Paterson New Jersey Renunciation And Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to waive their rights to inherit property when someone dies without a will. This renunciation enables them to release their claim to the deceased's assets, both real and personal property, by disclaiming any ownership or interest in the estate. There are various types of Paterson New Jersey Renunciation And Disclaimer of Property received by Intestate Succession, including: 1. Voluntary Renunciation: This type of renunciation occurs when an individual willingly chooses to relinquish their rights to inherit the property. They submit a written declaration, commonly known as a renunciation, to the Paterson New Jersey Surrogate Court stating their intent to disclaim any interest in the estate. 2. Involuntary Renunciation: In some cases, an individual may be required to renounce their right to inherit property received by intestate succession due to specific circumstances. This could arise if the renounced owes a substantial debt to the estate or if renouncing the inheritance is necessary to comply with certain legal obligations. 3. Partial Renunciation: Instead of completely disclaiming their interest in the entire estate, an individual may choose to partially renounce their rights to specific assets or property. This allows them to retain ownership of certain items while relinquishing others. 4. Conditional Renunciation: In certain scenarios, a person may renounce their claim to the property on the condition that it passes to another designated beneficiary. This type of renunciation comes into effect only if the specified conditions are met. 5. Posthumous Renunciation: This kind of renunciation occurs when an individual renounces their inheritance rights after the death of the decedent. It is important to note that the renunciation must take place within a specific time frame following the individual's knowledge or awareness of their entitlement, typically within nine months from the decedent's passing. Renouncing the property received by intestate succession through Paterson New Jersey Renunciation And Disclaimer of Property process is a significant legal decision that should not be taken lightly. It is best to consult with an experienced attorney who specializes in estate planning and probate laws to ensure compliance with all necessary legal requirements and to understand the potential consequences of renunciation.

Paterson New Jersey Renunciation And Disclaimer of Property received by Intestate Succession

State:

New Jersey

City:

Paterson

Control #:

NJ-03-03

Format:

Word

Instant download

Description

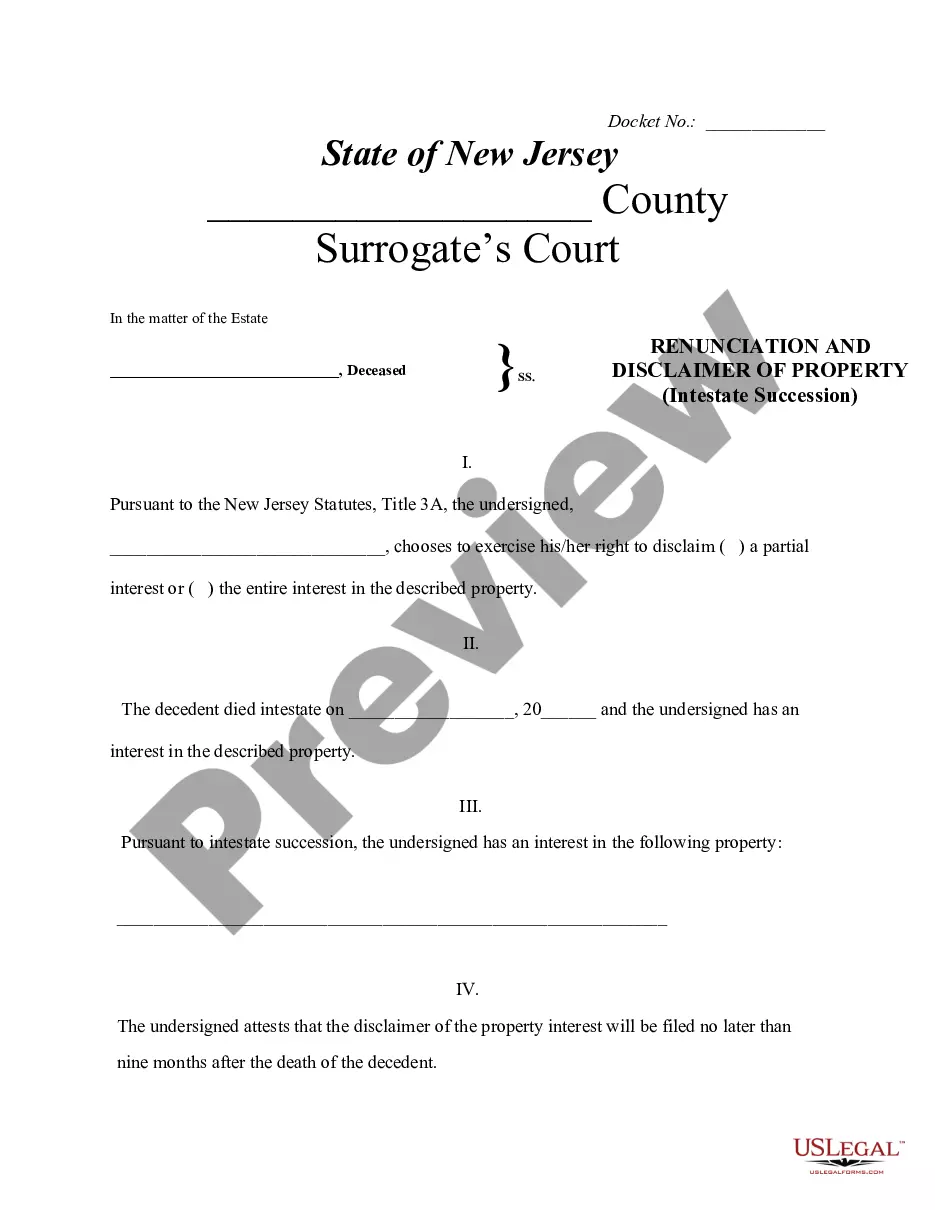

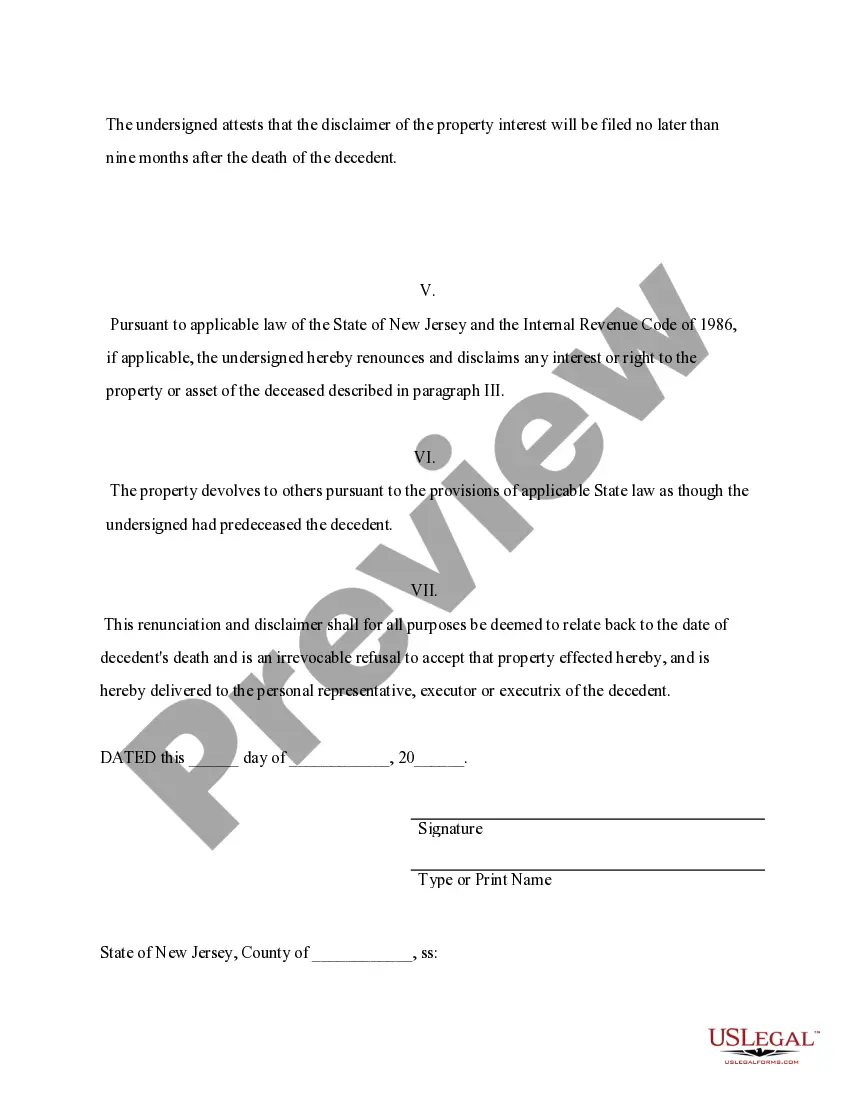

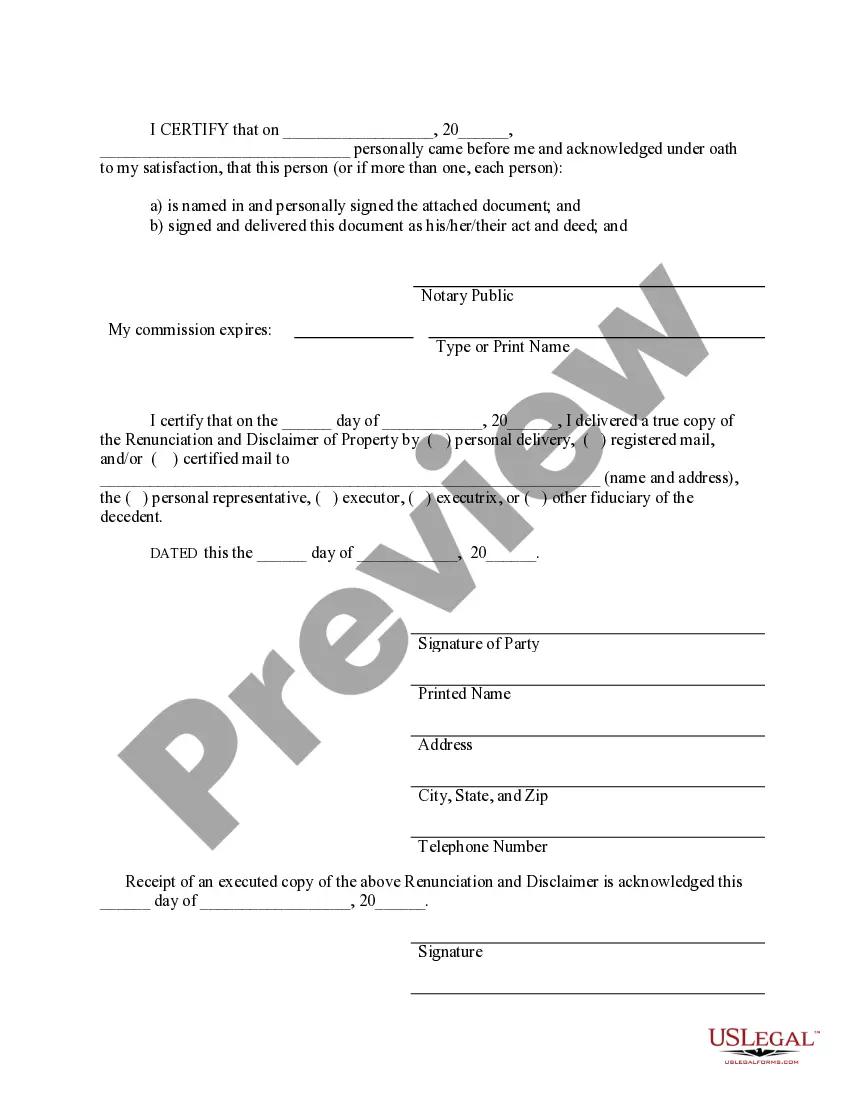

This form is a Renunciation and Disclaimer of Property acquired through intestate succession where the decedent died intestate and the beneficiary gained an interest in the property of the decedent, but, has chosen to disclaim a portion of or the entire interest in the property pursuant to the New Jersey Statutes, Title 3A. The beneficiary also attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify delivery of the document.

Paterson New Jersey Renunciation And Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to waive their rights to inherit property when someone dies without a will. This renunciation enables them to release their claim to the deceased's assets, both real and personal property, by disclaiming any ownership or interest in the estate. There are various types of Paterson New Jersey Renunciation And Disclaimer of Property received by Intestate Succession, including: 1. Voluntary Renunciation: This type of renunciation occurs when an individual willingly chooses to relinquish their rights to inherit the property. They submit a written declaration, commonly known as a renunciation, to the Paterson New Jersey Surrogate Court stating their intent to disclaim any interest in the estate. 2. Involuntary Renunciation: In some cases, an individual may be required to renounce their right to inherit property received by intestate succession due to specific circumstances. This could arise if the renounced owes a substantial debt to the estate or if renouncing the inheritance is necessary to comply with certain legal obligations. 3. Partial Renunciation: Instead of completely disclaiming their interest in the entire estate, an individual may choose to partially renounce their rights to specific assets or property. This allows them to retain ownership of certain items while relinquishing others. 4. Conditional Renunciation: In certain scenarios, a person may renounce their claim to the property on the condition that it passes to another designated beneficiary. This type of renunciation comes into effect only if the specified conditions are met. 5. Posthumous Renunciation: This kind of renunciation occurs when an individual renounces their inheritance rights after the death of the decedent. It is important to note that the renunciation must take place within a specific time frame following the individual's knowledge or awareness of their entitlement, typically within nine months from the decedent's passing. Renouncing the property received by intestate succession through Paterson New Jersey Renunciation And Disclaimer of Property process is a significant legal decision that should not be taken lightly. It is best to consult with an experienced attorney who specializes in estate planning and probate laws to ensure compliance with all necessary legal requirements and to understand the potential consequences of renunciation.

Free preview

How to fill out Paterson New Jersey Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you’ve already used our service before, log in to your account and download the Paterson New Jersey Renunciation And Disclaimer of Property received by Intestate Succession on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Paterson New Jersey Renunciation And Disclaimer of Property received by Intestate Succession. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!