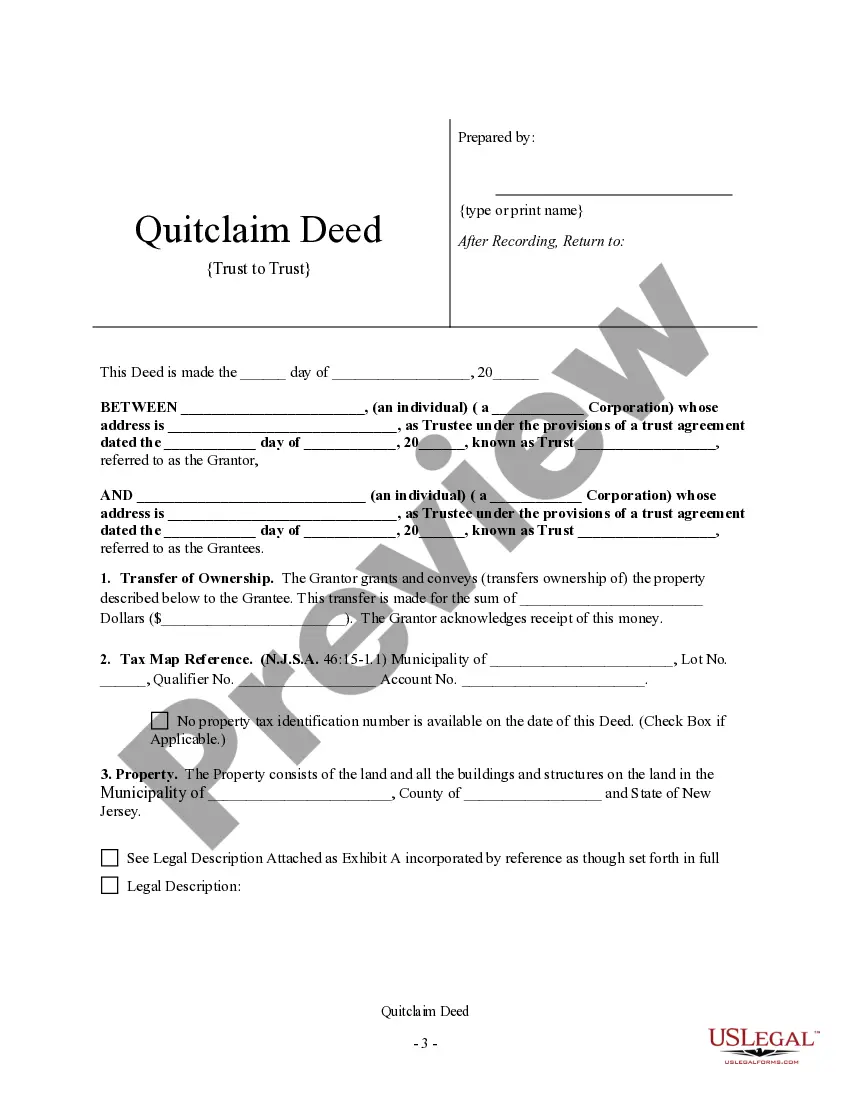

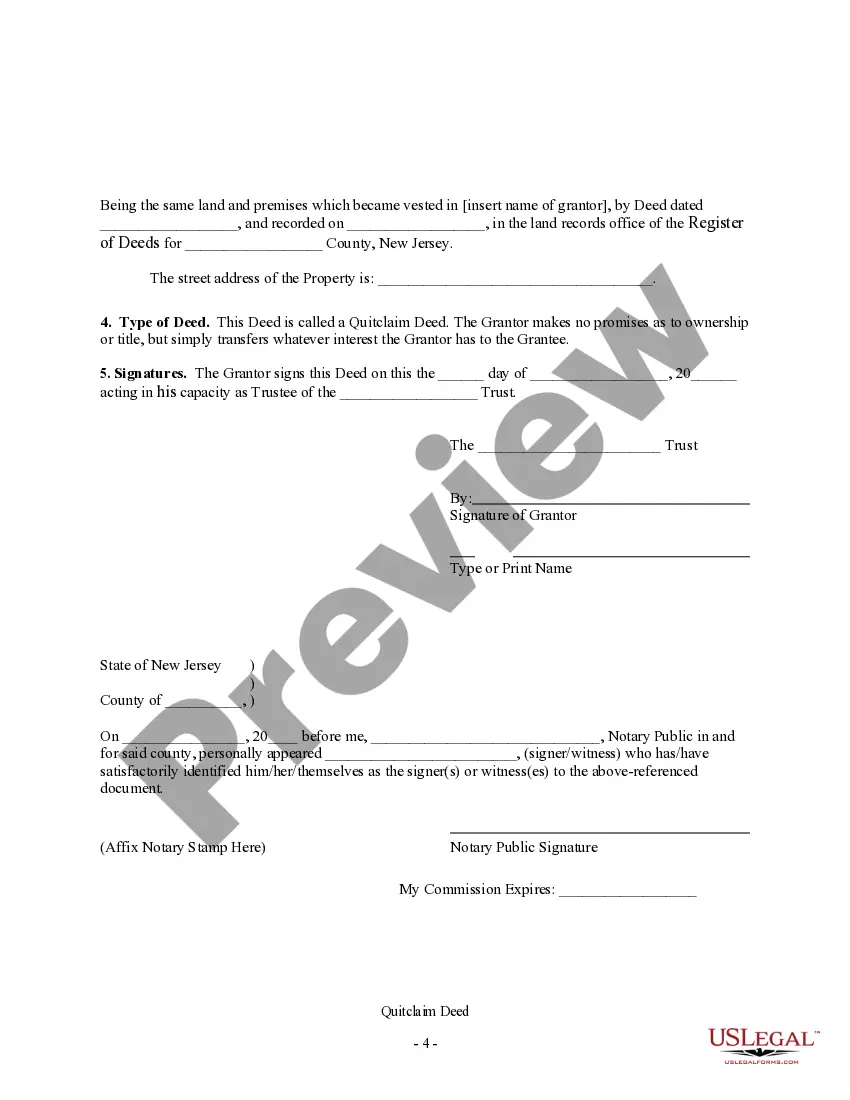

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Quitclaim Deed is a legal document used to transfer property ownership from one party to another. In the specific case of a Quitclaim Deed from a Trust to a Trust, it involves transferring property from one trust entity to another trust entity. This type of transfer is typically utilized by trust administrators or trustees to transfer property assets held in one trust to a different trust for various reasons, such as reorganization or tax planning. In Paterson, New Jersey, there are several types of Quitclaim Deeds from a Trust to a Trust that one might come across. The most common ones include: 1. Interviews Trust to Testamentary Trust Quitclaim Deed: This type of Quitclaim Deed is used when property assets held in an interviews trust, also known as a living trust, are transferred to a testamentary trust, which is created through a person's will. This transfer can occur upon the death of the granter or upon specific conditions outlined in the trust documents. 2. Revocable Trust to Irrevocable Trust Quitclaim Deed: Here, a Revocable Trust, which can be altered or revoked by the granter, transfers assets to an Irrevocable Trust, which cannot be amended or terminated without the consent of the beneficiaries. This transfer is often done for estate planning purposes or to protect assets from potential creditors. 3. Family Trust to Charitable Trust Quitclaim Deed: In this scenario, property assets held in a Family Trust are transferred to a Charitable Trust. This type of transfer is frequently utilized for philanthropic purposes, allowing the granters to support charitable organizations or causes while enjoying potential tax advantages. 4. Granter Trust to Revocable Living Trust Quitclaim Deed: A Granter Trust is a type of living trust where the granter retains control over trust assets. A Quitclaim Deed can be used to transfer assets from a Granter Trust to a Revocable Living Trust, which offers more flexibility and control while still avoiding the probate process. It is essential to consult with a qualified attorney or trust specialist familiar with New Jersey state laws and regulations when dealing with Quitclaim Deeds from a Trust to a Trust in Paterson. They can provide specific guidance and ensure all legal requirements are met during the transfer process.A Quitclaim Deed is a legal document used to transfer property ownership from one party to another. In the specific case of a Quitclaim Deed from a Trust to a Trust, it involves transferring property from one trust entity to another trust entity. This type of transfer is typically utilized by trust administrators or trustees to transfer property assets held in one trust to a different trust for various reasons, such as reorganization or tax planning. In Paterson, New Jersey, there are several types of Quitclaim Deeds from a Trust to a Trust that one might come across. The most common ones include: 1. Interviews Trust to Testamentary Trust Quitclaim Deed: This type of Quitclaim Deed is used when property assets held in an interviews trust, also known as a living trust, are transferred to a testamentary trust, which is created through a person's will. This transfer can occur upon the death of the granter or upon specific conditions outlined in the trust documents. 2. Revocable Trust to Irrevocable Trust Quitclaim Deed: Here, a Revocable Trust, which can be altered or revoked by the granter, transfers assets to an Irrevocable Trust, which cannot be amended or terminated without the consent of the beneficiaries. This transfer is often done for estate planning purposes or to protect assets from potential creditors. 3. Family Trust to Charitable Trust Quitclaim Deed: In this scenario, property assets held in a Family Trust are transferred to a Charitable Trust. This type of transfer is frequently utilized for philanthropic purposes, allowing the granters to support charitable organizations or causes while enjoying potential tax advantages. 4. Granter Trust to Revocable Living Trust Quitclaim Deed: A Granter Trust is a type of living trust where the granter retains control over trust assets. A Quitclaim Deed can be used to transfer assets from a Granter Trust to a Revocable Living Trust, which offers more flexibility and control while still avoiding the probate process. It is essential to consult with a qualified attorney or trust specialist familiar with New Jersey state laws and regulations when dealing with Quitclaim Deeds from a Trust to a Trust in Paterson. They can provide specific guidance and ensure all legal requirements are met during the transfer process.