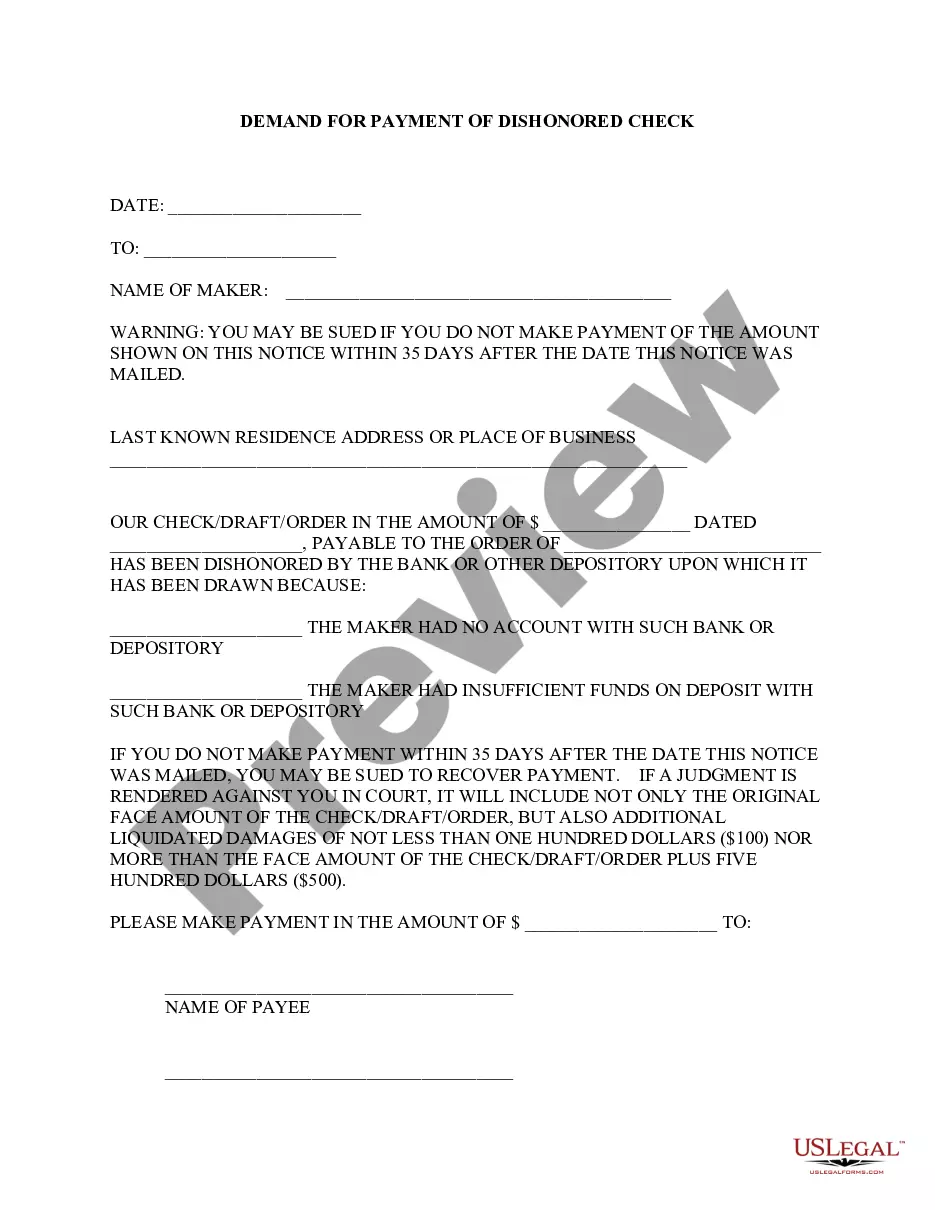

Title: Understanding the Elizabeth, New Jersey Demand for Payment of Dishonored Checks — Types and Process Introduction: The Elizabeth, New Jersey Demand for Payment of Dishonored Check is a legal procedure used to recover funds from a person or entity whose check has been dishonored due to insufficient funds or any other reason. This article aims to provide a detailed description of the demand process, its types, and the steps involved in pursuing legal action. Keywords: Elizabeth, New Jersey, demand for payment, dishonored check, legal procedure, insufficient funds, pursuing legal action. 1. Different Types of Elizabeth, New Jersey Demand for Payment of Dishonored Checks: a. Personal Dishonored Checks: — This type of dishonored check occurs when an individual writes a check on their personal account, but the check is returned unpaid due to insufficient funds or other reasons. b. Business Dishonored Checks: — Business dishonored checks involve checks written by companies or businesses that are not honored by the bank due to various factors such as insufficient funds, closed accounts, or irregularities. 2. The Elizabeth, New Jersey Demand for Payment Process: a. Notice of Dishonor: — The individual or business who receives a dishonored check must first send a written notice to the check issuer, informing them of the situation. This notice typically includes details such as the check amount, date, and a demand for payment. b. Waiting Period: — Upon receiving the notice, the check issuer is given a reasonable amount of time (usually around ten days) to make the payment or rectify the issue. c. Non-Payment: — If the check issuer fails to make the payment or take corrective action within the given timeframe, the payee may proceed with legal action by filing a lawsuit in a small claims court or other appropriate legal forums. d. Collecting Payment: — If the court rules in favor of the payee, various methods can be employed to collect the payment, such as wage garnishment, bank account levy, or asset seizure. Keywords: notice of dishonor, waiting period, non-payment, legal action, small claims court, lawsuit, wage garnishment, bank account levy, asset seizure. Conclusion: The Elizabeth, New Jersey Demand for Payment of Dishonored Check is an essential legal tool for individuals and businesses to pursue their rightful funds when faced with a dishonored check. By following the required steps and taking appropriate legal action, payees can increase their chances of recovering the owed amount successfully. Keywords: Elizabeth, New Jersey, demand for payment, dishonored check, legal tool, recover funds, rightful funds, legal action, recover owed amount.

Elizabeth New Jersey Demand For Payment of Dishonored Check

Description

How to fill out Elizabeth New Jersey Demand For Payment Of Dishonored Check?

If you are searching for a relevant form template, it’s difficult to find a better service than the US Legal Forms website – probably the most extensive libraries on the web. Here you can find a huge number of templates for business and individual purposes by types and states, or key phrases. Using our advanced search option, finding the newest Elizabeth New Jersey Demand For Payment of Dishonored Check is as elementary as 1-2-3. Additionally, the relevance of each document is proved by a group of professional attorneys that on a regular basis review the templates on our website and revise them according to the latest state and county demands.

If you already know about our platform and have a registered account, all you need to receive the Elizabeth New Jersey Demand For Payment of Dishonored Check is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have discovered the form you need. Read its explanation and utilize the Preview function to see its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to discover the needed file.

- Affirm your choice. Click the Buy now option. After that, select your preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Indicate the file format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the obtained Elizabeth New Jersey Demand For Payment of Dishonored Check.

Each form you save in your profile has no expiry date and is yours forever. You can easily access them via the My Forms menu, so if you need to get an extra copy for modifying or creating a hard copy, feel free to return and download it once more whenever you want.

Take advantage of the US Legal Forms professional collection to get access to the Elizabeth New Jersey Demand For Payment of Dishonored Check you were looking for and a huge number of other professional and state-specific samples in one place!