The Paterson Amendment to Postnuptial Property Agreement is a legal provision in the state of New Jersey that allows couples to modify their existing postnuptial property agreements. This amendment enables spouses to make changes to their agreement by adding or removing certain terms or conditions, ultimately ensuring that both parties' rights and interests are adequately protected. In New Jersey, there are various types of Paterson Amendments to Postnuptial Property Agreements that spouses can consider based on their individual circumstances and needs. Some of these include: 1. Financial Modifications: This type of amendment focuses on altering the financial aspects of the original postnuptial property agreement. It can address issues like asset division, debt allocation, spousal support, and other monetary matters. By amending these financial clauses, couples can update their agreement to reflect any changes in their financial circumstances or to address new concerns that may have arisen since the initial agreement was made. 2. Custody or Child Support Modifications: This category of Paterson Amendment deals specifically with modifications related to child custody and support. It allows couples to make changes to their parentage and visitation rights, as well as adjust child support payments agreed upon in the original postnuptial property agreement. This type of amendment is commonly sought when there is a significant change in the parents' or child's situation, such as a relocation, new employment, or changes in the child's needs. 3. Property Distribution Modifications: Paterson Amendments can also be used to modify the way property is divided between spouses in the event of separation or divorce. This type of amendment allows couples to revise the terms of their original agreement regarding the division of real estate, personal belongings, investments, and any other jointly owned assets. Changes may be necessitated by changes in the value of assets, the acquisition of new properties, or other circumstances impacting the equitable distribution of property. 4. Inheritance Rights Modifications: Spouses who have previously agreed on specific inheritance arrangements can use Paterson Amendments to update or modify these provisions. By doing so, couples can ensure that the distribution of assets upon one spouse's death aligns with their current wishes and priorities. This type of amendment is particularly relevant when either spouse's financial situation, family dynamics, or estate planning goals have significantly changed or evolved since establishing the original postnuptial property agreement. It is important to note that specific legal advice should be sought when considering a Paterson Amendment to a Postnuptial Property Agreement in New Jersey. Consulting with an experienced family law attorney can provide guidance tailored to your unique circumstances and help determine which type of amendment is most appropriate for your situation.

Paterson New Jersey Amendment to Postnuptial Property Agreement

State:

New Jersey

City:

Paterson

Control #:

NJ-01715-AZ

Format:

Word;

Rich Text

Instant download

Description

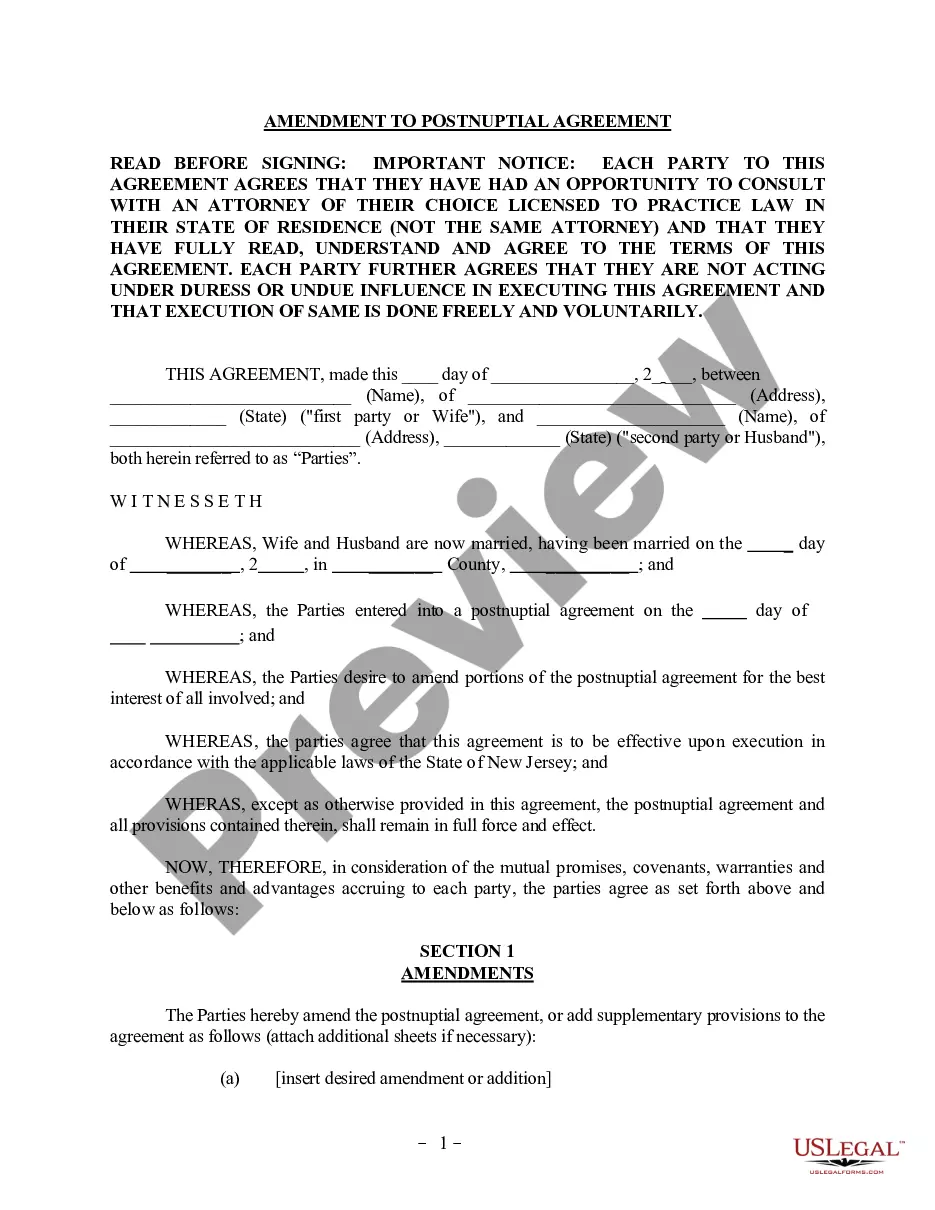

This Amendment to Postnuptial Property Agreement form is for use by parties to make amendments or additions to an existing postnuptial agreement. Both parties are required to sign the amendment in the presence of a notary public.

The Paterson Amendment to Postnuptial Property Agreement is a legal provision in the state of New Jersey that allows couples to modify their existing postnuptial property agreements. This amendment enables spouses to make changes to their agreement by adding or removing certain terms or conditions, ultimately ensuring that both parties' rights and interests are adequately protected. In New Jersey, there are various types of Paterson Amendments to Postnuptial Property Agreements that spouses can consider based on their individual circumstances and needs. Some of these include: 1. Financial Modifications: This type of amendment focuses on altering the financial aspects of the original postnuptial property agreement. It can address issues like asset division, debt allocation, spousal support, and other monetary matters. By amending these financial clauses, couples can update their agreement to reflect any changes in their financial circumstances or to address new concerns that may have arisen since the initial agreement was made. 2. Custody or Child Support Modifications: This category of Paterson Amendment deals specifically with modifications related to child custody and support. It allows couples to make changes to their parentage and visitation rights, as well as adjust child support payments agreed upon in the original postnuptial property agreement. This type of amendment is commonly sought when there is a significant change in the parents' or child's situation, such as a relocation, new employment, or changes in the child's needs. 3. Property Distribution Modifications: Paterson Amendments can also be used to modify the way property is divided between spouses in the event of separation or divorce. This type of amendment allows couples to revise the terms of their original agreement regarding the division of real estate, personal belongings, investments, and any other jointly owned assets. Changes may be necessitated by changes in the value of assets, the acquisition of new properties, or other circumstances impacting the equitable distribution of property. 4. Inheritance Rights Modifications: Spouses who have previously agreed on specific inheritance arrangements can use Paterson Amendments to update or modify these provisions. By doing so, couples can ensure that the distribution of assets upon one spouse's death aligns with their current wishes and priorities. This type of amendment is particularly relevant when either spouse's financial situation, family dynamics, or estate planning goals have significantly changed or evolved since establishing the original postnuptial property agreement. It is important to note that specific legal advice should be sought when considering a Paterson Amendment to a Postnuptial Property Agreement in New Jersey. Consulting with an experienced family law attorney can provide guidance tailored to your unique circumstances and help determine which type of amendment is most appropriate for your situation.

Free preview

How to fill out Paterson New Jersey Amendment To Postnuptial Property Agreement?

If you’ve already used our service before, log in to your account and download the Paterson Amendment to Postnuptial Property Agreement - New Jersey on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Paterson Amendment to Postnuptial Property Agreement - New Jersey. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!