Jersey Seller's Information for Appraiser provided to Buyer

Description

How to fill out Newark New Jersey Seller's Information For Appraiser Provided To Buyer?

If you are searching for a relevant form template, it’s difficult to find a more convenient place than the US Legal Forms site – probably the most comprehensive libraries on the internet. With this library, you can find thousands of form samples for company and individual purposes by categories and states, or key phrases. With our high-quality search function, finding the most recent Newark New Jersey Seller's Information for Appraiser provided to Buyer is as easy as 1-2-3. Additionally, the relevance of each and every document is verified by a group of skilled lawyers that regularly review the templates on our website and update them according to the newest state and county regulations.

If you already know about our platform and have a registered account, all you should do to receive the Newark New Jersey Seller's Information for Appraiser provided to Buyer is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the sample you want. Read its explanation and make use of the Preview option to check its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to discover the appropriate file.

- Confirm your selection. Select the Buy now option. Following that, choose your preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Choose the file format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the obtained Newark New Jersey Seller's Information for Appraiser provided to Buyer.

Each and every form you add to your account does not have an expiration date and is yours forever. You can easily access them using the My Forms menu, so if you need to have an extra duplicate for enhancing or printing, feel free to return and download it again at any time.

Take advantage of the US Legal Forms extensive library to gain access to the Newark New Jersey Seller's Information for Appraiser provided to Buyer you were looking for and thousands of other professional and state-specific templates in one place!