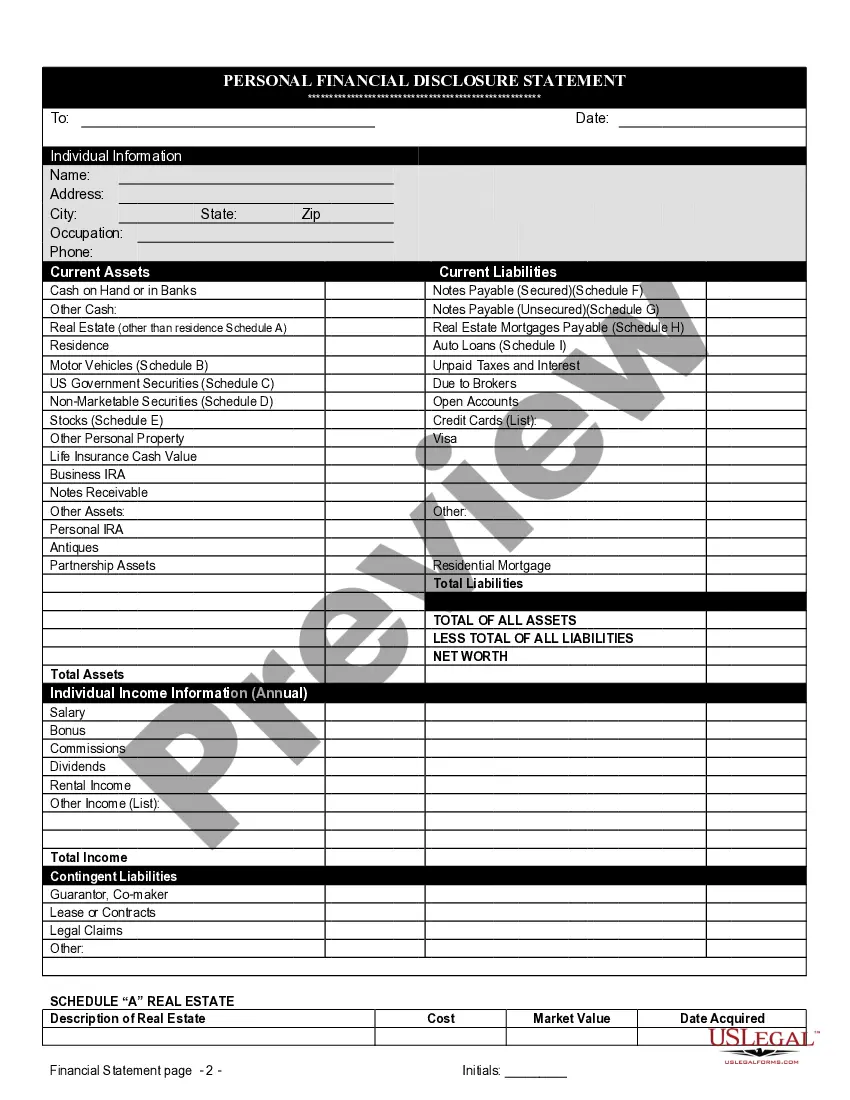

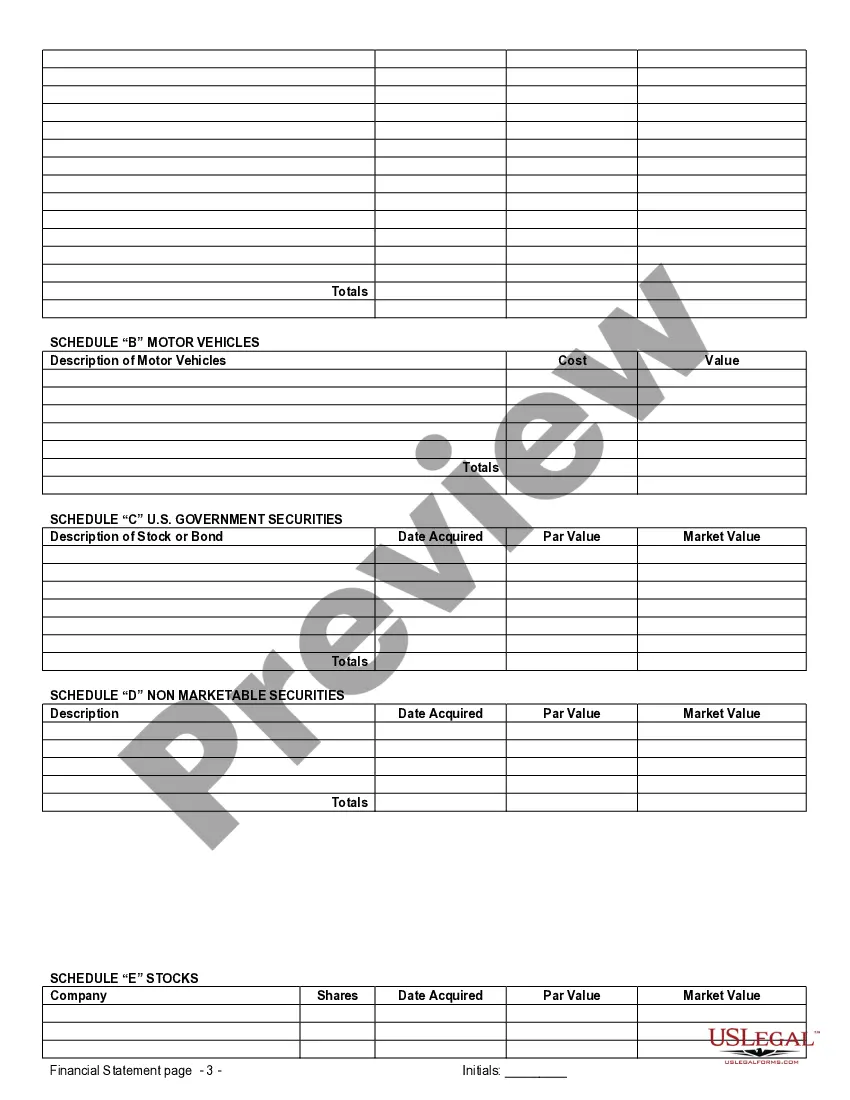

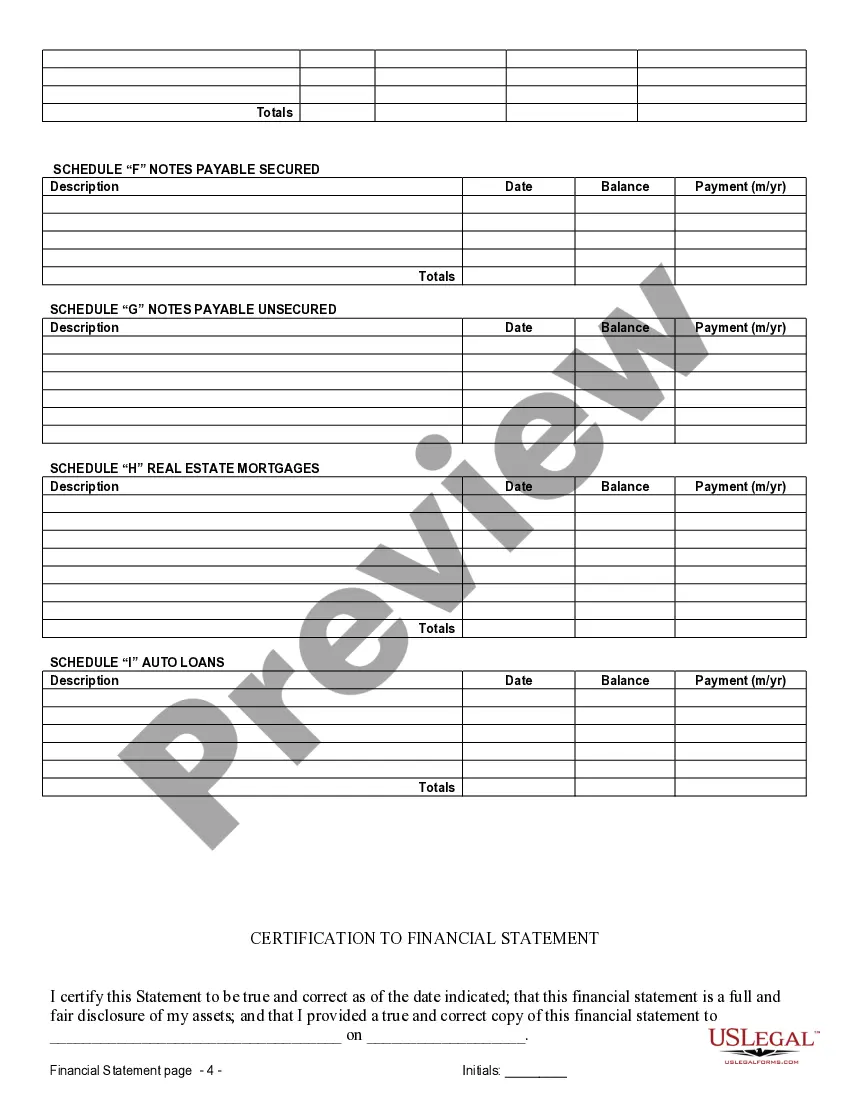

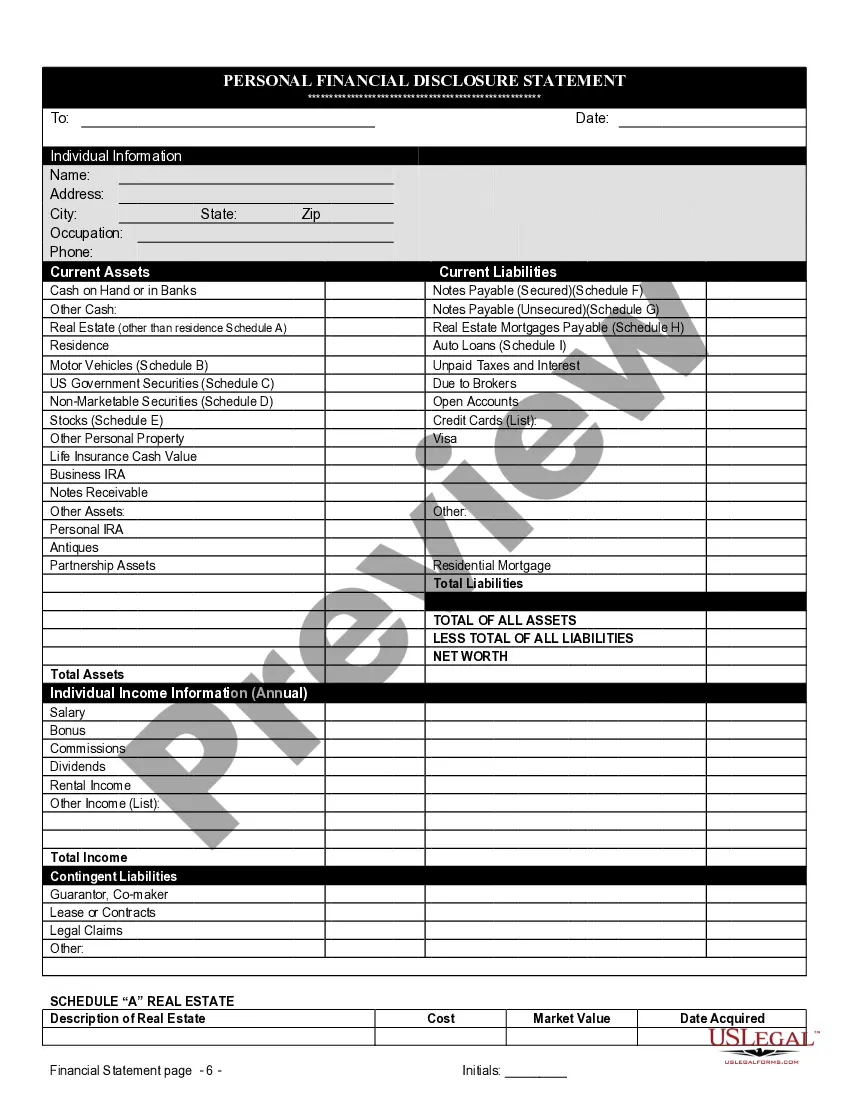

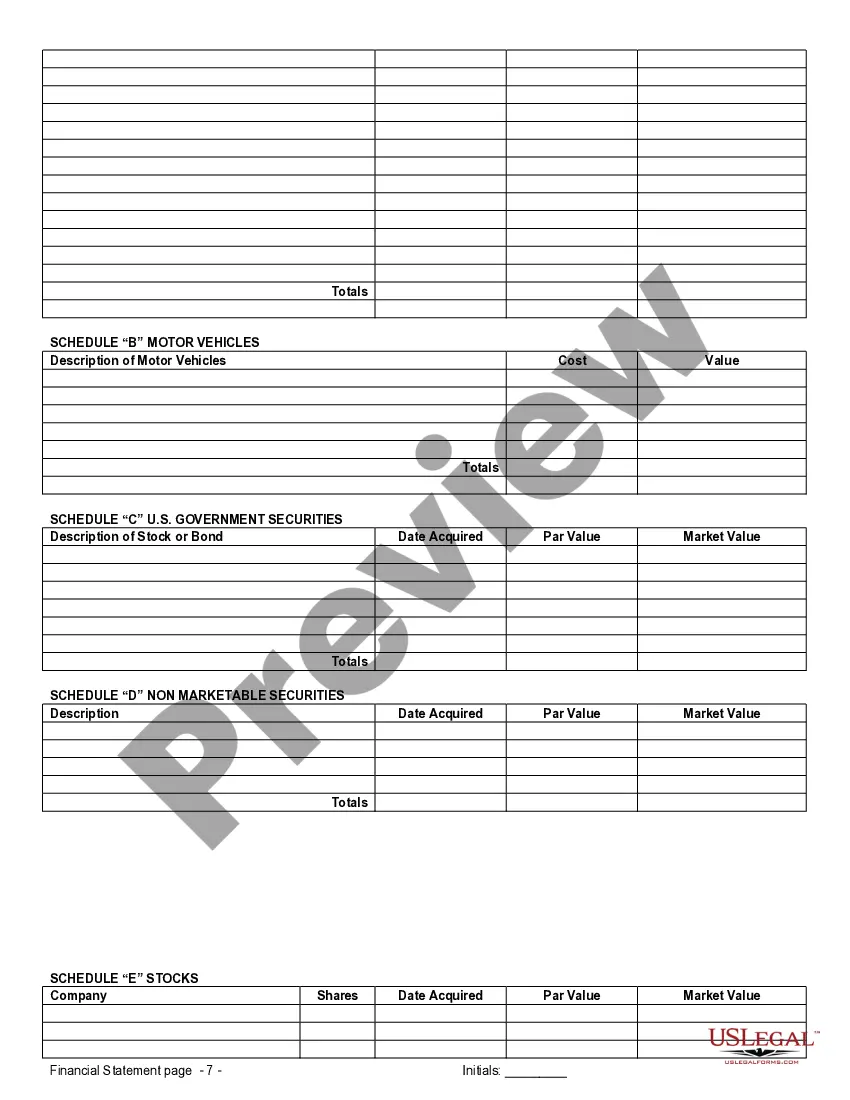

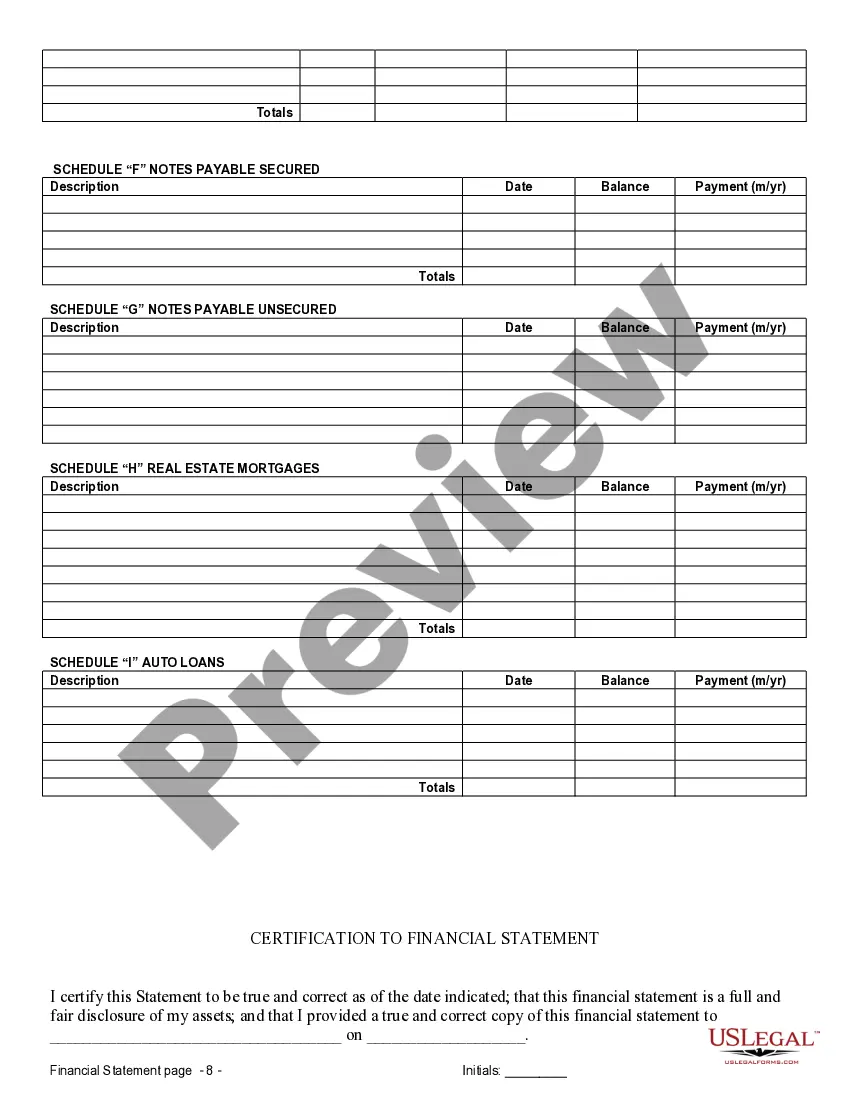

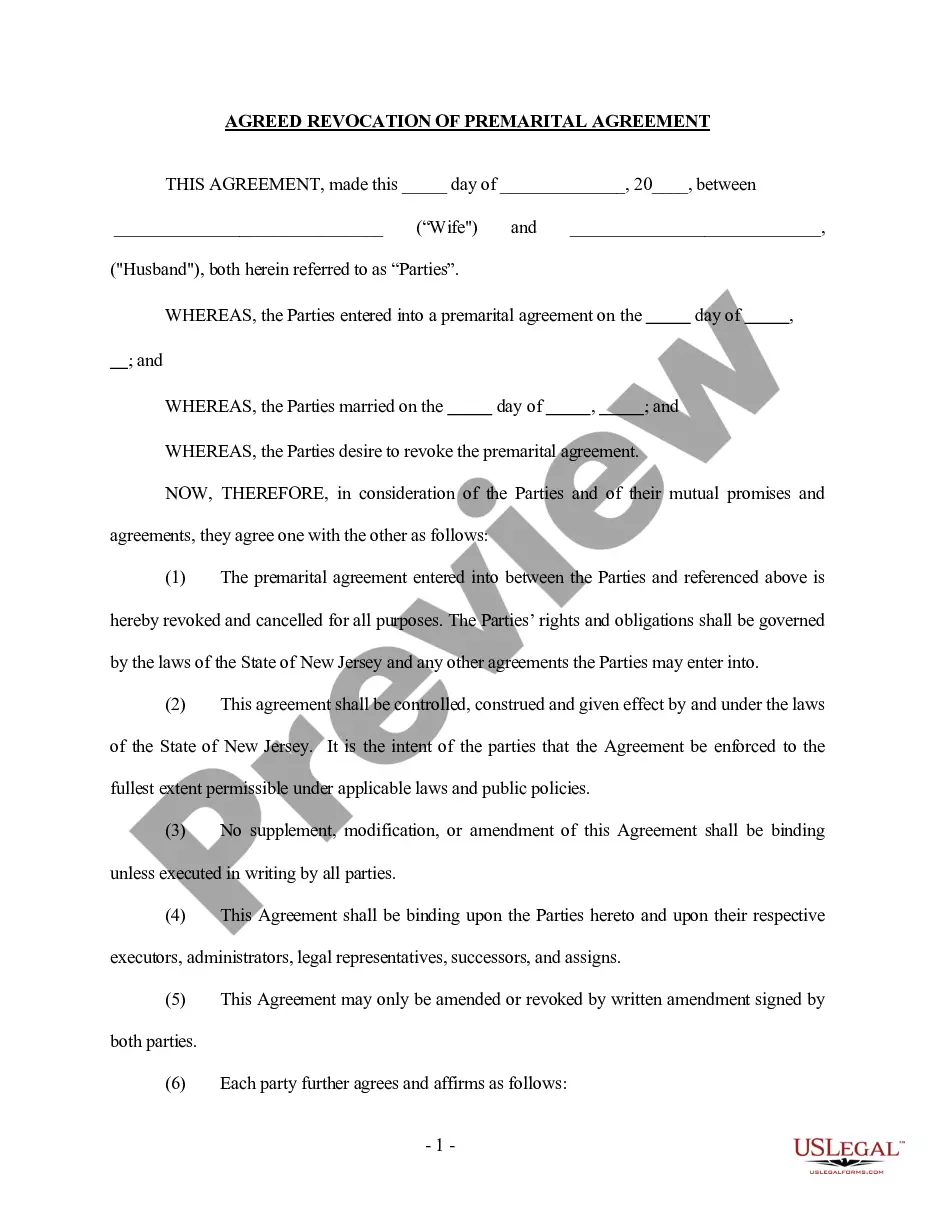

Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement are a crucial component when preparing for marriage and setting the terms of asset division, liabilities, and financial responsibilities within a marriage. These statements provide a comprehensive overview of each partner's financial situation, including income, assets, debts, and expenses, ensuring transparency and protecting individual interests. 1. Personal Financial Statements: These statements capture an individual's current financial position, including details about their income, expenses, assets, and liabilities. It helps evaluate personal financial health and understand how each partner manages their finances. 2. Business Financial Statements: If either partner owns a business in Jersey City, the statement should include details such as the business's income, expenses, assets, and liabilities. It helps assess any potential future income that might affect the asset division or negotiation of spousal support. 3. Real Estate Financial Statements: If one or both partners own real estate properties in Jersey City, this type of statement should provide an in-depth analysis of all properties involved, including their value, mortgage details, rental income, maintenance costs, and any outstanding debts on the properties. 4. Investment Account Statements: If any partner has investment accounts, such as stocks, bonds, mutual funds, or retirement accounts, these statements should outline the types of investments, their current values, and any associated debts or loans against these accounts. 5. Insurance Policies Statements: These statements detail any insurance policies held by either partner, including life insurance, health insurance, property insurance, or others. It helps understand the coverage, beneficiaries, and potential benefits tied to these policies. 6. Debt Statements: This type of financial statement highlights all outstanding debts, such as mortgages, student loans, credit card debts, or any other liabilities. It is crucial to have full disclosure of all debts to ensure fair division and allocate responsibility accurately. 7. Tax Returns: Including recent tax returns to the financial statements is essential to evaluate each partner's income, deductions, and overall financial situation. It provides a comprehensive understanding of the tax liabilities and helps in determining the potential impact on asset division. 8. Retirement Account Statements: These statements outline any retirement accounts, such as 401(k), IRAs, or pension plans. It is important to include the account balance, contributions, and vested rights to determine how these assets should be treated in the event of a divorce or separation. 9. Personal Property Statements: This statement lists significant personal assets like vehicles, jewelry, artwork, furniture, or other valuable possessions. These items are often considered separate property in a prenuptial agreement and may need to be specified for clarity and potential division if necessary. 10. Monthly Budget Statements: Including a detailed breakdown of monthly expenses and income can help the couple understand their spending habits, allocate responsibilities, and plan for potential financial obligations. Remember, each prenuptial agreement may require specific financial statements tailored to the couple's unique circumstances. Seek legal advice from a qualified attorney specializing in family law to ensure compliance with the laws applicable in Jersey City, New Jersey, and the specific needs of each partner.

Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement

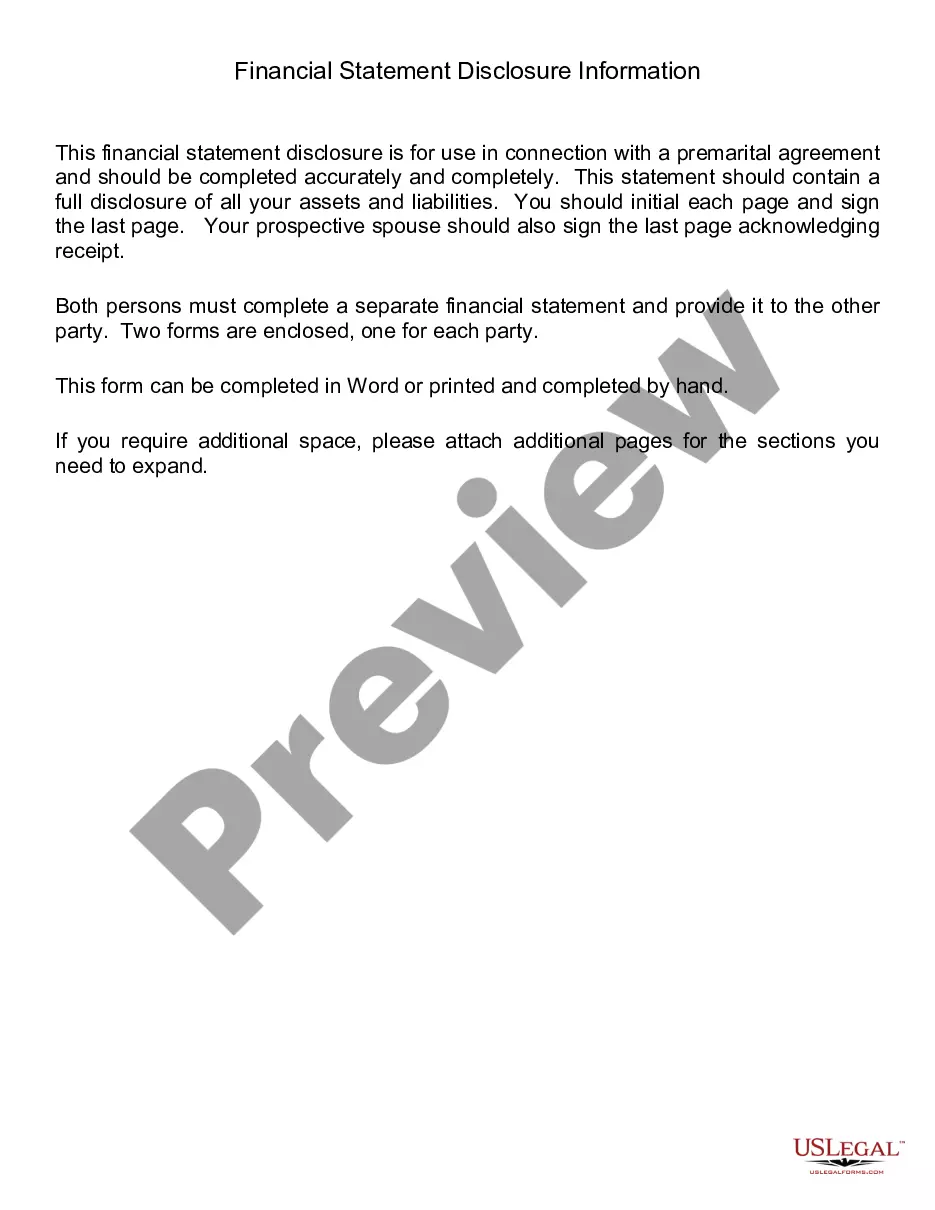

Description

How to fill out Jersey City New Jersey Financial Statements Only In Connection With Prenuptial Premarital Agreement?

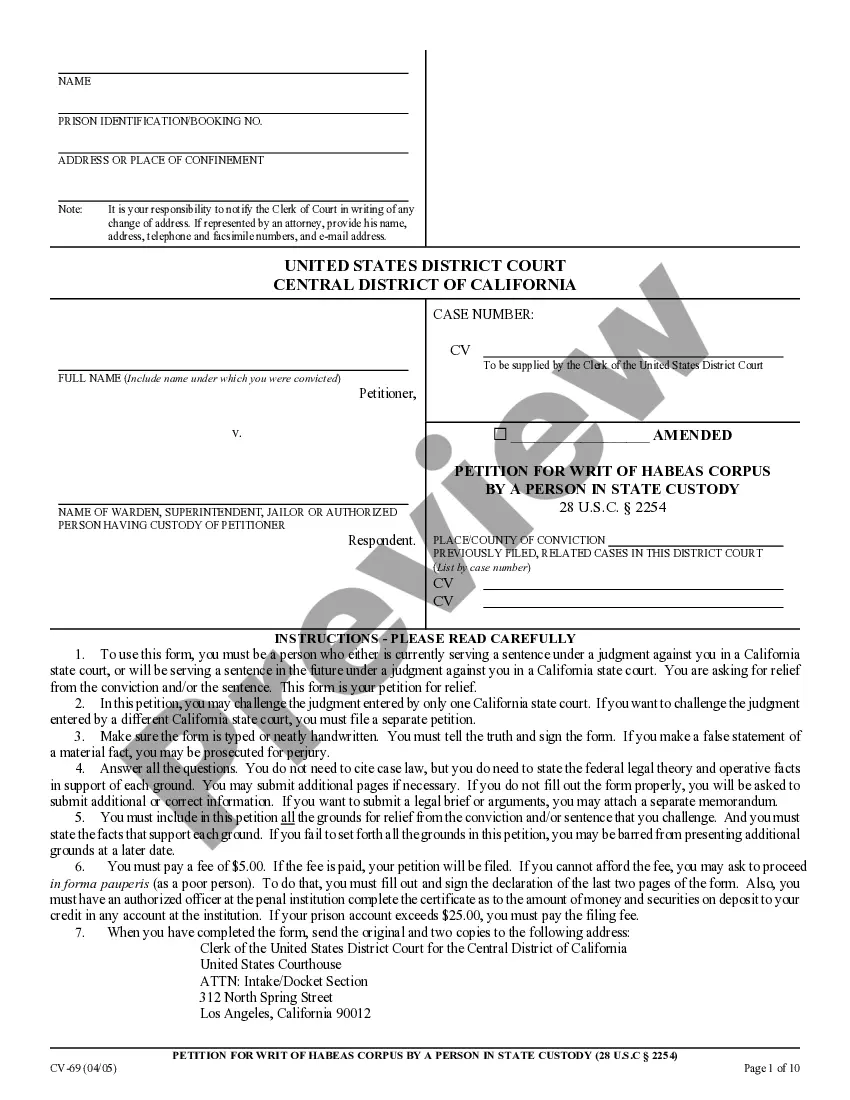

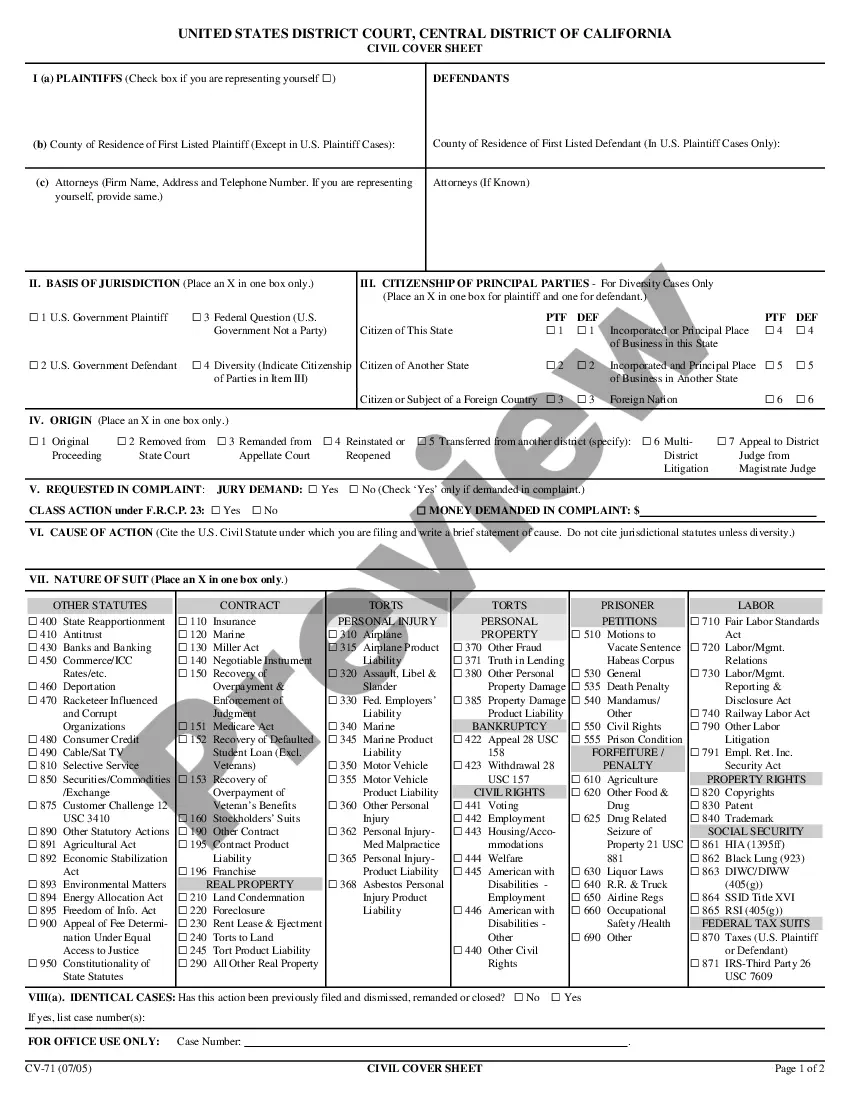

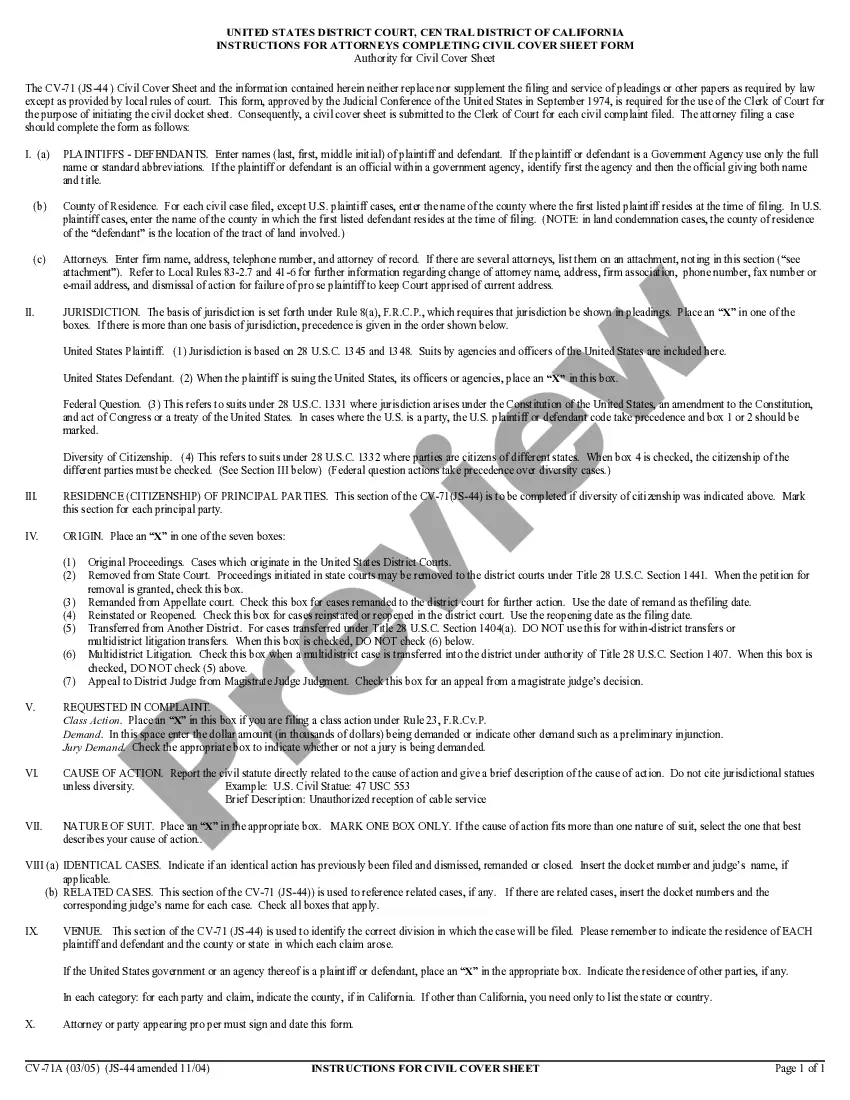

Are you looking for a reliable and inexpensive legal forms supplier to get the Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of specific state and area.

To download the document, you need to log in account, find the needed template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the document is good for.

- Start the search over if the template isn’t suitable for your specific situation.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement in any provided format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal papers online once and for all.