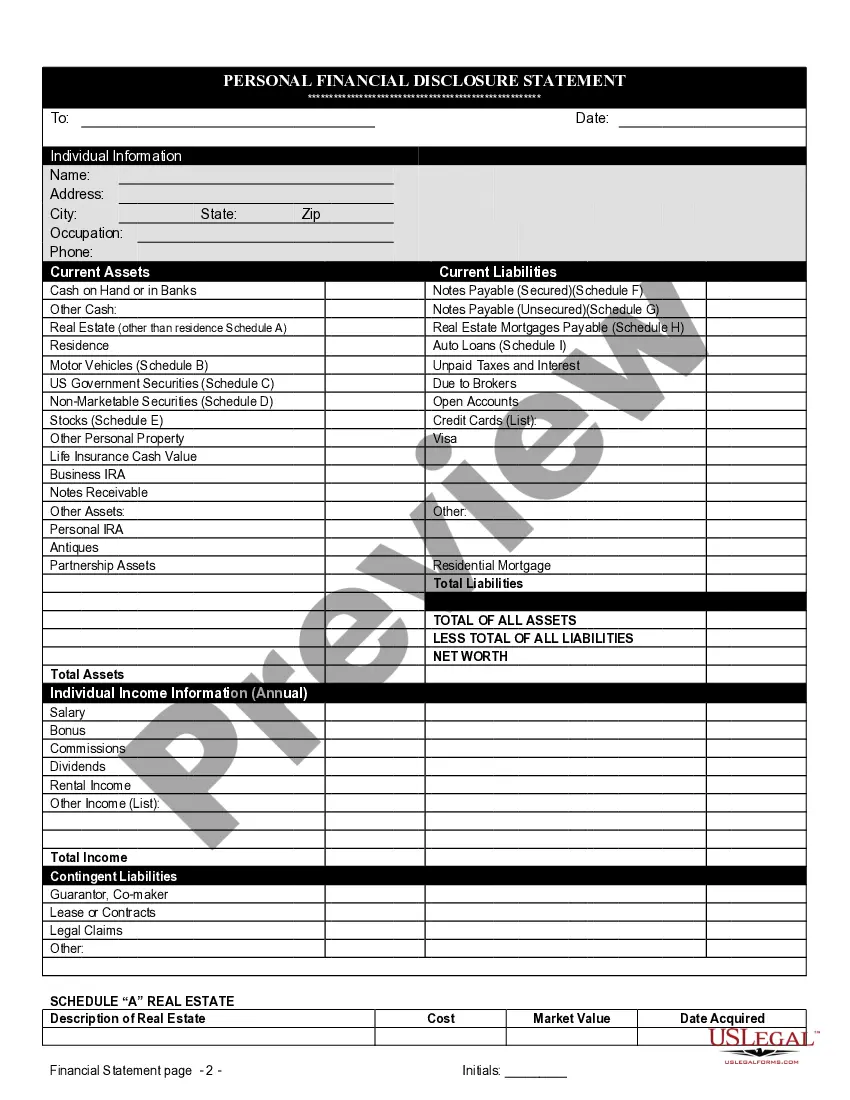

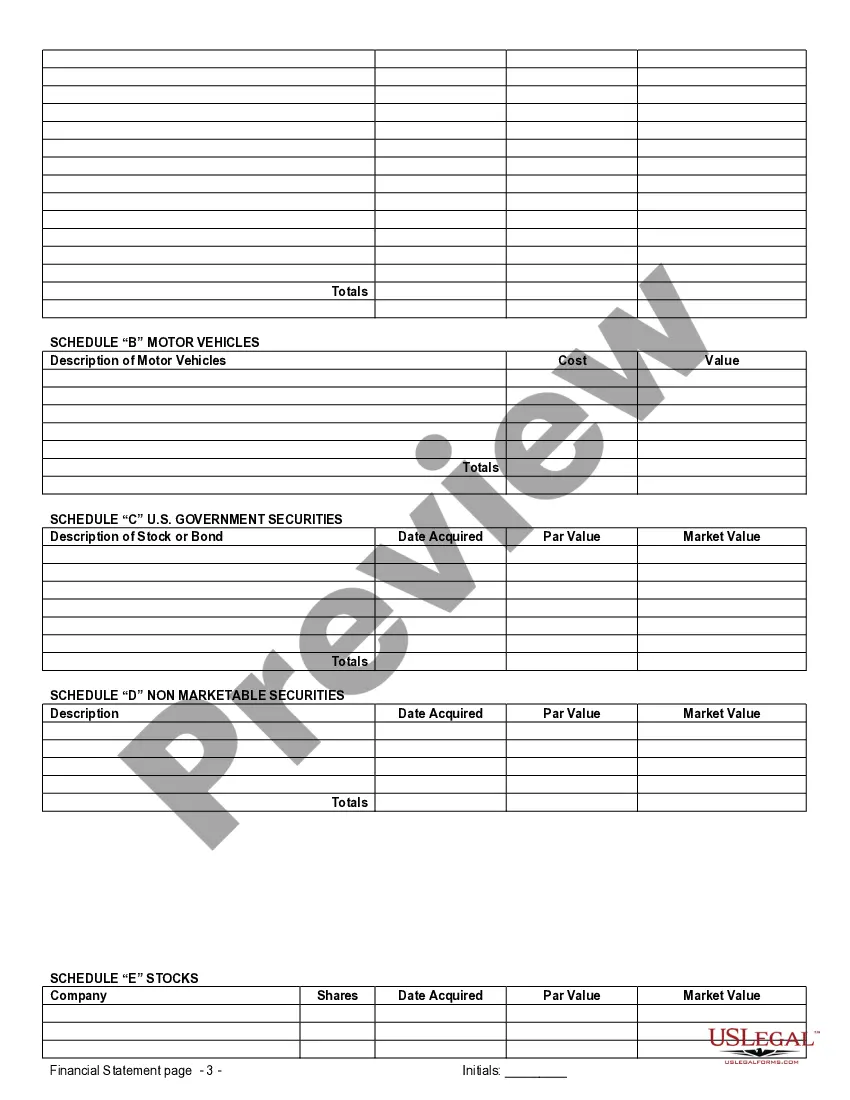

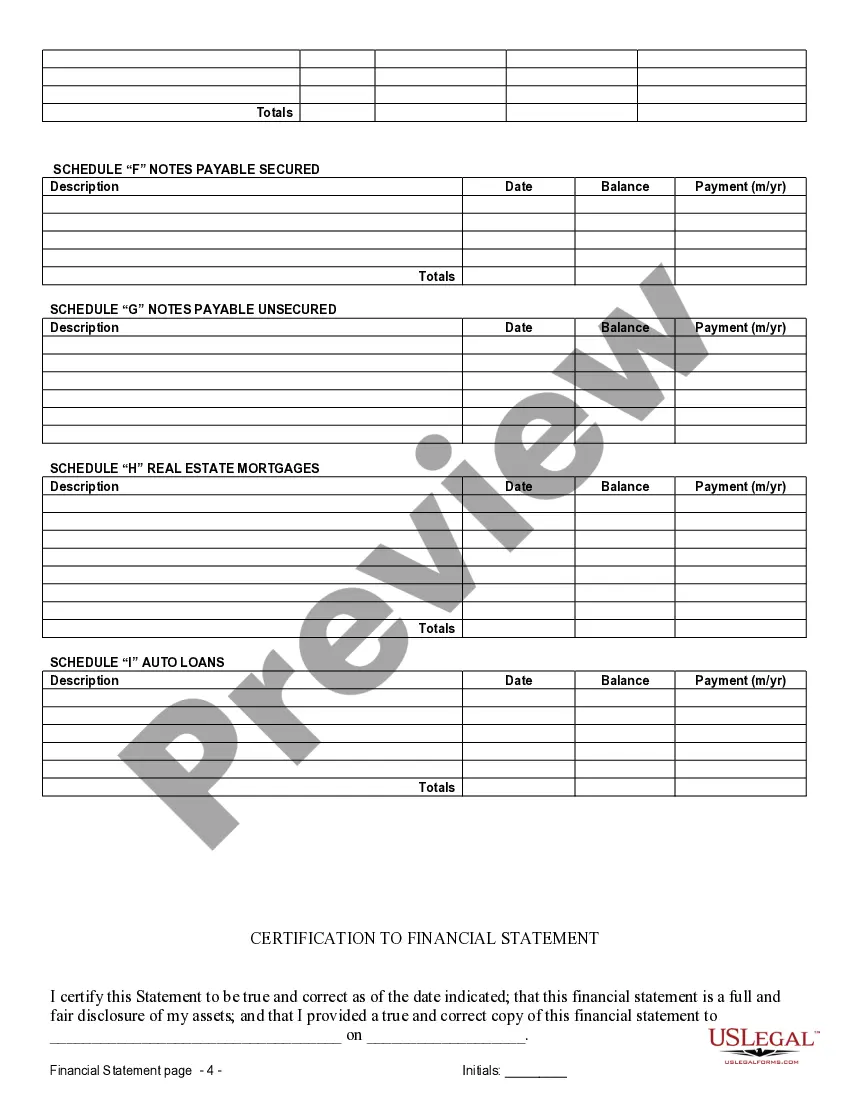

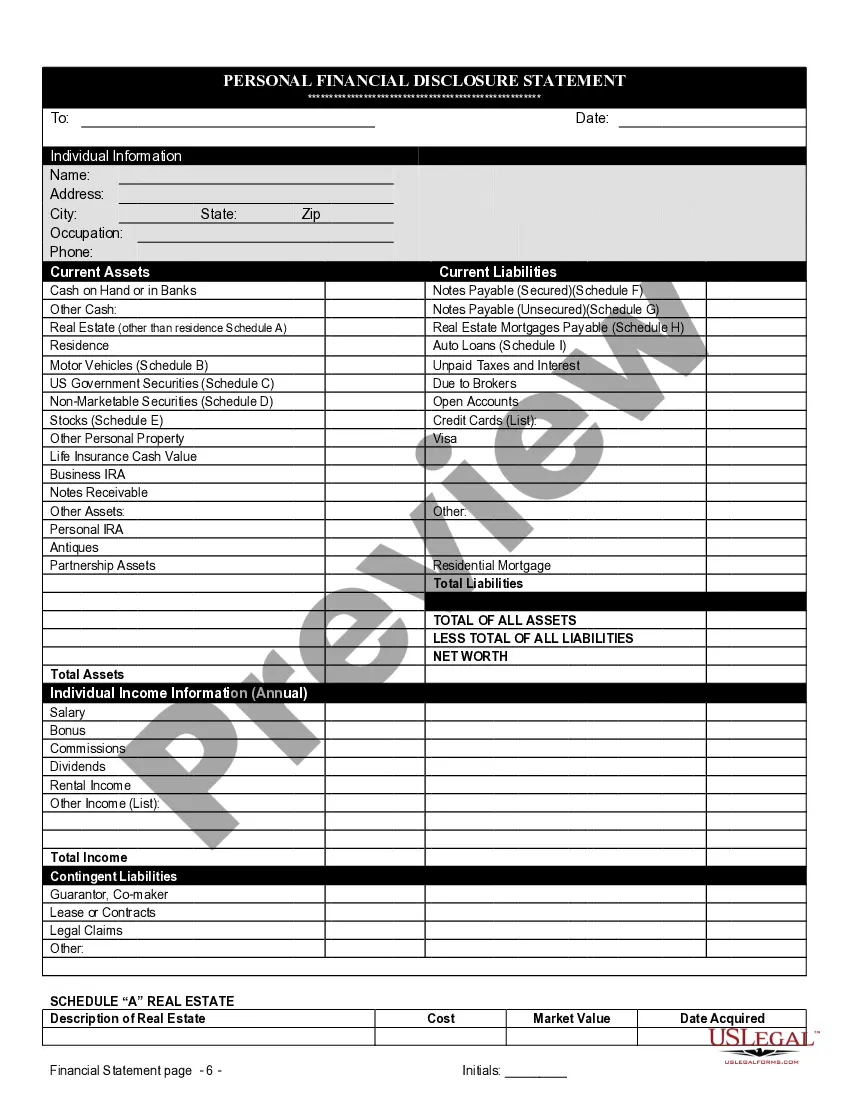

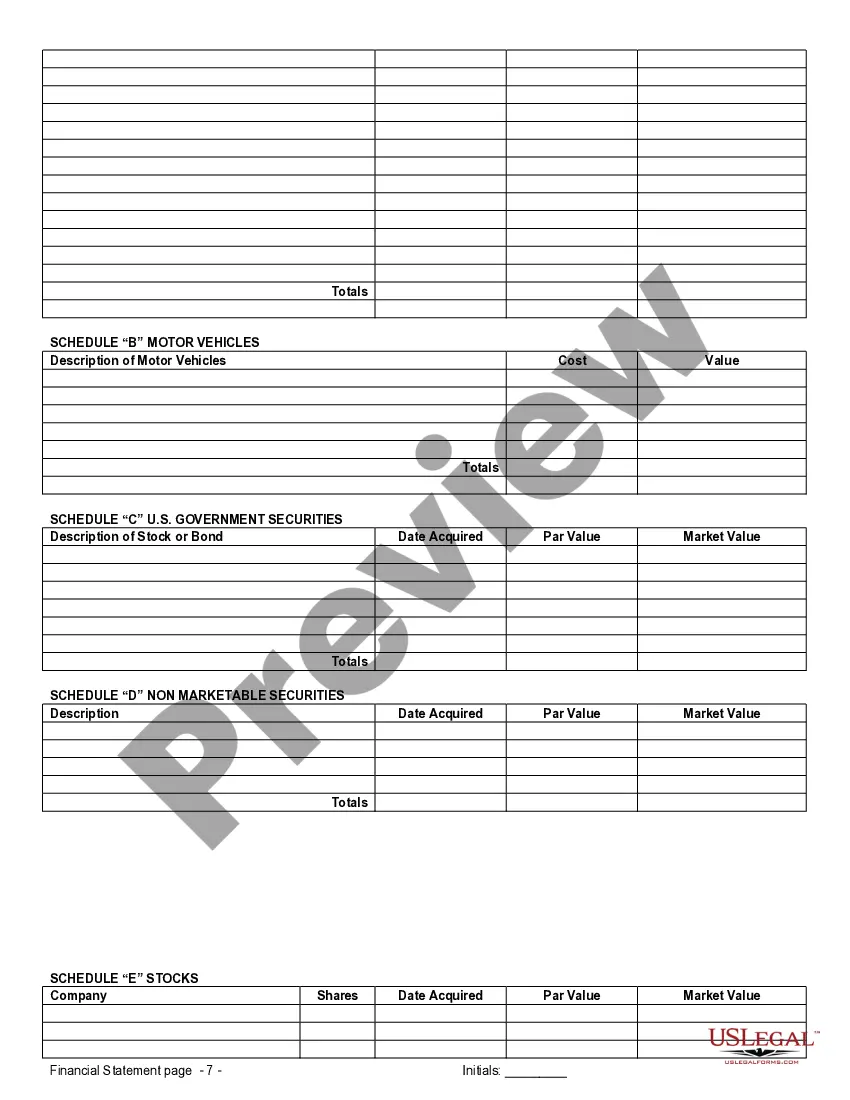

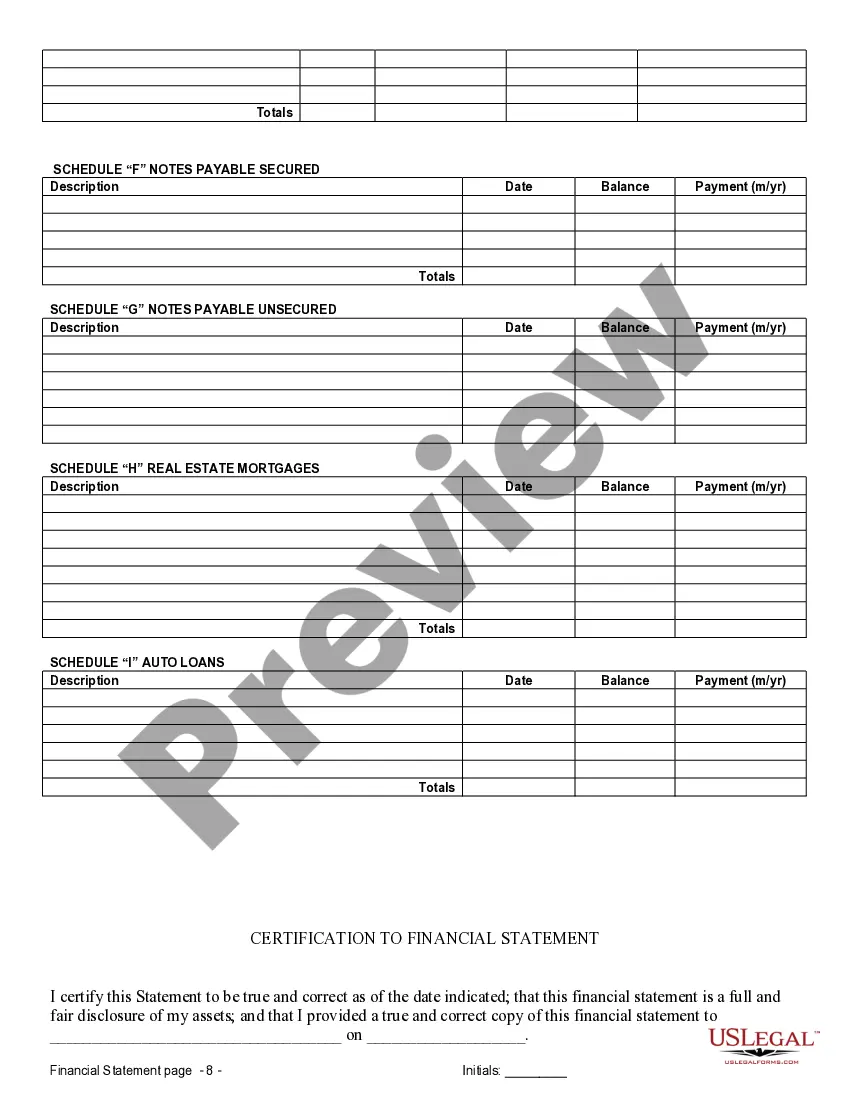

Newark, New Jersey Financial Statements in Connection with Prenuptial Premarital Agreement In the context of prenuptial or premarital agreements, Newark, New Jersey financial statements play a crucial role in ensuring transparency and protection of both parties' financial interests. These statements provide a comprehensive snapshot of each individual's financial standing before entering into a marital union, assuring transparency and facilitating fair division of assets and liabilities in case of separation or divorce. Several types of Newark, New Jersey financial statements are commonly used in connection with prenuptial or premarital agreements. These include: 1. Statement of Net Worth: The statement of net worth is an essential document that outlines an individual's financial position by detailing their assets and liabilities, income, expenses, and any other financial interests. This statement provides a clear picture of one's financial health and facilitates informed decision-making during the negotiation of a prenuptial agreement. 2. Bank Statements: Bank statements are an integral part of Newark, New Jersey financial statements in prenuptial agreements. These documents provide a comprehensive record of an individual's banking activities, including account balances, transactions, and any other significant financial activities during a specified period. Bank statements are crucial in verifying income, tracking expenditure, and uncovering any undisclosed financial obligations that may impact the prenuptial agreement. 3. Tax Returns: Tax returns serve as vital documentation in understanding an individual's financial history and obligations. By examining tax returns from previous years, each party's income, deductions, investments, and other financial liabilities can be ascertained accurately. These documents help ensure the equitable division of property and spousal support (if applicable) outlined within the prenuptial agreement. 4. Investment Statements: Investment statements, including brokerage account statements, mutual fund statements, and stock portfolios, provide insights into an individual's diverse investments and associated risks. These statements aid in determining the value of investments, any potential gains or losses, and contribute to the overall financial evaluation of each party involved in the prenuptial agreement. 5. Real Estate Documents: Real estate holds significant value in marital estates, and therefore, an assessment of real estate holdings is imperative when drafting a prenuptial agreement. Relevant real estate documents include property deeds, mortgage statements, rental agreements, and property valuation reports. These documents inform the prenuptial agreement's provisions regarding division, ownership, and potential rental income distribution of each real estate asset. 6. Business Financial Statements: If one or both parties have business interests, business financial statements become crucial in determining the value and ownership of such enterprises. These statements, including balance sheets, income statements, cash flow statements, and business tax returns, provide a comprehensive overview of the business's financial health, liabilities, and potential future earnings. In Newark, New Jersey, the use of comprehensive financial statements in connection with prenuptial or premarital agreements is vital to safeguard the financial interests of both parties. These documents ensure transparency, prevent disputes, and facilitate fair resolution in the unfortunate event of a separation or divorce. By including detailed and accurate financial statements within a prenuptial agreement, couples can proactively address their financial expectations and provide a solid foundation for their future together.

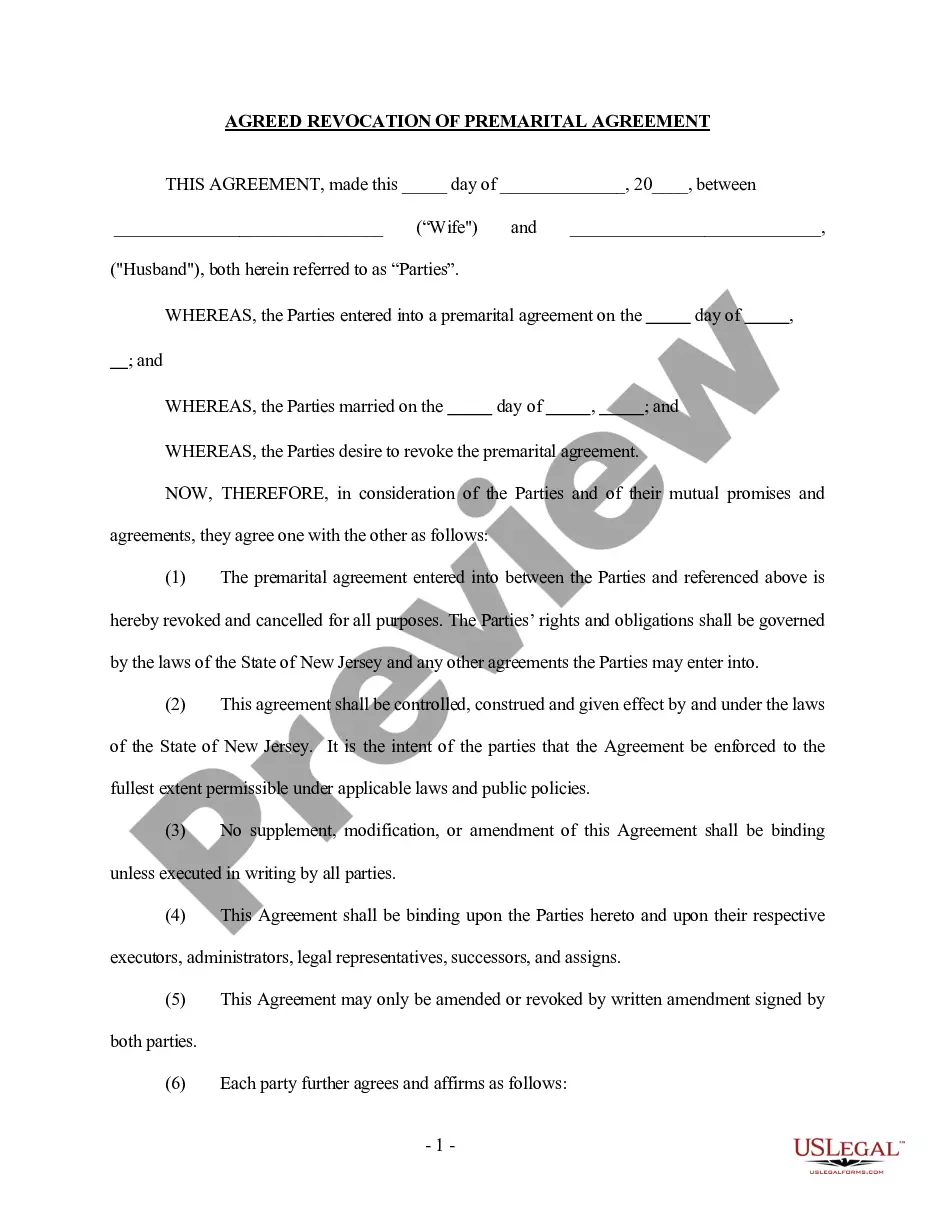

Newark Agreement

Description

How to fill out Newark New Jersey Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Take advantage of the US Legal Forms and obtain immediate access to any form sample you require. Our helpful platform with a large number of document templates makes it simple to find and get almost any document sample you need. You can download, complete, and sign the Newark New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement in a few minutes instead of surfing the Net for hours attempting to find an appropriate template.

Utilizing our library is a superb way to raise the safety of your form submissions. Our professional lawyers regularly check all the documents to make certain that the forms are appropriate for a particular region and compliant with new laws and polices.

How can you get the Newark New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement? If you have a subscription, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips listed below:

- Open the page with the form you need. Ensure that it is the template you were seeking: check its title and description, and take take advantage of the Preview feature if it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Download the file. Select the format to obtain the Newark New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and reliable form libraries on the internet. Our company is always ready to assist you in virtually any legal procedure, even if it is just downloading the Newark New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement.

Feel free to take full advantage of our service and make your document experience as convenient as possible!