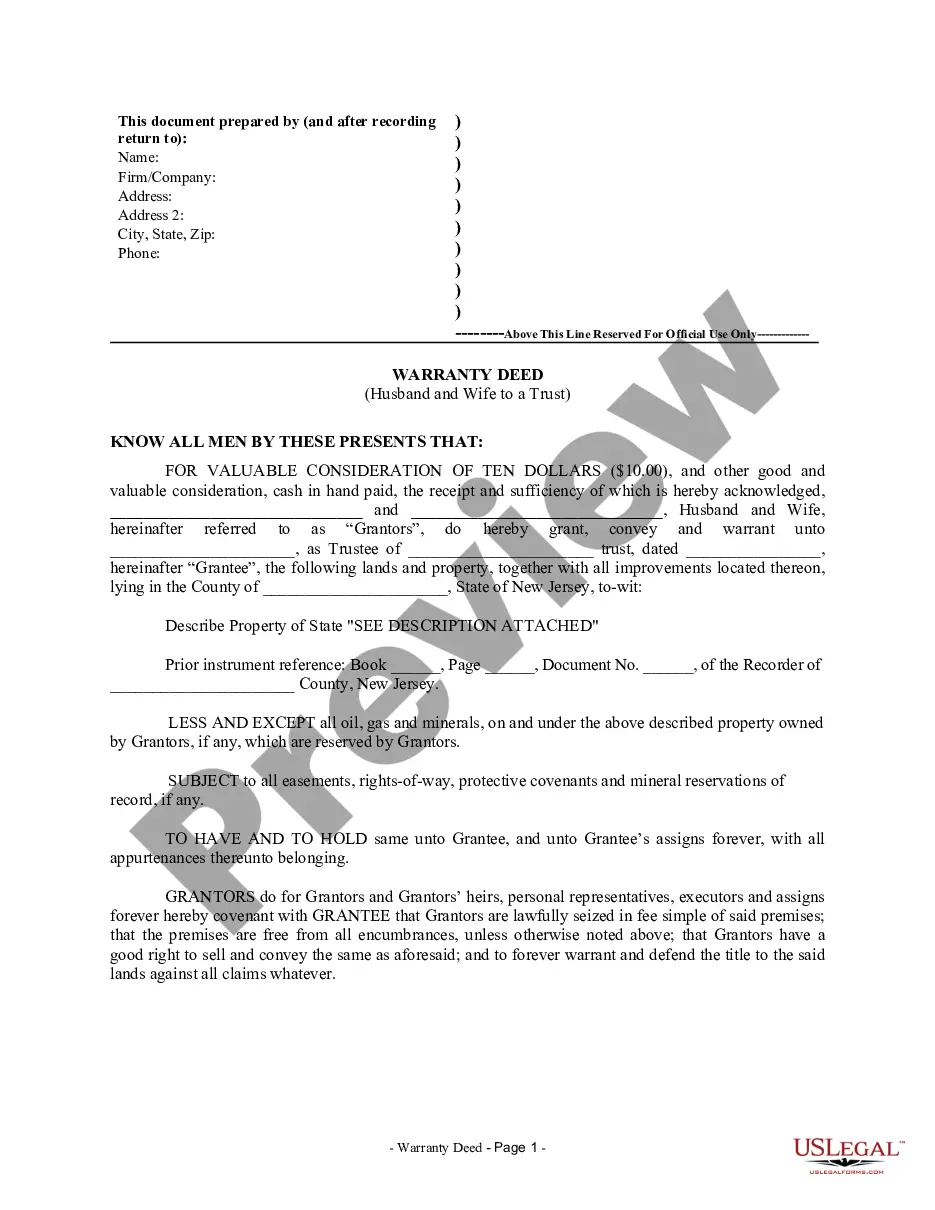

Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust

Description

How to fill out New Jersey Warranty Deed From Husband And Wife To A Trust?

Irrespective of one's social or occupational position, completing legal documents is an unfortunate requirement in the current professional landscape.

Too frequently, it becomes nearly unattainable for an individual without legal education to generate such documents from scratch due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms proves to be useful.

Verify that the template you selected is tailored to your region, as the regulations of one state or county do not apply to others.

Review the document and examine a brief summary (if offered) of situations for which the document can be used.

- Our platform provides an extensive repository of over 85,000 ready-to-use state-specific forms that cater to nearly every legal circumstance.

- US Legal Forms also acts as an exceptional tool for associates or legal advisors looking to save time by using our DIY documents.

- Whether you require the Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust or any other documents that would be valid in your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how to quickly obtain the Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust using our dependable platform.

- If you are already a member, you may proceed to Log In to your account to download the correct form.

- However, if you are new to our collection, make sure to adhere to these instructions before getting the Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust.

Form popularity

FAQ

To transfer a deed to a family member in New Jersey, you must complete a new deed form, typically a warranty deed. You will need to include relevant property details and ensure it is signed and notarized. After preparing the document, you should file it with the county clerk's office. For those considering a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust, using a structured process can provide clarity and legal protection.

Deciding whether to gift a house or put it in a trust depends on your goals. Gifting can have immediate tax implications, whereas placing the property in a trust, like a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust, can provide long-term management. Consider your estate planning objectives and consult a professional who can guide you in making the best decision.

While putting property in a trust has its benefits, there are also drawbacks. For example, you may face upfront costs for legal fees and paperwork, such as obtaining a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust. Furthermore, a trust can complicate the management of your property, as it may require ongoing administrative tasks and regular updates to remain compliant.

To place your house in a trust in New Jersey, start by selecting the type of trust that fits your needs. You will need to draft a deed that transfers the property into the trust, often referred to as a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust. After completing the paperwork, ensure it gets notarized and recorded with the county clerk’s office to make the transfer official.

You do not necessarily need a lawyer to transfer a deed in New Jersey, but it's highly recommended. Understanding the legal requirements can be complex, especially when dealing with a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust. A lawyer can ensure that the deed meets all legal standards, protecting your investment and simplifying the process.

Yes, you can add a spouse to a deed without refinancing your mortgage. This often involves creating a new warranty deed that lists both names. In cases where you are using a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust, it's especially important to follow the specific legal requirements to ensure proper transfer and protection under the trust. Consider utilizing online legal services to streamline this process.

To transfer property to a trust in New Jersey, you need to prepare a new deed that conveys the property to the trust. You should complete a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust, ensuring it includes all necessary details. After the deed is ready, file it with the county clerk's office to make it official. This process can protect your assets and simplify management for your heirs.

Yes, you can add a name to a warranty deed. This process typically involves creating a new deed that reflects the additional name. It's important to ensure that this type of modification follows the laws in Jersey City, New Jersey, especially if you are considering a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust. Using a proper legal service can simplify this task for you.

To add your spouse to your deed in NJ, start by preparing a new warranty deed that includes both names as co-owners. Ensure that the deed follows all legal requirements and is signed in front of a notary. Once completed, file the deed with the county clerk to make it official. This process is often facilitated by using a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust, ensuring compliance and ease.

Adding someone to a deed in New Jersey can have significant tax implications, including potential gift tax responsibilities. When you transfer property to someone else, it is treated as a gift, and you may need to file a gift tax return if the value exceeds certain limits. It’s wise to consult with a tax advisor to understand these implications fully. Executing a Jersey City New Jersey Warranty Deed from Husband and Wife to a Trust can aid in managing these complexities effectively.