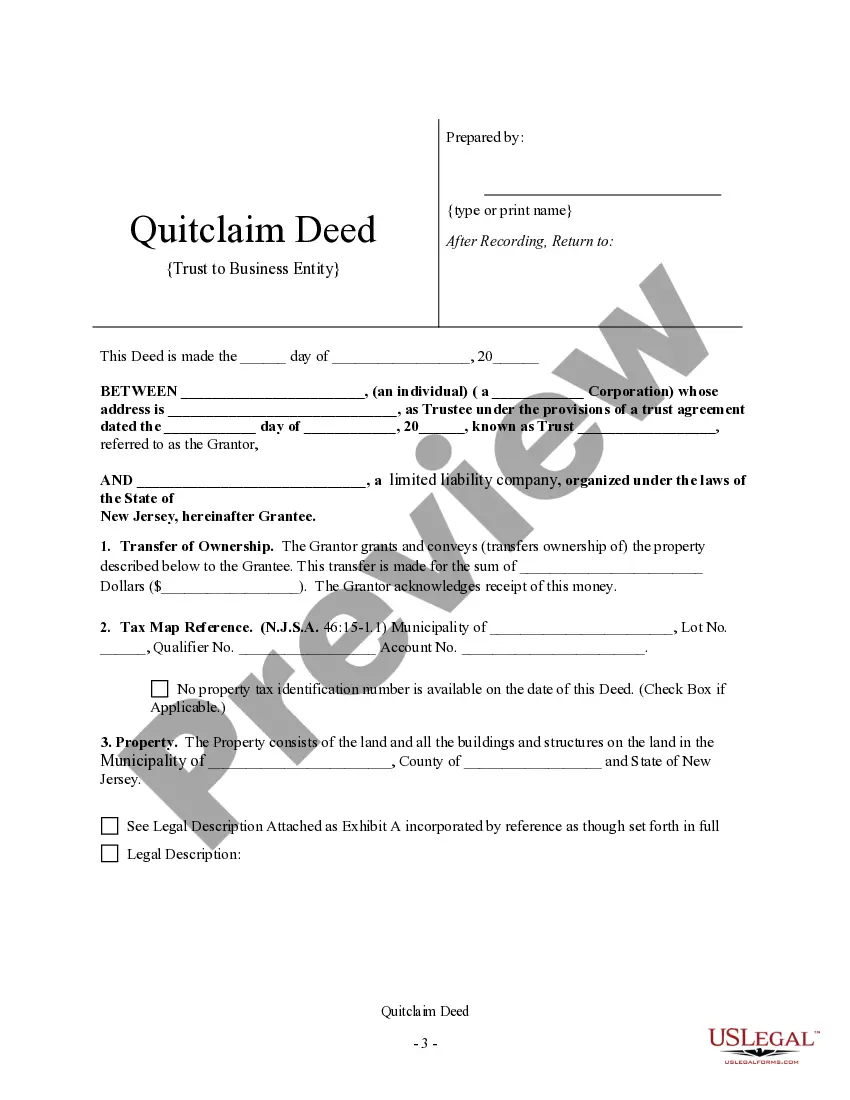

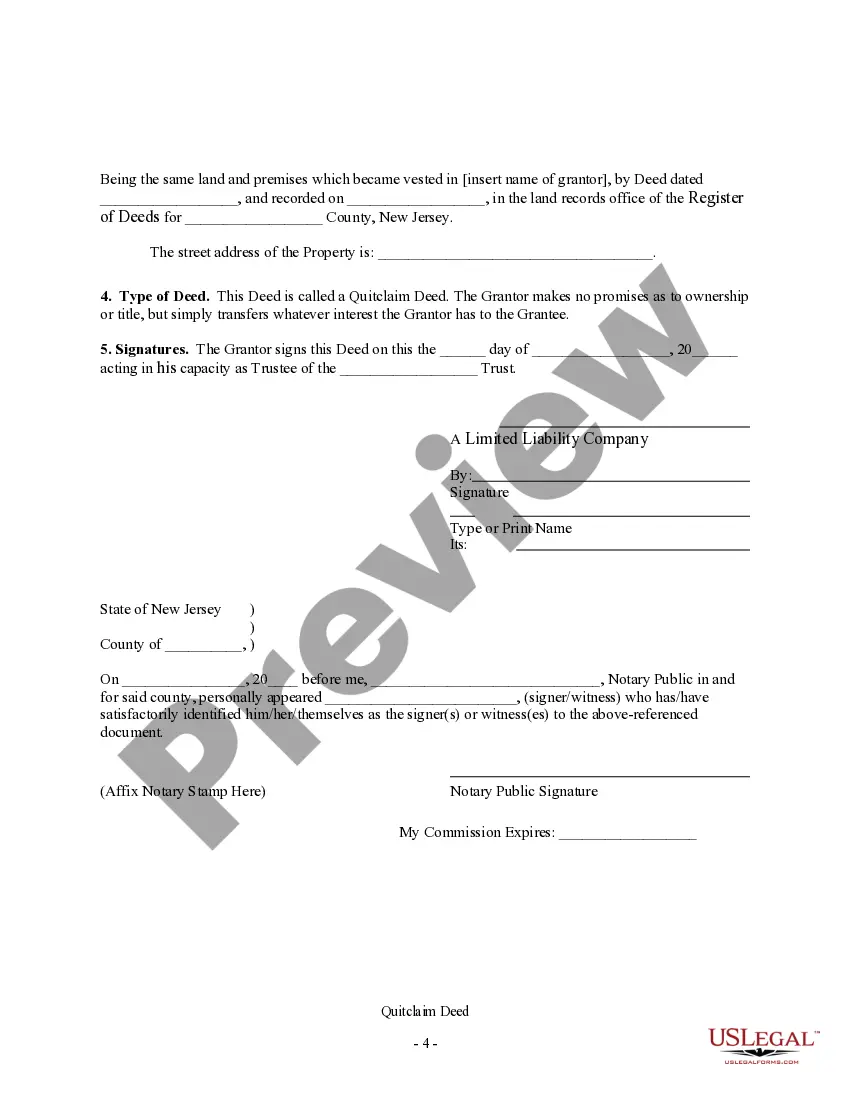

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is a Business Entity - a limited liability company or a corporation. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

A Paterson New Jersey Quitclaim Deed — Trust to Business Entity is a legal document that transfers ownership of property from a trust to a business entity through the use of a quitclaim deed. This type of deed is commonly used when a property held in a trust needs to be transferred to a business entity, such as a corporation, limited liability company (LLC), or partnership. The Paterson New Jersey Quitclaim Deed — Trust to Business Entity serves as evidence of the transfer of ownership and specifies the details of the property, parties involved, and any relevant legal obligations. It outlines the terms and conditions of the transfer, including any applicable warranties or encumbrances on the property. There are different types of Paterson New Jersey Quitclaim Deeds — Trust to Business Entity, such as: 1. Paterson New Jersey Quitclaim Deed — Trust to Corporation: This is used when a property held in a trust is transferred to a corporation. It establishes the legal transfer of ownership and outlines the responsibilities and obligations of both parties involved. 2. Paterson New Jersey Quitclaim Deed — Trust to LLC: This type of deed is used when a property held in a trust is transferred to a limited liability company (LLC). It ensures that the transfer is legally valid and protects the interests of both the trust and the LLC. 3. Paterson New Jersey Quitclaim Deed — Trust to Partnership: This deed is utilized when a property held in a trust is transferred to a partnership. It establishes the terms of the transfer and specifies the rights and responsibilities of both parties. In all cases, it is crucial to consult with a qualified attorney or legal professional familiar with New Jersey real estate laws to ensure the proper execution of the Paterson New Jersey Quitclaim Deed — Trust to Business Entity. They can guide you through the process, review the document, and address any specific concerns or requirements related to your unique situation. Keywords: Paterson New Jersey, Quitclaim Deed, Trust, Business Entity, transfer of ownership, legal document, property, corporation, limited liability company, partnership, warranties, encumbrances, obligations, New Jersey real estate laws, attorney