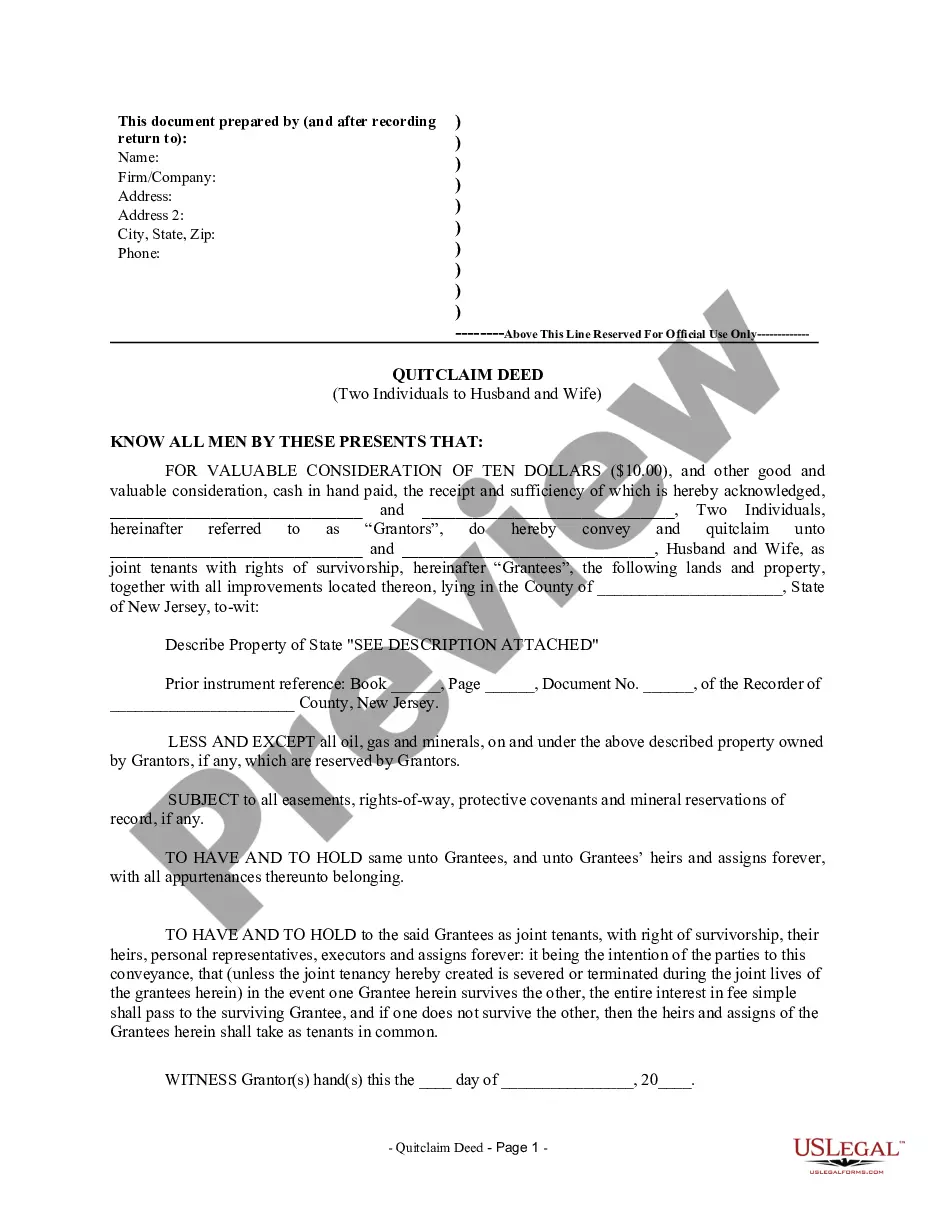

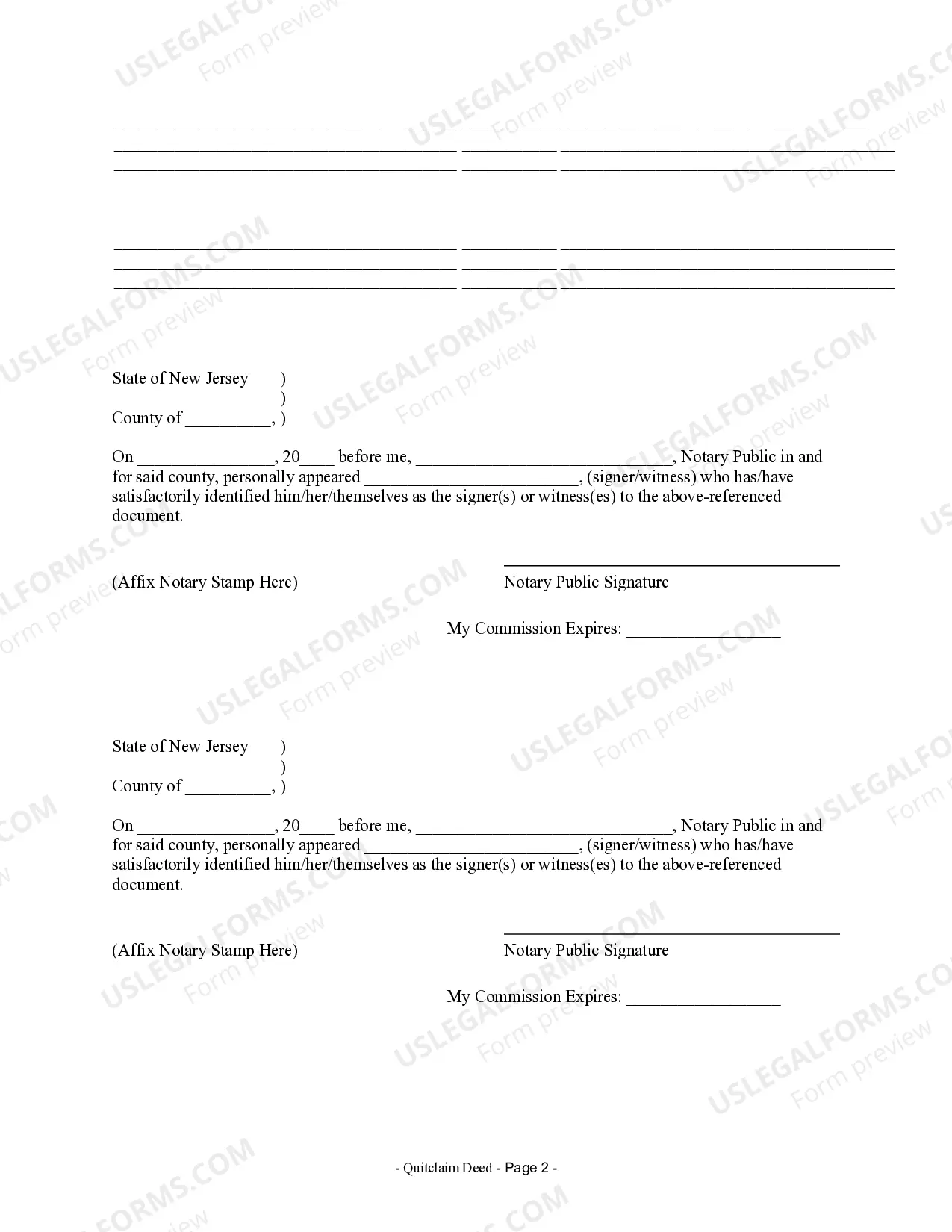

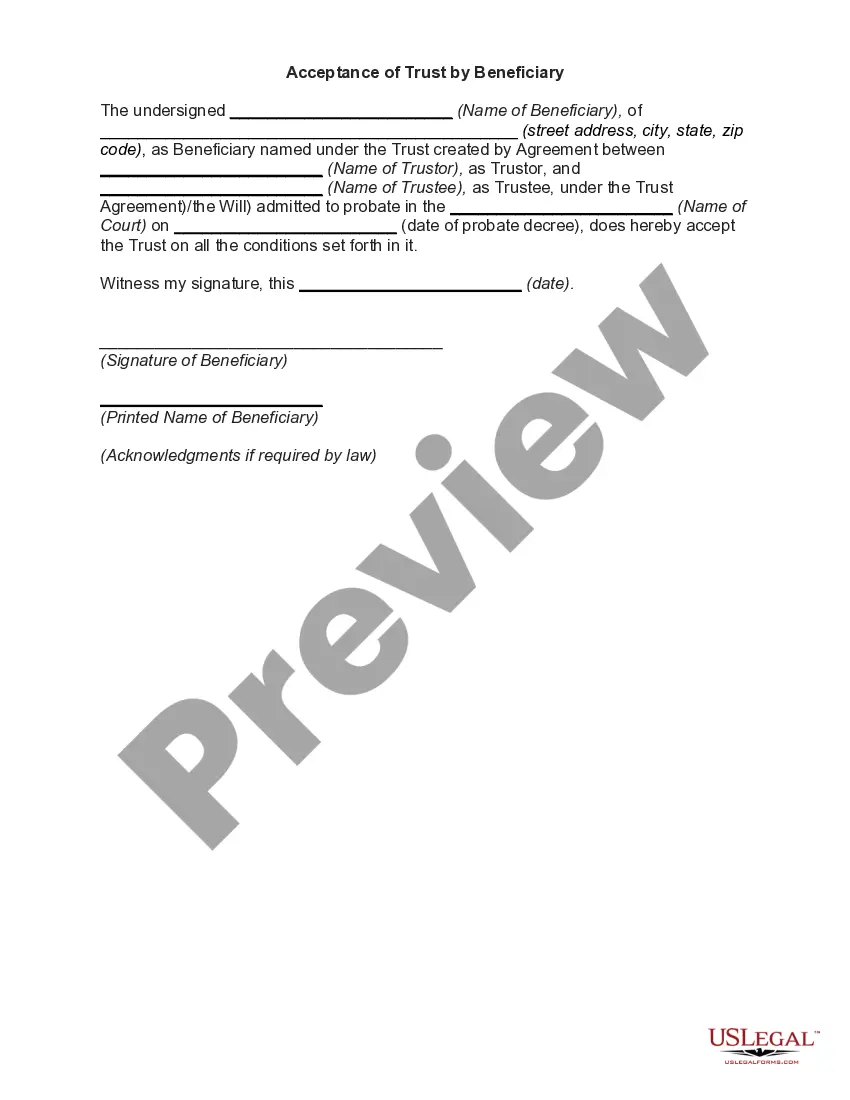

Title: Paterson, New Jersey Quitclaim Deed by Two Individuals to Husband and Wife Explained: Types, Process, and Key Aspects Introduction: In Paterson, New Jersey, a Quitclaim Deed by Two Individuals to a Husband and Wife is a legal document that facilitates the transfer of property ownership from two individuals to a married couple. This article aims to provide a comprehensive understanding of this type of deed, including its different types, the process involved, and the key aspects that individuals must consider. 1. Types of Paterson, New Jersey Quitclaim Deed by Two Individuals to Husband and Wife: a. Traditional Quitclaim Deed: This is the standard form of deed used to transfer property ownership, where the two individuals relinquish their interests and transfer them to the husband and wife as joint owners. b. Gift Quitclaim Deed: In some cases, the transfer may be considered a gift, where the two individuals willingly transfer ownership without any financial consideration, possibly for estate planning or familial reasons. 2. The Process and Requirements: a. Prepare the Deed: Both parties or their legal representatives must draft the Quitclaim Deed accurately, including relevant property details and a clear description of the transfer of ownership. b. Signatures: All parties involved must sign the Quitclaim Deed in the presence of a notary public or other authorized personnel. c. Consideration: Although financial consideration is not always required, it is advisable to mention a nominal amount or appropriate consideration to validate the deed legally. d. Record the Deed: The Quitclaim Deed must be recorded with the county clerk's office where the property is located to establish legal proof of the transfer. e. Additional Requirements: While specific requirements may vary, complying with New Jersey real estate laws, including property tax clearances and municipal fees, is crucial for a valid transfer. 3. Key Aspects to Consider: a. Title Search: Conducting a thorough title search ensures that the transferring individuals have a legal right to the property and that there are no outstanding liens or claims that could affect the new owners. b. Legal Assistance: Consulting with a qualified attorney experienced in real estate law is highly recommended navigating the complexities of the process and ensure compliance with all legal requirements. c. Understand Property Rights: The husband and wife receiving the property should have a clear understanding of their ownership rights, joint tenancy, or tenancy in common, and any applicable rights of survivorship. d. Tax Implications: It is essential to consult a tax professional to understand the potential tax consequences, such as property tax reassessment or capital gains tax, resulting from the transfer. Conclusion: A Paterson, New Jersey Quitclaim Deed by Two Individuals to Husband and Wife allows for the smooth transfer of property ownership to a married couple. By understanding its various types, following the required process, and considering the key aspects mentioned above, individuals can ensure a legally valid and successful transfer of property rights. Seek legal advice for individual circumstances and to ensure compliance with local laws and regulations.

Paterson New Jersey Quitclaim Deed by Two Individuals to Husband and Wife

Description

How to fill out Paterson New Jersey Quitclaim Deed By Two Individuals To Husband And Wife?

Benefit from the US Legal Forms and have immediate access to any form you want. Our useful website with a huge number of document templates allows you to find and get virtually any document sample you will need. It is possible to export, complete, and certify the Paterson New Jersey Quitclaim Deed by Two Individuals to Husband and Wife in a few minutes instead of browsing the web for many hours searching for a proper template.

Using our catalog is a superb strategy to improve the safety of your document filing. Our professional legal professionals regularly check all the documents to make certain that the forms are appropriate for a particular region and compliant with new acts and polices.

How do you get the Paterson New Jersey Quitclaim Deed by Two Individuals to Husband and Wife? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you view. Additionally, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instruction below:

- Find the template you need. Ensure that it is the form you were looking for: examine its title and description, and utilize the Preview function when it is available. Otherwise, use the Search field to look for the needed one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Save the document. Select the format to get the Paterson New Jersey Quitclaim Deed by Two Individuals to Husband and Wife and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most considerable and reliable form libraries on the internet. Our company is always happy to help you in virtually any legal process, even if it is just downloading the Paterson New Jersey Quitclaim Deed by Two Individuals to Husband and Wife.

Feel free to make the most of our platform and make your document experience as efficient as possible!