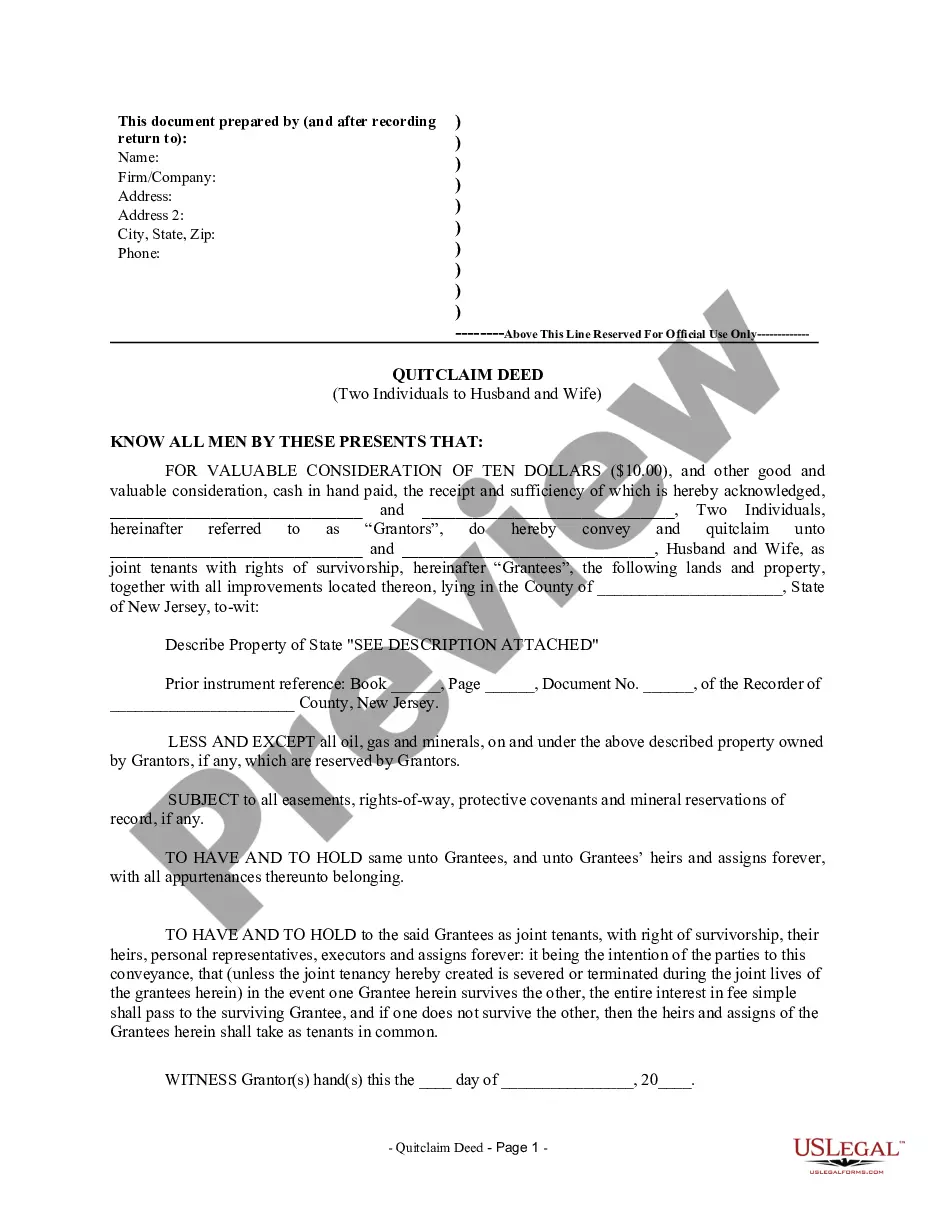

Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife

Description

How to fill out New Jersey Quitclaim Deed By Two Individuals To Husband And Wife?

If you are looking for a suitable form template, it’s hard to find a more accessible location than the US Legal Forms site – likely the most comprehensive collections online.

Here you can obtain a vast number of templates for both organizational and personal uses categorized by types and states, or by keywords.

With the superior search functionality, obtaining the latest Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and save it on your device.

- Additionally, the relevance of each document is confirmed by a team of experienced attorneys who continuously assess the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to obtain the Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have selected the template you wish to use. Review its description and use the Preview option (if available) to examine its details. If it does not satisfy your needs, use the Search bar at the top of the page to find the necessary document.

- Confirm your choice. Click the Buy now button. Following this, select your desired subscription plan and provide your information to create an account.

Form popularity

FAQ

In New Jersey, a quitclaim deed can be prepared by anyone, including the property owners themselves. However, having a legal professional draft the Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife is recommended to ensure that all legal requirements are met. Additionally, platforms such as uslegalforms can help you create a valid deed quickly and correctly.

One disadvantage of adding someone to a deed is that it may expose the property to new liabilities. For example, if the co-owner faces financial issues or legal problems, your property could be affected. It’s important to consider these risks when using a Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife.

You can add your spouse to your deed without refinancing by executing a quitclaim deed. This method transfers ownership without involving your mortgage, making it a simple option. A Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife is the ideal document for this purpose, allowing you to legally include your spouse as a co-owner.

To add your spouse to a deed in New Jersey, you typically need to complete a new deed that names both individuals as owners. You can file a Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife, which is a straightforward process. It is wise to seek guidance through platforms like uslegalforms to ensure accuracy and compliance with local laws.

It is advisable for a married couple to have both names on the deed. This ensures both spouses have legal ownership and rights to the property. Including both names in a Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife helps avoid potential disputes about property interest in the future.

In New Jersey, when one spouse signs a quit claim deed, that deed typically transfers their interest, which may affect their rights to the property. However, the spouse who does not sign may still retain rights depending on how the property is titled. It’s wise to consult a legal professional to understand the implications of a Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife fully.

In Pennsylvania, a quitclaim deed allows the owner to transfer their interest in a property without any warranties. This means that the grantee accepts the property as-is, which can be significant for potential buyers. This process can be beneficial for couples looking to jointly own property, such as in a Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife, where clarity in ownership is key.

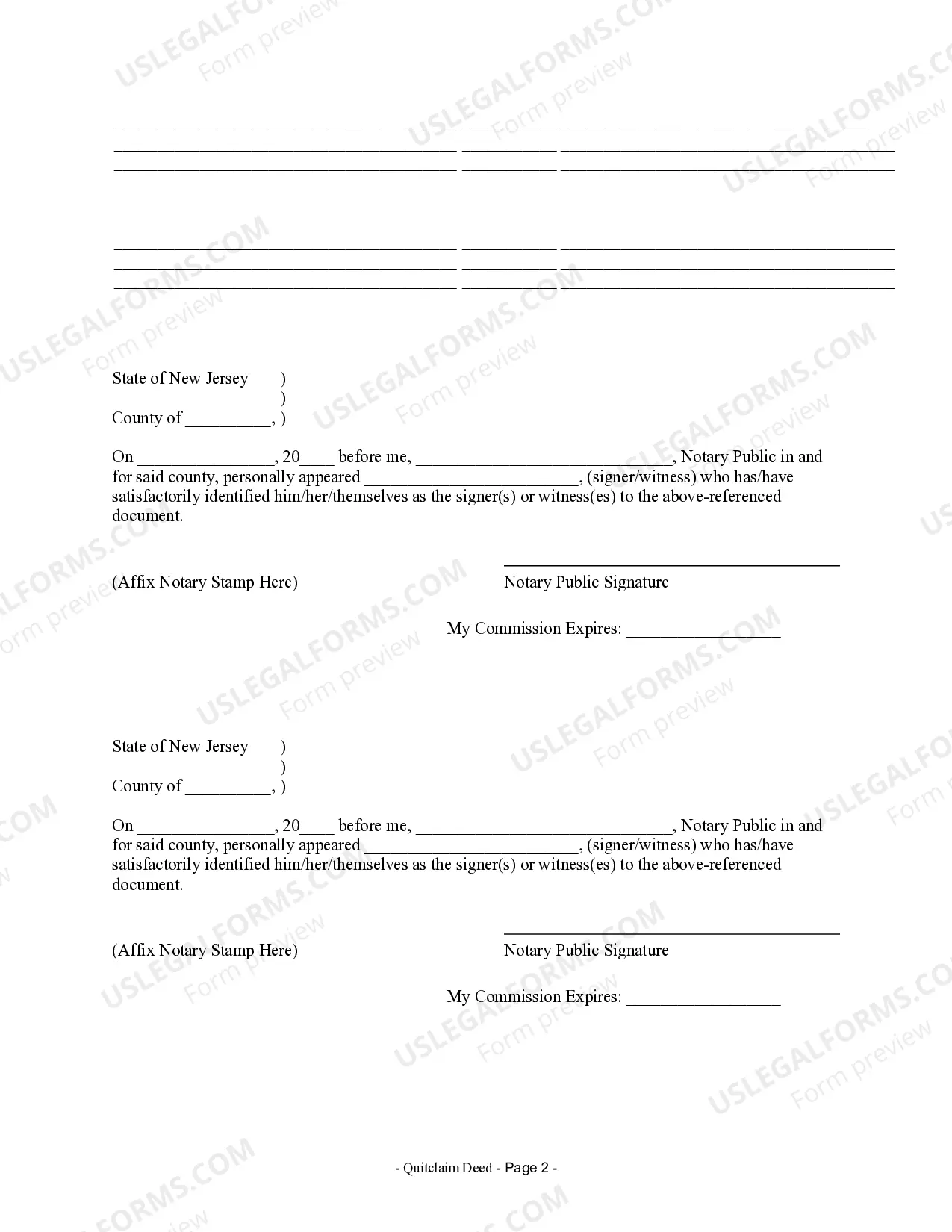

A quit claim deed can become invalid if it lacks the required signatures, does not contain a proper legal description of the property, or is not notarized. Additionally, failure to comply with state regulations can invalidate the deed. Users should ensure accuracy and proper execution, particularly in cases involving a Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife.

In Minnesota, a quitclaim deed transfers the ownership of property without guaranteeing any claims against it. The grantor simply transfers their interest in the property to the grantee. This straightforward process can similarly apply to situations involving a Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife, ensuring a transparent transfer.

To fill out a quit claim deed to add a spouse, begin by obtaining the appropriate form and listing both spouses as grantees. You must also include clear property descriptions and sign the document in front of a notary. Using this method allows you to change ownership easily and is particularly useful for transfers like the Jersey City New Jersey Quitclaim Deed by Two Individuals to Husband and Wife.