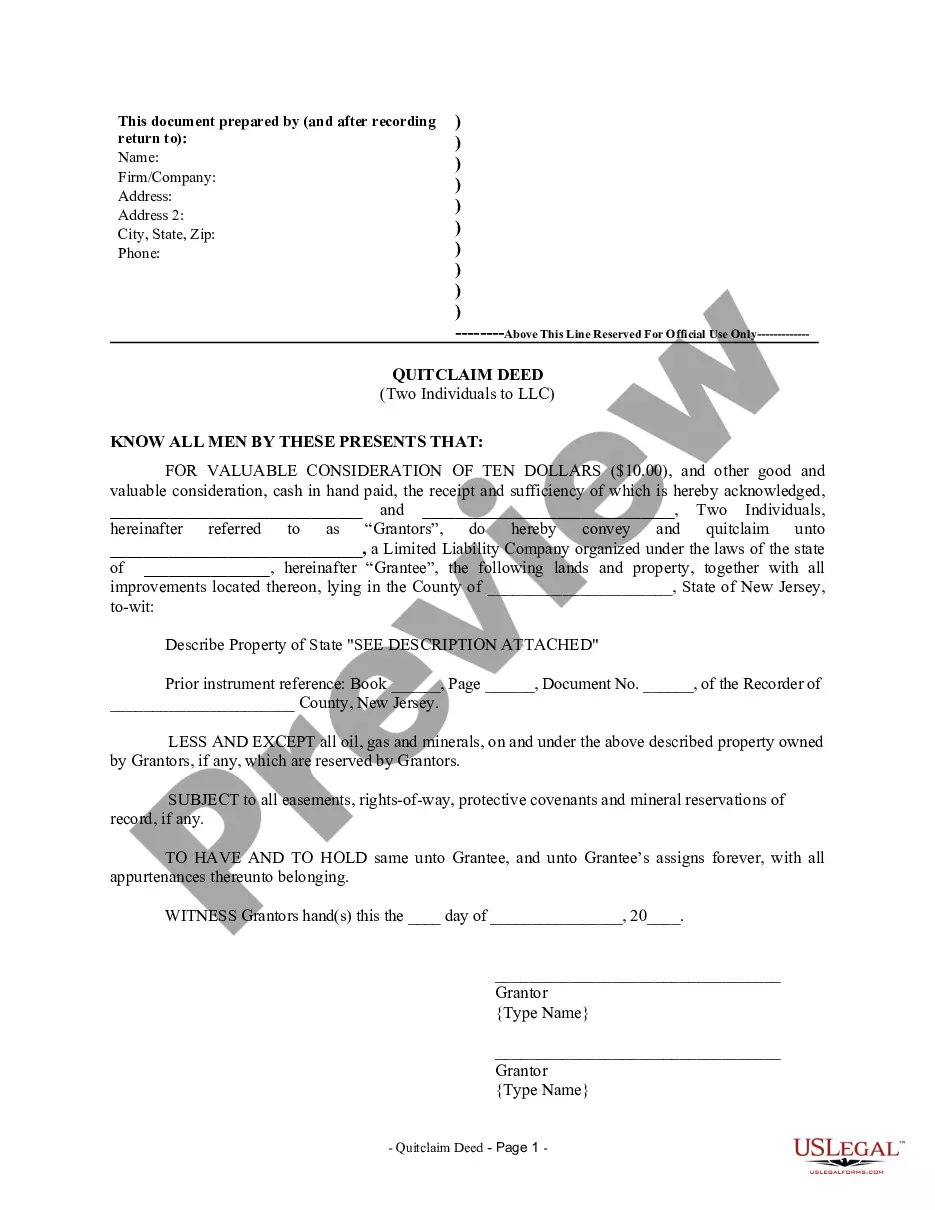

A Paterson New Jersey quitclaim deed by two individuals to an LLC is a legal document that transfers ownership rights of a property from two individuals to a limited liability company (LLC) in Paterson, New Jersey. This type of deed is commonly used when the individuals want to transfer their interests or rights in the property to the LLC without making any warranties or guarantees regarding the property's title. The Paterson New Jersey quitclaim deed by two individuals to LLC is a binding agreement that allows the individuals, known as granters, to relinquish any claim or interest they have in the property to the LLC, known as the grantee. This legal document is executed to ensure a smooth and legal transition of property ownership and to protect the rights of all parties involved. The Paterson New Jersey quitclaim deed by two individuals to LLC typically includes relevant information such as the names and contact details of the granters and the LLC, a detailed legal description of the property, and the terms and conditions of the transfer. It also outlines any considerations involved, such as financial transactions or obligations. There may be different types or variations of Paterson New Jersey quitclaim deeds by two individuals to LCS, each serving a specific purpose or addressing unique circumstances. Some possible types of quitclaim deeds could include: 1. Paterson New Jersey Quitclaim Deed with Consideration: This type of quitclaim deed involves a financial consideration, such as the LLC compensating the granters in exchange for their interest in the property. The consideration can be in the form of money, property, or services. 2. Paterson New Jersey Quitclaim Deed without Consideration: In this type of quitclaim deed, there is no financial consideration involved. The granters willingly transfer their interest in the property to the LLC without any compensation. 3. Paterson New Jersey Joint Tenancy Quitclaim Deed: If the two individuals hold the property as joint tenants, they can use this specific type of quitclaim deed to transfer their joint ownership to the LLC. Joint tenancy allows for the right of survivorship, meaning if one owner passes away, the other automatically inherits the deceased owner's interest. 4. Paterson New Jersey Tenants in Common Quitclaim Deed: If the two individuals hold the property as tenants in common, they can utilize this quitclaim deed to transfer their respective ownership interests to the LLC. Unlike joint tenancy, tenants in common own distinct shares of the property, which can be transferred or inherited separately. It is important to consult with a knowledgeable real estate attorney or professional in Paterson, New Jersey when preparing or executing a quitclaim deed to ensure all legal requirements are met, and the transfer of property ownership is properly documented and registered.

Paterson New Jersey Quitclaim Deed by Two Individuals to LLC

Description

How to fill out New Jersey Quitclaim Deed By Two Individuals To LLC?

Locating validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online resource containing over 85,000 legal documents suitable for both personal and professional purposes across various real-life scenarios.

All the papers are well-organized by field of use and jurisdictional areas, making it as straightforward as pie to search for the Paterson New Jersey Quitclaim Deed by Two Individuals to LLC.

Maintaining documents orderly and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates readily available for any requirements!

- Review the Preview mode and document description.

- Ensure you’ve chosen the appropriate one that fulfills your requirements and aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one.

- If it meets your needs, proceed to the next stage.

Form popularity

FAQ

Yes, you can complete a quitclaim deed yourself in New Jersey. It's essential to understand the process clearly, from obtaining the correct form to signing and recording it. While DIY may save you expenses, you might want to consider using a reliable platform like US Legal Forms, which offers step-by-step guidance and pre-filled forms for the Paterson New Jersey Quitclaim Deed by Two Individuals to LLC, ensuring accuracy and compliance.

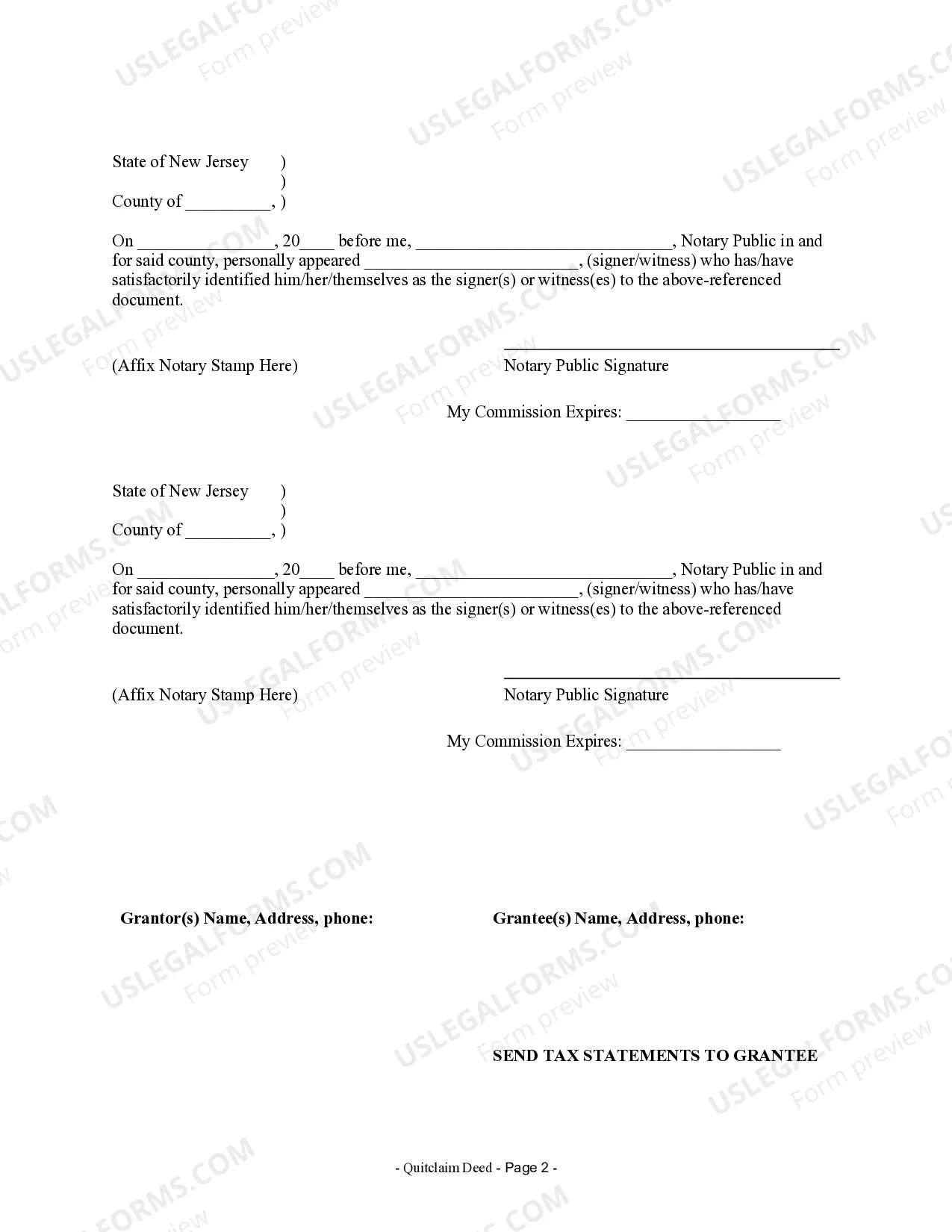

Filing a quitclaim deed in NJ involves a few straightforward steps. First, download or obtain a quitclaim deed form appropriate for your transaction, particularly the Paterson New Jersey Quitclaim Deed by Two Individuals to LLC. Ensure that you accurately complete the form, sign it in front of a notary, and then seek out your local county clerk’s office to record the deed. This recording step is crucial as it provides legal protection for the change in ownership.

To file a quitclaim deed in New Jersey, start by obtaining the correct quitclaim deed form suitable for transferring property from two individuals to an LLC. You can fill out this form with accurate details about the property and the involved parties. After completing the form, sign it in the presence of a notary public. Finally, submit the signed deed to your local county clerk’s office to officially record the transfer through the Paterson New Jersey Quitclaim Deed by Two Individuals to LLC.

Yes, both parties typically need to be present to complete a Paterson New Jersey Quitclaim Deed by Two Individuals to LLC. This ensures everyone involved understands the transaction and consents to the transfer. However, if one party cannot attend, some jurisdictions allow for notarized signatures, which can simplify the process. It's best to verify local requirements to ensure a smooth deed transfer.

While an LLC offers many benefits for property ownership, there are some disadvantages to consider when dealing with a Paterson New Jersey Quitclaim Deed by Two Individuals to LLC. One challenge is the potential for increased taxation, as LLCs may face self-employment taxes. Additionally, managing an LLC involves more administrative work and compliance with state regulations. It's essential to weigh these factors carefully before making a decision.

You do not necessarily need a lawyer to transfer a deed, such as a Paterson New Jersey Quitclaim Deed by Two Individuals to LLC. Many homeowners handle the paperwork themselves, especially for simple transactions. However, involving a lawyer can help clarify legal obligations, ensure all paperwork is correctly completed, and streamline the process. If you're unsure, consulting a legal professional is a wise choice for peace of mind.

You can list multiple individuals on a quit claim deed, allowing for flexibility in ownership transfer. When completing a Paterson New Jersey Quitclaim Deed by Two Individuals to LLC, ensure that all parties involved are clearly identified. This can include spouses, partners, or any individuals with ownership interests. Just remember to check your local regulations, as specific requirements may vary.

While you may not necessarily need a lawyer to transfer a deed in New Jersey, consulting one can offer valuable insight. A lawyer can provide guidance on the correct procedure, help avoid potential pitfalls, and ensure that all legal requirements are met. This can be particularly important for a Paterson New Jersey Quitclaim Deed by Two Individuals to LLC, where proper documentation is essential for a successful transfer.

Transferring a deed to an LLC in New Jersey requires specific actions. First, gather the property’s legal description and the current ownership information. Then, fill out a quit claim deed and have it notarized. Once completed, submit the deed to the county clerk’s office for recording, solidifying the Paterson New Jersey Quitclaim Deed by Two Individuals to LLC transfer and establishing LLC ownership.

To transfer a deed from an individual to an LLC, begin by obtaining a quit claim deed form specific to your state. Fill out the necessary information, including the names of the current owner and the LLC. After completing the form, have it signed in front of a notary public. Finally, file the quit claim deed with the appropriate local government office to ensure the transfer is recorded, thereby completing the Paterson New Jersey Quitclaim Deed by Two Individuals to LLC process.